A futures contract is a legal agreement to buy or sell an asset at a specific price at a predetermined time in the future. The buyer and seller must fulfill their responsibilities and pay the agreed-upon price for the item when the contract ends, regardless of the current market price. As an alternative to these contracts, you can also trade stocks, wheat, and natural gas.

Futures contracts are frequently used by businesses and investors to hedge. When it comes to hedging, investors and companies have options. How you can use futures or contracts to hedge a position is explained in detail here.

Using futures contracts to hedge

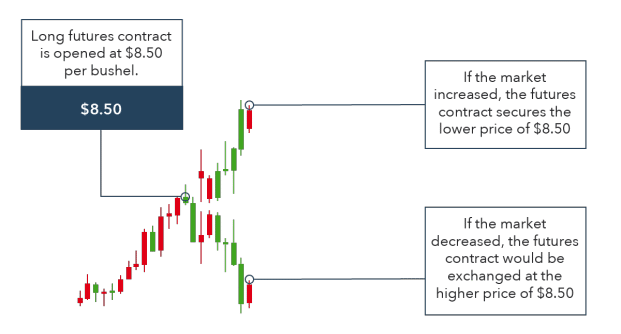

Companies may use the futures market to decrease the price of a future transaction. If a corporation expects to purchase a specific product in the future, it may choose to take a long position in a futures contract. In financial markets, a “long” position refers to an investment in the expectation that the asset’s value will rise in the future.

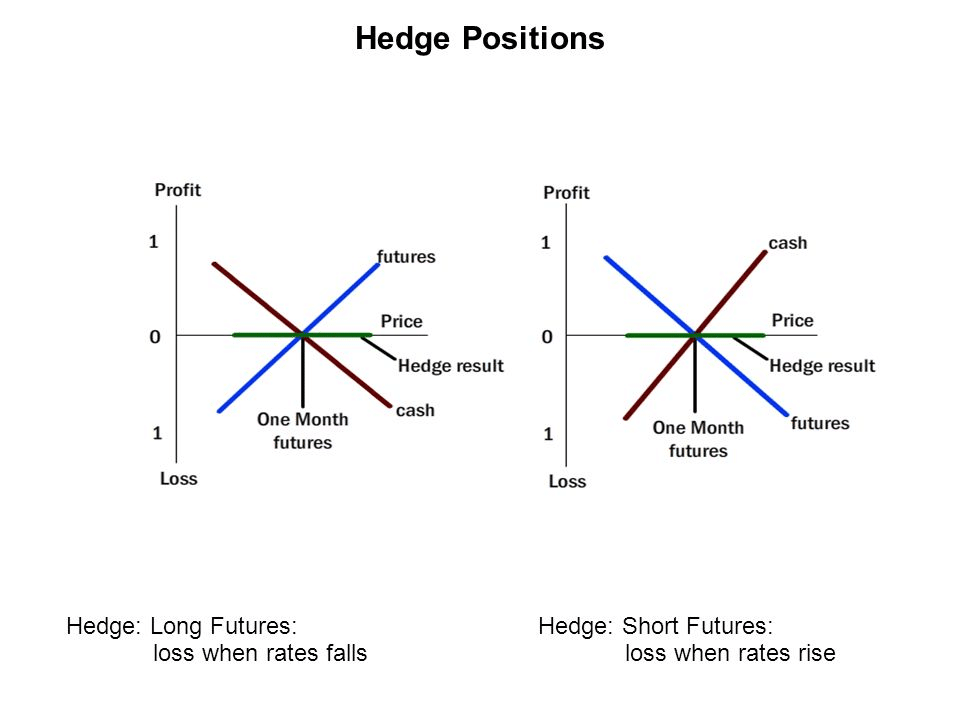

To protect themselves against market volatility, commodity producers take short bets. Hedgers protect themselves from price risk in a similar way as long hedgers.

When a futures contract is sold, it is possible to purchase an equal futures contract after the contract. Profit or loss is paid at the current market price after an offset. This will be the actual selling price that the manufacturer has been paid for their product.

Real challenges

While hedging is advised, it comes with its own set of obstacles and concerns. Some of the most often encountered are as follows:

- It is necessary to deposit margin money, which may not be immediately accessible at the time of deposit. In addition, margin calls may be needed if the price of a futures contract changes in your favor, regardless of whether you own the real commodity.

- Mark-to-market demands may arise regularly.

- In other contexts, using futures contracts eliminates the higher profitability chance. When it comes to huge companies, particularly those with several owners or publicly traded on stock exchanges, it might result in various views. A sugar firm, for example, may have expected increased profits owing to a rise in sugar prices last quarter. Still, shareholders may be dissatisfied if the company’s quarterly report indicates that earnings were negatively affected by hedging.

- Hedging coverage may not be entirely provided by the size and parameters of the contract. For example, one contract of Arabica coffee “C” futures covers 37,500 pounds of coffee, which may be too big or excessive compared to the hedging needs of a producer or buyer of the commodity.

