As inflationary pressures continue to mount in 2022, many market participants are rethinking their investment strategy to include so-called hard assets with tangible value. The most obvious example is the old fallback of precious metals like gold and silver.

Still, real estate is another example of an asset class with real-world value. Of course, buying an apartment complex or a shopping mall isn’t an option for most people. However, publicly-traded real estate investment trusts offer you a way to buy into these real properties just as you buy a share of Tesla.

If you’re interested in gaining exposure to real property amid the inflationary pressures of 2022, you may want to consider these hotel ETFs.

How does it work?

Twenty companies in the S&P 500 gained more than 9% on the day, with a dozen in travel, entertainment, and hospitality businesses.

In a protracted economic downturn, hotels and other retail outlets have suffered. In 2020, tenants had been forced to close for long periods. At the same time, both travels for business and leisure have been severely impacted. For example, Apple Hospitality REIT’s occupancy rate was 81.4% on June 30, 2019. In April 2020, it had dropped to a mere 17.7%.

Hotel ETFs are one of the most economically sensitive sectors, but if you’re a long-term investor, these three hotel ETFs are relative bargains.

Top three things to know before starting:

- Hotel real estate is the most economically-sensitive type of commercial real estate.

- REITs that invest in hotels expose investors to a portfolio of income-producing properties.

- Remember that the value of your investment may go down and up, and past performance is no indication of future performance.

Best hotel & REIT ETFs to buy in 2022

Let’s take a look at the best ETFs to invest in.

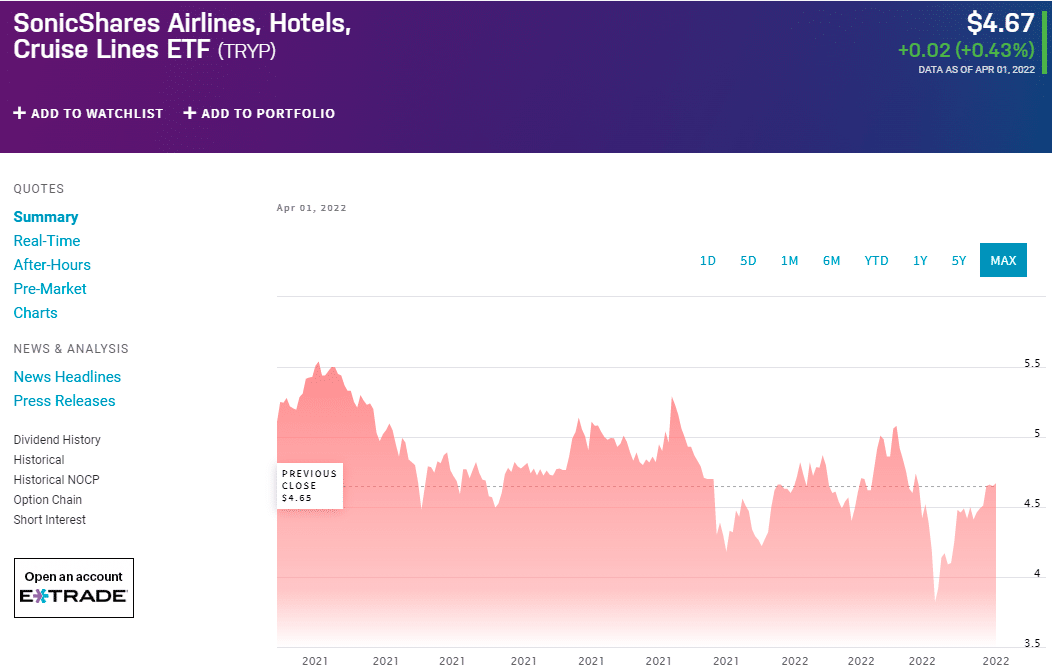

1. SonicShares Airlines, Hotels, Cruise Lines ETF (TRYP)

The Airlines, Hotels and Cruise Lines UCITS ETF (TRYP) seeks to offer exposure to the travel industry as it tracks global airline companies, hotel businesses, and cruise line operators.

The TRYP travel industry ETF tracks the Solactive Airlines, Hotels, Cruise Lines Index, which focuses on companies that derive significant revenue from the travel and tourism sector, including companies engaged in the airlines, hotels, and cruise lines business.

The fund holds globally-listed stocks of companies that meet minimum market-cap and liquidity requirements and derive at least 50% of their revenue from any three segments. The three stocks with the largest market cap are each given a 4.5% allocation in the portfolio within each segment. The remaining securities are weighted by market cap, subject to a 4% single security cap and a liquidity cap. The index is rebalanced semi-annually.

