Bitcoin is now not a new thing but is still the talk of the town. Now, if you are willing to trade BTC without even using the digital asset itself, you may do so with the help of Contracts for Difference, short for CFDs.

The benefit of trading Bitcoin with CFDs here allows you to trade it without even owning it. CFDs also help you not worry about having crypto wallets and those large backups.

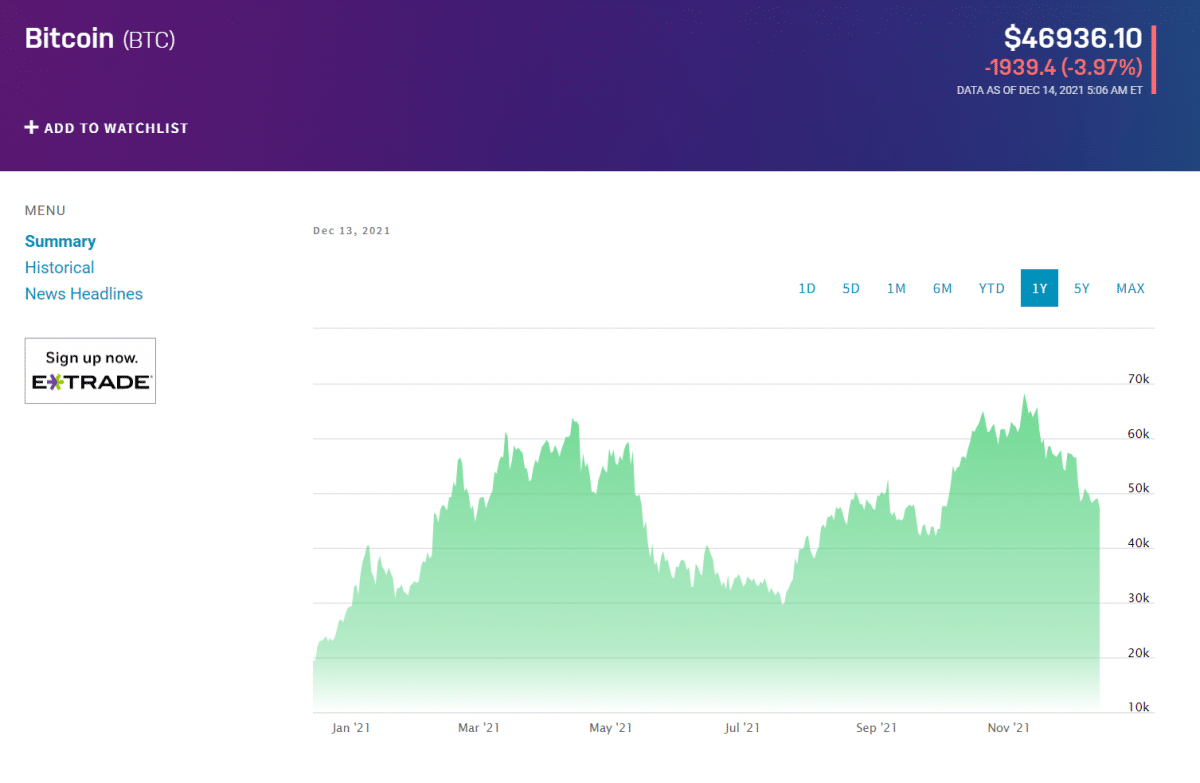

Traders can speculate and make money from the high Bitcoin volatility that leads to significant price movements. If you’re looking to get involved in the cryptocurrency sphere, CFDs are something you must know about.

Take a look at this article and learn how to trade BTC with CFDs.

Three things to know before starting:

- CFD is an easy way of getting into crypto trading without owning the asset itself.

- Trading CFDs are risky and need good knowledge to start.

- Market participants must choose the right broker to start trading as few also give risk management advice.

What is CFD?

It is contract for difference, a financial derivative made in futures contracts. Thus, it is a deal between a trader and a broker that allows a trader to profit from Bitcoin’s price movements without owning or buying the BTC.

Such an opportunity allows traders to trade BTC by keeping in mind the difference in the ask and bid price given by the broker. As a result, traders do not need to worry about buying, storing, and securing the BTC safely as they don’t have one.

