Like the 90’s internet revolution, blockchain and crypto are offering a wealth of opportunities. Blockchain and crypto prove their worth from streamlining industries to transforming financial institutions.

While the early days of BTC and crypto were dominated by traders looking to buy low and sell high, the crypto ecosystem has recently seen increased financialization and different ways in which users can earn passive income on their crypto holdings.

With developments such as staking and lending, crypto holders can now earn additional returns on top of the potential increase in the price of their underlying crypto holdings. Much like the traditional financial system, there are varying degrees of risk that come with different methods of earning passive income on Bitcoin, Ether, and many other crypto assets.

How does it work?

Many holders of cryptos have overcome the barriers of uncertainty. However, frequent fluctuations in the value of cryptos are prominent issues that investors have to deal with.

It is possible to earn passive income by following a specific investment strategy or investing in a platform. You can find ways to make your assets work for you with the proper methods and techniques. To hold is gold; the more you keep your coin, the more you can earn money from crypto.

Top three things to know before starting:

- Staking, crypto lending, interest-bearing accounts, and yield farming pay interest on crypto assets.

- Different passive income options carry different levels of risk.

- Many early investors managed to rake in hundreds of thousands or even millions of dollars for small investments.

Best 5 ways to generate crypto passive income

Investors can earn rewards on their crypto holdings in several ways, with varying risk and technical knowledge. Here are five ways crypto investors can earn passive income in 2022.

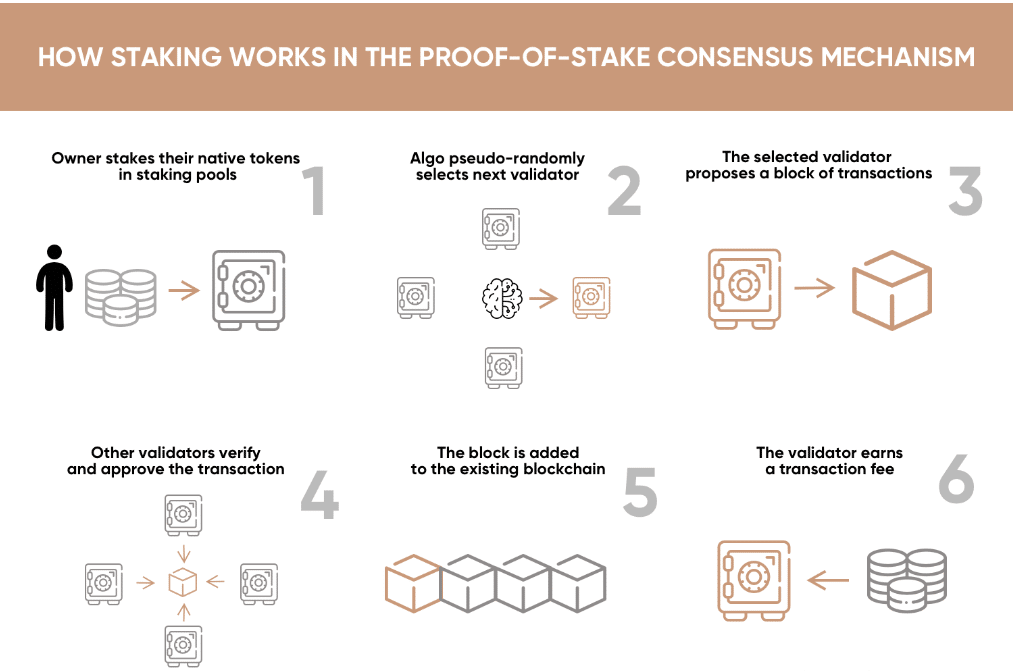

POS introduced a more efficient way to maintain consensus in a decentralized system and brought a new way for coin holders to earn a yield — through staking.

People who hold cryptos that operate on proof-of-stake hold the option of staking their coins. When individuals stake their coins, they essentially lend their coins to the network to validate transactions. In exchange for lending your coins and helping validate, the network rewards you with additional coins – effectively allowing you to earn interest. Similar to lending cash, staked coins are deposited into a special pool and thus available for everyday spending.

