Cryptocurrency is a widely acknowledged technology in today’s society. To engage in the digital world, one must have at least a basic knowledge of digital technology. Everything is regulated in the Bitcoin universe.

The concept of BTC is increasingly being used in volume trading operations. As a result, it’s become a tremendous hit on the internet. Since they have become so widely accepted and popular, many people feel that cryptocurrencies are a superior technology. However, like with any new technology, cryptos also have disadvantages. To take advantage of this problem and convert it into a benefit for Bitcoin enthusiasts. In response to the success of this initiative, stablecoin was launched.

There are many stablecoins, so let’s look at the top five to invest in 2022.

Tether (USDT)

Since its inception in 2014, Tether has been the world’s first stablecoin. It’s also the most valuable, with a market value of $78 billion. In addition, a fiat-based stablecoin called Tether was mentioned in a 2012 white paper. Tether Operations Ltd.’s parent company owns each currency approximately comparable to one dollar. Therefore, coins may always be exchanged for US dollars of equivalent value.

According to an audit by Moore Cayman in June 2021, Tether has “reserves held for its digital assets issued that exceed the amount required to redeem the digital asset tokens issued.” Despite paying a settlement to the New York Attorney General’s office in 2021 over allegations of a lack of financial transparency. According to InvestorsObserver, a market research company, the currency is considered low-risk.

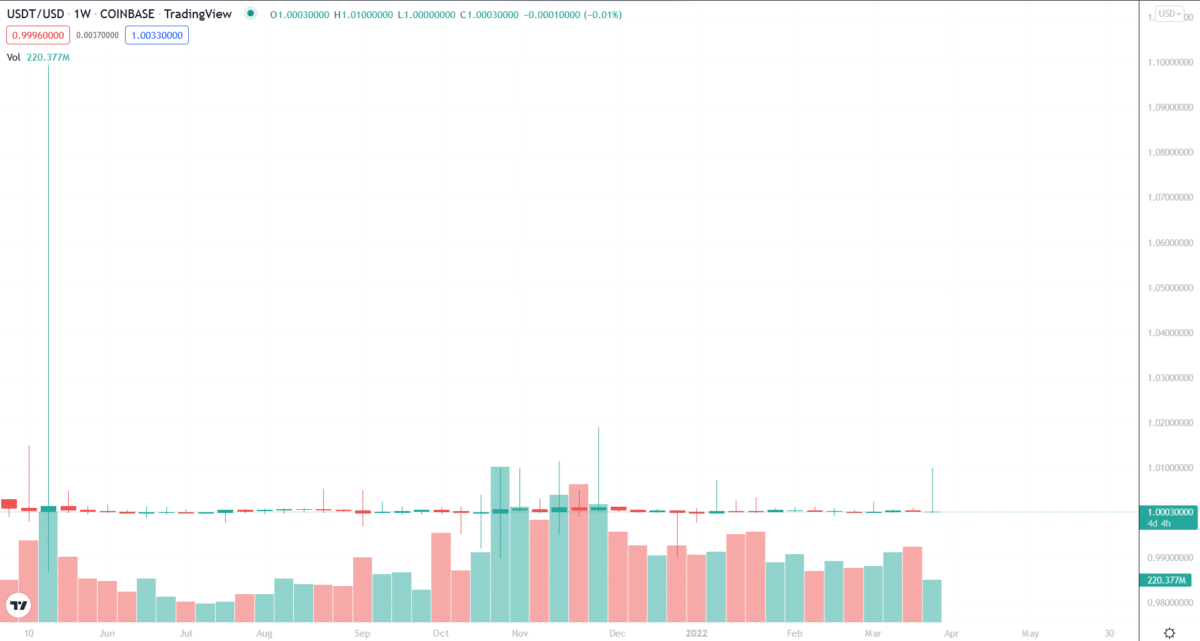

USDT price history

On July 22. 2018, USDT reached an all-time high of $1.32 and a record low of $0.57 on March 2, 2015. If we see it’s the overall growth of the past year, it is 0.2%.

Where to buy USDT?

Several prominent cryptocurrency exchanges, including Binance, eToro, Webull, Coinbase, and Uphold, have listed the USDT for trading.

What are the perspectives of the project?

It is a sort of cryptocurrency known as a “stablecoin,” which aims to stabilize the value of other cryptocurrencies. Those looking to avoid the extreme volatility of other cryptocurrencies while preserving their importance in the crypto market can turn to Tether.

Dai (DAI)

According to MakerDAO’s white paper on the company’s Dai stablecoin, “Dai is generated, supported, and kept stable” by Ethereum-based funds placed into MakerDAO’s vaults. The placed cryptocurrency acts as collateral when a user wants to withdraw Dai money. Because the deposited cryptocurrencies are worth more than the US money, MakerDAO can retain its stablecoin locked to the US dollar at a 1:1 ratio.

A venture capital firm, Andreesen Horowitz, invested $15 million in MakerDAO in September 2018, less than a year after the currency launched since confident investors were enthused about this notion. Six percent of the company’s total tokens at this writing. In addition to helping to keep the coin’s value stable, institutional investors also buy it. Although InvestorsObserver thinks Dai is a little more volatile than Tether, the site still considers it a very safe coin.

