You can earn a decent profit from options trading by implementing multiple parameters at a time. The extensive control over variables helps traders build highly probable options trading strategies based on trend direction, duration, or volatility.

Investors have to consider risks associated with the spot price fluctuation that often makes trading hard in the traditional financial market.

Can you earn from a market where the profitability is high and volatility is low? Options trading is one of the ways to diversify the portfolio where traders can benefit from both volatile and non-volatile market conditions. Anyways, learning to trade is not enough here; traders should capture the idea, practice it, and implement it with real money.

A good understanding of the market with high probability trading strategies may make options trading fruitful for you. Let’s discuss the Basic Butterfly and the Modified Butterfly strategies that may enrich your trading knowledge.

How do options work?

Options trading allows investors to reserve a trading asset at a certain price until expiration, known as the strike price. After the expiry date, investors can achieve the right to buy or sell the asset below or above the strike price. The duration from the strike to expiration can vary from weeks to years.

If the price condition seems to move higher, we open call options. Similarly, for an expectation of lower price than the current level is put options.

Reason to use options strategies for traders

Traders looking to make profits from short-term price fluctuations can benefit from options trading as its expiry dates start from daily to yearly. Therefore, traders can easily pick options trading in any financial market, including stocks, indices, forex, commodities, ETFs, and cryptocurrencies.

Besides, options trading works like traditional CFDs trading, where traders profit from bullish and bearish movements. Now many online brokers allow options trading where traders can operate their activities from home.

Reason to use options strategies for investors

There is no way to ignore that the main key players in the options market are investors who usually seek opportunities to hedge their positions. The hedging strategy allows investors to hold their position from significant collapse, which is possible with futures trading.

Let’s say Mr. X bought a put option at $14 with the guarantee to sell the stock at $10 in a one-year time frame. After that, the price moved to $16, but Mr. X did not sell it. Then, a few months later, the price of the underlying instrument moved to $6.

The ideal loss per stock should be $8 ($14-$6) in this condition. However, Mr. X can reduce the loss to $4 ($14-$10) through the put option.

Best option trading strategies

Although options trading has some benefits, it consists of some risks that a trader cannot ignore. Therefore, investing in the options market requires a systematic approach known as options trading strategies.

There are many options trading strategies, and among them, we will see the two best systems.

1. The Basic Butterfly spread

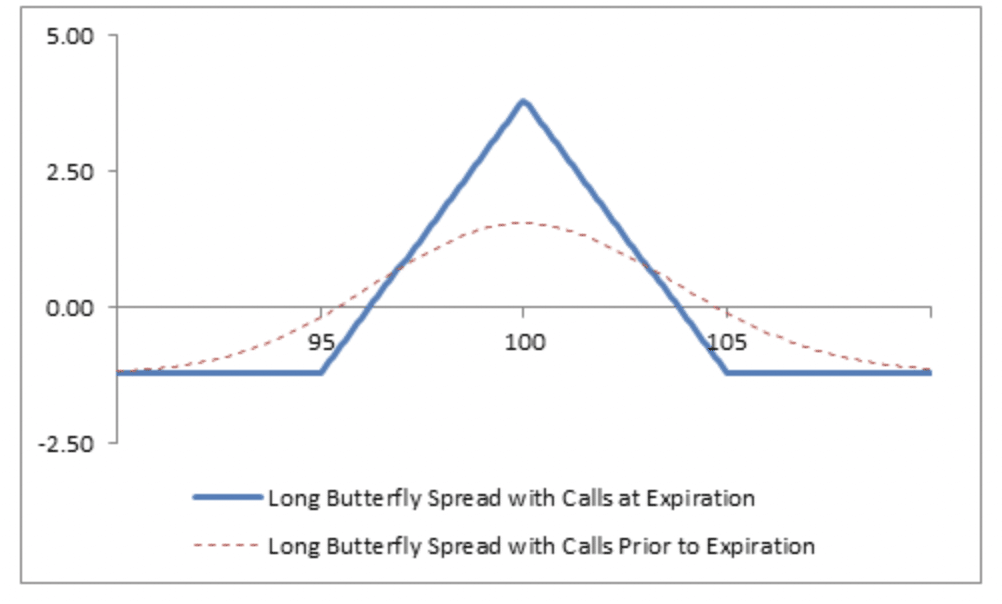

It is also a neutral trading system, applicable on when the stock price will consolidate. It combines both bull and bear spreads that have moved up and down from the strike price.