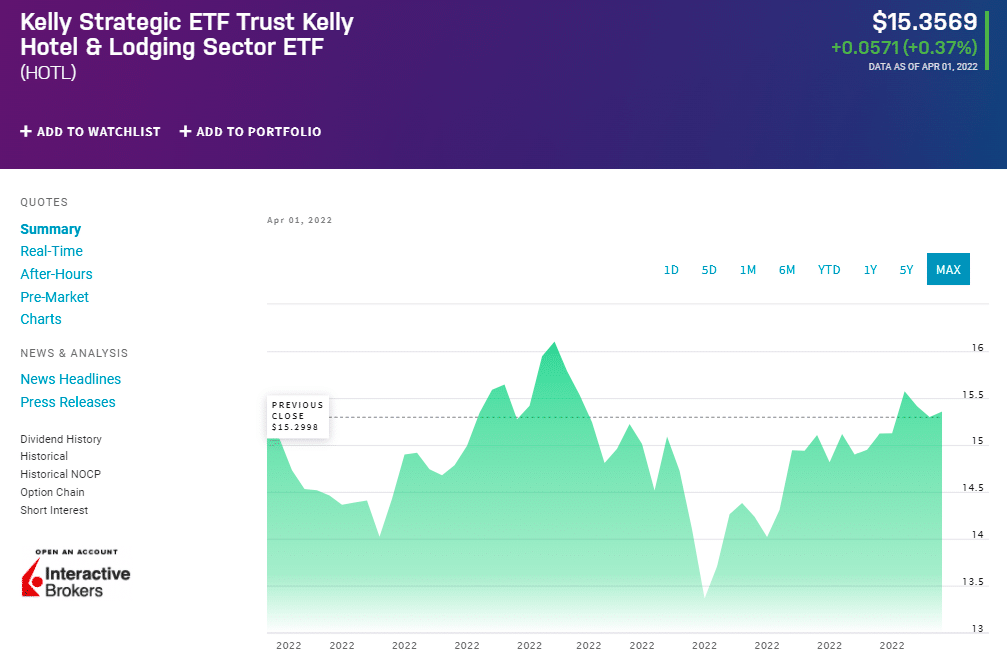

2. Kelly Strategic ETF Trust Kelly Hotel & Lodging Sector ETF (HOTL)

HOTL is a passively managed ETF that provides exposure to stocks from developed countries in the hotel and lodging sector. It was launched in 2022 and managed by Dustin Lewellyn since January 12, 2022, at Strategic.

The fund seeks to track the total return performance, before fees and expenses, of the Strategic Hotel & Lodging Sector Index, which consists of the stocks or depositary receipts of companies engaged in the hotel and lodging business. The fund invests at least 80% of its net assets in hotel and lodging companies.

The fund has the flexibility to use a representative sampling strategy if doing so is deemed in the best interest of shareholders. Such instances may include costs, illiquidity, or restrictions with underlying index holdings.

HOTL has an expense ratio of 0.78%, 46% higher than its category. Its expense ratio is above average compared to funds in the Consumer Cyclical category. Recently, in February 2022, HOTL returned 2.0%.

3. Defiance Hotel, Airline, And Cruise ETF (CRUZ)

CRUZ provides pure-play exposure to three segments of the travel and tourism business — airline, hotel and resort, and cruise. The fund holds at least 25 globally-listed stocks of companies that derive at least 50% of their revenue from the three business segments. Eligible companies must also meet investability and liquidity requirements, including a minimum market cap of $150 million.

The index is reconstituted semi-annually and rebalanced quarterly. Weighting is done in tiers; holdings are weighted by market cap within each segment, subject to a liquidity overlay and an 8% single security cap. Each segment is also restricted to 15-50% aggregate portfolio weight.

The ETF exposes retail and institutional investors to a cross-section of companies that we believe have significant growth potential. It seeks to track the performance before fees and expenses of the BlueStar Global Hotels, Airlines, and Cruises Index, a rules-based weighted index of companies primarily engaged in the passenger airline, hotel, and cruise industries.

Pros and cons

| Worth to invest | Worth to getaway |

| Hotel ETFs have the potential for big gains. | Hotels tend to perform worse than most other types of commercial real estate during tough times. |

| REITs, in general, tend to be relatively stable and solid long-term investments when appropriately managed, and hotel ETFs aren’t much different when times are good. | Hotel ETFs need to maintain a conservative balance sheet because of their economic sensitivity. |

| ETF investors have no active involvement in the property. They only need to choose their hotel ETF carefully, accept the risks that may come with it, and sit back and watch their investment grow. | Investors take a risk by buying an income-focused stock like a REIT instead of investing in Treasuries. |

Final thoughts

Not surprisingly, hotels are one of the most cyclical or economically sensitive commercial property types. When the economy turns worse, discretionary expenses like vacations are among the first to go.

The best way to invest in ETFs is with a long-term mentality. There are too many factors (like interest rates) that affect the short-term prices of hotel ETFs. And many of those factors have nothing to do with the underlying business. Over the long run, however, these factors matter less.