Among its several industrial uses, lithium is an integral component in the production of rechargeable batteries. These batteries are used to power portable devices, such as smartphones and tablets, feeding the increasing demand for ‘energy on the go’ products. It is also used in developing batteries for EVs such as cars and scooters, which has increased production levels since it began.

Demand for lithium has continued to surge thanks to its application in EVs and batteries. Investing in lithium ETFs is one of the easiest ways to ride its growing trend.

There are very few ETFs that focus specifically on lithium. However, many include lithium companies as major holdings in their portfolios.

By 2027 the lithium market is expected to grow to $4.93B, up from $3.39B in 2020, and investing in ETFs is one of the easiest ways to make money.

How does it work?

Lithium prices hit an all-time high in 2021 and continued that trend into 2022. Although prices have cooled slightly from their peak in March, they’re still sitting near historic levels.

Although the EV narrative remains reasonable, high prices for lithium and other battery metals have caused concerns over the affordability of these cars as manufacturers take on extra costs.

Our selected lithium ETFs are in the table below. You can use their ticker symbols to find them on your broker account or continue scrolling to learn more about each in detail.

Top three things to know before starting:

- Demand for lithium has continued to surge thanks to its application in EVs and batteries.

- Lithium ETFs track a benchmark index of 30+ companies involved with lithium mining and producing batteries.

- These funds are a way to diversify your portfolio and gain exposure to the sustainable energy sector.

Best lithium ETFs to buy in 2022

When choosing a lithium ETF, one should consider several other factors and the methodology of the underlying index and the performance of an ETF. For better comparison, you will find a list of funds with details on size, cost, age, income, expense ratio, dividend yield, returns, ESG rating, etc.

Read on to learn about our investment analysts’ top lithium ETF picks for this year.

