The idea of online trading is not new and has been around for decades. However, not everyone could trade online, and it was primarily large banks and hedge funds who dominated the markets. Trading CFDs is a reasonably new concept compared to other forms of trading and has become very popular since the ‘90s.

However, CFD trading, just like any form of trading or investing, comes with high risk. Furthermore, it is not legal in certain countries, which include the USA. Unfortunately, if you are a US citizen, you cannot trade CFDs.

This article will give you an overview of CFDs, how they work, and why the US has banned this form of trading.

History of CFD trading

The CFD tool originates from an investment firm in London in 1990. The initial idea was to use it as a form of hedging. They used this technique to offset the risk from stock losses garnered on the London Stock Exchange.

The advantage of using CFDs was the low funding, no taxes on capital gains, and no need to own physical shares.

Online trading boomed by the late 1990s, and retail traders and brokers started using CFDs as a favored trading tool. It was a popular tool since you could trade shares, indices, currencies, and commodities with an instant click. The profitability and ease of trading made CFDs popular among retail traders.

In addition, the Australian market increased in 2002, with almost 40,000 retail traders starting to trade CFDs from Australia alone actively. The trading of CFDs is now strictly regulated across the world and is available in certain countries only.

Which countries allow CFD trading?

Australia, Austria, Canada, France, Germany, Ireland, Israel, Italy, Japan, The Netherlands, Luxembourg, Norway, Poland, Portugal, Romania, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Turkey, UK, and New Zealand.

The United States does not permit CFDs since the Securities and Exchange Commission restricts over-the-counter (OTC) financial instruments.

What is CFD?

It is an agreement between two parties, the seller and the buyer, on the transfer of the difference between the current value of an asset at the time of the conclusion of the contract and its value at the end of the contract.

You can trade this contract through a financial broker. A trader will purchase a CFD on investment if they believe the value of an asset will increase or decrease. Once it reaches its target level, you would sell the contract and gain from the price change. You do not own the physical instrument when you purchase the contract. However, the variance in price is how you benefit.

CFDs are very similar to FX trading, the main difference being that you can trade CFDs across more than just currencies. You can trade them in stocks, indices, bonds, ETFs, and commodities.

We will explain how it works in the next section by using a practical example.

How does CFD trading work?

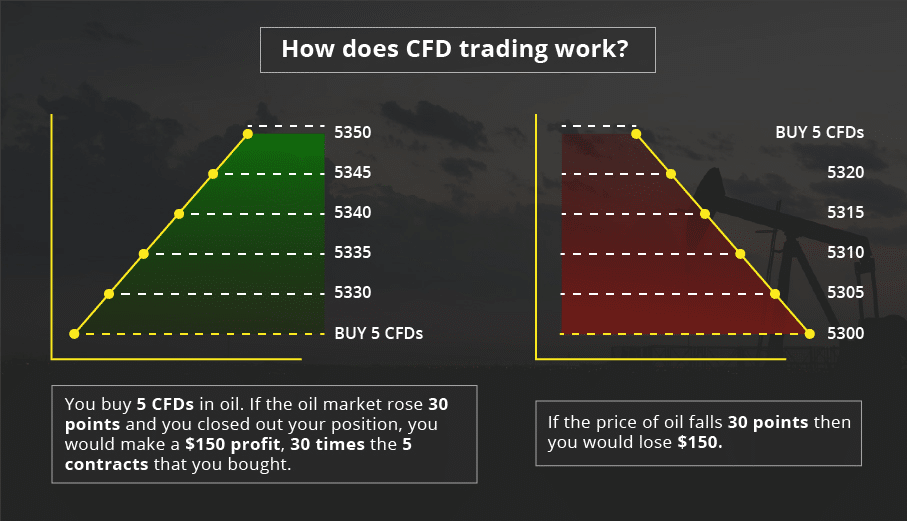

As we mentioned, the concept is to yield from a change in the price of an asset. Therefore, if you anticipate the asset price to go up, you will buy a CFD contract. And if you expect the value to go down, you will sell the contract.

Let’s use the following example.

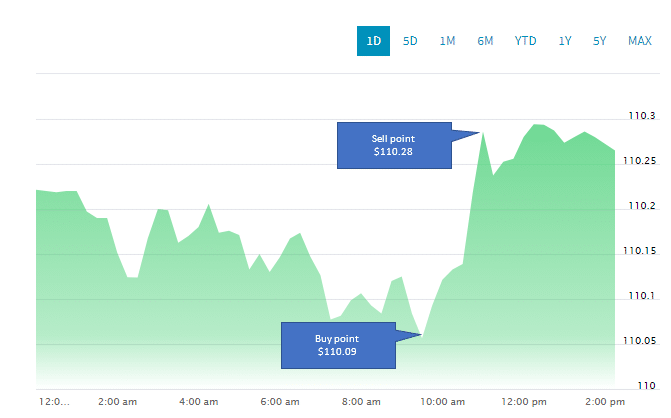

You have signed up with a broker that offers CFD trading in FX. Based on your market analysis, you determine that the price of USDJPY will increase, so you decide to purchase a contract for the USD/JPY pair.

Upon buying, the pair is trading at $110.09; you place a buy order at this price and invest $10. You also opt to use a leverage of 1:500, therefore for every dollar you invest, your potential profit is $500.

After a few hours, the price has increased, and you decide to sell the contract. You decide to sell the contract at $110.28. The price change is $110.28 minus $110.09, which equates to $0.19. Now, you have invested $10 at a leverage of 1:500; this means your total investment is $10 x 500, which is $5000. Based on the price change, $0.19 x $5000, you made $950.

To summarise, you have invested $10 and made $950 in profit by betting on a price increase.

Now that you know how CFDs work, we will delve into their banning in the USA.

Why are CFDs banned in the USA?

The USA prohibits citizens from trading CFDs, and they can therefore not open trading accounts with brokers that allow CFD trading. Brokers that offer CFD trading are not permitted to operate in the USA. It would be illegal for an individual to open an account with such a broker, even if it resides outside the USA.

US citizens with dual citizenship can trade CFDs if they reside outside of the country. In addition, regulated brokers in the USA are not allowed to offer CFD trading as an option.

The Security and Exchange Commission in the USA prohibits the trading of OTC CFDs due to the high risk it presents and based on research, relaxing this law is not an option shortly.

What form of trading is allowed in the US?

While you cannot trade CFDs as a US citizen, there are other legal methods of trading.

Forex trading

While similar to CFDs, forex trading involves only speculating a currency pair’s price direction. FX trading is allowed in the US but under strict regulation, and you have to sign up with a regulated broker in the country. As a US forex trader, you will have to pay taxes depending on your income bracket.

Binary options

Binary options are easy to trade and don’t require significant capital. They are allowed when traded through a broker, which the SEC authorizes in the USA. And the SEC oversees the compliance status of these brokers. Similar to CFDs, you bet on a price direction.

However, you are not subject to things like spread, for example. You bet a certain amount of money on the price direction, and the outcome is a fixed price, whether profit or loss. Once the contract time expires, which can be anything from 1 minute to a few hours, you will then make a profit or a loss.

Final thoughts

As you have read, CFDs are a highly profitable yet risky trading tool. Most day traders use this tool to trade various financial assets and hedge against other investments. However, it’s a different story for those living outside the USA, and depending on how regulated trading is in your country, you could probably trade CFDs legally.

Unfortunately, for US citizens trading CFDs is not allowed, and it seems that the government wants to protect citizens from potential losses. But it’s not all doom and gloom; as we mentioned, the US government allows other forms of trading, like binary options, which can be just as rewarding as CFDs.