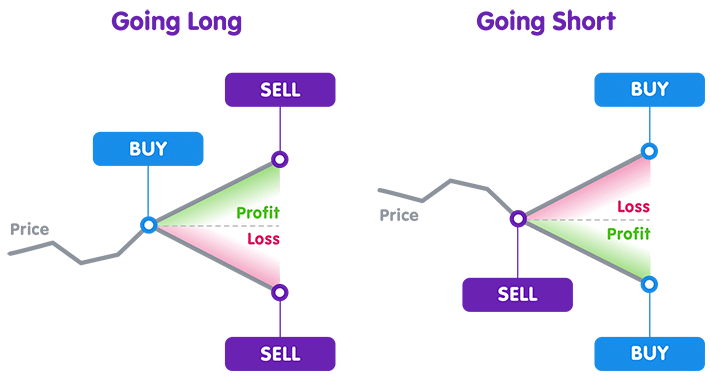

While trading Bitcoin CFDs, traders will take the trade in the direction of the BTC price movement by analyzing the market. If the trader thinks the price will go up, they will open the position for buying and vice-versa. If the prediction goes right, the trader makes a profit, and if it goes wrong, they bear a loss.

Why is it best for traders?

Trading Bitcoin CFDs is useful to market participants as there is no need for them to worry about buying the BTC. There is also no need to keep any wallets to hold the asset.

The most important benefit here is the allowance for buying and selling at exchange rates. Traders can also trade CFDs every day as the crypto market is 24X7.

Example of a CFD trade

For our example, we will assume the price of Bitcoin to be $34,000. You recognize a buying opportunity and purchase three CFDs at the current market price of $34,000. To simplify, we will ignore our example’s spreads and broker’s commission. The value of one CFD is the same as one Bitcoin, $34,000. Therefore, the total value of the CFD is (3 x $34,000) $102,000.

The price of BTC eventually goes up after a few hours, and it reaches $40,000. At this moment, you anticipate selling the CFDs back to the broker at the current market price. The value of the contract is now (3 x $40,000) 120,000. Therefore, the profit you make is the difference in your selling and buying price. This equates to ($120,000 – $34,000) $22,000.

On the other hand, if the price of Bitcoin moves downwards to $29,000, the CFD’s value would decrease to (3 x $29,000) $87,000. Therefore, if you decide to close the position, you would lose ($102,000 – $87,000) $15,000.

In the real market, brokers would charge commissions on CFDs. In addition, you would have to consider the spread. The spread would determine the bid price when you buy a CFD. Therefore traders should note that the larger the spread, the longer you will have to wait for your position to profit.

Pros and cons

You must be thinking how wonderful and easy CFD is right? Well, it is but as we all know everything comes with a tag called advantages and disadvantages and you must know them before involving your hard-earned money into CFD.

| Worth using | Worth to getaway |

| Leverage Leverage opportunities by the broker is a great thing that allows market participants to trade the assets even with small amounts. You do not have to have huge deposits in your trading account. | Volatility Volatility is good and also bad at the same time. But it is one such thing that makes BTC worth trading. The fast price movement helps traders to make quick money in the market. |

| Go long and short When you invest in any crypto, you do it with the hope that the value might rise in the future. While by trading CFD, you can take advantage when both the price is falling and rising. | No ownership In CFDs, you are trading by trusting the broker’s deal; hence you do not have your own assets like shares or commodities. |

| Time flexibility You can trade Bitcoin CFDs anytime, right from your mobile phone. This gives freedom to someone who wants to trade part-time. | Choosing a broker Choosing a broker is a big task while trading CFDs. As there are a lot of scammers, it is hard for anyone to distinguish between a good and a cheating broker. |

Final thoughts

Crypto is vast and yet evolving; if you are looking to step into this industry, CFD can help you do that. CFD is a simple way by which any trader can participate in the crypto space with the benefits of being fast and straightforward cryptocurrency market exposure.

Although there is much difference between trading crypto through a crypto exchange, choosing which one to go for depends entirely on your investment goals and trading styles.

While trading CFDs you may have to bear a few trading costs that summarize themselves as spread charges and commission.