Forex fundamental analysis is a trading method that analyzes the impact of economic, political, and social factors on a currency’s value.

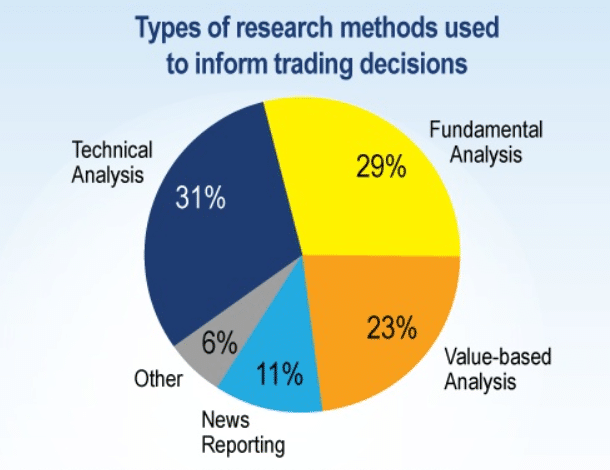

After technical analysis, most traders, especially investors, depend on fundamentals to trade the market. With major news comes high volume that allows you to make a good percentage in a few mins.

Making a profit by trading is a long-term desire of every market participant, including you and me. But the question is how? How to make a profit by using this analysis?

Read this article and learn how to tame the market in some steps.

Three things to know before starting:

- This analysis is very vast as you need to keep a watch and update yourself every day.

- Scalpers and day traders majorly use fundamental analysis.

- Data is not available for general people easily.

What is fundamental analysis in forex?

As the name suggests, you use it to analyze and understand the market for deciding the actual value of an asset and the circumstances that could impact its price in the future.

Unlike a technical trader who looks into the chart and predicts the future short or long-term price movement, a fundamental trader analyzes the price and economic data and considers real-time events for their trading moves.

Majorly there are two ways by which you can make this analysis:

- Top-down

It is like a funnel wherein the analysis starts with a more comprehensive view of the economy. Then it moves to sector and industry-specifics.

- Bottom-up

While in the bottom-up approach, the analysis begins with a specific value of the currency followed by sector specifics and then general economic status, respectively.

Now that we know what fundamental analysis is, let us jump into the below section to learn the three steps you can use to make a profit.

Step 1. Examining the fundamentals, microeconomic areas

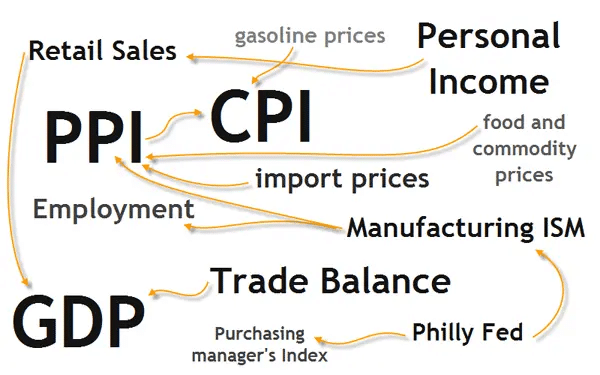

The first step is to examine the monetary policies of major central banks, cyclical dynamics, and a few other indicators.

The way monetary institutions behave in the past has a significant effect on future decisions. Historical data, in terms, is a wonderful lead and something to keep in mind before analyzing the market direction.

When developing economies choose to use new technologies, industrial productivity will develop and support growth without leading to inflation. In the same way, the adoption of air travel, telecom, and roadways for the first time will increase productivity and growth.

Gains in productivity will assure a growing global ecosystem. In other words — a boom phase. This in terms will create a bubble until the technology is fully understood and adopted.

Here is the right time to build your portfolio and manage your risk allocations through correlation studies and money management methods. Once you decide on this aspect of your trades, you can move to the second step and have a closer look at the monetary environment.

