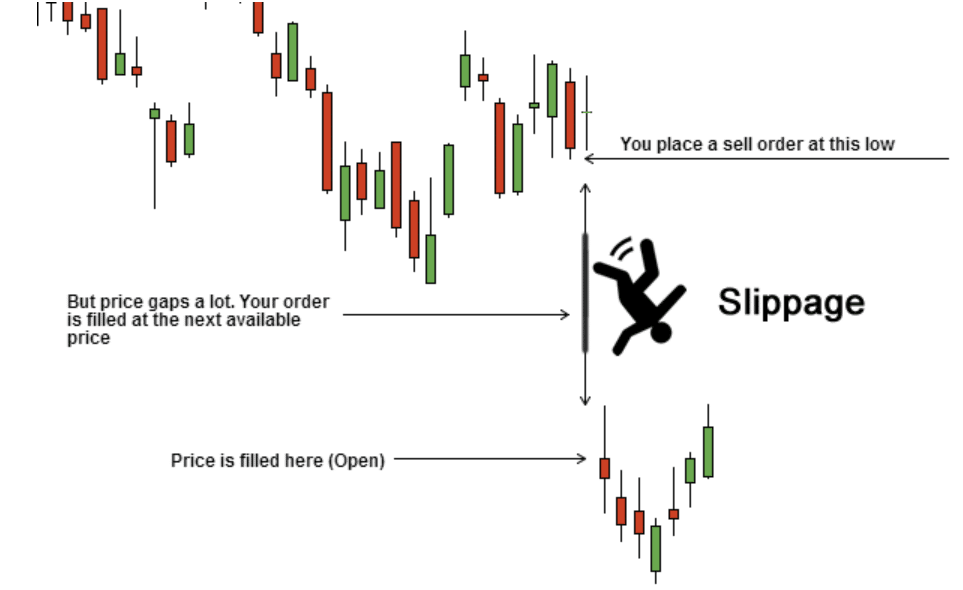

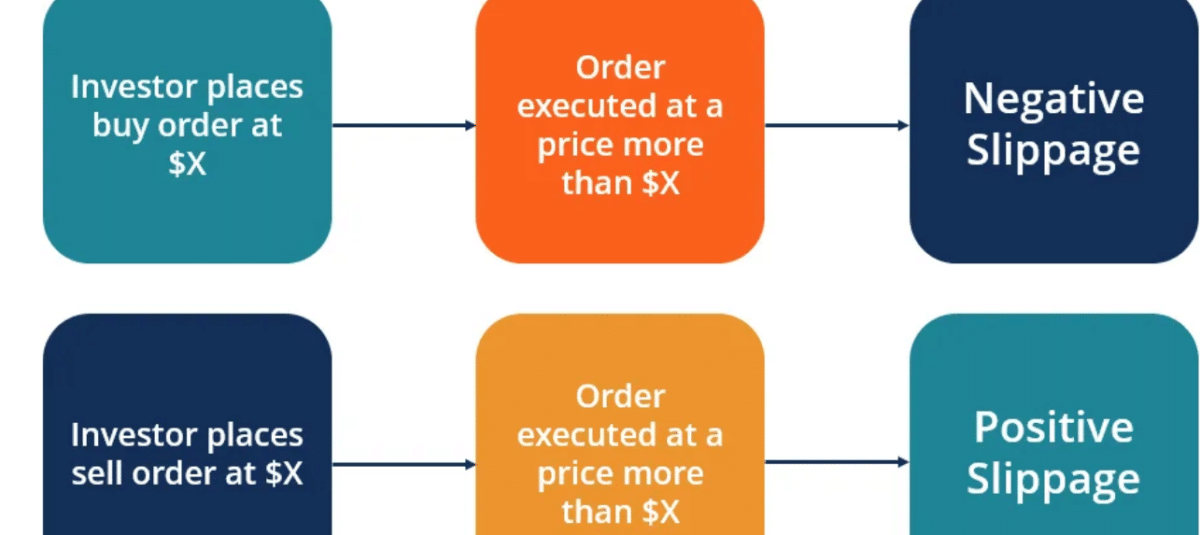

Slippage occurs when your trade price differs from the quoted price after the trade is completed. Investors notice this more if they place a large order, one that is market-priced, or if the market’s price fluctuates at a higher level.

The problem is even worse in crypto markets, where it is far more widespread and much worse than in the stock market. Slippage can happen when there isn’t a lot of money or investors trading up in a particular currency.

Market participants experience slippage when they obtain a price that differs from the one they expected. It is more prevalent during periods of market volatility, which is indicated by an increase in market orders.

What is slippage?

It occurs when the market moves fast, and the price at which an order is executed differs from the price at which it was submitted. As a result of price changes, the trader’s order is filled at a different price than planned.