- Standard accessible futures contracts may not necessarily correspond to the actual commodity specifications, resulting in hedging disparities between the two parties. Farmers planting different coffee plants might not get a contract covering their quality, so they have to accept the contracts available for robusta and arabica. At the expiration time, his real selling price may differ from the hedge provided by the robusta or arabica futures.

- Suppose the futures market is not efficient and well-regulated. This may result in price differences between entry and exit (expiration) at entry and exit times, thereby invalidating the hedge.

Before hedging, you need to know how much a producer will obtain from that commodity’s base. Broker costs must be subtracted from futures prices to arrive at the net selling price.

Commodities, securities, and financial assets may benefit from futures contracts that minimize uncertainty about their value. Companies can eliminate the risk of unanticipated expenses or losses by establishing a price to buy or sell a certain product.

Options vs. futures

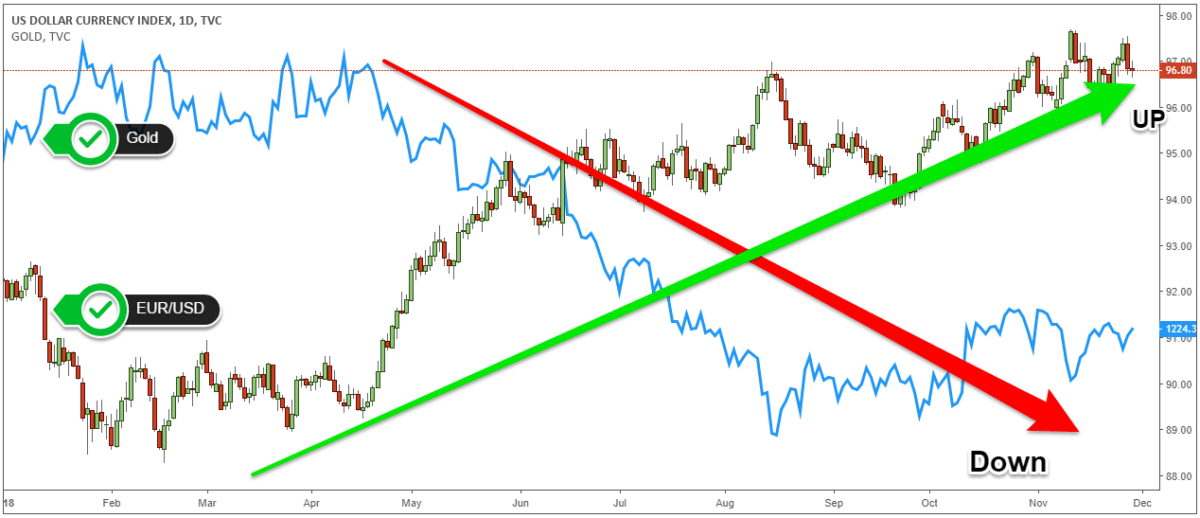

Purchase or sale of the underlying asset is an option available to the buyer. For a variety of reasons, futures markets are popular among active traders. Simply, futures trading is about predicting the price of a given commodity, stock index, or other assets in the future.

Many professional investors and traders use futures as a form of risk management. “Black swan” events like a financial crisis or an unexpected election result, as well as smaller-scale disturbances to asset prices, may prompt investors to take precautionary measures to preserve or insulate their holdings.

To accomplish a settlement on a futures contract, the owner must invest in the underlying asset. This is where options and futures contracts vary fundamentally. When an investor purchases a futures contract, they agree to acquire the underlying asset. Selling futures contracts, which is effectively selling the asset, is another option.

Futures contracts are available for trading 24 hours a day, six days a week. According to Hickerson, “you can hedge your portfolio at any time of day or night.”

Futures hedging risks

To satisfy their hedging requirements, both the soybean farmer and the manufacturer may use the same futures contract price, quantity, and expiration date. There were still some risks present, but they have reduced to the point that one firm lost out on larger profit potential.

In contrast to mutual forward contracts, where the opposite party might always fail, buyers and sellers are always matched in the futures market.

An investor using futures contracts as a part of their hedging strategy wants to minimize the risk of losing money if the asset’s value falls below a certain threshold. The volatility of a financial asset may make future contracts more appealing to investors.

When it comes to risk management, the aim is to ensure that you don’t suffer losses that exceed your risk tolerance. It is necessary to analyze the risks and benefits of a possible investment intake and make an informed decision to put this into practice.

Hedging is a critical component of risk management strategies. It is possible to use hedging to provide a safety net in unexpected or unfavorable situations.

Final thoughts

New asset classes enable local, national, and global markets to hedge practically at any risk. Commodity options serve the same purpose as futures contracts. As much as possible, hedgers should stay away from speculative gains. It can be successful if you pay attention to detail and study well.

Therefore, it is critical to monitor what is happening in the equity markets outside of typical business hours. Futures contracts may be used as a hedge during periods when the stock market is closed.