Investing in oil ETFs can be a complex endeavor. For most investors, even large traders, taking delivery of oil and storing it is simply impractical or impossible to do. Thus, oil ETFs have become a popular instrument with which to access the oil market.

Leveraged funds seek to provide a magnified return on the pricing of the current crude oil commodity for a single day. The funds bet on Brent and WTI futures contracts and apply a bit of leverage, either 2x or 3x, to improve returns.

How does it work?

Oil ETFs, or exchange-traded funds, are baskets of securities that either track oil price as a commodity or contain oil stocks.

Crude oil ETFs are funds that seek to track the price of crude oil with fewer expenses. Oil funds provide indirect exposure to the price movements of WTI or Brent crude oil without physically holding. To achieve this objective, oil funds may purchase crude oil futures contracts.

Top three things to know before starting:

- Crude oil prices have risen over $100 a barrel since Russia invaded Ukraine.

- There are currently 11 oil ETFs on the market, 7 of which are commodity-based crude oil ETFs.

- Oil prices have dramatically outperformed the broader stock market over the past year.

Best leveraged oil ETFs to buy in 2022

The following oil ETFs are commodities ETFs, meaning they track the price of oil through benchmarks such as the Brent Crude oil or West Texas Intermediate benchmarks. These funds do not hold oil company stocks.

Let’s see more information on leveraged Crude Oil ETFs, including historical performance, dividends, holdings, expense ratios, etc.

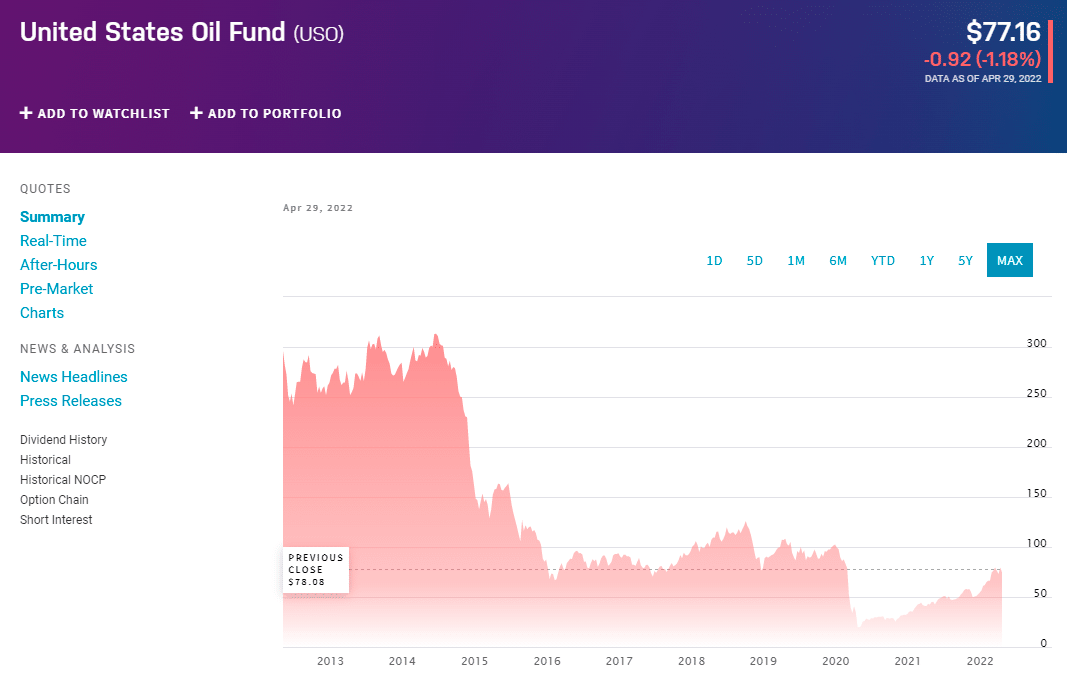

1. United State Oil Fund ETF (USO)

It is a fund that seeks to track the price, in percentage terms, of the spot price of light sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the Benchmark Oil Futures Contract. Its longer period returns are far lower compared to a basket of commodities or to the S&P 500. The fund’s inception date is 2006.

Dividend yield

The United States Oil Fund (USO) ETF granted a 0.00% dividend yield in 2021.

