All gold-backed cryptos are derivative assets that let you access purchases, trading, and holding of physical gold at will at any time and location. They remove the transport inconveniences, illiquidity, transferability, and volatility related to dealing with physical gold.

When Russia launched its invasion of Ukraine on Feb 24, the price of both cryptos backed by gold — PAX Gold and Tether Gold jumped, according to CoinMarketCap. PAX increased 7% to $2,043 in the first 12 hours of the war, while Tether jumped 3% to $1,978.

Modern tokens backed by gold allow access to gold futures markets. They are based on blockchain technology. As digital cryptos, most gold-backed cryptos are convertible to physical gold. They can be traded on crypto exchanges for fiat or other cryptos. Gold-backed them in different ratios depending on the project. For instance, one gram of gold or certificate backs one token.

This article explains what backed by gold cryptos are, how they work and enumerates top cryptos of this nature.

How does it work?

The idea of a digital gold currency as an alternative payment system is almost as old as the internet itself. Not long after the internet went mainstream, E-Gold emerged in 1995 as the first digital currency backed entirely by gold. At its peak, millions of people worldwide were using this service until it was shut down.

Other attempts to make a digital gold currency have been made, but this was before the age of Bitcoin. A new era of gold-backed digital currencies has emerged, with blockchain technology established as a secure accounting method and BTC becoming better known to the general public.

Top three things to know before starting:

- With high inflation and geopolitical turmoil in the headlines, these tokens benefit from the current investment climate.

- In recent years, the price action on gold has been anemic compared with many cryptos whose prices have gone up by many multiples.

- According to Arcane Research in its latest report, the market capitalization of gold-backed crypto tokens increased by 60% in 2022 to surpass $1 billion for the first time in history.

Best backed by gold crypto to buy in 2022

Let’s take a look at the five best gold backed cryptos.

Pax Gold (PAXG)

Paxos, a New York State Trust Company, issues PAXG tokens backed by one fine troy ounce (t oz) of a 400 oz London Good Delivery gold bar stored in Brink’s vaults. Paxos holds the underlying gold in custody, with full ownership rights belonging to the token holder.

The creators of Pax Gold launched the token as an ERC-20 token on the Ethereum blockchain. PAXG tokens can be traded worldwide and are redeemable for LBMA-accredited London Good Delivery gold bars. Paxos is bound by US law to back PAXG tokens with mandatory capital reserves.

Price history

Today’s crypto price is $1,811.66, with a 24-hour trading volume of $9,035,744. It is up 0.4% in the last 24 hours. The 24-hour trading volume of PAX Gold is $9,035,744. It has a circulating supply of 330 thousand PAXG coins and a total supply of 329 thousand.

- PAXG hit an all-time high of $2,241.37 on May 17, 2021.

- PAXG had an all-time low of $1,399.64 on Nov 18, 2019.

Where to buy it?

It is traded on 33 exchanges, with the top being AAX, Nami.Exchange, and Binance.

What are the perspectives of the PAXG?

As for this crypto price prediction for the rest of 2022, there are divergent opinions. Some expect an upturn towards $2130.28 by the year’s end. Other experts are more pessimistic about PAX Gold’s future price, citing numbers downwards of $1664.291 in December.

Tether Gold (XAUT)

The largest issuer of USD-backed stablecoin, Tether, now has a gold-backed token called XAUT. It holds its gold reserves in Swiss vaults and allows the token holders to search for the serial numbers of their specific gold bars on the company website. Investors can request Tether to deliver their gold physically or redeem it for cash.

Price history

Today, Tether Gold’s price is $1,798.9, with a 24-hour trading volume of $1,110,685. The 24-hour trading volume of Tether Gold is $1,110,685. Its price has been up 1.3% in the last 24 hours. It has a circulating supply of 250 thousand XAUT coins and a total supply of 247 thousand.

- XAUT hit an all-time high of $2,096.29 on May 19, 2021.

- XAUT had an all-time low of $1,447.84 on Mar 19, 2020.

Where to buy it?

It is traded on seven exchanges, with the top exchanges being BigONE, FTX, and Bitfinex.

What are the perspectives of the XAUT?

As for this crypto price prediction for the rest of 2022, there are divergent opinions. Some expect an upturn towards $2196.86 by the year’s end. Other experts are more pessimistic about its future price, citing numbers downwards of $1675.981 in December.

Adventure Gold (AGLD)

AGLD is the Loot NFT project’s native ERC-20 token. Dom Hofmann, co-founder of Vine, designed Loot, a text-based, randomized adventure gear generator stored on-chain. The project deliberately lacks a front-end interface, pictures, statistics, or functionality. Instead, it is built on a collection of 8,000 text-based NFTs subject to interpretation by the community. The floor price of Loot on OpenSea is $8164 as of February 8, 2022.

Price history

Today, its price is $0.48 with a 24-hour trading volume of $28,258,067. It is up 8.6% in the last 24 hours. The 24-hour trading volume of Adventure Gold is $28,258,067.

- AGLD hit an all-time high of $7.70 on Sep 03, 2021.

- AGLD had an all-time low of $0.25 on Sep 02, 2021.

Where to buy it?

It is traded on 34 exchanges, with the top exchanges being Bybit and Binance.

What are the perspectives of the AGLD?

As for AGLD price predictions for the rest of 2022, expect an upturn towards $1.10574 by the year’s end. Other experts are more pessimistic about its future price, citing numbers downwards of $0.2092 in December.

Gold Coin (GLC)

This gold backed crypto is fractional, which means one coin is worth a fraction of one gram of gold. This means that the barrier to entry for Gold Coin is incredibly low. This contrasts with some other coins and gold itself, where the buy-in can be rather costly.

