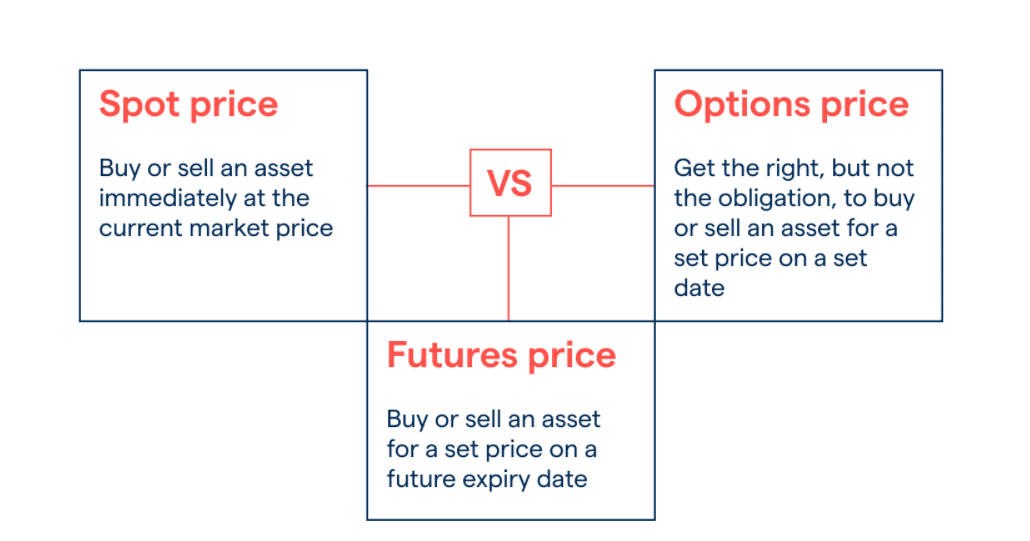

Futures and options are derivative products, meaning their value is derived from the underlying asset or instrument. They are similar to how stocks and bonds are generated from the underlying asset or tool. One of the obvious advantages of having options is that you can choose what you want to do.

An option is a legal contract that is executed between two parties. It grants the contract buyer the right to purchase an asset at a predetermined price on or before the first day of a specific future month at a predefined price. The maximum amount of risk that the buyer of an option may face is limited to the amount of the premium paid.

