Bitcoin has been a real success story in trading. Ever since it first arrived, it has been traded heavily. Its price has risen massively too. While much of the trading in BTC happens on specialist exchanges, online brokers allow traders to speculate on the price movements of the crypto assets rather than having to buy the underlying asset, which can be risky.

CFD crypto trading works similarly to other CFD trades. This is where two parties will enter a contract that states that the difference between the opening and closing values of the asset will be paid by either the broker or investor.

Let’s choose BTC brokers to work with according to a few factors.

How does it work?

CFD brokers are something different. At first glance, it might look like you’ve bought BTC when executing a buy order, but that’s not the case. You haven’t physically bought the crypto. When buying Bitcoin at a CFD broker, you are within a trade of the Bitcoin price, which is finished when you exchange your virtual BTC balance back into USD. And that will hopefully be more than before. But you wouldn’t be able to withdraw Bitcoin to your own BTC wallet.

One benefit of CFD brokers, in general, is that they usually have less spread than brokers where you trade the asset directly. Lower costs mean that traders get faster in potential profit with single trades.

Another method of trading is through binary options. Here the trader will speculate on whether the price of the BTC will go up or down by a set expiry time.

- If the user thinks that its price will go up by the end of the option, he will press PUT on his platform.

- If he thinks the price will decrease, he will place a CALL option.

If his trade is correct, he stands to make around 80% ROI.

Top three things to know before starting:

- 68% of retail investor accounts lose money when trading CFDs.

- Bitcoin CFD brokers are a subsidiary monetary instrument that permits traders to put resources into BTC without owning them.

- These brokers empower investors to take advantage of BTC’s profits and risks without owning the coin.

Best Bitcoin CFD brokers

Here are the best brokers around.

| Broker | Trading platforms | Min. deposit | Max. leverage | Regulations | Year of foundation |

| eToro web and mobile | $200 | 1:30 | FCA, CySEC, ASIC, FinCEN | 2006 |

| MT4, MT5, FXTM Trader | $50 | 1:2000 | FCA, CySEC | 2011 |

| MT4, MT5, cTrader | $200 | 1:500 | ASIC, FSA, CySEC | 2007 |

| MT4, MT5, WebTrader, AvaTrade Go | $100 | 1:400 | ASIC, CBI, PFSA, BVIFSC, FSA, SaFCA, FSRA, IIROC | 2006 |

