You can indeed be a millionaire within a few years just by trading forex. There is no way to disagree with that because thousands of people worldwide have already made their fortune by trading in the FX market. But remember, there are thousands, not millions.

Although it is firmly possible to make money from FX trading, it might not be suitable for everyone. It requires a strong knowledge of the market with an appropriate step to get involved in it.

Therefore, a simple guideline that you will see in the below section might be a blessing to you as it will give you the exact way to become a profitable trader.

Can you make money trading forex?

Trading in the FX needs to know the core structure of the market. Many online gurus will attract you by saying a lucrative return in a short time. However, when you buy their service, you will end up with nothing.

Is it possible to make money from FX? Yes, possible, but with some conditions.

When you open a trading account through a forex broker and start buying and selling a currency pair, you need to know who is selling that currency pair to you. However, people say that the FX market is decentralized and has no one to control, which is not entirely true.

Banks are the key participants in the forex market, and they buy and sell from the opposite directions of retail traders. As a result, the price does not move on a single side for a long time and forms swings.

So, you can earn money from trading by observing how banks are operating the market or if your trading strategy matches their direction, you can get the reward.

How to invest wisely?

Come to the straight point! Do not invest any money in the forex market that you are not willing to lose.

If you plan to sell your asset or acquire money from a credit card, you should stop now. The forex market is a volatile marketplace where any uncertain movement can happen. Moreover, the use of leverage often makes using more risk on the investment. Therefore, only invest spare money in forex and focus on diversifying the investment.

Diversifying means investing in several currency pairs at a time. Moreover, you can invest in several marketplaces like forex, stocks, cryptocurrencies, etc. Another approach is to follow different trading approaches like short-term and long-term trading in a single pair.

Let’s see how you can diversify the portfolio with your $1000 investment.

| Market | Allocated Amount | Percentage |

| Forex | $400 | 40% |

| Crypto | $300 | 30% |

| Stock | $200 | 20% |

When you take a trade-in a forex pair, calculate the risk per trade based on a $400 investment, not $1000.

How to pick up a trading strategy?

In the first section, we have seen that banks operate the forex market, and you should focus on what banks are doing with the price. However, it is often hard to find their activities as the actual trading volume is unavailable in the forex market.

If you roam online, you will see thousands of trading strategies globally, and creators of this system claim themselves profitable. But when you try to find a suitable trading method, you should understand the core functions of every element.

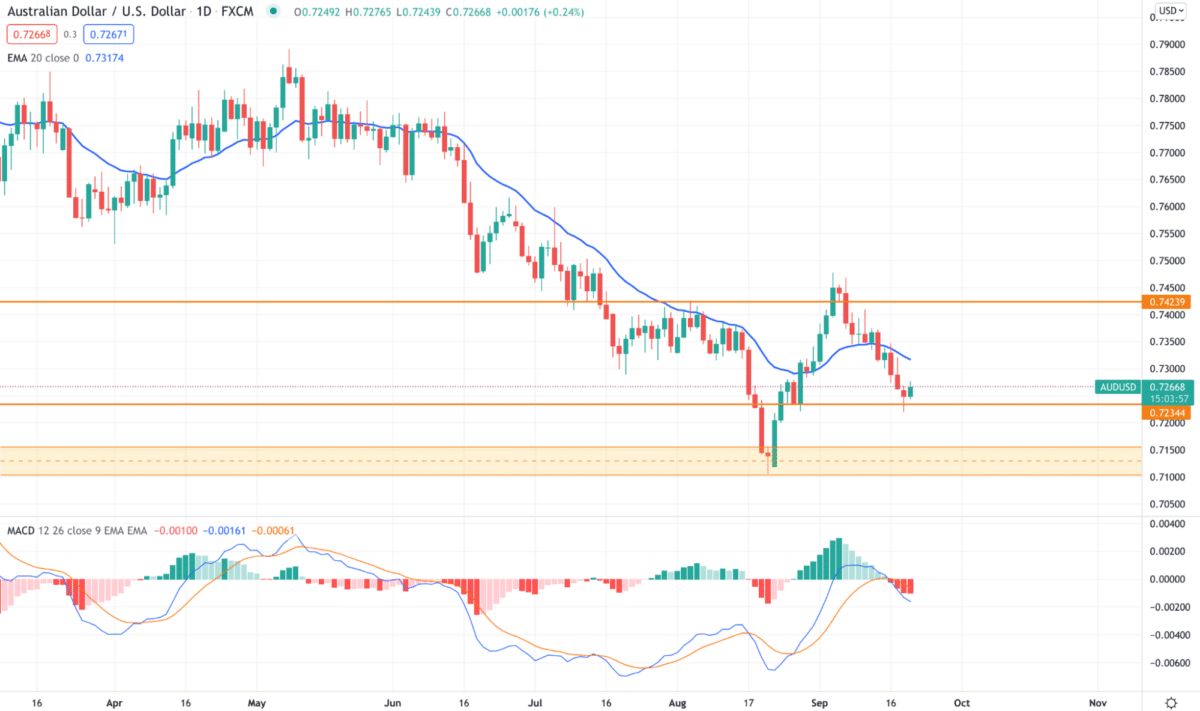

For example, let’s look at the trading chart below where the price is moving up and down from an indicator called the moving average.

Now, if you want to build a trading strategy using a moving average, make sure that you know the moving average’s core structure and calculation method.

Whether you are a technical trader or fundamentals, you can easily earn money from trading if you understand the logic behind the trade.

How to profit from forex trading?

The core idea of making a profit is to follow what institutional traders are doing. When they drive the price, either buy or sell sides, they leave some signs. For retail traders, finding and following their signs are important.

Retail trader’s involvement in forex trading has increased nowadays because of technological advancement. No people can do trading just by sitting in front of a laptop or smartphone. However, it does not mean retail traders have a significant impact on price changing.

There is no alternative to having a systematic approach while making a trading decision. You can do it just by following these steps:

- Identify and build a trading strategy.

- Ensure that the trading strategy can read what is happening in the broader market.

- Back-test the strategy in the past price of more than six months.

- Come to real trading with a lower deposited amount.

- Follow money management and risk management to minimize uncontrollable risks.

How much do professional forex traders make?

Professional traders making a consistent profit from FX trading do something extra that an average trader doesn’t do.

What does an average trader skip?

The first thing is that they rely too much on their trading method. The market moves by itself by following an algorithm that doesn’t care what an indicator tells you. On the other hand, professional traders focus on fighting uncertainties because you can make money again if your balance is safe.

But the question is, how much does a trader earn to lead a financial freedom life?

Well, it depends on the trading style and risk management. If you are a conservative trader and you earn 2-5% a month, you can have a 24-60% return on investment in a year, which is impressive. On the other hand, intraday traders make more money to catch short-term movement in the price. On average, 2% to 10% is the average winning ratio for successful traders.

Is automated forex trading profitable?

Automated trading has become profitable due to the introduction of different tools and AIs. There are many records of making millions by using a computerized system. A higher return with a higher drawdown can blow your account at any time, whether it is from automated trading or manual. In that case, investors should find or build a system that follows consistency.

Final thoughts

After completing the whole section, we can conclude that the forex market is an excellent source of earning money online but with some conditions. Moreover, managing risks is more important here than making profits.