Exchange-traded funds (ETFs) are increasing in popularity among investors as they provide diversification. The risk/reward trade-offs may be worth your consideration as well — if you are aware of them. The year 2022 has gotten off to an extremely rough start, with the markets heading into their worst January since the dark days of 2008. Several major stocks, such as Netflix Inc. (NFLX), has fallen sharply in recent weeks, contributing to the current volatility.

Increasingly, exchange-traded fund investors are looking beyond the standard index funds to take advantage of market segments that have performed exceptionally well. As a result, market conditions are improving even as we head into February with downward momentum in other market sectors. As a result, the following seven funds are suitable short-term investments.

How do ETFs work?

Investment managers own the underlying assets and design funds to track their performance, selling them to investors. A shareholder of an exchange-traded fund holds a share of the fund but does not own the underlying assets. Nonetheless, investors in a stock-tracking ETF may receive dividends in lump sums or reinvest in the stocks that make up the index. See how index funds work or compare equity mutual funds and index funds.

The value of an ETF may track an underlying asset, like gold, or a basket of stocks, like the S&P 500. However, the price of an investment is typically different from that of the asset. In addition, the returns of ETFs will differ from the returns of their underlying asset. It’s due to factors such as expenses.

What to check before choosing ETFs?

It is then up to you to decide whether or not you can buy a fund if it has the proper strategy and performs well. You might lose money if you don’t watch your trading costs.

You should look out for three factors: the fund’s liquidity, its bid/ask spread, and whether it trades according to its actual net asset value.

There are two sources of liquidity for an ETF: the liquidity of the fund itself and the liquidity of the shares that make up the fund’s underlying portfolio. As a result, daily-trading funds with more tremendous assets under management and lower average daily trading volumes generally have tighter spreads.

Best ETFs to buy in 2022

The following trends are worth watching.

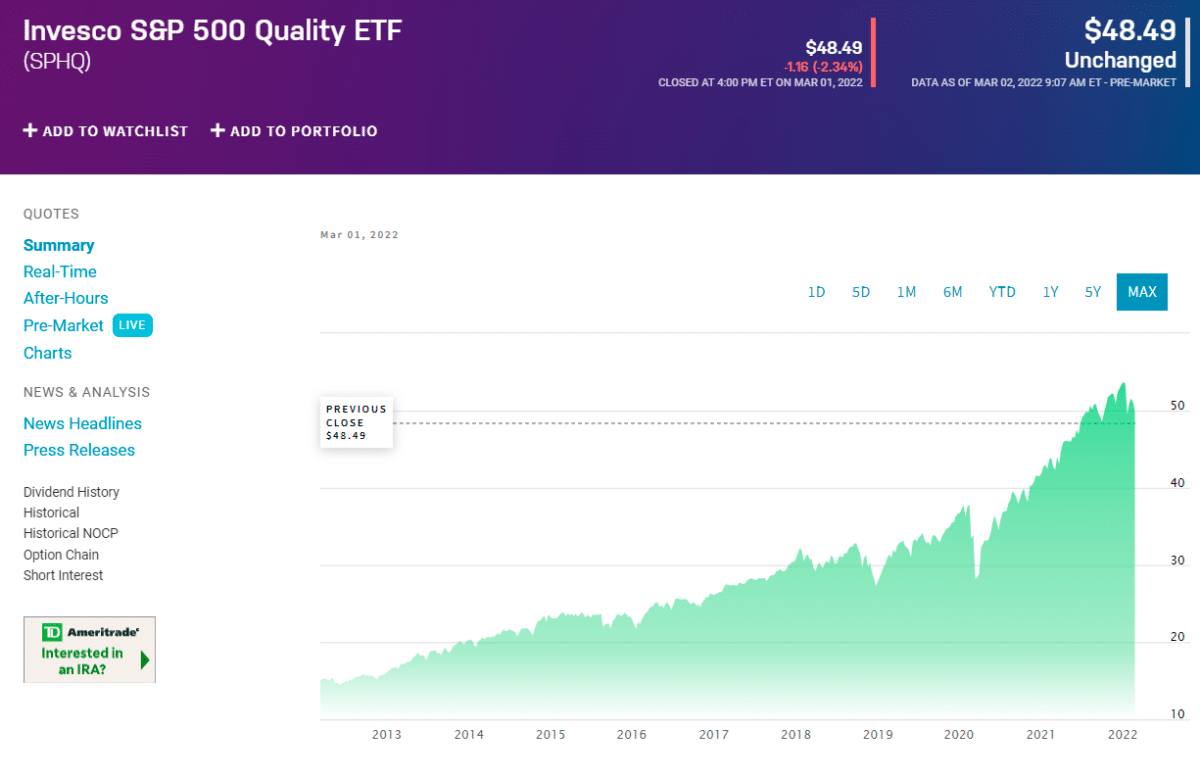

1. Invesco S&P 500 Quality ETF (SPHQ)

Historically, SPHQ has tracked the S&P 500 Quality Index, which comprises S&P 500 stocks ranked based on return on equity, accruals ratios, and financial leverage ratios. The fund’s portfolio is heavily weighted toward large-cap stocks, while most of the portfolio consists of companies in the information technology industry.

