According to a 2021 report from the American Society of Civil Engineers, a funding gap of some $2.59 trillion over the next decade is needed to “maintain a state of good repair.”

After President Joe Biden swept into office in November 2020, a massive infrastructure spending bill was one of the first oversized agenda items. It took a lot longer than some had hoped, but in November 2021, Congress finally passed a $1 trillion spending package, and the president signed it into law. The final package did not include some items on the original spending agenda targeting so-called “social infrastructure including health care or education.” That left a traditional infrastructure bill focused on roads, bridges, and similar items.

As the money starts to roll out of Washington and into local communities in 2022, investors who want to tap into this spending should consider the following infrastructure exchange-traded funds.

How does it work?

To understand the composition of infrastructure ETFs and how they work, we first must acknowledge social and economic infrastructure. With this in mind, infrastructure ETFs comprise organizations involved in the construction of buildings, bridges and road networks, sewer and water infrastructure, communications infrastructure, electricity infrastructure, and all firms generating significant revenues from providing ancillary services to the above mentioned.

Top three things to know about this sector before starting:

- It is outperformed the broader US stock market over the past year.

- Investors seeking to own a diversified basket of infrastructure companies might consider an infrastructure funds rather than betting on an individual stock.

- Due to their attachment to government spending, such investments are an excellent inflation hedge asset, with the potential for huge returns.

Best infrastructure ETFs to buy in 2022

When choosing an infrastructure ETF, one should consider several other factors and the methodology of the underlying index and the performance of an ETF. For better comparison, you will find a list of funds with details on size, cost, age, income, expense ratio, dividend yield, returns, ESG rating, etc.

We examine the best three infrastructure ETFs below.

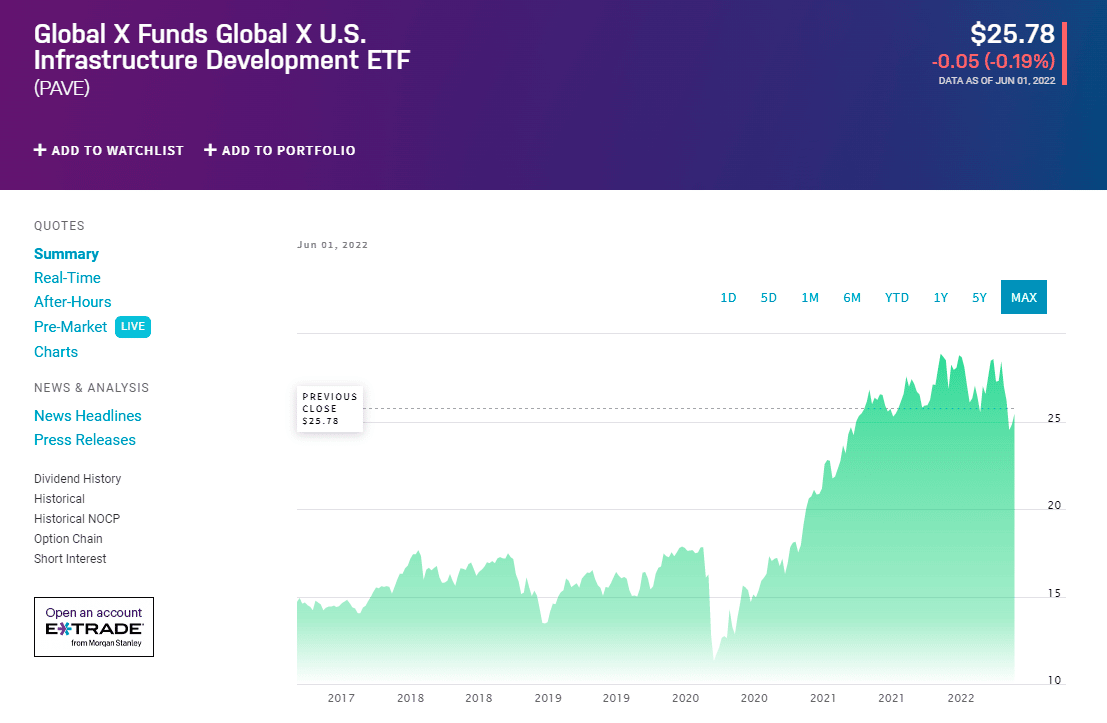

1. Global X US Infrastructure Development ETF (PAVE)

It was launched in 2017 and managed by Nam To since March 1, 2018, at Global X Funds. It is the largest dedicated infrastructure ETF on Wall Street, with more than $4 billion in assets under management. Its holdings consist of domestic, publicly-traded stocks involved in construction materials, heavy equipment, engineering, and construction.