Step 2. Study the global monetary environment

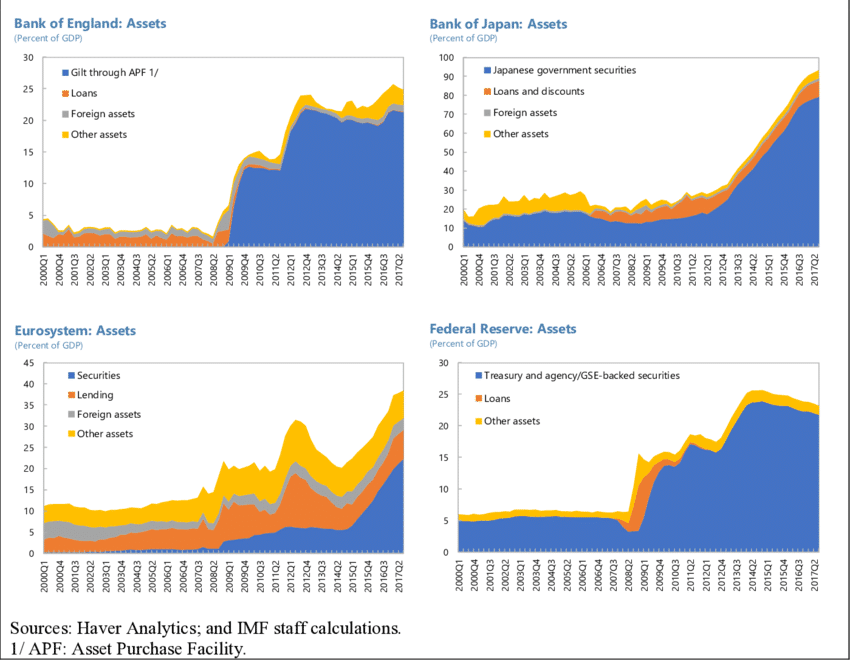

In the second step, you will need to study the policy preferences of major central banks, such as the Federal Reserve, Bank of Japan, and the European Central Bank. Your study will consider the policy biases and legal commands of these institutions, along with their independence.

By studying and understanding their policies, you can get an idea of money supply growth, which in return will help you decide on emerging market growth potentials. It will also help you in understanding the interest rate in the local market, stock market volatility. All this knowledge will help you understand the crucial rate differentials when compared to other countries.

Once done with the study of global central banks’ policies, you can now compare them with their forerunners and decide their potential influence on the global economy.

Step 3. Trading decisions

The third step will be studying the unemployment data and the output gap. One of the reasons for inflation in an economy is the unemployment fall and labor market shortages, which create wage pressure.

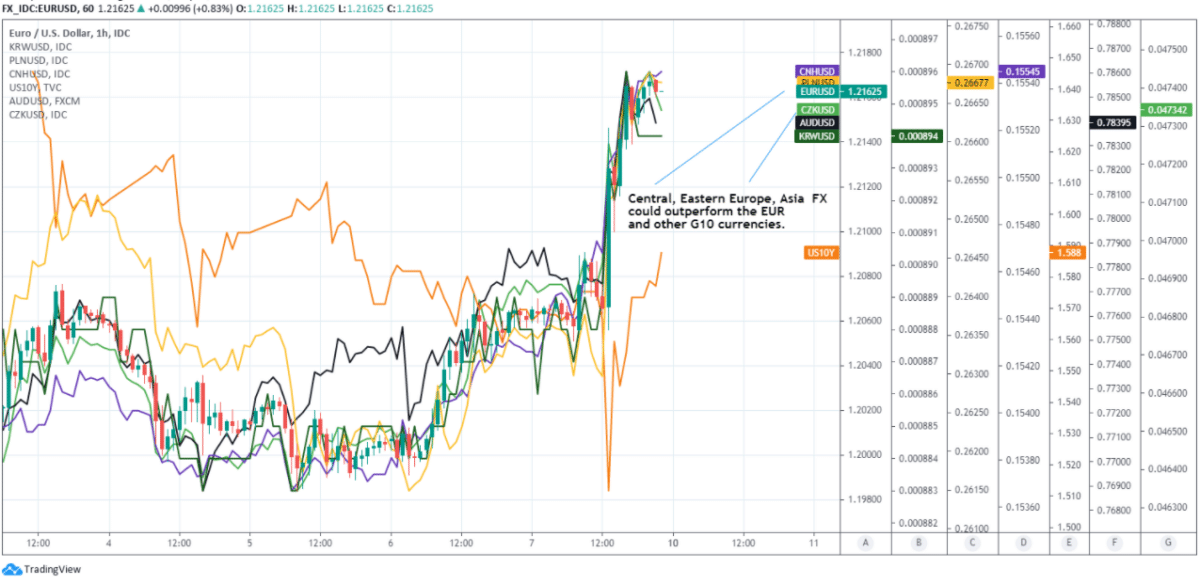

During the growth phase, currencies with more powerful fundamentals are likely to be exchanged with those who wish to draw capital through higher interest rates. While during the boom phase, you will sell currencies with solid fundamentals that offer low-interest rates and buy the currencies offering high-interest rates to compensate for weaker fundamentals.