Basic Butterfly call conditions:

- Buy one below the current stock price

- Sell two above this price

- Buy one below this price

For example, if a stock is trading at $100 and you want to build a Basic Butterfly spread, you should buy call options at $95, sell two call options from $100 and buy again at $105 call. Let’s say the trading value of these is.

- $95 at $6.4

- $100 at $3.3

- $105 at $1.45

Therefore, the net debit should come at $1.25 ((3.3X2)-6.4+1.45). Moreover, the maximum gain from this system would be the gap between the lower strike price and net debit. The maximum benefit will come if the stock price expires above the $55 call for the above example. Conversely, the maximum loss will come if the stock closes below $45.

2. The Modified Butterfly

This strategy has two call/put options where the distance between the middle and higher strike calls is closer than that of the lower and middle strikes. In that case, the maximum profit will come if the expiry price remains at the center strike area. Therefore, the maximum profit would be the difference between buying and selling strikes, deducting the premium.

The Butterfly option is suitable for a ranging market, but there is no guarantee that the upper or lower boundary would hold in the future. If it happens, the Butterfly strategy will end up with a loss.

Modified Butterfly buy conditions:

- Buy one lower strike call option

- Sell two call options from the middle

- Buy two higher strike call options

The maximum benefit will come when the price expires near the strike price. Let’s see an example:

AA is trading at $50 on December 1, 20XX.

Therefore, buy with the following conditions:

- Buy the December strike at $45 for a $6.12 premium

- Sell two December strikes at $55 for a $1.3 premium

- Buy two December strikes at $60 for a $0.5 premium (modified)

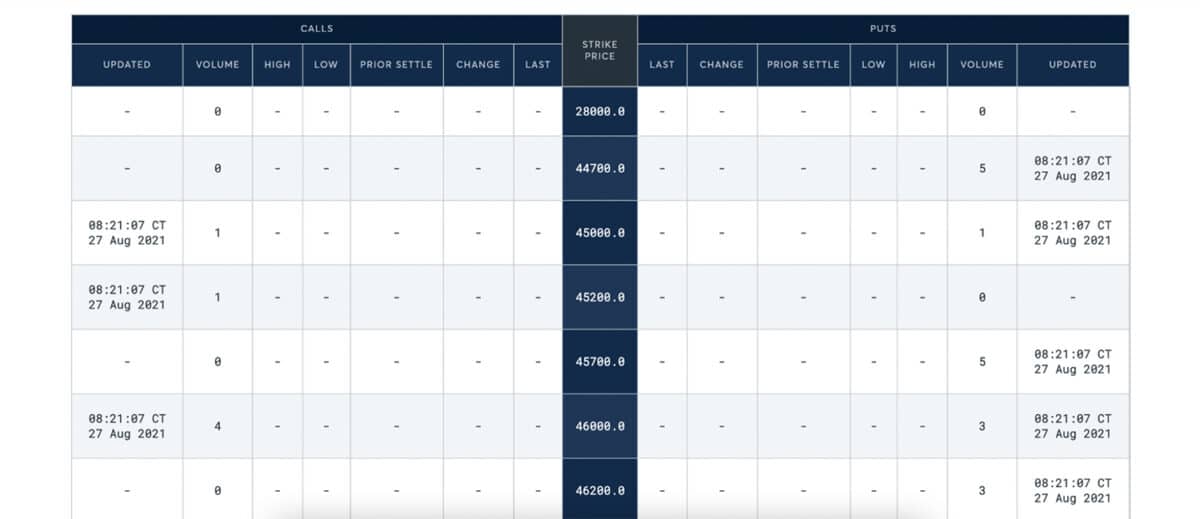

The above image shows the S&P 500 options call and strike price expiry on September 2021 available on the CME group.

Main pros & cons

Let’s see the pros and cons of both spread strategies for options trading.

| Pros | Cons |

| Both strategies worked perfectly when the stock price remained within a range. | Both strategies ignore price volatility. |

| Strategies work in both bull and bear contexts. | Both methods are not suitable for a trending market. |

| Traders can get out of the setup at any time by buying back the options sold and selling back the options bought. | The whole setup will incur a loss for call options if the price expires below the lower strike. |

Final thoughts

The strategies described above actively use selling and buying options with different strikes but the same expiration dates. However, such combinations should be used only when the trader is already confident in his abilities and has extensive experience with futures, options, and other derivatives.

Without such experience or not fully understanding the work of options, the investor runs the risk of receiving significant losses. However, the competent use of the butterfly will be able to make the most of some situations in the market, participation in which, with ordinary linear trading, would be too risky.