Many cryptos now offer staking rewards, including Ethereum, Solana, Cardano, Avalanche, etc. Some of these enforce a fixed minimum stake and a lock-up period, posing barriers to some users.

How much can you earn?

The yield you will get usually depends on a few things, including the stock supply proportion and any commissions you might lose. In general, you can expect around 5-15% APY.

What to watch out for?

Staking yields are paid out in the same coin you stake, e.g., staked DOT yields more DOT. If the value of the coin you stake falls, there is a chance that you could end up net negative in fiat terms if the staking rewards do not cover the losses.

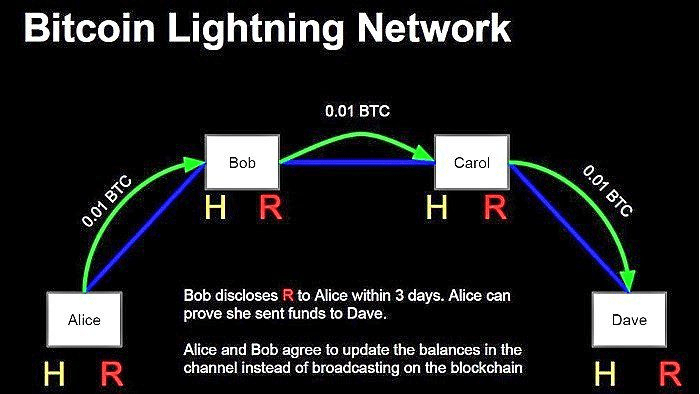

2. Running a Lightning Node

The Bitcoin Lightning network is a layer-2 scaling solution that allows affordable micropayments at scale lightning-fast. The nation of El Salvador, which has made Bitcoin legal tender, uses Lightning for its Bitcoin transactions, for example. Lightning nodes facilitate these transactions. Those who run nodes receive a small portion of each transaction fee that gets routed through their node.

How much can you earn?

Running a Lightning node generates very little income. Because fees are so low, those who run a node might only make a few dollars per month in Bitcoin or less. Some users report earning as much as $25 in one month. This also depends on the price of BTC versus a user’s local fiat currency.

What to watch out for?

This method doesn’t generate that much Bitcoin passive income. Most participants do it to support the use of Bitcoin as a medium of exchange. And as the Lightning network grows and more transactions get routed through it, the income for node operators will presumably rise.