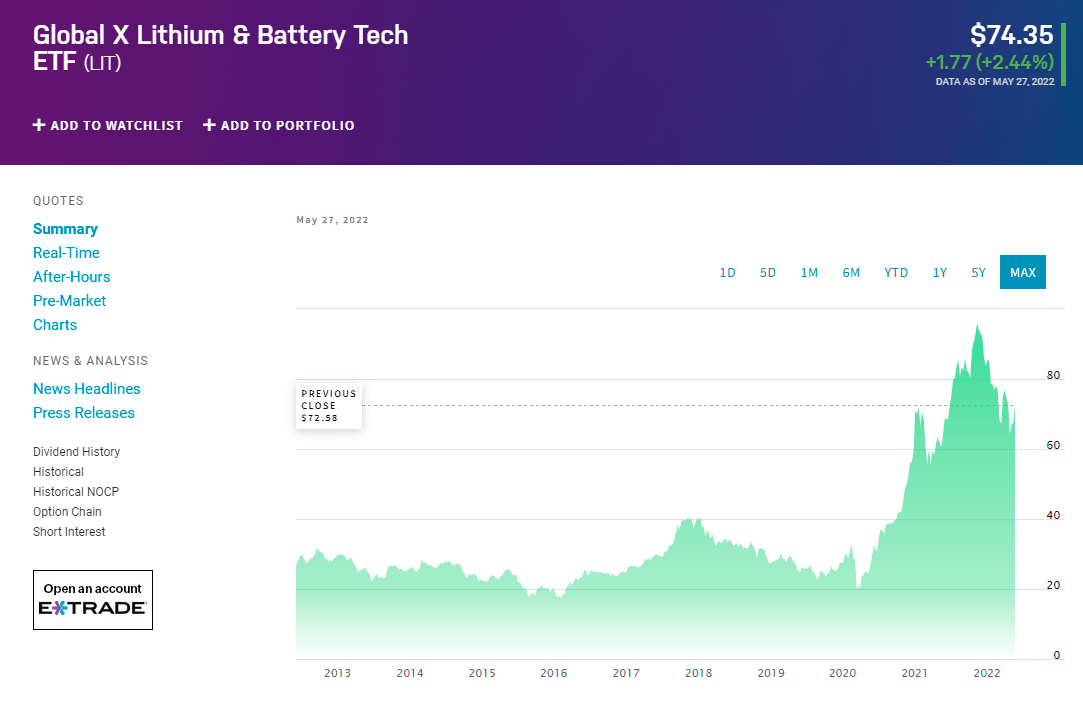

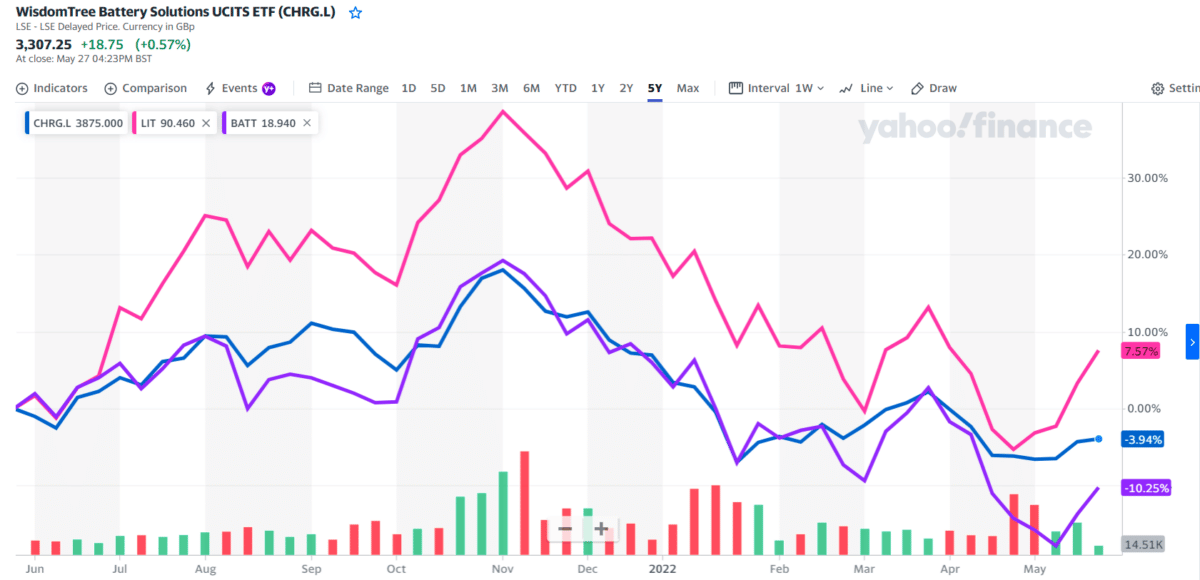

1. Global X Lithium and Battery Tech (LIT)

Founded in 2010, LIT seeks to track the performance of the Solactive Global Lithium Index. Its holdings cover all aspects of lithium, from miners to battery producers and everything in between. The fund invests in various companies and is a top option for investors wanting exposure to the full lithium cycle.

In line with the market recovery, the fund gained over 220% in the past year, rising from around $20 per share to its current price of $74.

It has a total net asset of around $2.8 billion and includes stocks from worldwide. However, most of the fund is invested in the USA and Chinese-based companies, where 60% of its holdings reside. It operates a tired weighting system meaning it allocates more money to companies it has the most confidence in.

Dividend yield

The current dividend yield for LIT is 0.67%.

Holdings

LITs top ten holdings amount to over 50% of the fund. Some of the largest lithium stocks in the world are included in it. Its exposure to the best lithium stocks has seen its price surge by more than 400% since 2020.

Fund holds companies like Albemarle Corp. (12.55%), Ganfeng Lithium Co Ltd (6.07%), EVE Energy Co Ltd (5.45%), Sociedad Quimica Y Minera De Chile SA ADR (4.82%), Tesla Inc. (5.21%), etc.

Expense ratio

Its expense ratio is above average compared to the Natural Resources category funds. It has an expense ratio of 0.75%. It is 51% higher than its category.

Returns (annualized)

The fund has returned 4.7% over the past year and 35.1% annually over the past three years, 20.4% per year over the past five years, and 9.2% per year over the past decade. In April 2022, it returned -14.1%.

It has an R-squared of 60%, a beta of 1.46, and a standard deviation of 34.0%. It has a high total risk rating.

The fund does not have an ESG score.

