ETFs over the last few years have evolved into the top exchanged investment vehicle. This popularity is not just attributable to the endorsement of the oracle of Omaha but due to their simplicity in trading, associated low costs, and the promise of returns. Most funds either cut across the entire economy or an economic niche, which is bound to grow long-term.

Despite being a long-term investment vehicle, the ETF market has grown to accommodate different investor appetites, including day trading. Daily ETF market volatility is an avenue for making a quick buck if done correctly through CFDs and the high-risk and high-reward leveraged ETFs.

What are leveraged ETFs?

Traditional funds comprise a pool of investments with the same economic characteristics as the holdings of indexes they track. They also try to replicate the performance of their underlying index by investing more than 80% of their funds in their composite holdings.

On the other hand, leveraged ETFs composition incorporates their underlying index holdings, its derivatives, and the index itself. Such a cocktail ensures that leveraged funds outperform the index that they track. In most cases, leveraged ETFs seek to either double or triple the returns of their underlying index. However, the same way that leveraged funds can double the returns in case an investor loses by the same factor.

For example, the 3x, leveraged ProShares UltraPro Short QQQ Fund, SQQQ, tracks the Nasdaq 100 index with an objective of 300% returns. If the Nasdaq 100 gains 10%, the SQQQ gains 30%. On the flip side, when the QQQ is in a market downturn and loses 3%, the SQQQ undergoes a 9% market downturn.

Why bother investing in leveraged ETFs?

Investors in leveraged ETFs site the following as their reason for overlooking the associated high-risk of investing in them:

- Heightened liquidity

Leveraged ETFs take advantage of intra-day market volatilities and are relatively more liquid than conventional funds, eliminating the risk of overtrading.

- Loan option

The leveraged ETFs market offers investors in-fund financing for trading, facilitating more investment than investor capital and a chance to make more money.

The best leveraged ETFs to take advantage of short-term market volatility

In a high-risk, high-reward scenario, what matters the most is how fast you make the right decisions. Unlike traditional funds that promise returns at low investment risk, leveraged ETFs are for investors comfortable risking it all for a big payday.

If the investment is timed to perfection, the following leveraged ETFs are among the most popular funds for minting money off volatile markets.