Slippage can happen in many different ways. You can’t be sure of the price or execution when you put an order on the market to get the best price. Market orders automatically trade at the best price when an asset rises or falls in value to account for price changes. The more you start with, the more you’ll get.

How to avoid slippage?

Consider these five steps.

Use limit orders

Slippage happens when trades are moved between open positions. Limit orders can help to cut down the risk of slippage. For example, traders might use limit orders instead of market orders to ensure that their trades don’t go through at a lower price than they planned to pay for them.

The use of a limit order can help you avoid making a mistake. For example, you might not get into markets at the right time because the market moves quickly. So, the limit order is helpful regarding that.

To use a limit order, the prices must be very accurate. Traders might use a “pullback” order to buy a coin that has a lot of people interested in it. People use the term “pullback” when the price of a coin goes down significantly.

Evaluate crypto market events and news

If you keep an eye on the market and the news, you might be able to keep your money safe. To keep prices from going down, you should keep an eye on the market.

If you want to trade on crypto, you should watch the economic calendar to see changes. Investors may predict how much an asset’s value will change based on stories in the news.

Following a hard fork, there may be a short-term change in the value of the currencies. There is no way to overstate how important it is to keep an eye on this little news.

Investing when the market is very volatile is not a good idea. Keeping up with the rising risk is hard.

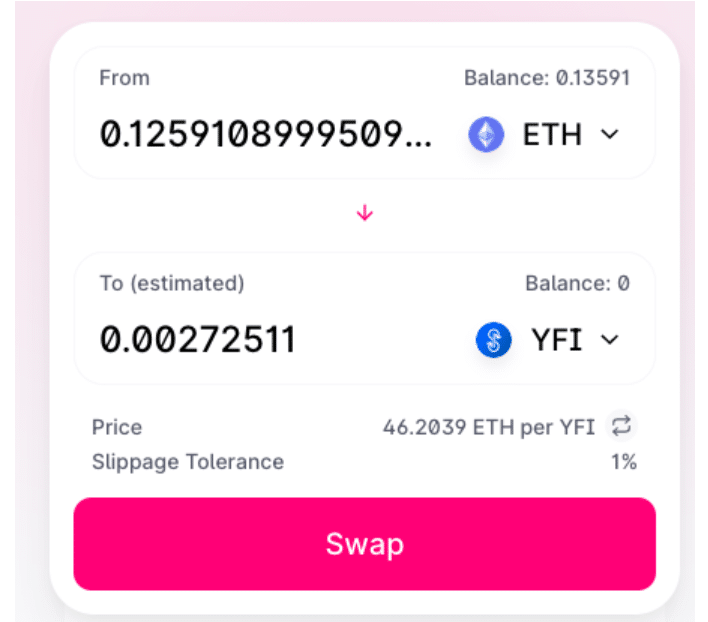

Adjust slippage tolerance level

If you wish to trade on a decentralized exchange, most of them allow you to choose a slippage tolerance. To guarantee that your transaction gets picked up, you can adjust the amount of slippage tolerance to suit your needs.

Slippage can be hard to fix, depending on what caused it. There are indeed a few things that every cryptocurrency trader should be aware of, though.

Limit orders work better than market orders at cutting down on slippage. A counter-order is almost always made even when investors are trading well-known coins.

To buy or sell a coin, you can set a limit order that says how much you’re willing to pay for it. Of course, price changes may happen when you choose, but this can’t be foreseen.

Find a fast executing broker

Slippage is almost always avoided when you trade with a broker that processes orders fast. Slippage rates are less likely to rise or fall if you promptly close your buy or sell orders, as prices have less time to fluctuate.

Brokers and crypto exchanges display slippage warnings when the order percentage reaches a specified amount. Whenever your balance drops below 2%, the broker will notify you.

Avoid trading during volatile market events

Market price movements are correlated with changes in market events. Therefore, a cryptocurrency’s price might change considerably due to market news and announcements.

Slippage will be minimized if you avoid trading during these periods. You can specify a precise price for your orders, which will be fulfilled at that price on the cryptocurrency market.

Pros and cons

Following are the major pros and cons of slippage in the crypto market.

| Worth to use | Worth to getaway |

| There is a possibility that your profit will increase due to slippage. | Due to the fast change of market values, slippage can occur within it. |

| Slippage results from market event occurrences rather than a hidden factor in the market. | You might face a considerable risk by investing and trading in a market with many slippage chances. |

| Such strategies help in getting a more detailed understanding of the cryptocurrency industry. | No fix time of slippage occurrences. |

Final thoughts

The vast majority of crypto dealers have experienced slippage. If the market price does not match your provided price, the trade will fail. The term itself isn’t inherently inaccurate, despite its possible connotations. A small change in the value of the cryptocurrency you’re dealing with might have a significant impact on your trade.

To avoid unfavorable consequences, cryptocurrency traders must remain vigilant at all times. Stop orders, a fast broker, and updated market news and trends may help traders prevent slippage.