An altcoin is any cryptocurrency besides Bitcoin. It has similar attributes to BTC, but it has other characteristics different from the crypto-leader. For instance, an altcoin may use a different consensus method to authenticate transactions or generate blocks. It also distinguishes itself from BTC by offering new or more features, such as low-level volatility or smart contracts.

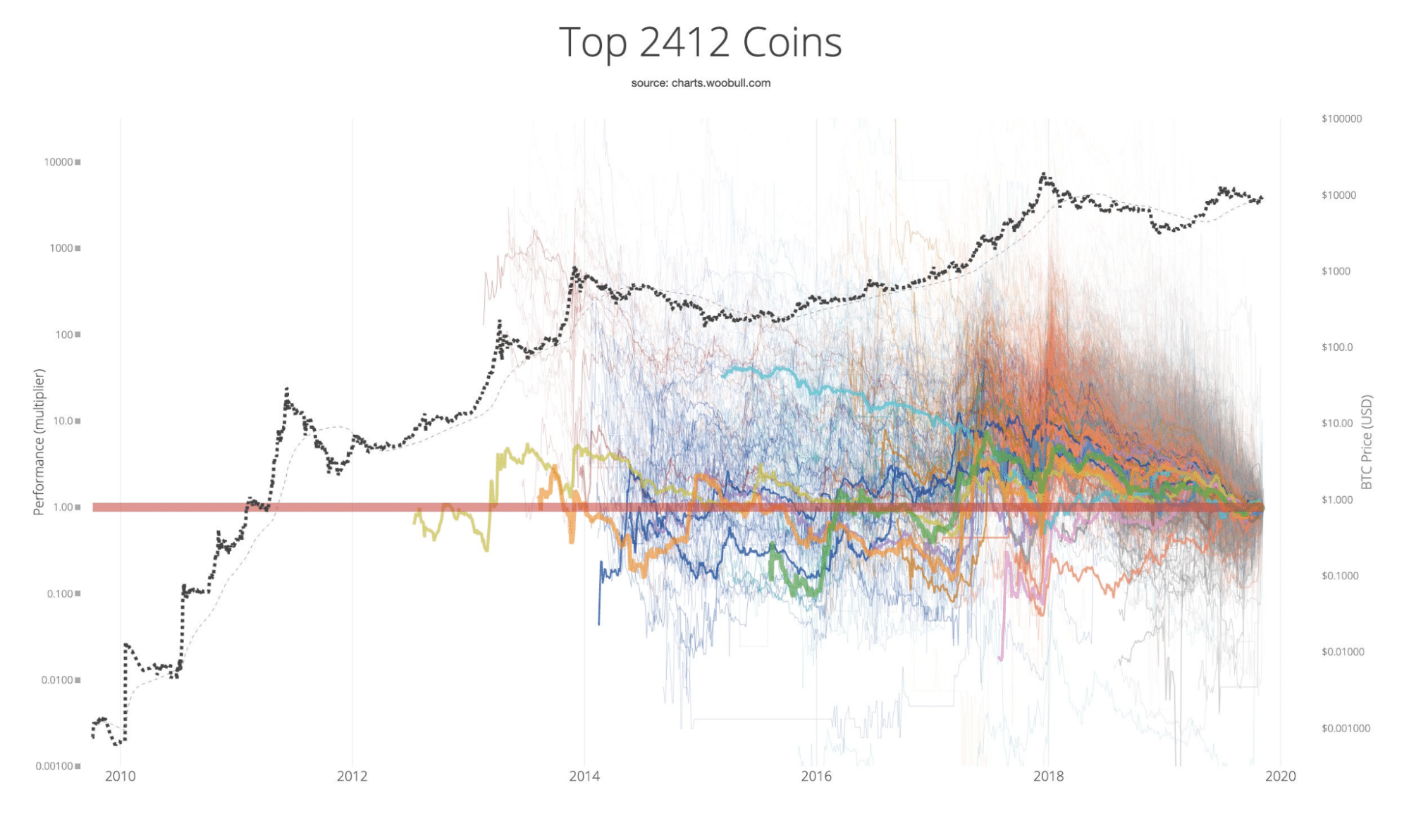

There were about 9,000 cryptocurrencies already in March 2021. Altcoins make up forty percent of the overall crypto market. As a derivative of BTC, an altcoin tends to simulate the price movement of BTC.