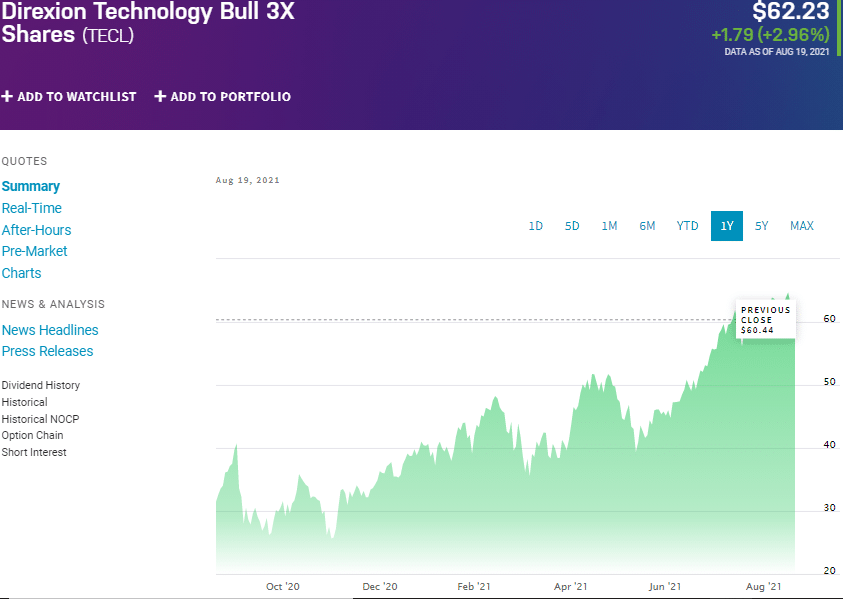

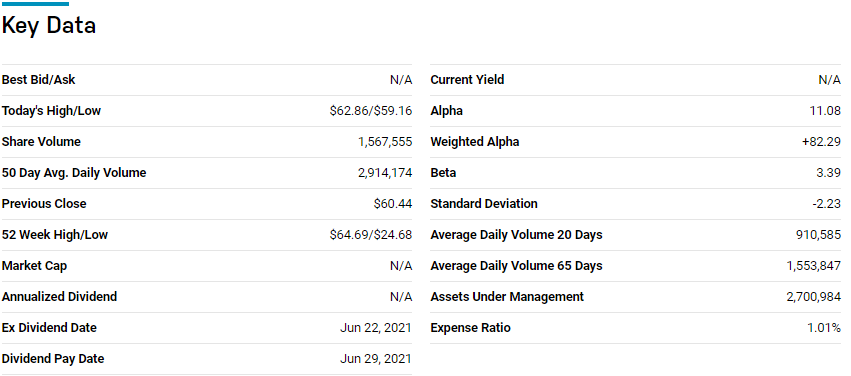

№ 1. Direxion Technology Bull 3X Shares Fund (TECL)

Price: $62.23

Expense ratio: 1.01%

In the investment world, you cannot talk about leveraged funds and not mention Direxion since they are ahead of the pack in the provision of leveraged funds and is the leading provider for leveraged ETFs in the investment world.

The TECL tracks the Technology Select Sector Index and seeks to provide daily returns of 300%. Investors in this ETF get exposure to the volatility in the local technology equities.

Boasting $2.7 billion in assets under management, it is one of the largest leveraged ETFs in market capitalization terms. An investment of $10,000 will have investors parting with 101 dollars annually as expenses. This is a leveraged fund that promises a quick buck if played right, given that so far, it has recorded year-to-date returns of 52.86%, which is a ratio of 2.8:1 when compared to its underlying index year-to-date returns of 18.57%.

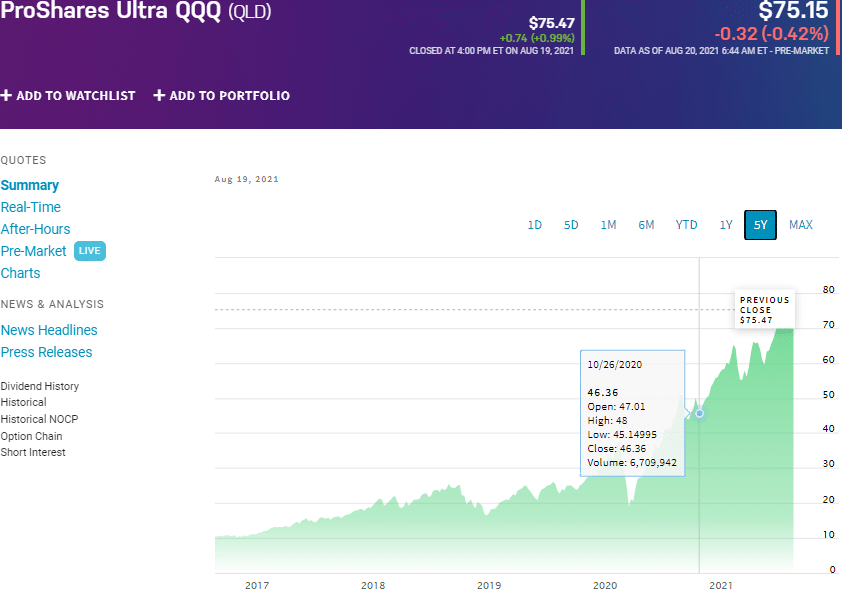

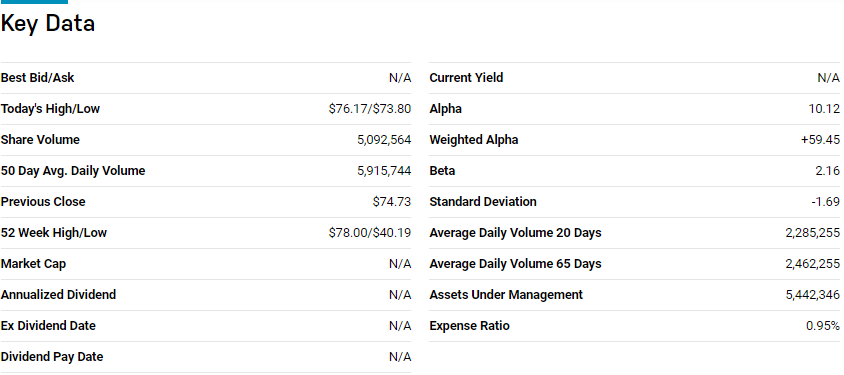

№ 2. ProShares UltraQQQ (QLD)

Price: $75.15

Expense ratio: 0.95%

The QLD tracks the performance of the Nasdaq 100 index with a view of doubling the returns, 2x. It is thus a non-diversified fund that exposes investors to the largest 100 non-financial firms globally, based on market capitalization.