The fund has dropped in 2022 and the rest of Wall Street but has fared slightly better than the S&P 500 year-to-date.

Dividend yield

It has a dividend yield of 0.54% and paid $0.14 per share in the past year. The dividend is paid every six months and the last ex-dividend date was Dec 30, 2021.

Holdings

Despite a targeted approach, the total portfolio is quite extensive, with about 100 total positions, including steelmaker Nucor Corp. (NUE), machinery giant Deere & Co. (DE), and construction materials company Fastenal Co. (FAST). It’s pretty darn diversified, too, with no single position representing more than about 4% of the portfolio.

Expense ratio

Its expense ratio is average compared to funds in the Infrastructure category. The fund has an expense ratio of 0.47%, the same as its category.

Returns (annualized)

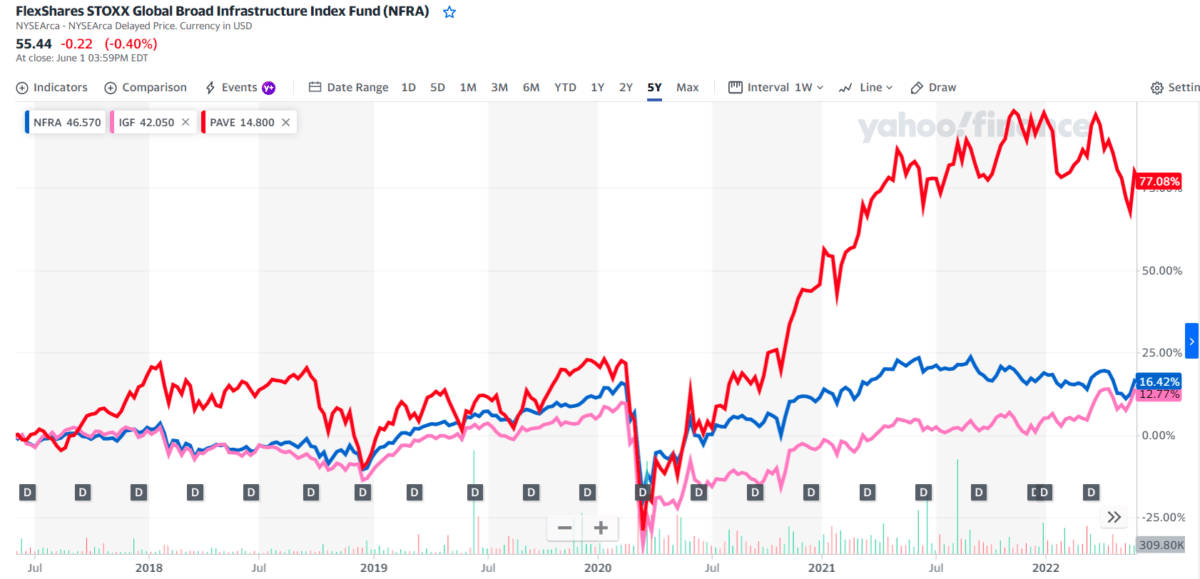

The fund has returned 2.5% over the past year and 17.6% annually over the past three years. In April 2022, PAVE returned -6.9%. It has an R-squared of 84%, a beta of 1.28, and a standard deviation of 25.1%. It has an above-average total risk rating.

