Since 2017, crypto startups have raised over $20 billion via ICOs, showing great potential for blockchain-based tokens in the business world. However, digital assets remain widely misunderstood despite their exponential growth and benefits. The general public seems to confuse crypto with payment systems and perceives that digital asset investments are hazardous.

Breaking these findings further, 29% think Bitcoin will replace fiat currency by 2050 as soon as 2035 and an additional 20% by 2040, according to the Finder survey of a panel of 42 crypto experts. On the other hand, 44% of panelists don’t expect hyperbitcoinization.

More people and companies use tokens every day, and the trend is only accelerating. For example, Recur, a fintech company based in Miami, enables NFT transactions by buying, collecting, and reselling NFTs.

How does it work?

The rise of fiat currency began in 1971 under the tenure of Richard Nixon when a financial crisis and declining gold reserves forced the US president to make a historic economic decision that would shake up the international monetary system. Nixon’s controversial new measures effectively canceled the direct convertibility of the US dollar into gold, leading to the global mass adoption of a new type of money called “fiat” currency.

In early 2009, an unknown person using the name Satoshi Nakamoto sought to offer an alternative to the current system through the invention of the Bitcoin blockchain. This decentralized network could record the transactions of its users in real-time without the need for a central authority. Acting as a digital ledger, a blockchain can connect users worldwide and verify financial transactions — eliminating the need for third parties such as banks and governments.

Top three things to know before starting:

- It is unknown what would happen to global or geographic financial stability if digital assets replaced fiat currencies.

- The irrepressible trade and exchange of cryptos have led to many concerns among governments. But despite such problems, many countries are on the verge of rendering a legal status to cryptos.

- Most people see digital assets as a way for rapid wealth creation, given its volatile nature.

Fiat vs. crypto

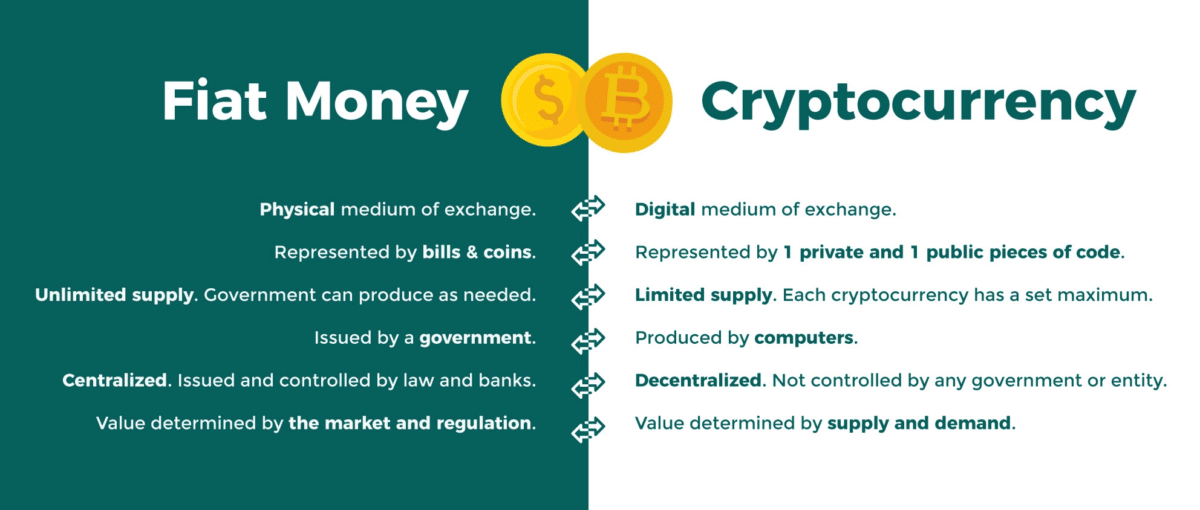

We traditionally use fiat money to acquire goods and services — the dollar, euro, etc. On the other hand, cryptos are assets that come in a digital format. Crypto is the blockchain’s native asset, and tokens are a platform built on an existing blockchain.

Digital assets has many advantages over fiat, including transaction security, high levels of transparency, and the elimination of intermediaries like banks or brokers. With blockchain, you can follow the money trail back to when it was created, and since it works on a decentralized network, it can’t be affected by government rulings.

Fiat is centralized — issued and controlled by third parties, while crypto is decentralized — peer-to-peer transactions. Both currencies have no intrinsic value — their value results from user trust.

What would happen if digital assets replaces fiat?

Digital assets in their current form transcend borders and regulations, which have positive and negative effects. Central banks are not controlled or influenced by fiat currencies in developed countries. They use monetary policy tools to influence inflation and employment through interest rates and open market operations. Decentralization, one of the fundamental principles behind crypto, removes these tools.

Consumers may also not have financial recourse or protections if digital assets replace fiat currency in its current state. The effects a complete replacement of fiat would have are still being explored and evaluated. There could be significant adverse impacts on economic and financial stability, or the change could usher in an era of complete global stability.

Crypto has unlimited potential and is beneficial as a currency. It is also being used by many in countries with severe fiat devaluation to preserve their savings, send remittances, etc. For example, many Ukrainians turned to digital assets after fleeing the Russian invasion in 2022.

Fiat vs. crypto: top 5 differences

Storage

Fiat currencies are versatile. Thus, you can store them in different forms. Crypto is all virtual and exists online only. Therefore, you can only store the currency in a crypto wallet; however, not all of them are secure.

Tangibility

It’s impossible to hold digital assets since they operate digitally physically. Meanwhile, fiat exists as coins and notes, making it possible to hold them. That tangibility that fiat has can pose some challenges. For example, it can be a nuisance and even a security threat when you walk around with large cash.

Divisibility

It is what makes something valuable able to turn into exchangeable money. You can divide both fiat and crypto into smaller units. The difference is that crypto is more feasible for micropayments than fiat.

Legality

Crypto is a digital asset that acts as an exchange medium that no government or central authority controls. The central bank regulates governments’ issue of fiat, which means it is legal tender and the official means of confirming and finalizing transactions. Laws constantly change to control fiat currency supplies, which affects their value.

Deflationary

Thinking about fiat, the government can print more cash, making it inflationary. Because central authorities don’t control digital assets, no one is changing monetary policies.

Fiat vs. crypto: top 5 similarities

Money

They can be called money or currency.

Transfer value

They are mediums of exchange that are used to store and transfer value.

Buying power

They can be used to purchase goods and services.

Value

Their value is governed by supply, demand, scarcity, and other economic factors.

Exchanges

They can be traded on exchanges.

Technically, dollar bills have value today because lenders and investors believe the US government will repay its debts. On the other hand, crypto has value because of its limited supply and decentralization, meaning that it can never be manipulated by governments who want to print more of it.

Advantages of crypto

Digital assets are often touted as a competitor to fiat as their supply is limited, and it is not subject to excessive printing by corrupt governments. For example, Bitcoin is known as “digital gold” because there will never be more than 21 million BTC.

Advantages of fiat

Governments favor fiat money for greater flexibility, which allows them to set monetary policy and stabilize global markets. Today, fiat money gives politicians more economic power than previous governments could only have dreamed of.

Since fiat currencies are not a scarce or fixed resource like gold, central banks have much greater control over their supply, which gives them the power to implement controls such as quantitative easing and stimulus payments that inject money back into the economy.

Final thoughts

So cryptos are changing the world. Its market share will grow, but it will take a long time for digital assets to replace any fiat currency outright, but it doesn’t have to, the cat is out of the bag, and the new world order is upon us.