Thus, you will be choosing currency pairs that contribute to the most significant imbalances to the trader. Also, either you will take long-term counter-trend trades with low leverage, or you will await the market to confirm your analysis with its activities.

An example of using fundamental analysis

Now try to put the fundamentals that we covered in this article into practice.

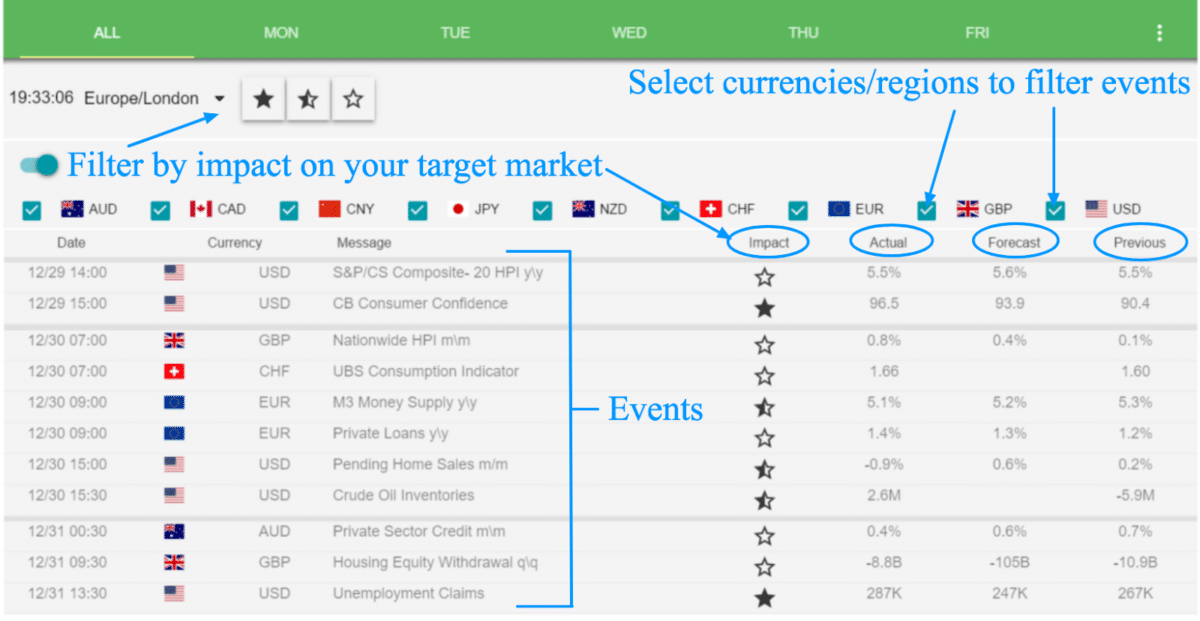

Your assistant is the Economic calendar. Open and start watching the changes in the quotes of the selected currency pair.