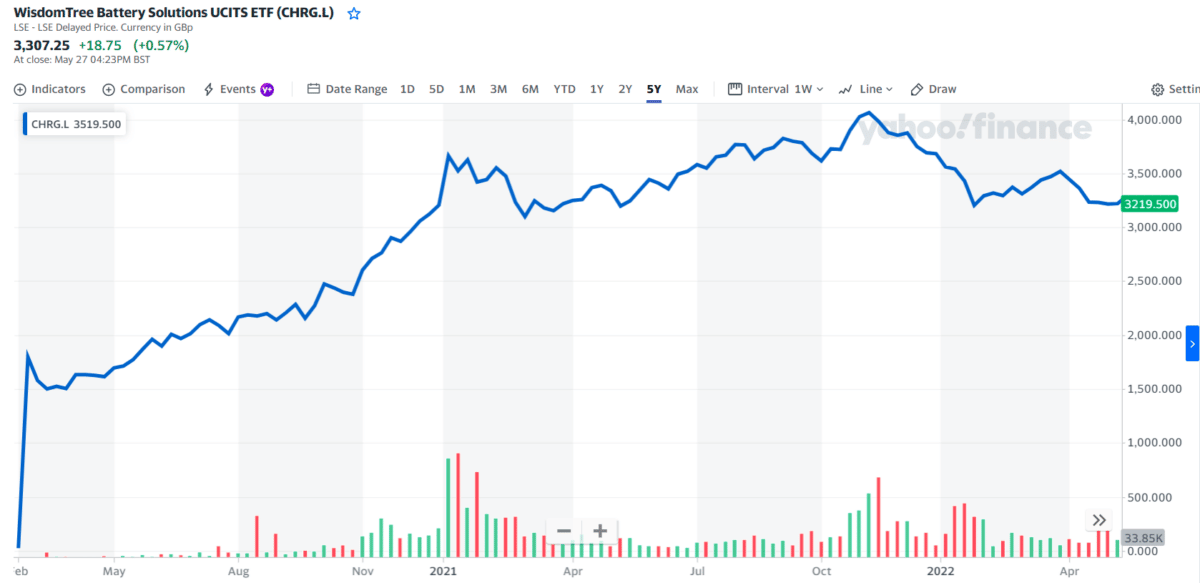

2. WisdomTree Battery Solutions UCITS ETF (CHRG)

It is another newly created ETF launched in 2020. Like most lithium-based funds, many of the companies it holds reside in the USA or China. Almost half the ETF is weighted to these two regions. Some of its top holdings are lithium battery manufacturers like Simplo technologies and Enersys. The top ten investments amount to only 30% of its total holdings, so it’s more equal than other ETFs on our list.

Dividend yield

It has an annual dividend yield of 1.29%, the highest among all the lithium ETFs in the market.

Holdings

The ETF holds stocks like Plug Power Inc, Ganfeng Lithium Co Ltd, Livent Corp, Contemporary Amperex Technology Co Ltd Class A, and more.

It came to the market at the perfect time. Since its inception in March 2020, it’s primarily moved in one direction, upwards. As it targets battery companies, it includes a lot of holdings that are not direct lithium plays, making it a more diverse ETF.

Expense ratio

This ETF has an extremely low expense ratio of just 0.45%.

The fund does not have an ESG score.