Expense ratio

Its expense ratio is high compared to funds in the commodities-focused category. USO has an expense ratio of 0.83%, 32% higher than its category.

Returns (annualized)

The fund has returned 82.7% over the past year and -9.6% annually over the 3 years, -2.8% per year over the 5 years, and -13.5% per year over the past decade. Recently, in March 2022, USO returned 9.5%. It has an R-squared of 57%, a beta of 2.60, and a standard deviation of 57.7%. It has a high total risk rating.

The fund does not have an ESG score.

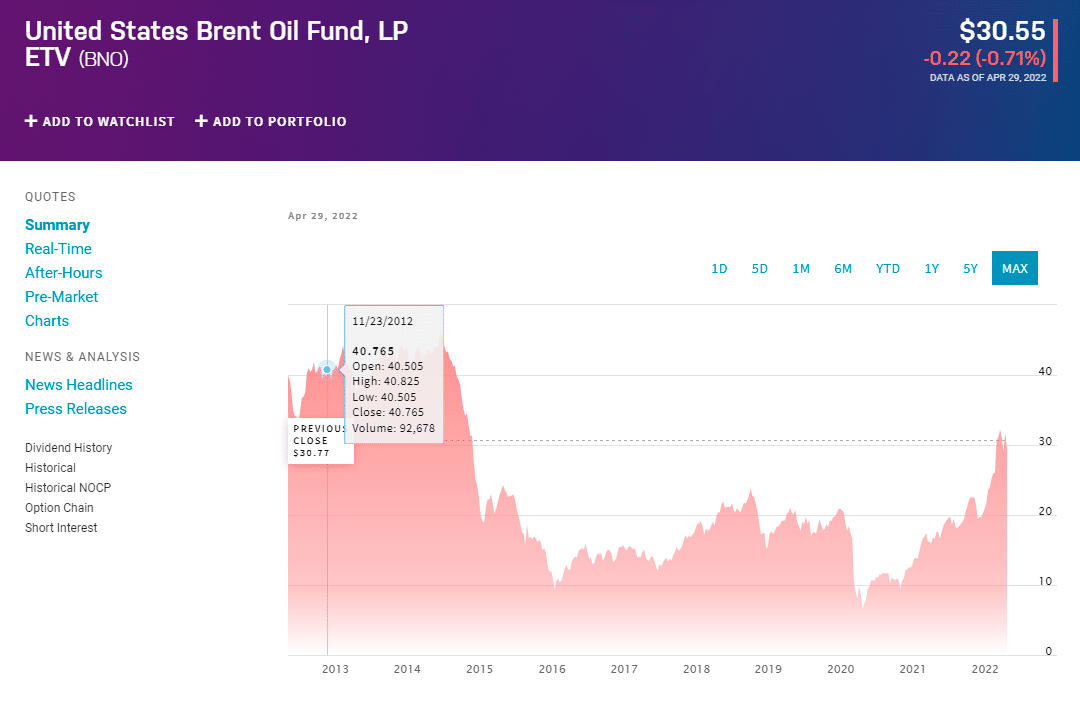

2. United States Brent Oil Fund LP ETF (BNO)

This fund seeks to track the daily price movements of Brent crude oil. Its benchmark is the near-month futures contract traded on the ICE Futures Exchange. Significantly outperforms the broader index, Bloomberg Commodity TR, and the US equity index, S&P 500, for the 1-year return.

Like USO, BNO is structured as a commodity pool. Its objective is for the daily percentage changes in its shares’ net asset value (NAV) to reflect the daily percentage changes in the spot price of Brent Crude oil, as measured by changes in the price of BNO’s Benchmark Oil Futures Contract.

BNO’s returns also outperform the commodity index in more extended periods. However, USO’s longer period returns are far lower than the S&P 500. The fund’s inception date is 2010.

Dividend yield

The United States Brent Oil Fund (BNO) ETF granted a 0.00% dividend yield in 2021.

Expense ratio

It has an expense ratio of 0.90%, which is 43% higher than its category.

Returns (annualized)

The fund has returned 88.3% over the past year and 15.8% annually over the past three years, 15.5% per year over the past five years, and -3.6% per year over the past decade. Recently, in March 2022, BNO returned 10.1%. It has an R-squared of 63%, a beta of 2.41, and a standard deviation of 51.2%. It has a high total risk rating.