DAI price history

On November 16. 2021, DAI reached an all-time high of $3.67 and a record low of $0.94 on May 10, 2020. So if we see it’s the overall growth of the past year, it is 0.42%.

Where to buy DAI?

Several prominent cryptocurrency exchanges, including Binance, eToro, Webull, Coinbase, and Uphold, have listed the DAI token for trading.

What are the perspectives of the project?

To counteract the volatility of more renowned crypto-assets such as Ethereum and Bitcoin, DAI is often used as a stable hedge or counterweight.

Binance USD (BUSD)

As the third biggest stablecoin globally, BUSD has a market value of more than $14 billion, making it a strong contender for the world’s best stablecoin. USD was given the “green light” by the New York State Department of Financial Services in August 2020. Investing in cryptocurrencies has four significant consequences as a result of this.

As a first step, Binance’s BUSD partner, Paxos Trust Co., has adequate reserves to support all BUSD currencies in circulation. Second, the funds that underpin these currencies are closely monitored by regulators. Finally, as the last consideration, all reserves must be held in safe assets such as US Treasury securities and FDIC-insured bank accounts.

To summarize, token reserves are entirely separate from the company’s assets. There is no chance that Paxos would declare the coins as assets in the event of bankruptcy, making them safer for investors. The fact that InvestorsObserver rates BUSD as a low-risk currency is not surprising.

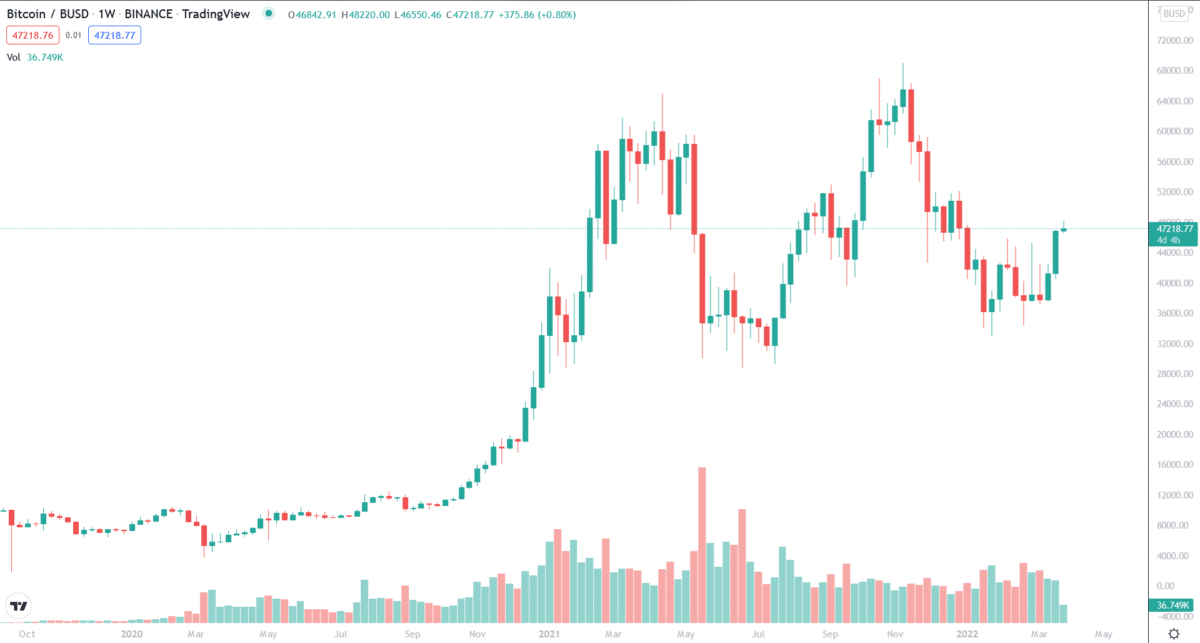

BUSD price history

On March 12. 2020, BUSD reached an all-time high of $1.15 and a record low of $0.9 on May 19, 2021. If we see it’s the overall growth of the past year, it is -0.1%.

Where to buy BUSD?

Several prominent cryptocurrency exchanges, including Binance, eToro, Webull, Coinbase, and Uphold, have listed the BUSD token for trading.

What are the perspectives of the project?

BUSD is a stablecoin that aims to keep its market value constant. So rather than needing to abandon the cryptocurrency market, investors and traders may now own a low-volatility asset on the blockchain.

Digix Gold Token (DGX)

DGX works differently than the other coins included on this list of stablecoins. Consequently, InvestorsObserver gives this currency a higher risk rating than the others. As a medium-risk coin, the price of DGX is unlikely to be manipulated, even if it fluctuates more than usual. However, due to its detachment from a fiat currency, DGX has higher volatility. On the other side, each DGX coin may be exchanged for one gram of gold.

According to this information, the coin’s value is based on the price of gold. The cost of DGX is linked to the price of gold, which fluctuates constantly. Despite this, many investors who believe in the value of physical assets find this attractive. DGX has a market worth of $4.1 million, with 58,000 coins in circulation.