| MT4, MT5, WebTrader, Mobile App | $100 | 1:500 | ASIC, CySEC | 2005 |

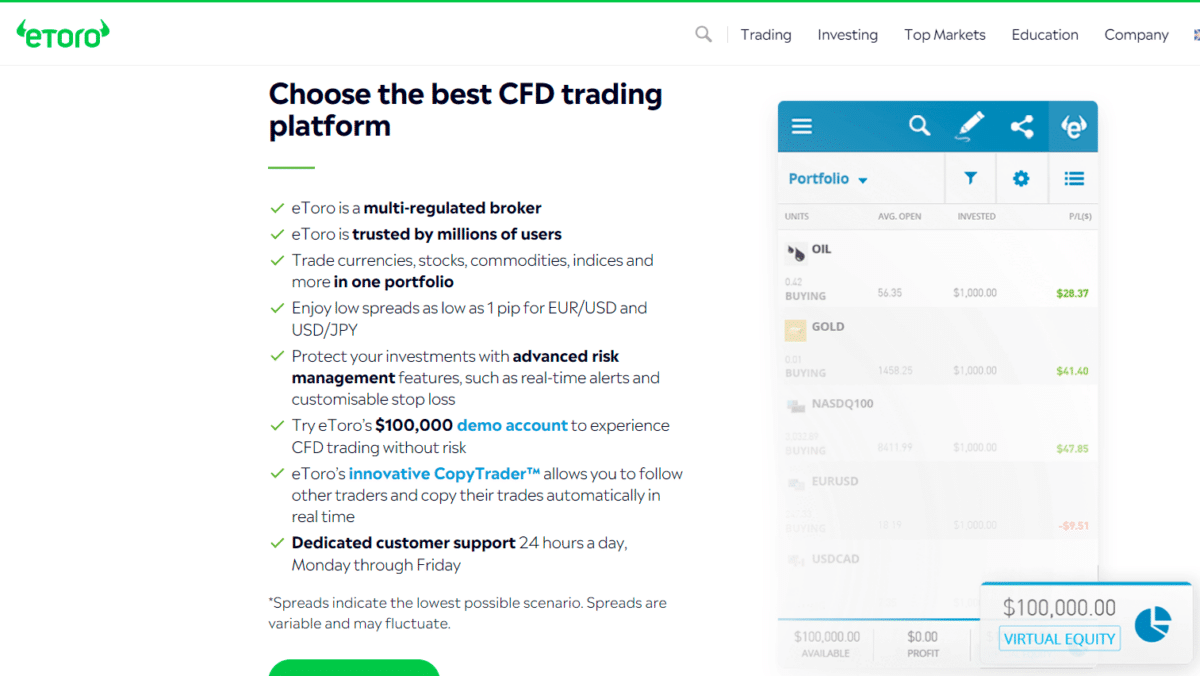

eToro broker

It is an Isreal based Bitcoin CFD broker organization working in this position for over ten years. This crypto broker doesn’t serve US clients because of administrative obstructions. However, if you are from any other nation that needs to begin with Bitcoin CFD trading, eToro is the best approach.

You can exchange your money here, which can be immediately deposited utilizing your Mastercard, PayPal, ACH, or wire transfers. Besides, the innovative CopyTrader allows you to follow other traders and copy their trades automatically in real-time.

eToro will supply you with a demo account with $100,000, so you can practice your trades before going live.

| Worth to use | Worth to getaway |

| Huge selection of assets with some interesting portfolios trading types. | No access to the MT4 platform. |

| Platform with a wide selection of functions and trade types. | High spreads. |

| Seamless account opening. | Only one account base currency. |

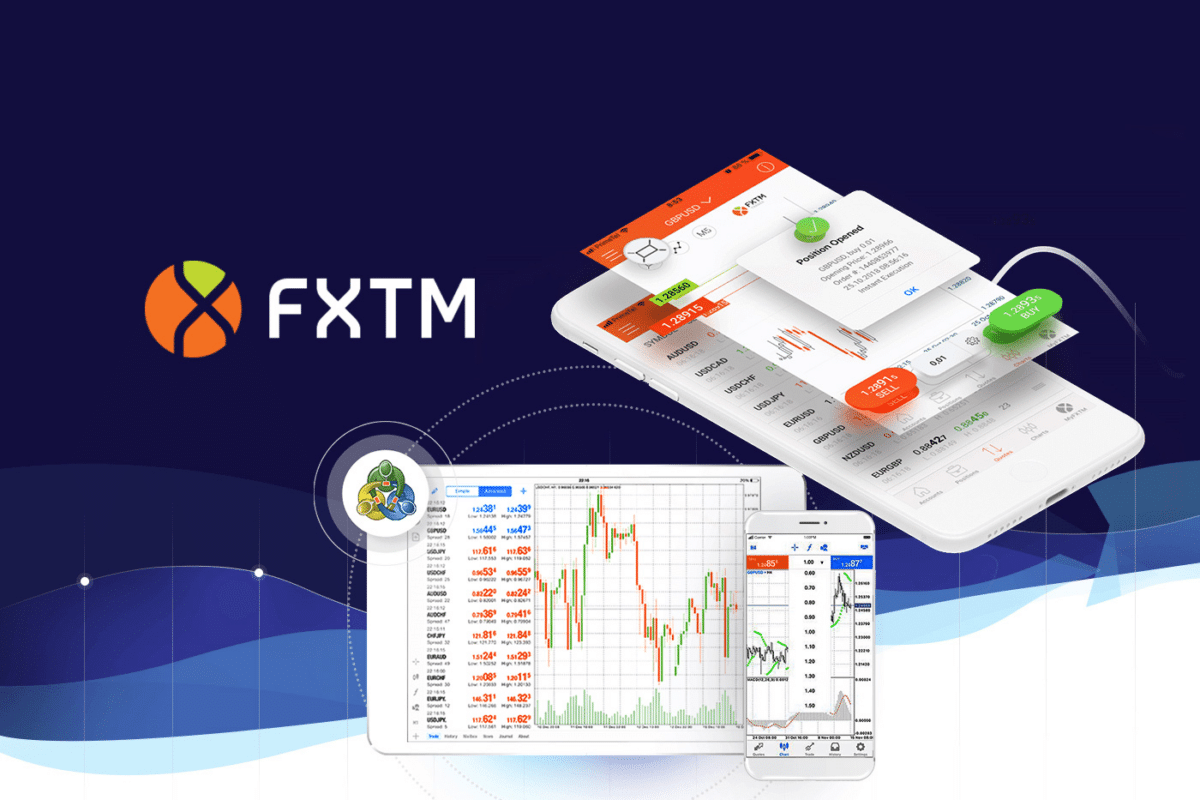

FXTM broker

This company was established in 2011 and is now present in many regions. It is regulated by FCA in the UK and by CySEC in Cyprus and offers over 250 assets, including 50 currencies, five metals, three commodities, 180 share CFDs, five indices, and three cryptos. The broker gives traders access to both the MT4 and MT5 platforms.