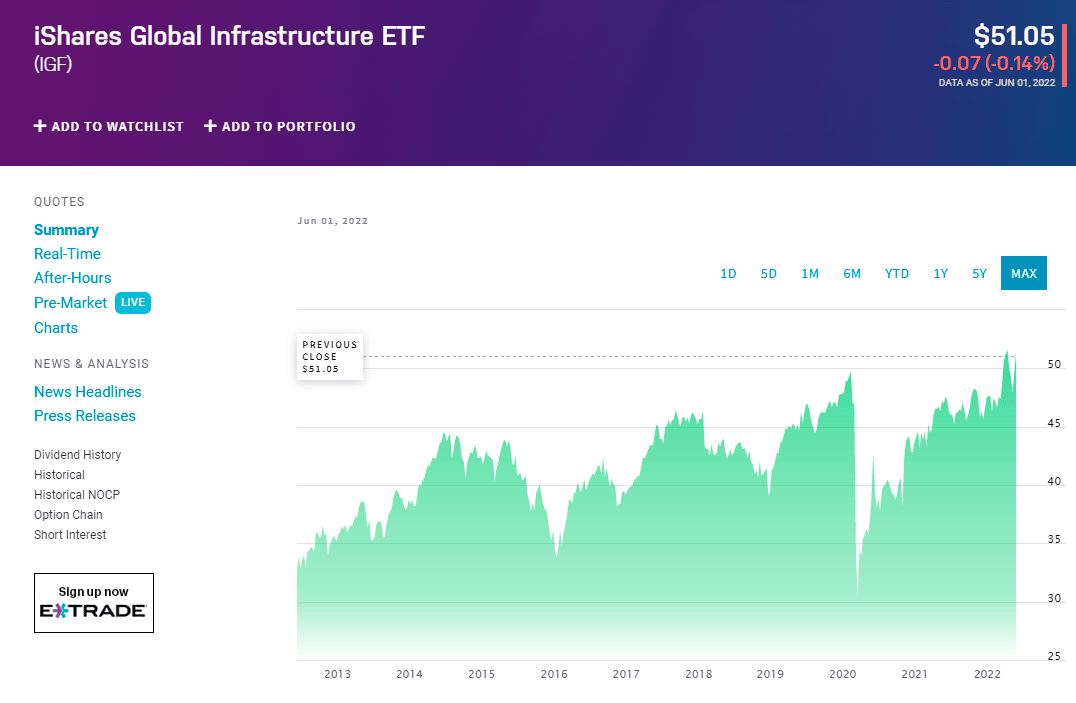

2. iShares Global Infrastructure ETF (IGF)

It was launched in 2007 and managed by Greg Savage since January 1, 2008, at iShares. While the US infrastructure bill is undoubtedly a domestic priority, it’s worth pointing out this globally focused fund here because the size of the $1 trillion spending agenda could undoubtedly make its way into the hands of some of the more prominent global players out there. And besides, with this infrastructure, ETF is posting a small profit so far in 2022; even while the rest of Wall Street has suffered, it’s worth a look based on performance alone.

Dividend yield

It has a dividend yield of 2.25% and paid $1.15 per share in the past year. The dividend is paid every six months and the last ex-dividend date was Dec 13, 2021.

Holdings

This fund, valued at more than $3 billion in total assets, is not exclusive to international stocks. Nearly 40% of assets are in US-headquartered companies. Furthermore, some of the 75 stocks in this ETF, like Australia-based toll road operator Transurban Group (TCL.AX), do brisk business in the US.

Expense ratio

Its expense ratio is average compared to funds in the Infrastructure category. IGF has an expense ratio of 0.43%, which is 9% lower than its category.

Returns (annualized)

The fund has returned 7.7% over the past year and 5.5% annually over the past three years, 5.8% per year over the past five years, and 6.6% per year over the past decade. In April 2022, IGF returned -3.5%. It has an R-squared of 73%, a beta of 0.95, and a standard deviation of 19.9%. It has an average total risk rating.