ESG rating

The fund does not have an ESG score.

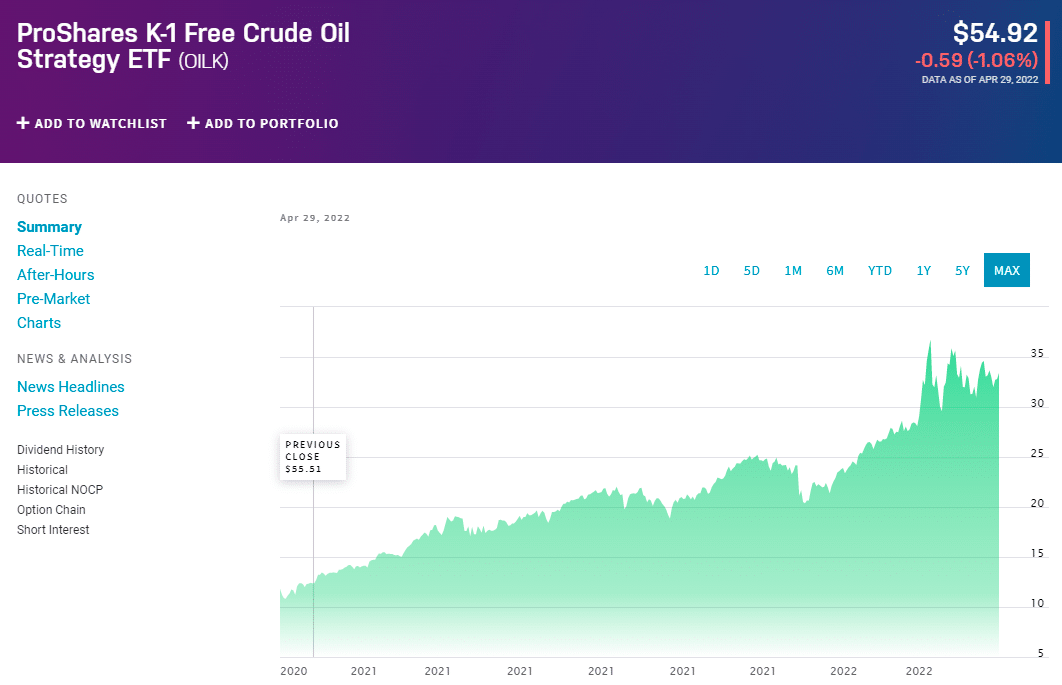

3. K-1 Free Crude Oil Strategy ETF (OILK)

OILK is the first crude oil ETF that does not issue a K-1 to its shareholders, which may be attractive to some investors who wish to invest in oil ETFs. The fund seeks investment results that track the performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. The fund’s inception date is 2016.

Dividend yield

OILK has a dividend yield of 53.67% and paid $30.05 per share in the past year. The dividend is paid every three months, and the last ex-dividend date was Apr 1, 2022.

Expense ratio

Its expense ratio is above average compared to funds in the commodities-focused category. OILK has an expense ratio of 0.67%, which is 7% higher than its category.

Returns (annualized)

The fund has returned 80.1% over the past year and -4.3% annually over the past three years. Recently, in March 2022, OILK returned 10.9%. It has an R-squared of 61%, a beta of 2.54, and a standard deviation of 54.8%. It has a high total risk rating.

ESG rating

The fund does not have an ESG score.

Pros and cons

| Worth to invest | Worth to getaway |

| In today’s market, investors can find ETFs that track the daily price of oil and aim to mitigate the effects of contango and backwardation and funds exposed to companies in the oil sector. | Such can be riskier investments than non-leveraged ETFs given that they respond to daily movements in the underlying securities that they represent, and losses can be amplified during adverse price moves. |

| Oil prices have dramatically outperformed the broader stock market over the past year. | These funds are designed to achieve their multiplier on one-day returns, but you should not expect that they will do so on longer-term returns. |

| They offer investors more direct and easier access to the often-volatile energy market than many other alternatives. | Market participants should remember that oil prices can significantly fluctuate in the short term. |

Final thoughts

You can get started by including oil ETFs in your investing arsenal when you have a good feel for the commodity. Conduct thorough research first if you’re ready to include these funds in your investment strategy. Track oil prices and pay attention to how some major oil funds react to different market conditions.