The advantage account is the most popular among traders. You can trade stock CFDs, individual stocks, or stock baskets. The clients can enjoy a wide range of instruments, market execution, and competitive pricing.

Advantage plus account offers a similar experience to the advantage, with stock CFDs, individual stocks, and stock baskets trading available. A bonus is that you can trade other leveraged instruments with zero commission but wider spreads.

| Worth to use | Worth to getaway |

| Great educational tools. | High CFD fees. |

| Superb customer service. | Limited product portfolio. |

| Digital and fast account opening. | Inactivity and withdrawal fees. |

IC Markets

The broker was founded in Sydney, Australia, in 2007. It offers three core trading accounts. The standard account offers commission-free trading with spreads from just one pip. Spreads start from zero pips on the raw spread accounts with commission-payable. The broker also offers demo trading accounts and Islamic swap-free accounts.

| Worth to use | Worth to getaway |

| Raw spread accounts with institutional grade liquidity available. | Beginner traders may be overwhelmed by choice of markets and platforms. |

| Maintains regulatory status in one tier-1 jurisdiction and one tier-2 jurisdiction, making it a safe broker for CFDs. | Limited product selection. |

| Impressive library of educational material and videos. | No investor protection for non-EU clients. |

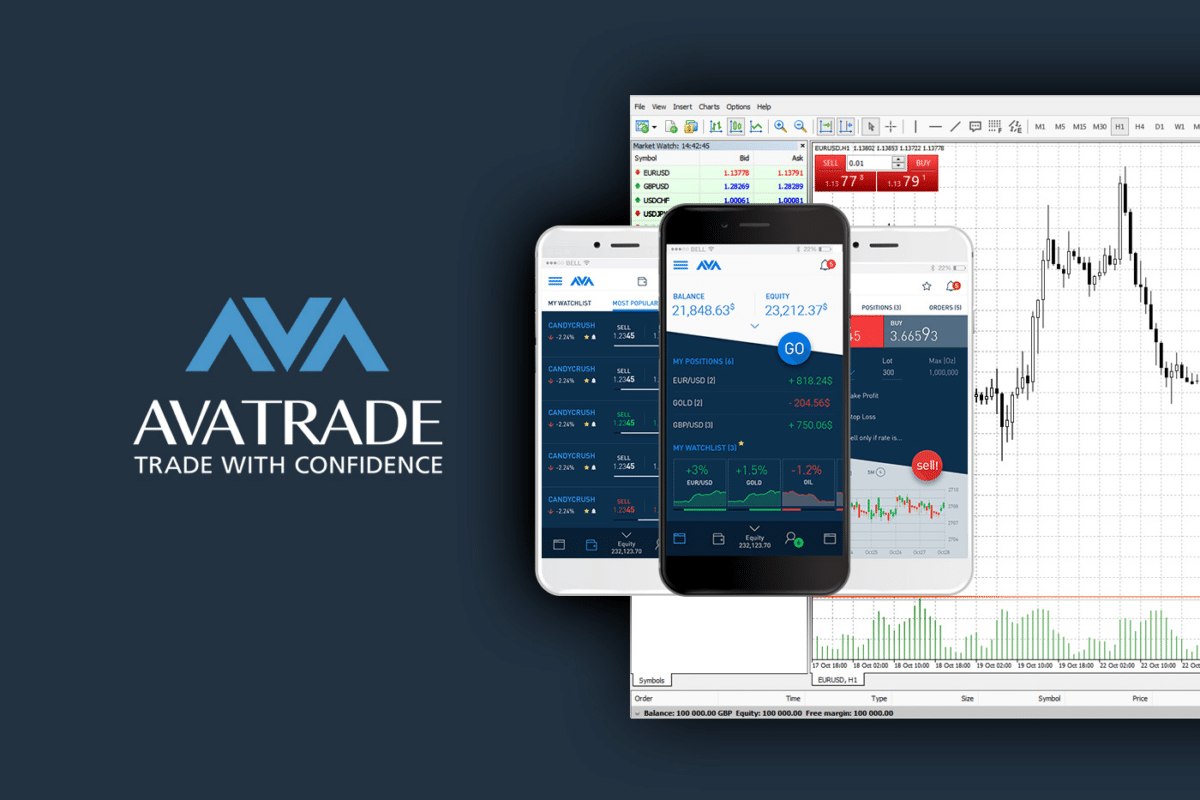

AvaTrade

It was founded in 2006. Our testing found AvaTrade great for copy trading, competitive for mobile, and generally in line with the industry average for pricing and research.