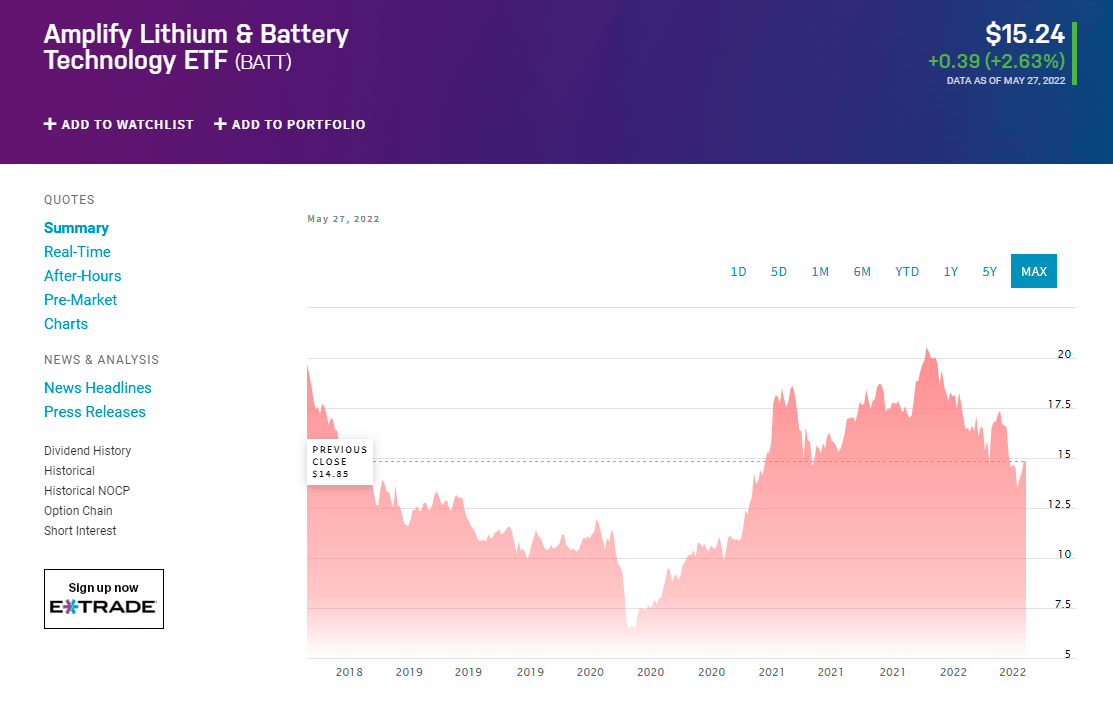

3. Amplify Lithium and Battery Technology ETF (BATT)

It is a new fund and was only created back in 2018. It tracks the performance of the EQM Lithium & Battery Technology Index and invests in stocks that generate revenue from the development, production, and use of lithium battery technology.

This fund may not be as large as other lithium ETFs however it gives investors an excellent option to play the lithium battery market, which is only expected to grow. In its first 18 months of trading, it lost 70% in value. However, when the lithium bull run started in 2020, it was able to regain its losses.

Although it heavily weighs on the Asian lithium market, Amplify’s fund invests in companies globally. It invests in various companies and includes several well-known electric vehicle manufacturers.

Dividend yield

It has a dividend yield of 2.74% and paid $0.42 per share in the past year. The dividend is paid once per year, and the last ex-dividend date was Dec 29, 2021.

Holdings

It’s much smaller compared to the LIT above, with just 87 holdings and around $200 million net assets. This ETF invests in battery materials and technology companies. This means you indirectly invest in companies like BHP Group Ltd ADR, Tesla, Nio, Contemporary Amperex Technology Co Ltd Class A, Glencore, etc.

Expense ratio

Its expense ratio is average compared to funds in the Natural Resources category. The fund has an expense ratio of 0.59%, which is 19% higher than its category.

Returns (annualized)

It has returned -5.5% over the past year and 9.6% annually over the past three years. In April 2022, it returned -14.7%.

The fund has an R-squared of 68%, a beta of 1.58, and a standard deviation of 34.4%. It has a high total risk rating.

It has a high rating of A based on the MSCI ESG Fund Rating.

Pros and cons

| Worth to invest | Worth to getaway |

| The price of lithium has surged in recent years, largely due to its use in batteries. | When buying any capital, it is essential to consider the price today and what is likely to happen in the future. |

| The EV market is expected to grow as traditional carmakers move into space. | There are very few ETFs that focus specifically on lithium. |

| The popularity of EV s has benefited the price of lithium. | Not all early-stage technologies end up developing into large markets. |

Final thoughts

Although lithium-ion batteries have been around for some time, their use has become increasingly relevant to the lithium mining industry because of the push for environmentally sound policies and the growing popularity of EVs and electronic devices.

Lithium is widely used in electronic devices batteries like mobile phones, laptops, tablets, etc. But more importantly, the rapid growth of the EV market around the world will have a huge impact on lithium-related mining and production companies.

If you’re interested in investing in an industry projected to grow significantly, you should seriously consider buying lithium ETFs since the demand for the metal is expected to increase considerably over the next few years.