Getting maximum profit from forex trading does not require being a guru in the market. Instead, if you follow a systematic approach, a simple strategy brings you enough profits.

The global financial market is full of uncertainties. Therefore, the first thing you should keep in mind is that no one can say what might happen in the future. As a trader, we always anticipate the price, not participate. However, it is crucial because you will not sail here if you don’t know how deep the sea is.

Some simple steps can give you more than you expect from the market. In the next section, we are going to disclose five steps to maximize profits. Completing the whole unit will dramatically change your trading career if you struggle to be a consistently profitable trader.

Step 1. Understand the market

Talking about the FX market, the major market participants are banks and financial institutes, often known as smart money. They are standard terms in the FX market, where any investment from retail traders is known as street money.

This is because smart money investors have enough liquidity to run the market. Here the primary duty of the street money is to follow what banks are doing.

Therefore, if you want to be successful in trading, use a strategy that considers the footprint of smart money. No matter what your indicator says or the price is trading above or below any critical level. All is how you can find their footprint.

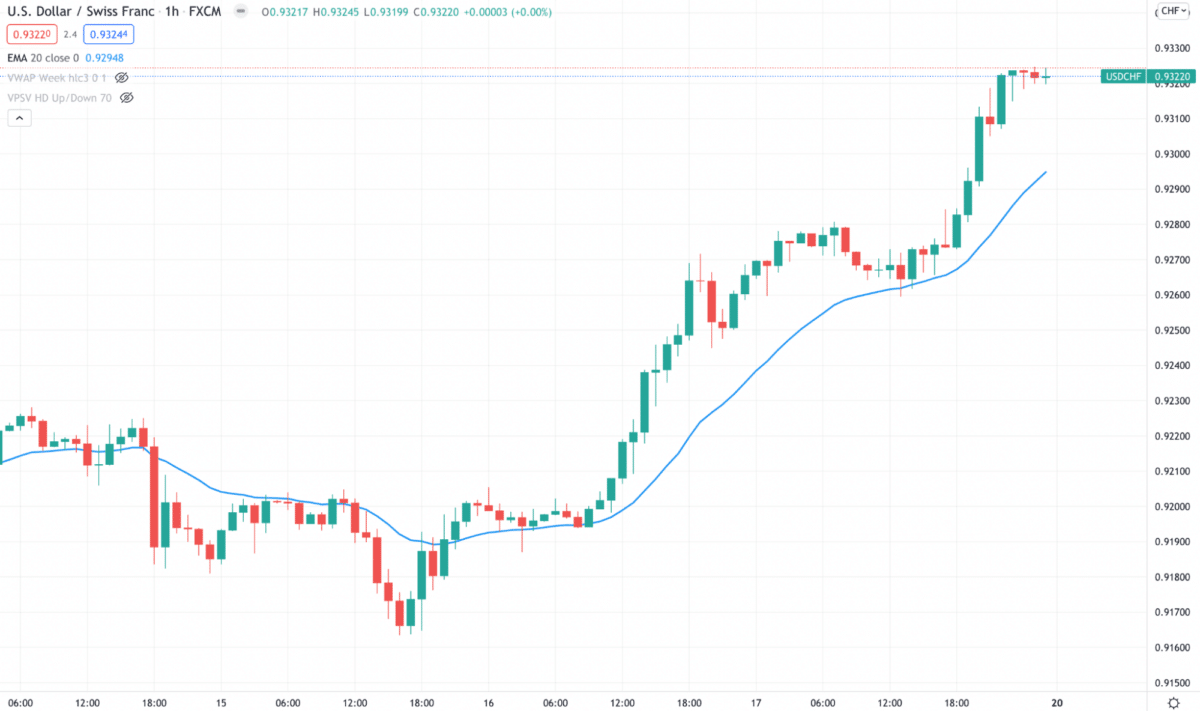

However, the process is not complicated here. You have to change the chart reading style. For example, let’s see the image below.

We are watching an upward market where the price is moving up by creating new higher highs. We all know that we should focus on buying in this market. So it would help if you considered who is behind the bullish movement. They are smart money.

So think differently. Instead of thinking of a trend, think like the smart money is taking the price higher, and when they feel like adding more orders, the price will come back before making another surge.

Step 2. Do not overtrust horizontal levels

Horizontal levels are straight lines or zones from where a significant market movement happens. Once the price reaches them, we wait for a reversal candlestick and open sell trade from resistance and buy trade from support.

Commonly, most trading guru teaches, but not tells when you should trust them and when not. S/R levels represent a memory of traders. Therefore, people may react the same if the price action reaches the same level. In that case, you should trust that level but not more than three times.

Yes, do not trust horizontal levels after making three consecutive touches! But why?

Because these levels are not honoring, the opposite party is getting ready to breach the barrier.

