How can you quickly grow your investment portfolio and its value? According to the majority of the world-renowned investors, exchange-traded funds and dividend-paying investment assets are the answer; with exchange-traded funds, you better on a segment of the economy to grow in the long run which is almost always the case.

On the other hand, dividend-paying investment assets provide a constant stream of income for reinvestment and recurrent expenditure and, as a result, constant investment capital. Dividend aristocrat ETFs provide an avenue of having your cake and still eating it, betting on the long-term growth of a segment of the economy while enjoying more than the average income and returns.

How does it work?

One of the primary reasons stocks’ investing is so popular is its dividend-paying attribute. Why? Cash dividends are a share of a company’s profits, which informs them about the financial stability of an organization. However, not all dividend-paying stocks are equal. Dividend aristocrat stocks are established blue-chip companies with history; the norm is more than five years, increasing dividend payouts year over year.

Top three things to know before starting:

- Aristocrats tend to skew the portfolio to low volatile sectors and mature companies.

- Dividend ETFs may appeal to certain types of investors, like those who are more conservative with their investing dollars or more interested in cash flow for retirement.

- Traditional dividend ETFs own companies that don’t grow as fast as the overall market.

The best dividend aristocrat funds to earn easily and cheaply

Since the turn of the year, equity markets have been declining. Geopolitical factors, rising inflation rates, and rising interest rates are weighing down on returns and eroding the purchasing power of consumers and investors alike.

Dividend aristocrat ETFs regularly have a history of outsized dividend payouts, making them highly attractive in economically uncertain times. These three dividend aristocrat ETFs provide comfort in the current economic turmoil state and are great for long-term investing.

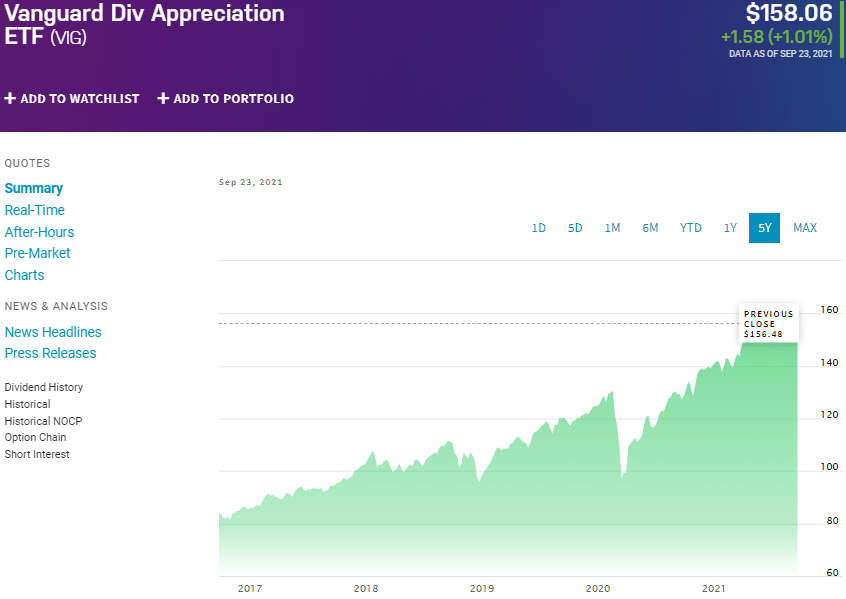

№ 1. Vanguard High Dividend Yield ETF (VIG)

The Vanguard High Dividend Yield ETF tracks the performance of the FTSE High Dividend Yield Index, net of expenses and fees. It utilizes an indexing investment approach, concentrating on equities with a history of more than average dividend payouts and increasing dividend yield yearly. In a list of 121 large value funds, the VYM ETF is ranked № 17 for long-term investing.

Dividend yield

It has a dividend yield of 2.91% for May 19.

Holdings

- Johnson & Johnson – 3.35%

- Procter & Gamble Company – 2.72%

- Exxon Mobil Corporation – 2.54%

Expense ratio

It is one of the most popular dividend aristocrat funds and hence has been able to amass quite the assets under management, $44.58 billion, at a relatively low expense ratio of 0.06%.

Returns (annualized)

A holding base of upwards of 400 high dividend-paying equities results in a fund free of concentration risk while providing regular incomes and returns; 5-year returns of 63.89%, 3-year returns of 39.47%, and 1-year returns of 4.02%.

More weight assignment to the health care sector, consumer staples sector, and financials sector ensure the resilience of this fund and enjoy an annual dividend rate of $2.97 coupled with a yearly decent dividend yield of 2.69%.