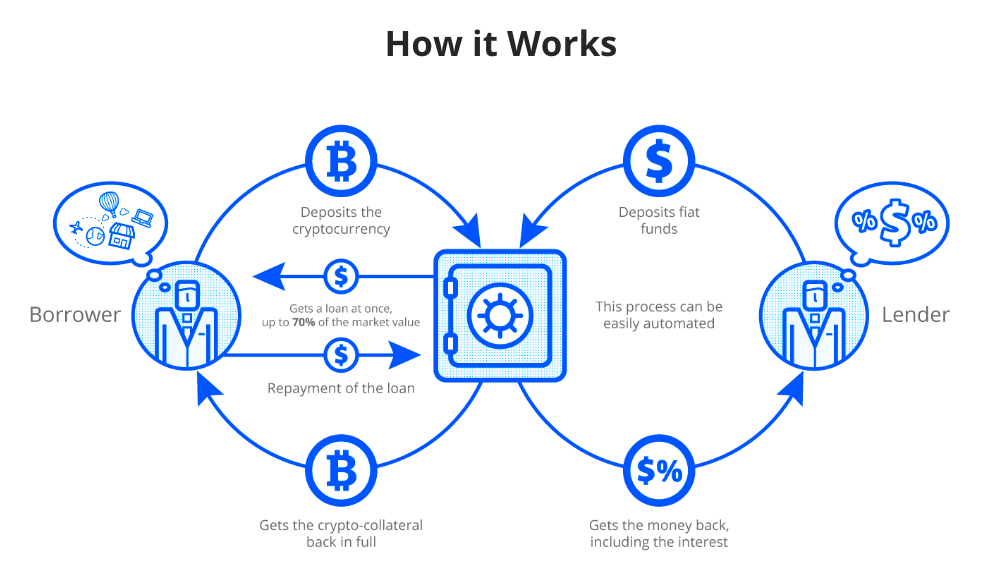

3. Crypto lending

It is one of the most popular services in the centralized and decentralized domains of the crypto ecosystem. Some of the top crypto passive income generators include lending strategies such as peer-to-peer lending, margin lending, or DeFi lending.

- Peer-to-peer

Investors can use the services of P2P lending platforms to determine the amount they want to lend to borrowers and the interest on the loan.

- Margin

The option of margin lending to earn crypto passive income primarily focuses on lending crypto assets to traders who want to borrow them for trading.

- DeFi

It takes away the intermediaries from traditional lending. On the contrary, borrowers and lenders depend on smart contracts for automated lending without any proactive involvement from your side.

- Centralized platforms

The next noticeable lending strategy for generating passive income on crypto-assets is centralized lending.

How much can you earn?

There are some qualifications to use peer-to-peer lending, such as being in a state that allows it and having a certain level of verified income in different states. Usually, it’s $70,000 a year or more in revenue.

What to watch out for?

You can lose money. Like any loan, the person who got the loan could get sick, hurt, have bad luck, be irresponsible, or decide not to pay anymore. If this happens, it is called a default.

4. Dividend on tokens

Some companies may give investors a particular share of their revenue. You can hold the tokens and get a share of the company’s revenues based on the number of tokens. Therefore, dividend-bearing tokens can give passive income via crypto assets. They’re flexible and offer crypto investors an opportunity to gain passive income.

How much can you earn?

Stakers can receive up to 30% per annum in dividends.

What to watch out for?

Not all cryptos pay dividends, though. Moreover, some of them pay more than others. So, it is essential to pick the proper crypto to get maximum benefit.

5. Become a Liquidity provider

Decentralized exchanges revolutionized how traders access and capitalize on opportunities in the market by providing a permissionless source of liquidity for a wide variety of cryptos.

But a specific type of DEX, known as an automated market maker, also unlocked an entirely new way for crypto holders to generate a yield on their assets — by becoming liquidity providers.

The community, who continually maintain their proportionate share of the pool regardless of how much liquidity is added, is generally contributed. This liquidity is then used to serve traders executing swaps using this pool.

But here’s where it gets interesting. When traders source liquidity from the pool, they pay a trading fee — usually around 0.2-0.3% of the trade size. This is split between all liquidity providers, including you.

Many AMMs now exist, and most major smart contract platforms now have one or more suitable options. Some of the most popular currently include Uniswap (for ETH), PancakeSwap (for BSC), WagyuSwap (for Velas), and SushiSwap (multi-chain).

How much can you earn?

The amount you will earn can vary considerably between pools and platforms. Generally, the higher your fraction of the overall liquidity and the more trading volume your pools see, the more you will earn. Yields can range from almost nothing to potentially well over 100% APY.

What to watch out for?

If you’re providing liquidity for volatile assets, you will need to understand impermanent losses.

Pros and cons

| Worth to use | Worth to getaway |

| You have many methods to earn crypto passive income without staying updated with the market. | Your earnings depend on the success of the companies behind your tokens. |

| Crypto gives people the opportunity to make a profit through trading and investment. | With DeFi, there is also a risk of protocols being hacked. |

| Many market options – including platforms, protocols, and d’Apps – allow users to generate income from cryptos. | With mining, there is a risk of rising electricity costs, equipment failure, or tokens losing market value. |

Final thoughts

You can notice the simplicity of different methods used for generating passive income from crypto. The multiple options for generating passive crypto income provide unique opportunities and feature distinct ways. However, it would help if you started with a primary impression of the risks in crypto investment.