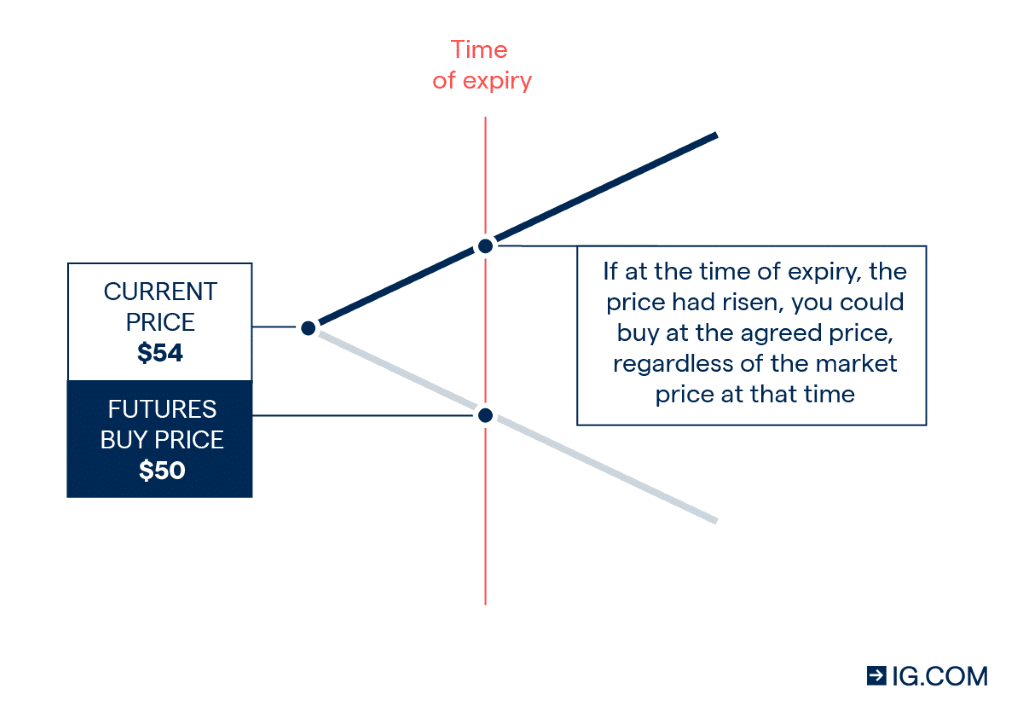

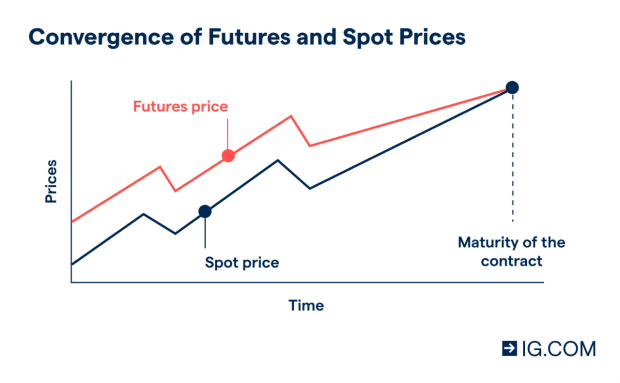

Futures, on the other hand, provide many significant advantages over options in a variety of ways. Buyer and seller agree to purchase or sell an asset or financial instrument at a particular price and time in a specific future month.

This is referred to as entering into a legally binding agreement. Although it is not ideal for all investors and investments, they are well suited to particular investments and investors. Throughout this article, you will learn about the top three advantages of futures over options.

Why is it best for advanced/novice traders?

The usage of futures options provides market participants with an unrivaled assortment of chances. However, their name occasionally confuses and actively discourages many active traders from trading. This blog post will cover the basics of futures options and the three primary reasons to use them in your trading strategy. In addition, proper market research and trading skills may help both novices and professionals gain expertise.

Top three advantages

Let’s take a look at the three overwhelming advantages of futures.

Simplicity

Futures options employ futures contracts as their underlying assets, as opposed to traditional options contracts. Contrary to popular belief, these contracts operate in the same way as ordinary options contracts.

How to buy/trade?

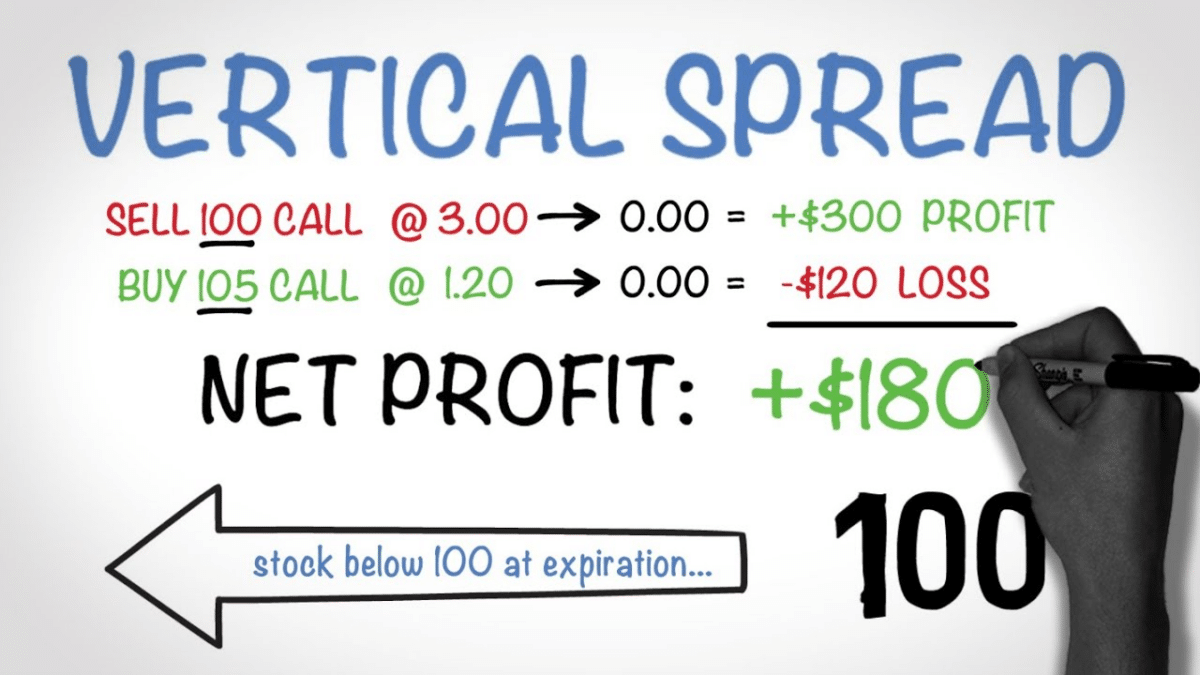

With a call contract, you can go long in the market. Conversely, you can short a market if you buy a put option at a specified strike price.