Over time as altcoin investing matures and new markets for altcoins form, experts say the price movement of altcoin might become independent from the crypto-leader.

A closer look at altcoin

The term “altcoin” comes from the two words “alt” (meaning alternative) and “coin.” The foundation of both BTC and altcoin is similar. Coding is comparable, and both work on a peer-to-peer basis and process huge amounts of transactions and data. At other times, altcoins intend to remove BTC from its leading position by offering faster digital transactions at a lower cost.

There are several differences between BTC and altcoin. As a forerunner of altcoins, BTC sets the tone and baseline standard for cryptocurrency development. However, this coin is not a perfect technology. For instance, the consensus method implemented to produce blocks is time-consuming and energy-intensive.

The smart-contract capacity of the crypto-giant in comparison with altcoin is relatively low; what makes altcoins competitive is their improvement of the perceived shortcomings of BTC. Many altcoins utilize proof of stake to reduce energy use and lessen the time needed to generate blocks and authenticate transactions.

Types of altcoins

Altcoins have different types based on their consensus methods and functionalities. Below are some of the prominent types of altcoins:

- Mining based

- Stablecoins

- Security tokens

- Utility tokens

Mining-based

As the name implies, a mining-based altcoin comes into existence through mining. Typically, this altcoin uses proof of work to solve complex mathematical problems and thus bring a new coin to life. Below are some examples of altcoins generated in this manner:

