According to Internal Revenue Service (IRS) rules, there is no way to contribute cryptos directly to any Roth IRAs. There are no limitations if you want to purchase crypto coins from your Roth IRA account. On the other hand, some of them provide facilities for having cryptocurrencies in your account but in a different way.

If you are keen to make your retirement stress-free, holding cryptocurrencies in the Roth IRA account would be an excellent option to have a tax-free income. In the following section, we will see everything a trader should know regarding the crypto Roth IRA including the investment process.

Three things to know about Roth IRA before starting:

- It was introduced before the invention of cryptos. Therefore, no rules were set for cryptos except for conjuring them as assets.

- Although some Roth IRA providers allow having cryptocurrencies through purchase, the number of such providers is not much.

- Crypto IRA is a process where investors can deposit cryptos as a retirement investment.

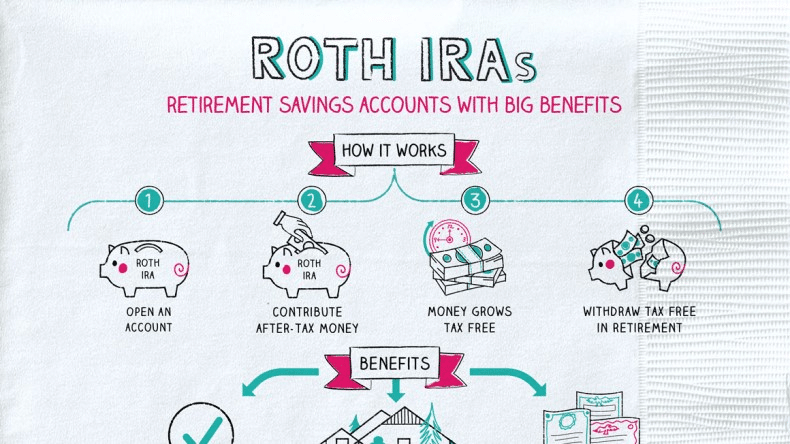

What is a Roth IRA?

Roth IRA offers an individual retirement account to have tax-free withdrawals. The process is to pay tax while injecting money into the Roth IRA account that allows investors to enjoy the no-tax payment on the investment growth.

The significant difference between traditional and Roth IRAs is the process of taxation. The Roth IRA offers a tax fee withdrawal, while the conventional IRAs provide a tax break beforehand. If you are interested in making tax-free income on retirement, selecting Roth IRA over the traditional IRA would be the best option for you.

In traditional IRAs, investors deposit the pre-tax dollar and get tax deductions when they withdraw the money during retirement time. Moreover, the contribution to the Roth IRA account comes from the following sources:

- Regular contribution

- Rollover contribution

- Spouse IRA contribution

- Transfers

Another rule the regulator set is that the Roth IRA contribution should come in the form of cash, not from securities or properties.

How to own crypto in your Roth IRA?

Roth IRAs were introduced in 1997 when cryptos did not exist. Therefore, there was no mention of cryptos on Roth IRAs. However, the associated regulation defines which types of assets a person can contribute to their IRAs account.

In these rules, investors can contribute through cash only, and cryptos are not cash. On the other hand, the IRS Revenue Ruling 2019-04 states that the US currency is in the form of dollar bills, cheques, and coins.

It does not mean you cannot own crypto in your Roth IRA account. There is a process to add cryptocurrencies to the Roth IRA account through the purchase. There are some rules regarding holding properties that match the qualification of cryptocurrencies. The crypto is a property, and the IRA can acquire it by buying it. Since 2014, BTC and other altcoins are known as propertied for the retirement account and they cannot act like cash. They are also taxed like traditional stock or bonds.

How does Bitcoin Roth IRA work?

Some companies allow bitcoin in their IRAs, which is very helpful for crypto investors seeks for benefits in their retirement. Therefore, in recent times, custodians and investment companies have been looking to include Bitcoin in IRAs. Companies like Equity Trust, BitIRA, etc., are popular in the industry.

Overall, it is possible to have Bitcoin in the IRA, but the worthiness of this inclusion is still questionable. Some argue that adding a diversified crypto token in the Roth IRAs would increase the industry’s popularity, which is not present for now. Moreover, the excessive volatility of the crypto market often makes future earnings questionable. Looking at the Bitcoin intraday chart, you might find some price behavior where a 10-15% price drop is widespread. For other altcoins, this situation is even worse.

How many fees do you have to pay?

Although crypto IRA is a good option, you need to ensure that the process includes a higher risk. One of the most significant risk factors of owning cryptocurrencies in the Roth IRA is its higher cost than the traditional IRAs.

For example, if you open a $50K self-directed IRA account, it might take as much as $6000 as a charge for the initial setup. Moreover, a custody and maintenance fee applies to the service, besides fees associated with crypto trades. Usually, providers take nearly 3.5% charge per transaction with a 1% flat fee for each sale. On the other hand, the benefit of such investment is that you don’t have to pay any fees on taxation.

Pros and cons

| Worth to use | Worth to getaway |

| Investing cryptocurrencies in the Roth IRAs would be an excellent option to diversify the trading portfolio. | Although you don’t have to pay any tax, the higher trading charge is the main drawback of the system. |

| Bitcoin Roth IRA follows a simple method of investment that applies to any level of traders. | In the current world, the Roth IRA investment applies to Bitcoin only. Other assets like ETH, LTC etc., are not available now. |

| Roth IRA investment is tax-free. | The efficiency in traditional IRAs is higher than in Bitcoin IRAs. |

Final thoughts

In the above section, we have seen a detailed overview of the Roth IRA and the benefit of allowing cryptocurrencies in the IRAs. The process is straightforward and unique. People from all levels can take part in this.

However, if you plan for retirement, you might face some challenges in the Roth IRA account as it takes higher fees. Therefore, the best decision is to wait for the availability of multiple cryptocurrencies in the Roth IRA account, which will increase the possibility of having higher returns from the portfolio diversification.