After information technology, financial stocks and healthcare stocks are next in importance. One of SPHQ’s top holdings is Apple Inc. (AAPL), a technology company that sells computers, smartphones, and services. Visa Inc. (V), a financial services provider and electronic funds transfer provider, trades in Class A shares. JPMorgan Chase & Co. (JPM) is a primary financial services provider.

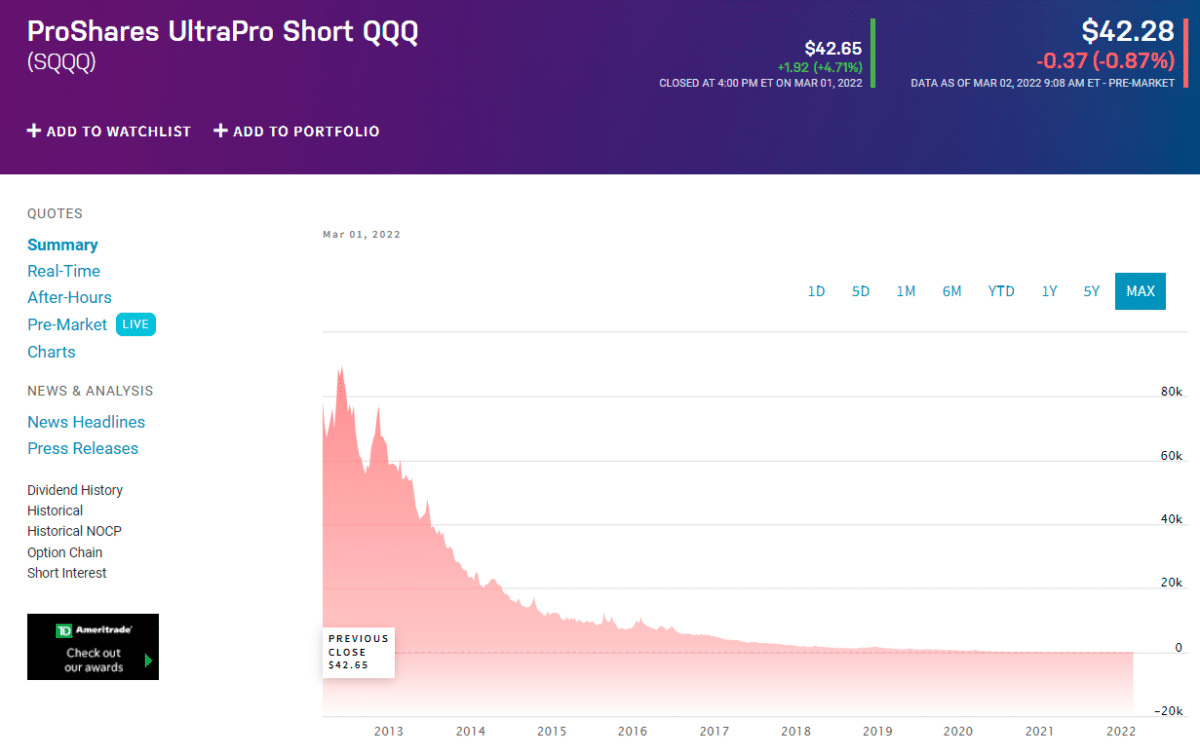

2. ProShares UltraPro Short QQQ ETF (SQQQ)

ETFs that play the downside may be well suited to hedge against short-term declines or take advantage of a brief decline on Wall Street and make some money. A number of these “short” ETFs have performed very well in January, but the supercharged SQQQ deserves special mention. Due to its specialty strategy, it has very liquid assets under management, about $2 billion. In addition, it has leverage, meaning it aims to gain more than it loses. SQQQ’s benchmark is three times the inverse of daily Nasdaq 100 movement.

This fund has gained a staggering 50% this year, whereas the Nasdaq has fallen more than 14% in it. Keep in mind that while this might be an excellent short-term investment or hedge during high market volatility, you will ultimately lose significant if and when the markets rise, and SQQQ plunges the other way.

