Cryptocurrency has the potential to obtain value on exchange platforms, and its value escalates depending on its supply and demand. The cryptocurrency’s supply relied upon the number of newly mined coins and the number of current owners willing to sell.

On the other hand, the demand for a cryptocurrency is contingent on several factors. Relying on the usefulness of the coins to their owner, the demand for the coins may shoot up. It implies that in case the monetary system of the cryptocurrency performs well, the demand will be sky-rocketed.

The cryptos’ value goes up and down according to the market’s sentiment of any value at any certain time similar to any market. These fluctuations are perhaps ingrained in some of the above-mentioned impacting factors of supply and demand or may occur due to available hidden factors in the market. Furthermore, there is amplified demand for crypto as a deposit of value investment.

Three things to know before starting:

- As mentioned before, cryptocurrencies are immensely volatile and may fluctuate frenetically with hardly any notification. Typically, investors of digital currencies endeavor to buy the dip, implying that they’ll buy more of the cryptos while the price collapses.

- Successful traders formulate a strategy for their cryptocurrency assets by selecting a limit order. Limit order implies that their assets will be spontaneously sold if prices reach a particular level.

- It is vital for novice investors, especially to gather knowledge about the operation process of the digital currency beforehand investing. Try to learn about the various offered currencies since hundreds of different coins and tokens are available. Hence, it is essential to look beyond the most prominent names and know-how the blockchain technology feature functions in the cryptocurrency space.

What is Lucky Block (LBLOCK)?

Lucky Block is developed on the Binance Smart Chain and provides significant clarity. It is a lottery platform built on blockchain technology. Lucky Block seems to appreciably upgrade itself to the lotto experience even though traders are offered scope for making a passive money stream.

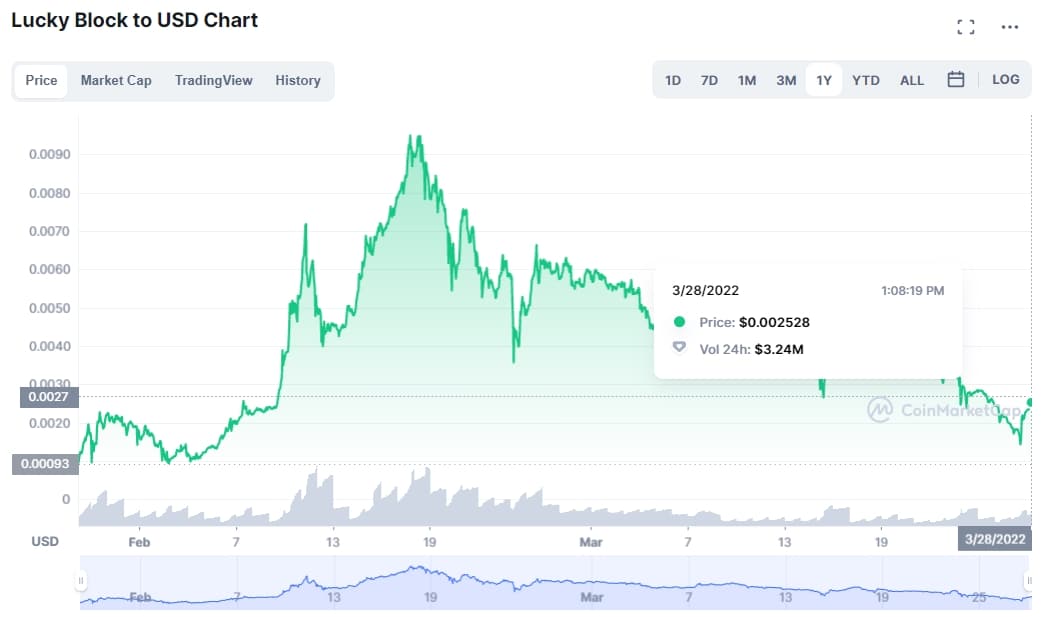

Lucky Block (LBLOCK) price history

It is currently trading around the $0.002528 price area and trying to recover higher. The price has nosedived after touching an all-time high of $0.0095 price level.

Lucky Block (LBLOCK) optimistic forecast 2022

It may recover upside towards the $0.0070 price area again in the coming days.

Lucky Block (LBLOCK) skeptic forecast 2022

In the worst-case scenario, it may reach at least a $0.0050 price area in the year 2022.