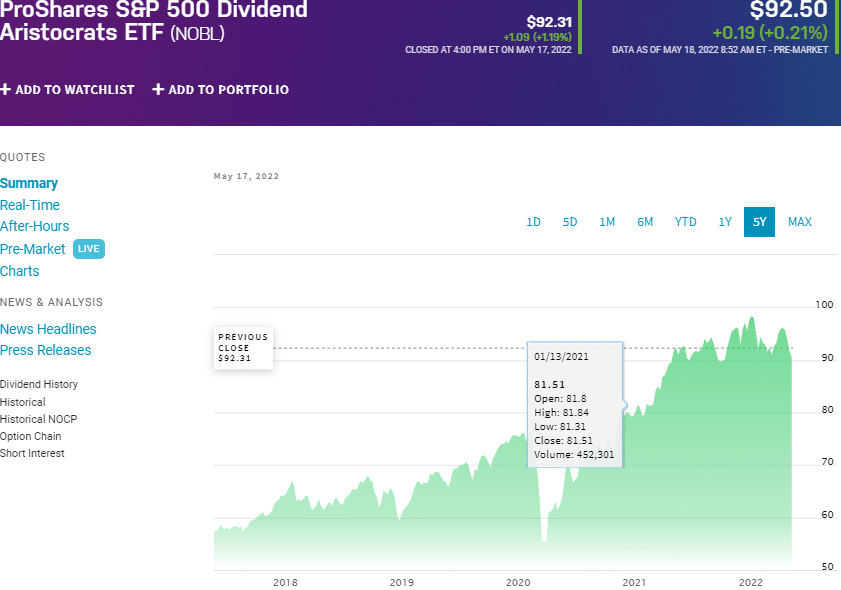

№ 2. ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

In times of market uncertainty, it is always prudent to seek diversification on different fronts. When it comes to dividend aristocrat ETFs, one of the best funds to achieve global diversification is the ProShares S&P 500 Dividend Aristocrats ETF.

The NOBL ETF tracks the investment results of the S&P 500® Dividend Aristocrats Index, investing at least 80% of its total assets in the equities compromising the tracked index. It offers exposure to the largest global conglomerates included n the S&P 500 index. In a list of 121 large value funds, the NOBL ETF is ranked № 12 for long-term investing.

Dividend yield

Investors get to enjoy annual dividends at the rate of $1.76 and a yearly yield of 1.84%, focusing on global S&P 500 conglomerates with a history of +25 years of dividend yield growth.

Holdings

- Johnson & Johnson – 3.35%

- Procter & Gamble Company – 2.72%

- Exxon Mobil Corporation – 2.54%

Expense ratio

The NOBL ETF despite having global exposure, does not match up to the VYM in assets under management, with its control being valued at $9.88 billion, at an expense ratio of 0.35%.

Returns (annualized)

An equal weighting, sector cap of 30% and concentration on the largest and most liquid global conglomerates results in a resilient fund with the ability to provide consistent income to withstand rising rates and inflation rate hikes; 5-year returns of 80.98%, 3-year returns of 46.32%, 1-year returns of 1.92%.

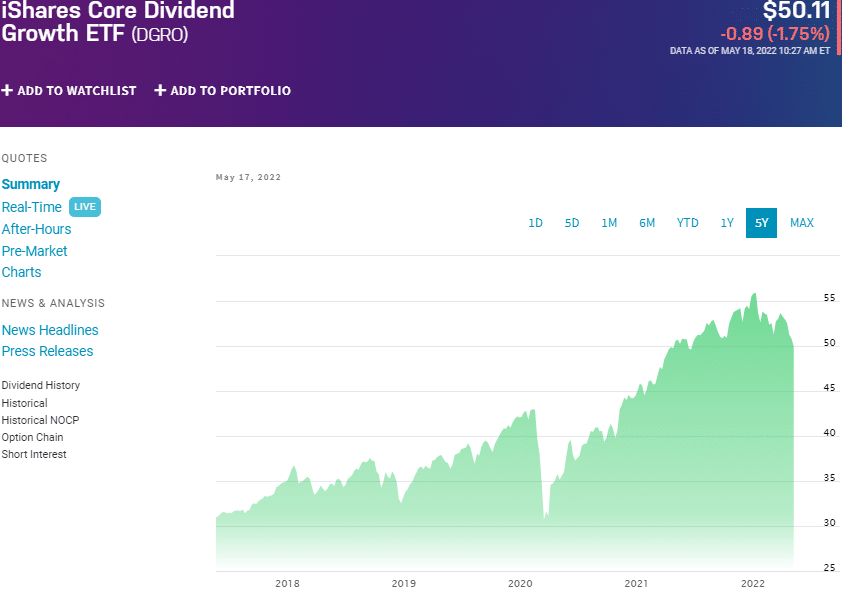

№ 3. iShares Core Dividend Growth ETF (DGRO)

The iShares Core Dividend Growth ETF tracks the investment results of the Morningstar US Dividend Growth IndexSM, investing at least 80% of its total assets in the tracked index underlying holdings and other investment assets with similar economic characteristics to the composite index holdings. It exposes investors to 97% of the US publicly traded dividend aristocrat equities.

Dividend yield

Investors can expect to beat the current inflation with an annual dividend rate of $1.05 and an annual dividend yield of 1.94%.

Holdings

- Johnson & Johnson – 2.96%

- Pfizer Inc. – 2.82%

- Microsoft Corporation – 2.79%

Expense ratio

This ETF is a significant player in the dividend aristocrat niche boasting $22.57 billion in assets under management, with an expense ratio of 0.08%.

Returns (annualized)

Focusing on equities with more than five years of dividend growth while ensuring they don’t pay more than 75% of earnings means ensuring continued and steady incomes and returns. A holding base of more than four hundred equities and a pretty even weighting provides for a pretty resilient fund; 5-year returns of 85.51%, 3-year returns of 46.42%, and 1-year returns of 2.55%.

Final thoughts

Dividend aristocrat ETFs have a history of weathering market volatility while providing steady and more than average income. Against the backdrop of rising interest rates, rising inflation, and the geopolitical risks resulting from the Ukraine war, the three dividend aristocrat ETFs above provide upside potential and a quality investment strategy to ensure a portfolio weathers the resultant downturn.