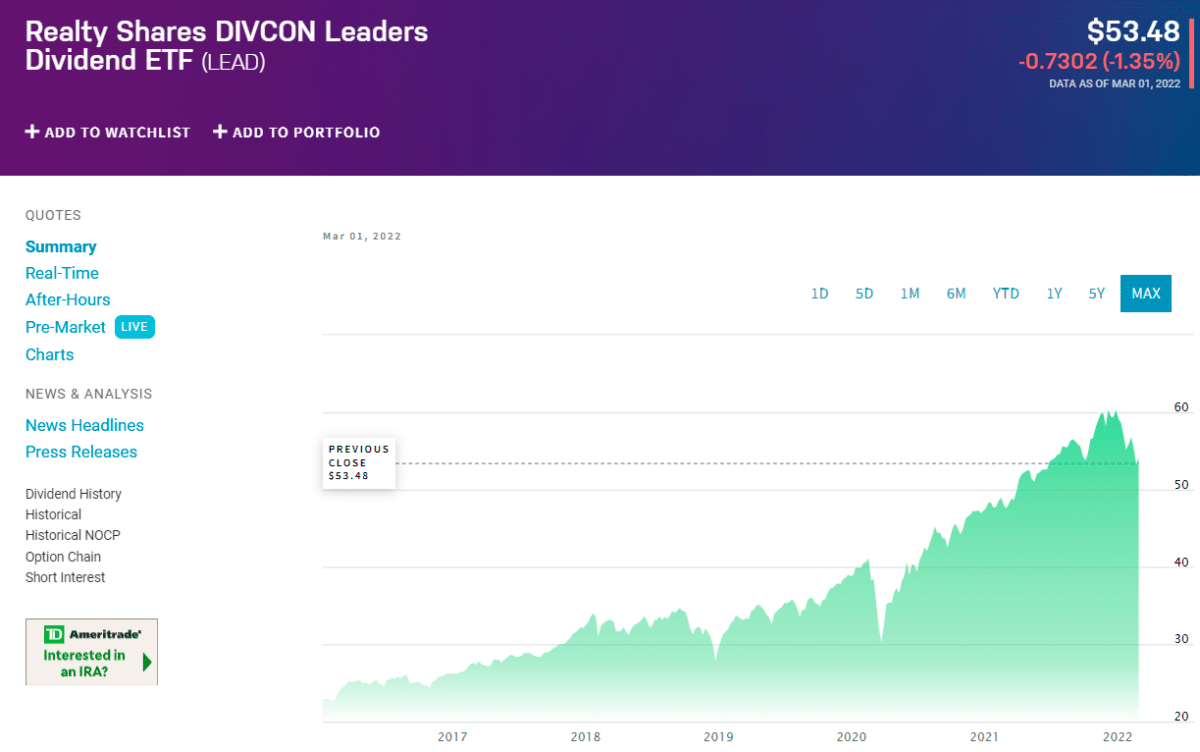

3. Siren DIVCON Leaders Dividend ETF (LEAD)

The LEAD index tracks the Siren DIVCON Leaders Dividend Index, which includes large-cap companies forecast to raise their dividends in 12 months. To determine which companies within the S&P 500 are most likely to increase their prizes, the index relies on the DIVCON methodology, including various qualitative factors.

A few of LEAD’s top holdings include Mastercard Inc. (MA), the financial services company; Nordson Corp. (NDSN), a manufacturer of adhesives, sealants, and coatings; and Sherwin-Williams Co. (SHW), a paint and coating company.

Pros and cons

| Worth to invest | Worth to getaway |

| Can be sold short and bought on margin Because ETFs trade like stocks, they can be used as part of particular investment strategies, such as short selling and margin purchases. | Tax efficiency ETFs are likely to be more tax-efficient than traditional mutual funds. To satisfy redemption requests by investors or pursue fund objectives, mutual fund managers may trade stocks. However, selling shares may result in shareholders having to pay taxes, and redeeming ETFs isn’t a problem because they are like stocks. In addition, index-based ETF managers only trade in response to changes in their index, which may allow them to realize greater tax efficiency. |

| No minimum investment While mutual funds usually require a minimum investment, ETFs are generally available to investors at any amount. | Low expenses Passively managed ETFs incur fewer fees than actively managed funds (managers generally trade shares only to track underlying benchmarks). |

| Diversification Adding an ETF to your portfolio may help to diversify your investments. For example, buying shares of an ETF that holds various technology companies’ claims could be less risky than purchasing shares of single technology stock. | Flexible trading ETFs are traded all day long at real-time prices, just like stocks. Mutual funds, by contrast, lack this flexibility: Prices are set at the close of business. |

Final thoughts

It is essential to consider the risks associated with different ETFs carefully. For example, most sector ETFs are more volatile than those that track the broad market. Therefore, ensure you understand the risks and possess the latest information about an ETF before investing.

The majority of ETFs track an index and use passive management. However, investing in mutual funds, managed by professional managers who attempt to outperform the market, appeals to some investors. The active managed ETFs are similar to mutual funds, but they have higher fees. Therefore, it is essential to know your investment style before investing.