This is one of the oldest CFD brokers with a well-established reputation for customer support, competitive fees, and spreads. In addition to offering a large range of financial instruments, even including ETFs and FX options for those who like to diversify across assets. Users can choose to open several different account types – retail, professional, spread betting, and options.

It has various CFD instruments: trade commodities, indices, ETFs, stocks, bonds, and cryptos like Bitcoin and Ethereum CFDs.

| Worth to use | Worth to getaway |

| Competitive spreads and fees. | Not available to residents in the USA and Iran. |

| Multilingual customer support. | High inactivity fees. |

| Easy and fast account opening. | Only CFDs, FX, and cryptos are offered. |

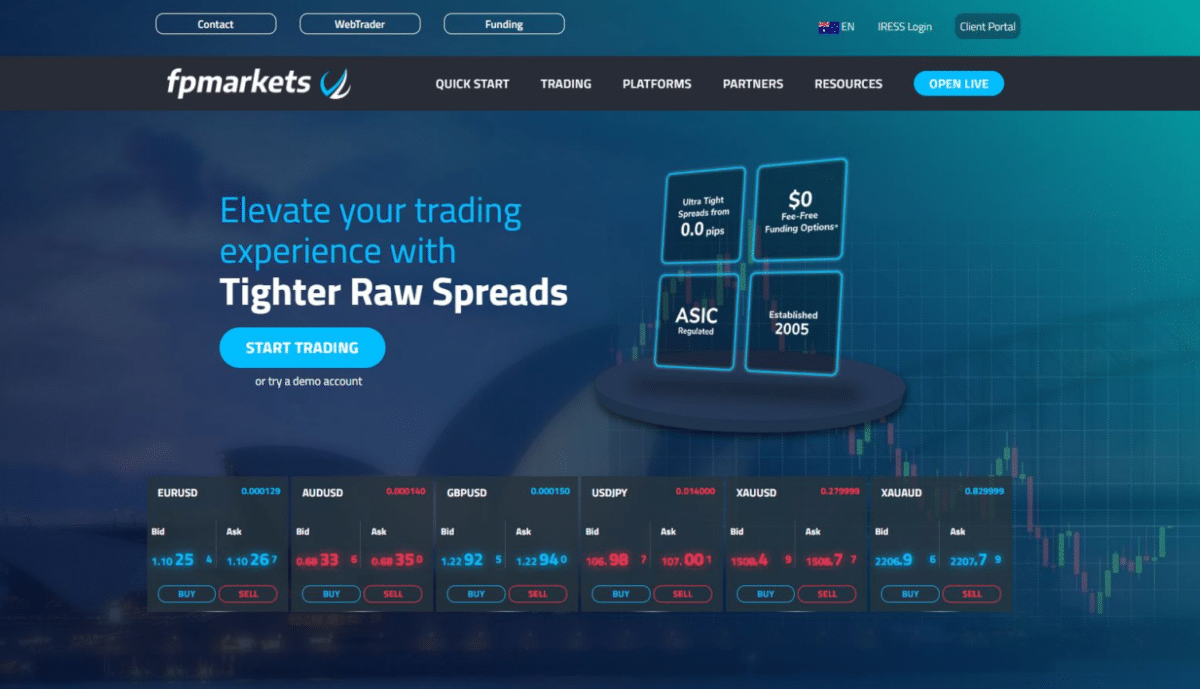

FP Markets broker

The platform was founded in 2005. It is a group of companies that includes First Prudential Markets Ltd.

The broker offers the ability to trade on more than 10,000+ financial instruments covering FX, equities as share CFDs, metals, commodities, indices, and crypto CFDs. Users have access to a range of accounts, including the standard or commission-free and raw or commission-based for MT users, both offering ECN pricing and maximum leverage of 500:1.

| Worth to use | Worth to getaway |

| ECN pricing and DMA trading are available. | The volume of choice of markets and accounts may be overwhelming for beginner traders. |

| 10,000+ tradable financial instruments. | Outdated web and desktop platform. |

| Excellent customer support and education tools. | Limited product portfolio. |

Final thoughts

We have compiled a list of some of the best brokers that offer Bitcoin trading. They are considered safe and secure, reliable and technologically advanced. Plus, their customer support is helpful and fast.