What risks to avoid?

Ooptions on futures contracts may be purchased or sold. Traders often pay premiums when purchasing contracts and earn premiums when selling contracts. Purchasers’ risk is limited to the price paid; sellers’ risk is unlimited as they promise that the contract will start regardless of the conditions.

For example, each product, much like stocks or commodities, has an options chain that determines the premiums paid on the contract. The value of a premium is determined by whether the strike price of a contract is at the money (ATM), in the money (ITM), or out of the money (OTM). ATM and ITM contracts are given more significant premiums than OTM contracts, which is the only difference between the two.

Market exposure on a direct basis

At its most basic level, the functioning of a futures options contract is exactly what its name implies. It is an options contract that is dependent on the performance of a futures contract. Depending on your objectives, you can take long or short positions in a market by purchasing calls or puts.

How to buy/trade?

You are concerned about the state of the market and believe that gold has significant upside potential over the next six months. It is the beginning of June, and CME December gold (GCZ) is trading at $1,750.00; given the advent of new Covid-19 variations, you believe that $2,000.00 by the end of the year is a realistic prospect.

What risks to avoid?

To get long gold utilizing options on futures contracts, all you have to do is purchase a call contract at a strike price that you find appealing. For example, if you believe that the current market price ($1,750.00) represents an intermediate-term floor, acquiring ITM, ATM, or OTM GCZ will create a new long position.

The beauty of this deal is that the only money at risk is the premium. If you are completely wrong and the price drops to $1,000, you lose the trade premium. A long one-month futures contract bought at $1,750.00 and sold at $1,000.00 would result in a $75,000 loss (every $1.00 is worth $100).

Affordability at the time of expiry

The fact that all derivatives goods have a limited shelf life should not be lost sight of is essential. This is represented by the official expiration date for futures and options contracts. Expiry means the contract has been removed from the market and is no longer available for trading.

How to buy/trade?

Options contracts on futures contracts normally expire one month before the underlying futures contract, which is called the “call option.” Because the premium value of an option is susceptible to time decay, this can be either a good or a negative thing for an open position (delta). Although this connection appears to be complicated, traders are given several options.

What risks to avoid?

To make use of the alternative, your long position in one GCZ contract, starting at $1,800, is created by exercising the option. It is possible to make an initial profit of $3,500 ($75*100 = $7,500 – $4,000); but, the value of this position will change as the price of GCZ goes up and down.

For example, you entered your futures options trade in June and purchased one GCZ call with a strike price of $1,800 at a premium of $4,000 per contract. As of mid-October, GCZ has risen to $1,875.

Can you make money by trading options?

Only experienced traders who know how to make accurate predictions can win on the sale of options. They calculate the future price of assets and offer call options at a price lower than the forecast. And put options are at a price higher than what they expect.

Sellers calculate options prices based on asset value fluctuations, just as insurance companies calculate policy prices based on insurance claims statistics.

Plus, professional players closely monitor the financial condition and plans of companies that issue stocks and bonds and the situation on the markets.

Let’s say you are a financial analyst. You know that company N will launch a new product shortly, long-awaited on the market. And therefore, according to your forecasts, its shares will grow from the current $100 to $130 at least. You sell an option to buy 1,000 of these shares at $120 in three months and charge a premium, say, $10,000.

If your predictions come true, then your option will not be used. As a result, you will earn $10,000.

But you might be wrong. The product will fail, and the comnanie’s share prices will drop to $80 a share. Then, at the request of the option owner, you will have to pay him the difference between the option and the current exchange price: 120,000 (option share price) — 80,000 (market share price) = $40,000. Your losses will be: 40,000 (payment to the option owner) — 10,000 (option premium) = $30,000.

The option seller is at significant risk. The most he can earn is the cost of the option. And the losses are not limited by anything — it all depends on the change in the asset price.

Final thoughts

Futures provide several advantages that make them appealing to a wide range of investors, whether they are speculative or not. However, although the investor is exposed to big losses even for minor market changes, highly leveraged positions and large contract sizes leave the investor vulnerable to catastrophic losses.

Therefore, before engaging in this type of trading, one should prepare and conduct due diligence to ensure that one is aware of the advantages and hazards of the trade.