Since the crypto market is somewhat immature and crypto-assets come and go, it is not easy to maintain a list of well-performing assets. This makes crypto investing risky. However, you can lessen the risk with the use of fundamental analysis.

The reasons that push investors away from crypto investing are those same reasons that draw other investors into crypto. Because of the volatile nature of crypto, it could mean your small investment might transform into a fortune in the near term. But the question is, which crypto assets should you put your investment in. To answer this question, we can look at the stock market and get some ideas.

Crypto is vastly different from stocks, but the two have commonalities as well. One of the everyday things is fundamental analysis. Be aware that you can do the same fundamentals in crypto as you do in stocks. While the technicalities vary, the same process is applicable.

What is fundamental analysis?

It functions on the premise that a market could misvalue security in the beginning. However, the market would correct this fault after some time and eventually reflect an asset’s actual value. You can tell if the market has undervalued or overvalued security through fundamentals and then make better investment decisions.

This kind of market analysis dictates you to buy undervalued assets and steer clear of overvalued securities. In this way, you can avoid taking part in attractive but risky investments and focus on less popular but potential options.

Relevance of fundamental analysis to crypto

This kind of analysis is a common method for stock investing. But is it applicable to crypto? Sure, it is, albeit slightly differently. Like the stock market, the crypto market may also underestimate or overestimate the value of digital currencies. Therefore, you can apply the same process you use to assess the value of stocks to estimate the value of crypto assets. Using this valuing method, you can figure out if crypto is undervalued or overvalued.

Because crypto prices can change dramatically in a short period, you could realize considerable profits if you buy undervalued crypto. On the flip side, you might lose big time if you invest in an overvalued crypto. With your fundamental analysis knowledge, you have the edge over other market participants when making trading decisions.

Metrics to consider in cryptanalysis

To conduct this kind of market analysis in crypto, you must consider various factors. Due to the decentralized nature of crypto, you might find it very difficult to find reliable information. You might not get information from one source or reference, but you can muster relevant data surrounding the crypto of your choice. Make sure you get data that have an impact on the value of such crypto.

Some data are easy to come by, such as the number of users actively trading specific cryptocurrencies. Other data that may influence crypto price might be elusive to you, such as sociopolitical events in various parts of the world. It would be best if you considered several metrics so you can do thorough cryptanalysis.

This section will discuss the three major metrics: project, financial, and blockchain.

№1. Financial metrics

Financial metrics refer to the economics behind the price dynamics of crypto. You can easily find these metrics as many of them are quantitative factors. Most investors look at these metrics first, but you should not stop looking.

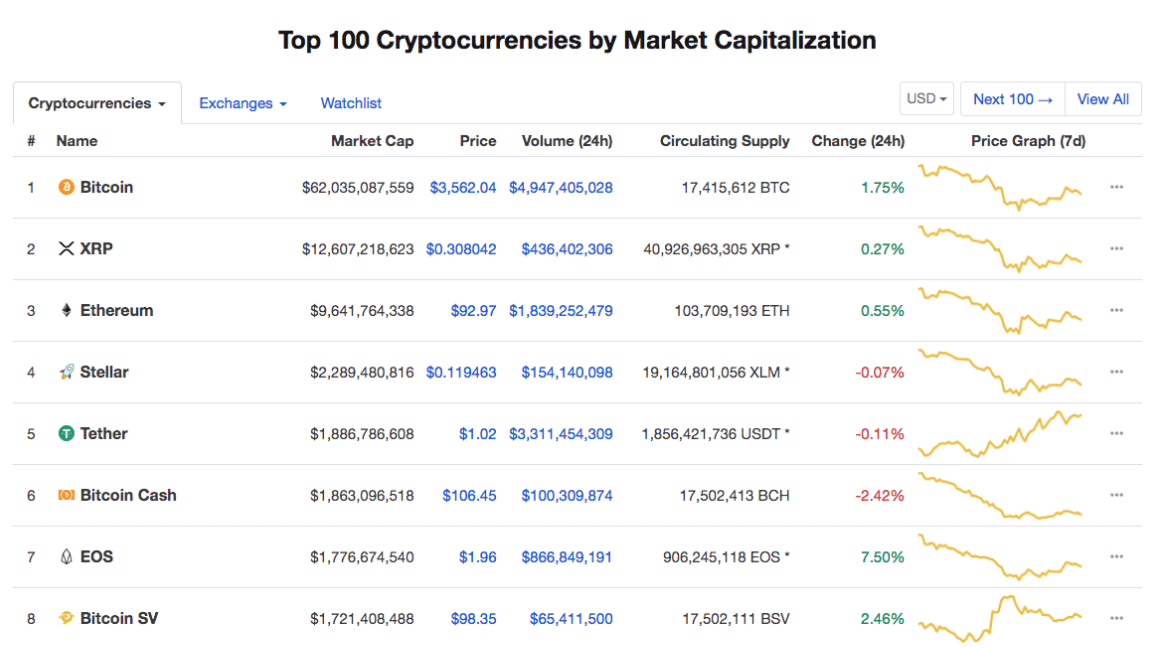

Market capitalization is the basic financial metric you must look into. Market cap refers to the net value of all coins in circulation for specific crypto. When you multiply the current price of crypto and its available coin supply, you will get the market cap value. Low-cap crypto assets may grow in value, but coins with a high market cap are generally more stable.

Another critical financial metric for crypto is liquidity. This factor refers to the speed of execution of buy and sell orders. You might not figure this out unless you do an actual transaction. An alternative to this without actually taking trades is identifying the spread, the difference between the lowest buy price and the highest sell price. Lower spreads suggest high liquidity.