What is Decentraland (MANA)?

According to market analysts, Decentraland is one of the best cryptos for Metaverse exposure. Decentraland is a virtual world established on the blockchain. Decentraland’s customers may build avatars and buy lands here.

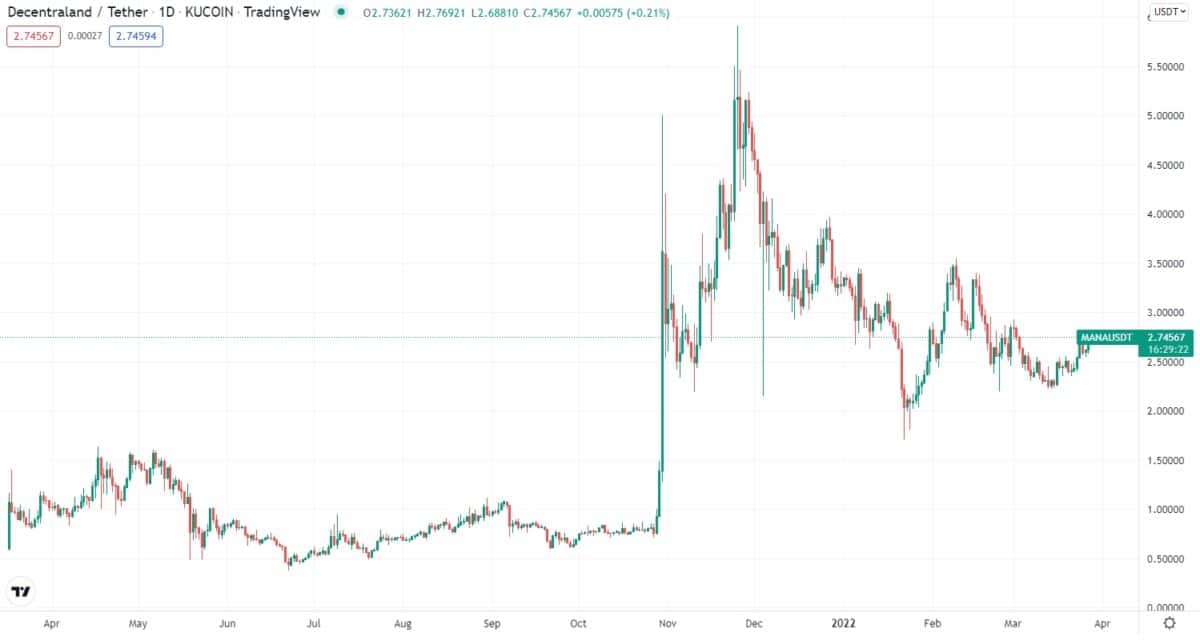

Decentraland (MANA) price history

Decentraland is currently trading around the $2.7454 price area and trying to continue higher; after bouncing from the $2.00 price area, the bulls regained momentum and pushed the price upward quite impulsively.

Decentraland (MANA) optimistic forecast 2022

Decentraland may recover upside towards the $5.00 price area again in the coming days.

Decentraland (MANA) skeptic forecast 2022

In the worst-case scenario, the Decentraland may reach at least a $4.00 price area in the year 2022.

What is Cardano (ADA)?

Cardano is a cryptocurrency to be bought as a substitute for Ethereum since the Cardano blockchain platform utilizes a PoS algorithm to obtain consensus, which makes the network relatively more scalable.