The above image shows that the XAU/USD bears failed to breach the 1785 support level but failed five times. As a result, the level became weaker and made a sharp fall downside.

Step 3. Understand market context

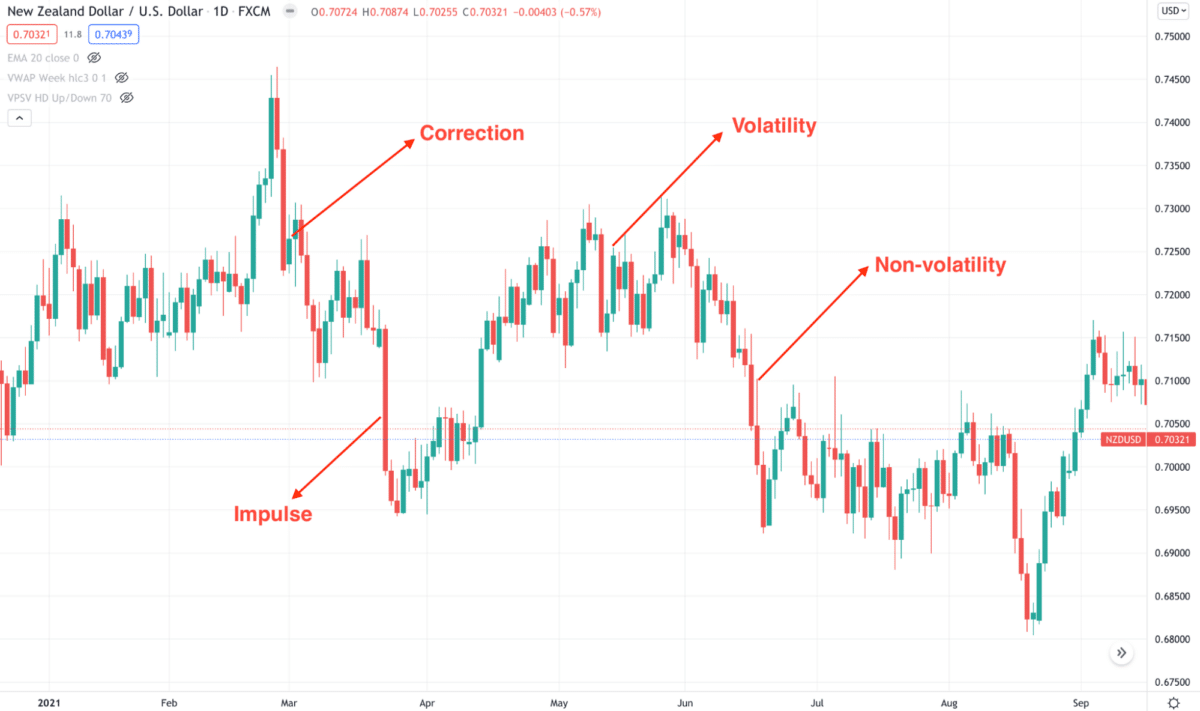

Context is a way to observe the price and describe its nature. No matter if you are following a technical indicator-based trading or price action. If your trading direction matches the path of context, take the trade; otherwise, ignore it. Let’s see the core elements of market context.

- Impulse

A sharp move where the price makes new highs or lows aggressively.

- Correction

It appears after an impulse and indicates profit-taking. Price barely makes new highs or lows.

- Volatility

Indecision and violation of near-term levels. The major price reversal happens after strong volatility.

- Non-volatile

It seems like the current trend is strong, and it may break near-term support or resistance areas.

Step 4. Focus consistency

If you trade for financial freedom, you should focus on consistency. You cannot beat market makers, and you cannot force your trade to go your direction. You will make losses, mistakes, and frustrations but blowing up the trading account with loss? No way!

Make sure to follow a set of trades to justify your understanding of the market. Like, try to remain profitable in every 20 sets of trades. You will make profits and losses, but you should ensure that you are overall profitable each month. Even if you make a loss in a month — don’t worry, you can recover it sooner. Do not take too many risks per trade.

Step 5. Build a trading psychology

It is the hardest part of a trader’s journey. Not because it is impossible to build trading psychology, it is because most people ignore it. Most newbies focus on making money from trading. They think that they will be millionaires soon by implementing a profitable strategy or buying robots. Moreover, some trading gurus offer excessive profits that often confuse new traders about the truth behind the market.

Therefore, syncing your brain to the market is very important, and traders can do it by understanding the strength and weaknesses of the trading method. Instead of focusing on when to trade, focus on when not to trade. In this way, you can make a perfect shot with maximum accuracy.

Final thoughts

In the final section, one thing that you should know is practice. There is no alternative to practicing a lot with a system. You cannot make a profit even if you completely understand the market with strong theoretical knowledge. You will make mistakes as everyone does. But learning from mistakes and promising not to repeat the same mistakes is the key to success in trading.