Given its holdings, it is no wonder that this leveraged ETF boasts $5.18 billion in assets under management, with an expense ratio of 0.95%.

As the economic resumption picks up pace, the QLD fund is the basket to help you reap from the volatility in the largest non-financial organizations globally. So far, the year-to-date returns of 30.96% represent a 1.8:1 ratio compared to the Nasdaq-100 index year-to-date returns of 18.57%.

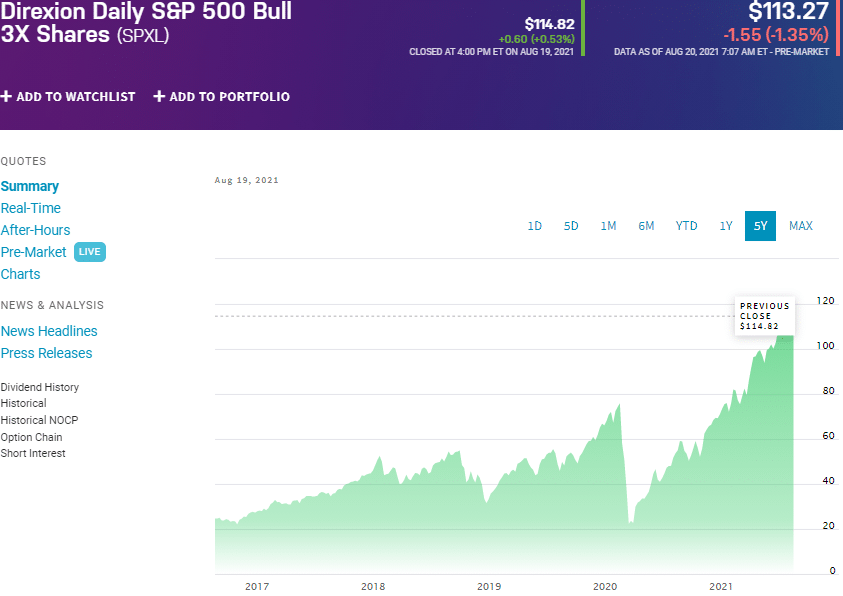

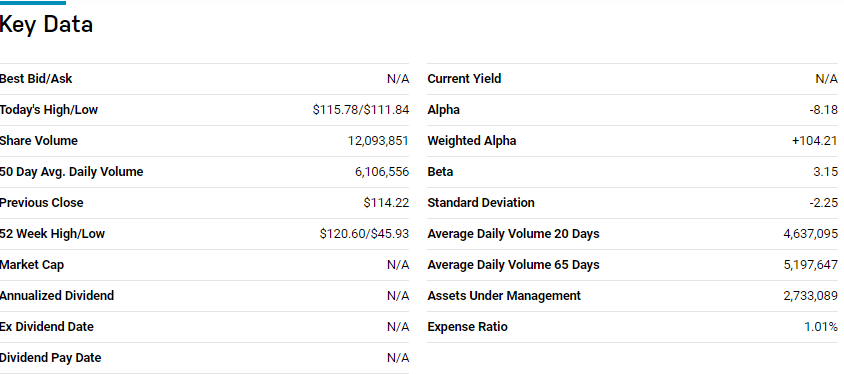

№ 3. Direxion Daily S&P 500 Bull 3X Shares Fund (SPXL)

Price: $113.27

Expense ratio: 1.01%

Leveraged ETF investors are after a quick buck hence tend to revolve more towards funds with a few underlying assets and promise huge returns. For the trigger-happy investors who are also cautious, the Direxion Daily S&P 500 bull 3X Shares fund is the way to go. The SPXL tracks the S&P 500 Index, intending to give its investors thrice the returns of the S&P 500 daily.

Boasting $2.6 billion in assets under management, it is yet another leveraged fund top dog. An annual investment of $10,000 calls for an investor to part with 101 dollars as expenses. As equities continue to experience ups and downs post-pandemic, these leveraged ETFs ensure you play the whole economy for big bucks.

At present, it has managed year-to-date returns of 58.59%, which translates to a 3.1:1 ratio compared to the year-to-date returns of the S&P 500 index.