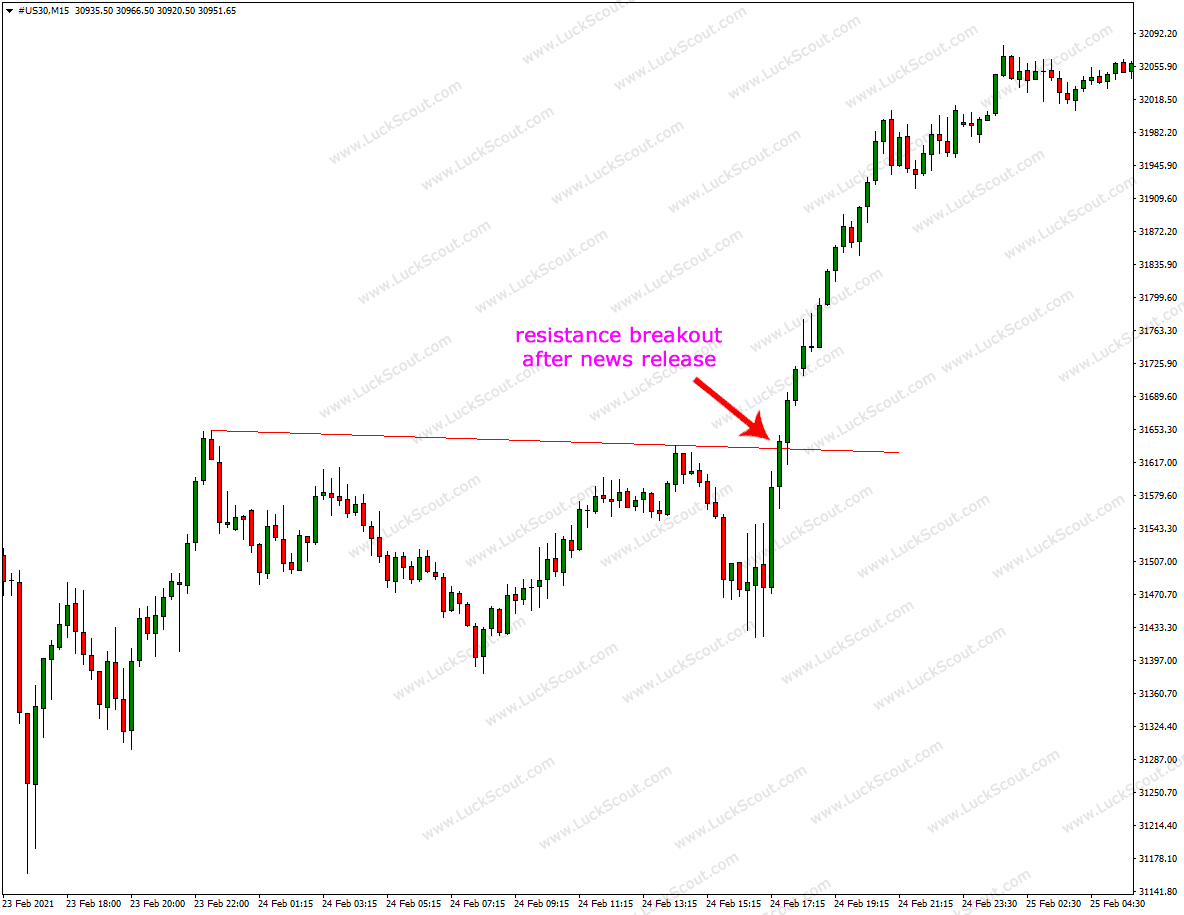

Approximately 15 minutes before the actual value of the indicator appears on the calendar, powerful, unpredictable up or down movements can begin in the market.

One of the possible trading methods with the news in mind is to focus on the difference between the actual value and the forecast. Also, we must not forget that there can be a rapid price reversal, and therefore trading on the news implies making quick deals.

More often than not, you will be dealing with US news. Accordingly, your focus will be on the dollar — USD. If the American statistics turn out to be good, then get ready for the fact that the EUR/USD pair may go down: yes, the dollar’s value, in this case, will rise, but it is the second in the pair. Accordingly, the price of euros in dollars will fall.

If it is easier for you to open more understandable and visual trades, for now, keep an eye on the USD/JPY pair. Here the dollar is the first, and the markets of Japan (JPY) are already closed by this time. If the released data affects the growth of the dollar value, then the pair’s chart will potentially grow.

Pros & cons

Fundamental analysis is good but will you not want to know if it is right for you? The best way to analyze this is by looking into its pros and cons. We have listed a few critical ones below.

| Worth to use | Worth to getaway |

| Know the ins and outs of an asset Reading and understanding more data leads to developing the right decision at the end. | The complex process to follow It is a complex and complicated process. It is also time-consuming as you analyze multiple areas of the market. |

| Benefits in the long run Fundamental analysis helps understand the actual value of an asset that benefits in the long-term trades. | Data is not readily available for everyone The data used to analyze the market using fundamentals is not easy for everyone but for more influential people. |

| Diving the market Fundamental analysis is somewhat better than technical analysis and is told to be the driving factor of the market. | Subjective analysis You can learn fundamental analysis, but you need to remember some massive chunk of data. Sometimes fundamental analysis is subjective, meaning you will need to make assumptions and arguments. |

Final thoughts

After reading this article, you would have concluded how fundamental analysis works. Fundamentals work great when choosing to go for long-term investment and trades.

One of the drawbacks of using it is the time it consumes for an analysis. But at the same time, you get to know many more things when compared to technical analysis.