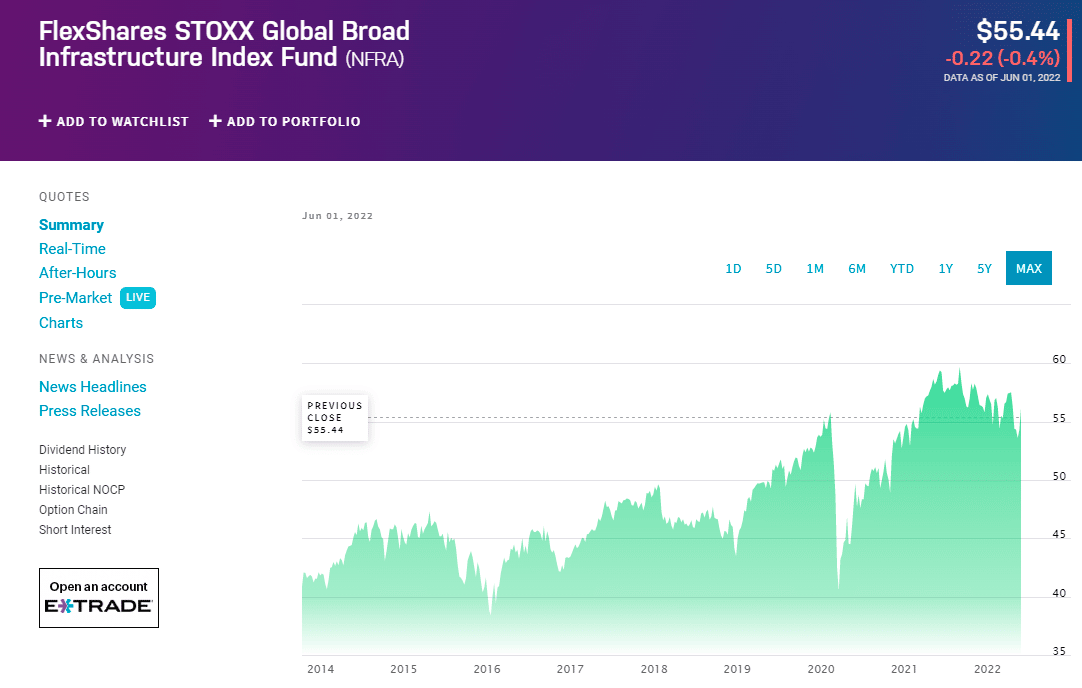

3. FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA)

It was launched in 2013 and managed by Robert Anstine since October 8, 2013, at Flexshares Trust. Though slightly smaller with about $2 billion or so in assets, NFRA is perhaps the most significant infrastructure ETF out there as measured by holdings with a list of nearly 180 stocks in the current portfolio.

As stated before, the original infrastructure bill was in largely traditional areas. However, it was not exclusively a highway bill. For instance, the package includes about $1.5 billion in prior spending for the all-important “Northeast Corridor” of Amtrak, among other railroad-specific items.

NFRA has held pretty roughly with a small decline even as the S&P 500 has lost about 17% since January 1, 2022. That shows this level of diversification may provide a bit more stability for this fund.

Dividend yield

It has a dividend yield of 2.75% and paid $1.54 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Mar 18, 2022.

Holdings

It also has a slightly different lineup from other funds, including railroads like Union Pacific Corp. (UNP), energy pipelines companies like Enbridge Inc. (ENB), and even telecom companies.

Expense ratio

It is average compared to funds in the Infrastructure category. The fund has an expense ratio of 0.47%, the same as its category.

Returns (annualized)

The fund has returned -3.0% over the past year and 5.5% annually over the past three years. In April 2022, it returned -5.3%. It has an R-squared of 86%, a beta of 0.78, and a standard deviation of 15.1%. It has a below-average total risk rating.

Pros and cons

| Worth to invest | Worth to getaway |

| Infrastructure spending will impact many companies, providing cross-sector thematic ETFs with an opportunity to shine. | The most significant risk is an eventual rise in interest rates or a blow-out in government bond yields. |

| Instead of picking winners within the sector, ETFs give you exposure to a specific industry, theme, or geography. | High inflation can also cause pricing pressures and decreased returns for infrastructure players. |

| No industrial niche transcends multiple economic segments like the infrastructure sector. | There is also construction, operational, management, and business risk. |

Final thoughts

With the current high inflation levels and increased government spending on infrastructure, the three ETFs might outperform the broader market and result in phenomenal gains.