This crypto is on the ETH blockchain and has been around for years. You can invest in it incrementally as it gains your trust without breaking the bank. The stable platform and the ease of entry mean this is one of the safer choices.

Price history

The live price of GLC is $ 0.0211147 per USD today, with a current market cap of $922,321.07. The 24-hour trading volume is $ 1,580.41. Its price has been up 2.67% in the last 24 hours. It has a circulating supply of 44 million GLC coins and a total supply of 72.2 million.

- GLC hit an all-time high of $0.77 on Apr 14, 2021.

- GLC had an all-time low of $0.000340590485 on Dec 02, 2021.

Where to buy it?

It is traded on two exchanges, with the top exchanges being ZBG and Dex-Trade.

What are the perspectives of the GLC?

Its current price range might interest many traders, and because of this, GLC can reach $0.17 by 2022 with substantial cooperation with financial institutions if the following requirements are satisfied. With an average price of $0.15 for 2022, it can beat the latest price trend to reach new highs. The price tagline can vary as the crypto market can see another bullish trend in 2022.

Perth Mint Gold Token (PMGT)

PMGT is one of the best stablecoin backed by gold coins. Created by Western Australia’s Perth Mint, their tokens are backed by actual gold blocks, and a digital gold certificate accompanies each token as proof. Western Australia’s Perth Mint also incurs all the storage, custody, and insurance fees, providing a competitive and cost-effective alternative to other gold-backed cryptocurrencies.

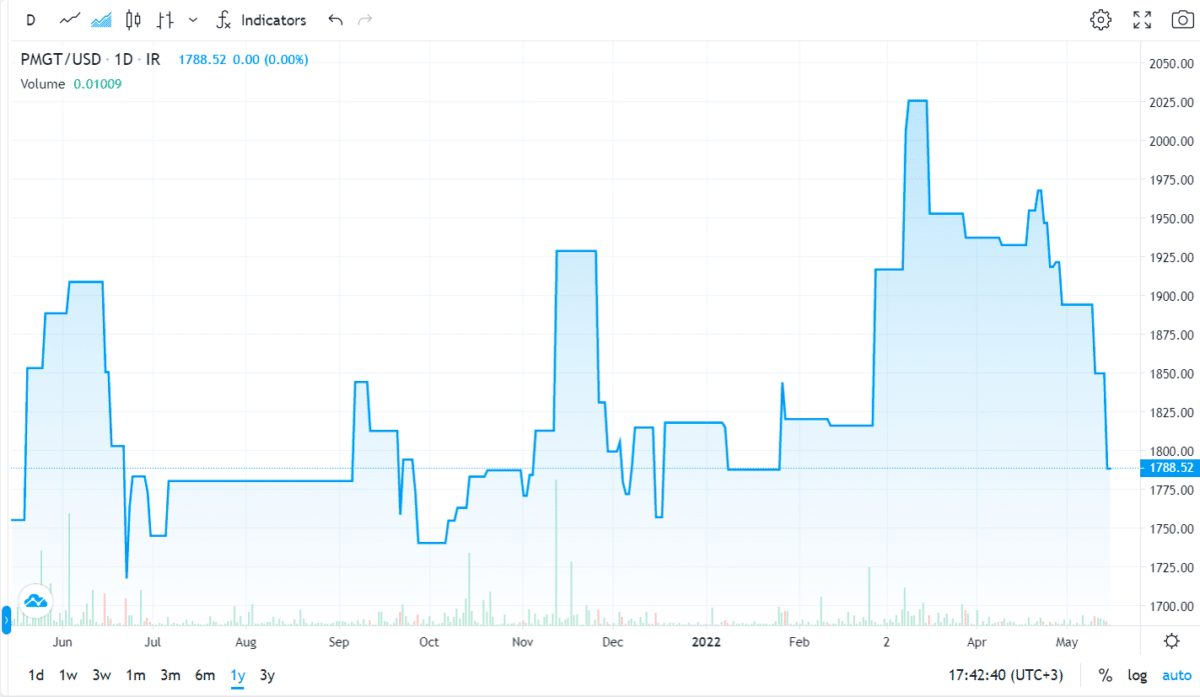

Price history

PMGT price is down -0.1% in the last 24 hours. Today, its price is $1,788,52, with a 24-hour trading volume of $26.89. It has a circulating supply of 1.2 thousand PMGT coins and a total supply of 1.16 thousand.

- PMGT hit an all-time high of $8,974.58 on September 30, 2020.

- PMGT had an all-time low of $953.57 on January 25, 2021.

Where to buy it?

It is traded just on the one exchange Independent Reserve.

What are the perspectives of the PMGT?

According to our deep technical analysis on past price data of this crypto, in 2022 its price is predicted to reach at a minimum level of $2,443.40. The PMGT price can reach a maximum level of $2,705.27 with an average trading price of $2,516.97.

Pros and cons

| Worth to buy | Worth to getaway |

| In a world of increasing innovation, investors no longer need to choose between owning gold or cryptos, both are on offer. | These assets involve risks like other cryptos. |

| Crypto has long been on the verge of revolutionizing payments and banking globally. | An underlying risk is associated with the holding company backing gold, given a lack of auditing mechanism. |

| Cryptos backed by gold are an increasingly popular alternative for traders seeking to escape increasing market instability and the looming threat of stagflation. | Negative carry can come when playing with a large amount of gold. |

Final thoughts

The most significant advantage that digital versions of gold hold over their physical counterparts are that they can be divided into any small unit or amount and transferred to another party.