- Monero

- Litecoin

- Zcash

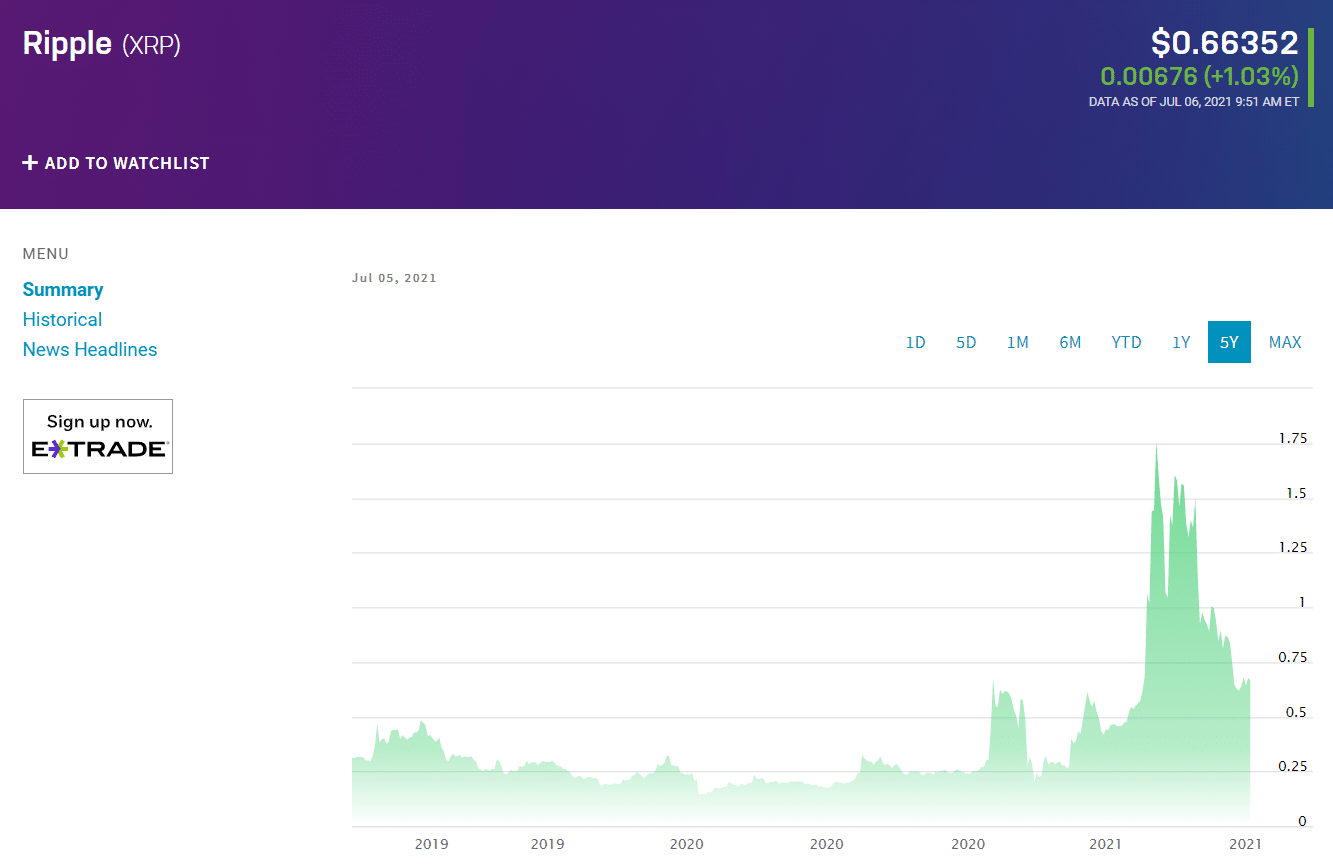

The majority of premier coins produced in early 2020 belong to the mining-based group. On the other end of the spectrum are pre-mined coins. The qualifier “pre-mined” means that such coins come into being without the use of a computer solving complex problems. Pre-mined coins already exist at the time of introducing the coins to the market. One example of this altcoin is Ripple.

Stablecoins

The cryptocurrency market has been volatile since its inception. To address the unpredictable and large fluctuations in price, stablecoins come into the picture. Real assets, such as other cryptocurrencies, precious metals, and fiat currencies, back stablecoins. This asset backing aims to serve as collateral for coin owners if the cryptocurrency encounters problems or fails altogether. Price fluctuations in stablecoins should stay within a limited range.

Some examples of stablecoins worth mentioning are the following.

| Stablecoin | Symbol | Short description |

| Diem | DIEM | Issued by social media giant Facebook |

| USD coin | USDC | Backed by US dollar at 1:1 ratio and running in Ethereum network |

| Dai | DAI | Pegged to US dollar 1:1 and attempts to maintain a value of one US dollar |

Security tokens

Security tokens are like stocks that investors may invest in. The difference is that security tokens have no physical presence, only electronic existence. Like stocks, you can expect a return on investment, typically in the form of a dividend, when you own security tokens.

Many investors see this opportunity as a lucrative deal as they expect such tokens to grow in value over time. Like a stock’s initial public offering (IPO), investors can own security tokens through an initial coin offering (ICO).

Utility tokens

A utility token is a coin issued by a network and used within the network for specific purposes. For instance, you can use a coin to redeem a reward or purchase a service. In contrast with security tokens, you cannot receive dividends out of owning utility tokens. One example of a utility token is Filecoin. Users within a network use Filecoin to buy storage space in the network.

What factors should you pay attention to while choosing an altcoin?

- What is the capitalization of the project?

A reputable crypto rating must be selected. The project you will invest in should be included in the worst case in the top 30 cryptocurrencies and better — in the top 20 or 10. The volatility of the value of these assets will not be as high as that of non-capitalized assets. Still, they will be reliable investments, proven historically, which are in demand by market participants.

- Is the company real?

Often, projects have nothing but a website and several documents. It is essential to find out if the company has a real product and consumers. You can also check if there are ambassadors behind the project, for example, famous and wealthy people who believe in this product and trust its owners.

- What exchange is the altcoin traded on?

A project worth investing in must be present on popular and highly liquid exchanges. It must be possible to buy or sell an asset quickly. That is, it must be liquid.

- What product or technology does the project offer?

Behind every altcoin, there is some proposal from the developers. It is like investing in a startup — in the case of cryptocurrency, you are buying not the “dollar” but rather the “shares” of the company.

- What payment services does the project use?

Pay attention to projects of payment services, which, for example, present a debit card as a product that can be used both for fiat money and for storing cryptocurrencies.

- Is the PR around the project worth attention?

When choosing an altcoin worth investing in, 80% should consider the technology that the project offers, and only 20% the PR around the company.

Pros and cons of altcoin investing

The altcoin market is entirely new. However, the number of altcoins coming into the market is continuously increasing, and retail investors notice this phenomenon and take advantage of this opportunity. The goal of these investors is not to buy and hold the investment for long. They only want to realize profits whenever the price of altcoins appreciates in the near term. Often, these investors are small in terms of capital and cannot create market liquidity.