№2. Project metrics

These metrics consider the development aspect of crypto, reflecting on its origin, purpose, and mechanics. The challenge with these metrics is that many are qualitative factors, though some are available and measurable.

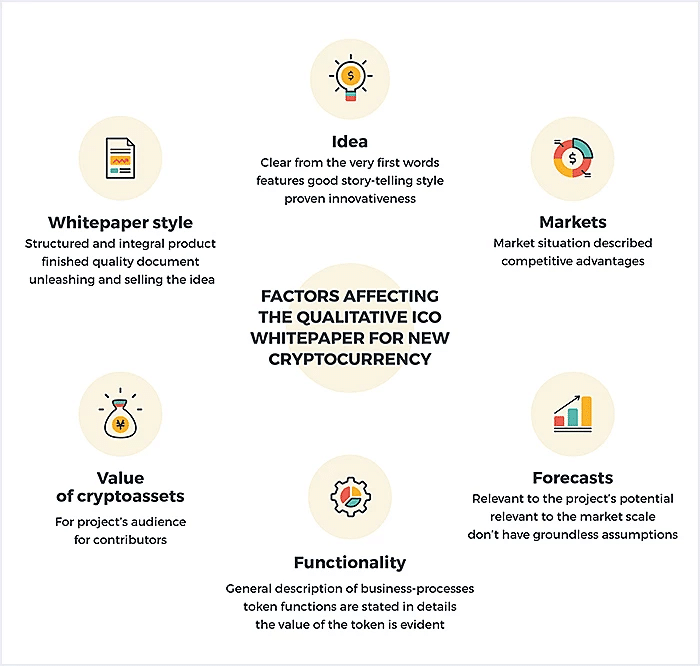

The whitepaper is the most crucial project metric to look into. Whitepapers contain the plan of a crypto project as defined by the developers, from the purpose to the technology being used. As an investor, you may want to find a whitepaper that is not only comprehensive but also showcases a realistic and straightforward definition of goals.

The team of developers and even sponsors behind a crypto project is another metric you can look at. While some crypto inventors prefer to use an alias to hide their identity — think of Bitcoin, for example — other crypto creators reveal their true identity and provide other types of information.

Knowing who created crypto can help you assess if the crypto is trustworthy or otherwise or the project has a chance to succeed.

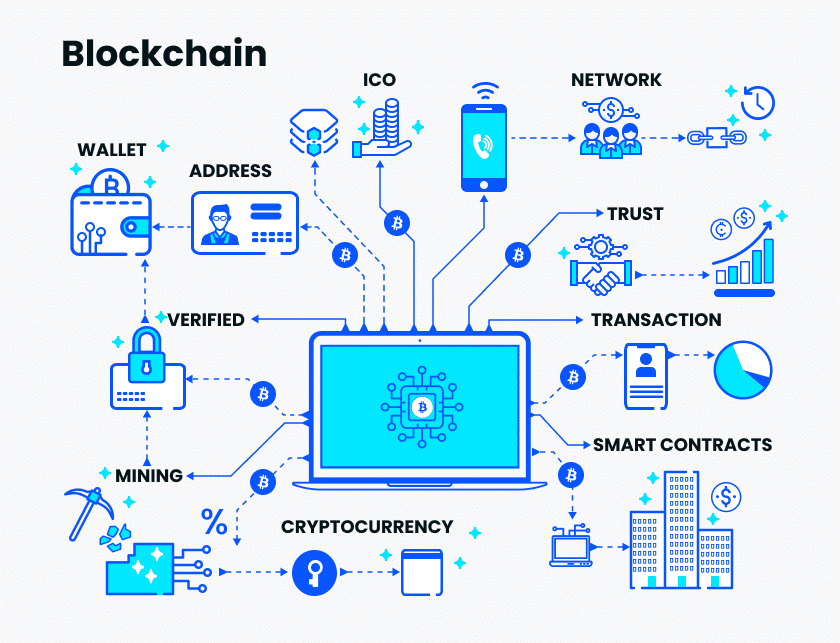

№3. Blockchain metrics

All crypto platforms use blockchain technology. Not all emerging technologies run on the same blockchain, but each uses a slightly different technology to run its operations. Knowing which blockchain is in use or what process it uses to authenticate transactions can give you a clue as to the strength of the technology used by the crypto platform.

One critical metric is hash rate, which can help you figure out how secure an asset is. The hash rate determines the speed at which you can mine a block on the network. The higher the hash rate, the easier it is to complete a block and the more difficult it is for hackers to attack the network.

Aside from the hash rate per se, you can look at its value as it changes over time. If this value is decreasing, not only does it mean that security is declining, but it also shows that miners are losing interest in the asset.

There are a lot of indicators you can use. Just get enough fundamental data to make an informed investment decision. Trying to get every information available is often not practical. Just focus on those metrics that really matter.

Final thoughts

When done correctly, fundamentals can provide invaluable insight into crypto that technical analysis will not. The ability to separate the market price from the “true” value of the network is an excellent trading skill. Of course, technical analysis can tell us something that fundamental ones cannot predict. Therefore, many traders combine the two.

As with many strategies, there is no universal guide to fundamentals. We hope this article helps you with some factors to consider before you start pouring money into a crypto asset or two.

If you invest in crypto-based on value, such as market adoption, then you have more confidence that the crypto will thrive and provide you with sizable returns in the future.