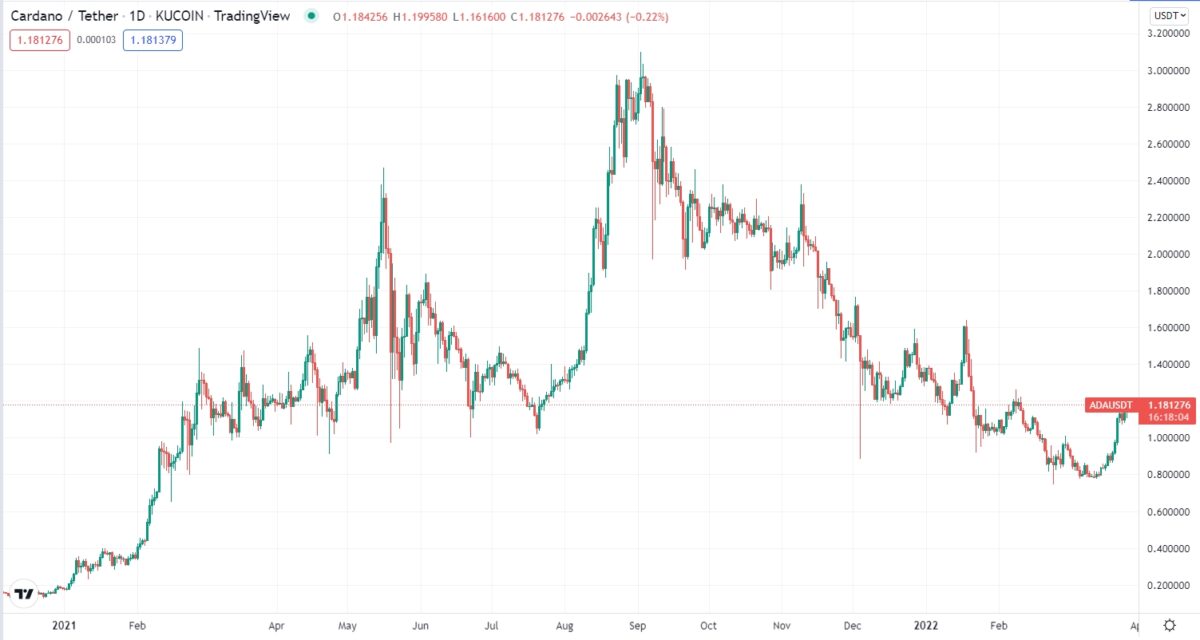

Cardano (ADA) price history

Cardano is currently residing near the $1.18180 price area and trying to recover upside. After an extended period of bearish momentum, the price found support around the $0.8000 price area and pushed higher.

Cardano (ADA) optimistic forecast 2022

Cardano may recover higher towards the $2.40 price area again in the coming days.

Cardano (ADA) skeptic forecast 2022

In the worst-case scenario, the Cardano may reach at least a $1.60 price area in the year 2022.

What is Axie Infinity (AXIE)?

It is a game established on the blockchain. It allows players to develop in-game characters and accomplish pursuits. Players may also have customized pets named Axies, formed as NFTs, monetizing them via the Axie Infinity marketplace.

Axie Infinity (AXIE) price history

Axie Infinity is currently trading around the $67.35 price area and trying to push upside. After bouncing from the $45.00 price area, the bulls pushed the price higher impulsively and reached the $70.00 price area.

Axie Infinity (AXIE) optimistic forecast 2022

It may recover higher towards the $120.00 price area again in the coming days.

Axie Infinity (AXIE) skeptic forecast 2022

In the worst-case scenario, it may reach at least a $100.00 price area in the year 2022.

What is Avalanche (AVAX)?

Avalanche utilizes three blockchains instead of one, making it a sensational crypto project. Each blockchain does its part of the task, lowers the overall load, and increases TPS. All of these are possible by the grace of using three blockchains together.

Avalanche (AVAX) price history

Avalanche is currently trading around the $91.0658 price area and trying to recover further upside. The price has been trading below the $100.00 price area for an extended period.

Avalanche (AVAX) optimistic forecast 2022

Avalanche may recover higher towards the $130.00 price area again in the coming days.

Avalanche (AVAX) skeptic forecast 2022

In the worst-case scenario, the Avalanche may reach at least a $100.00 price area in 2022.

Pros and cons

| Worth to buy | Worth to getaway |

| Investing in crypto may potentially generate high returns on capital. | As a result of the tremendously volatile nature, there is potential for massive losses. |

| Since the crypto market is decentralized, it eliminates the intermediaries, thus safeguarding from payment fraud. | Consequent to being decentralized, the cryptocurrency market is unregulated, instigating the possibility of cyber hacking. |

| Due to being a decentralized market, it can settle off-shore transactions instantly. | Mining cryptocurrencies are very much energy-consuming. |

Final thoughts

To conclude, similar to the other currencies, cryptos also gain their value contingent on the extent of participation of the community. In the case of increasing demand against the supply, the value of the cryptocurrency will shoot upwards. Also, the more exploitable the cryptocurrency will be, the more surge demand will be. Additionally, people are willing to utilize rather than sell cryptocurrencies that indicate more demand than supply. It is an excellent indication of the increasing value of cryptocurrencies shortly.