DGX price history

On February 13, 2021, DGX reached an all-time high of $207.4 and a record low of $0.000004 on October 9, 2021. So if we see it’s the overall growth of the past year, it is -4.4%.

Where to buy DGX?

Several prominent cryptocurrency exchanges, including Binance, eToro, Webull, Coinbase, and Uphold, have listed the DGX token for trading.

What are the perspectives of the project?

To put it another way, it uses the Ethereum network and the Interplanetary File System to provide for public certification of an asset’s existence via its chain of custody through its Proof of Provenance (PoP) protocol (IPFS)

TerraUSD (UST)

With a dual focus on “price stability and growth,” TerraUSD’s white paper explains the coin’s mission. Coins backed by TerraUSD’s system are referred to as “Terra” tokens. Using the Terra platform protocols, TerraUSD users can earn extremely low-risk profits when the currency’s price is less than $1. It’s a simple process that gets the job done.

More UST is created by linking TerraUSD to the regular Terra (LUNA) coin and allowing LUNA to be exchanged for UST or dollars. When its price rises above a dollar, the UST pool contracts when its price falls below a dollar, bringing equilibrium.

As a consequence of this back and forth, the value of TerraUSD stays stable against the dollar. It seems to be working well. InvestorsObserver deems TerraUSD a low-risk currency, despite the currency’s slightly higher risk than Tether and Binance USD.

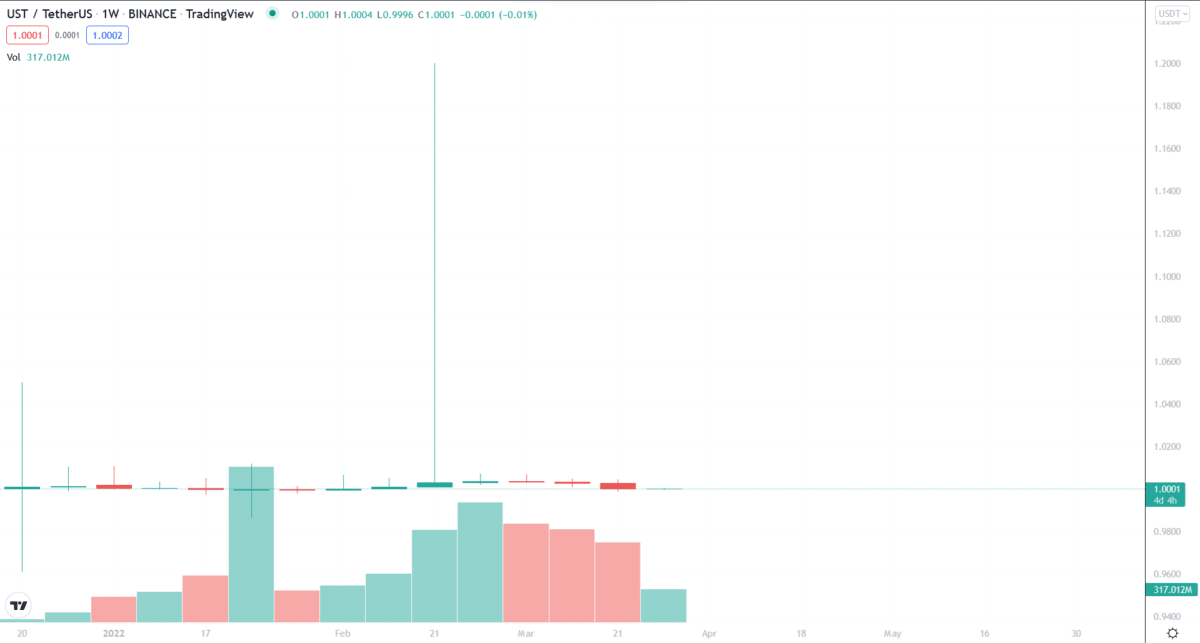

UST price history

On January 11. 2021, UST reached an all-time high of $1.09 and a record low of $0.857 on May 19, 2021. So if we see it’s the overall growth of the past year, it is -0.1%.

Where to buy UST?

Several prominent cryptocurrency exchanges, including Binance, eToro, Webull, Coinbase, and Uphold, have listed the UST token for trading.

What are the perspectives of the project?

TerraUSD is a decentralized stablecoin built on Ethereum that attempts to maintain a value of $1. Unfortunately, uncontrolled stablecoins like UST are not backed by US dollars in a bank account like UST. Therefore, it is not possible to coin 1 TerraUSD without destroying LUNA, the reserve asset of TerraUSD.

Pros and cons

| Worth to buy | Worth to getaway |

| You can rely on them since they’re well-capitalized. You may use whatever sort of resources you choose. | It necessitates a third-party intervention. |

| The crypto market they have a minimal degree of volatility. | External audits are a necessary evil. |

| They make it simpler to conduct transactions rapidly and securely in the face of increased market volatility. | Lower rates of return on investment (ROI). |

Final thoughts

It took a long time to transfer fiat to crypto before stablecoins existed, which deterred many individuals from joining the cryptocurrency business. However, as public confidence in the cryptocurrency business grows, stablecoins are becoming more popular.