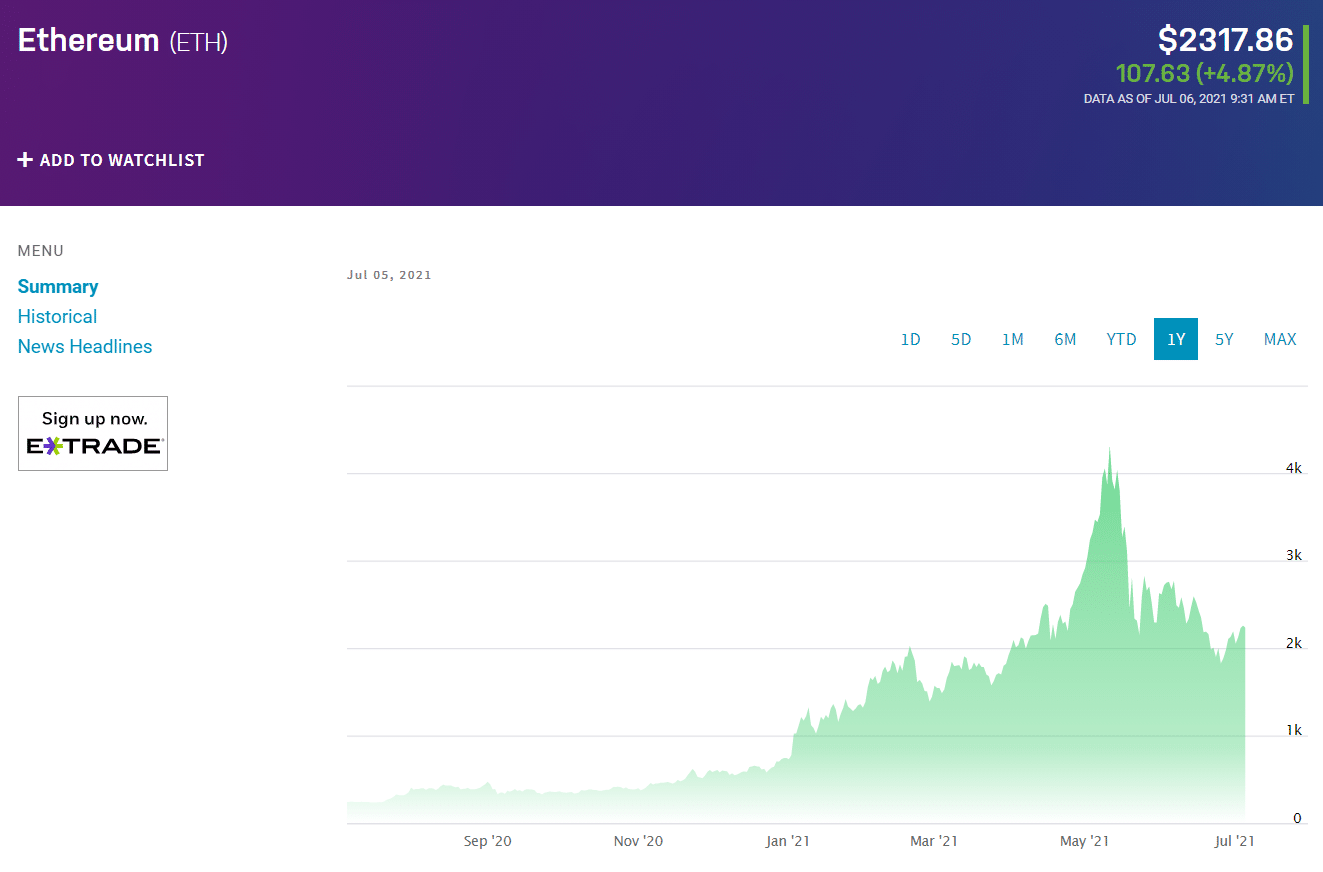

The absence of regulation and a thin market bring about unpredictable volatility and price changes to altcoins. Let us take the altcoin Ether (ETH), for example (see above chart).

On 12 January 2018, it reached almost $1,300. After one month or so, the price went down to less than $600. When the year ended, ETH bottomed at less than $90. Two years later, it scored a significant comeback, breaking the previous high of around $1,300 and managing to make a new high of about $2,000. You could have made substantial profits had you bought the altcoin at value areas on its way up.

Despite the profit appeal, there are risks you have to understand. In general, the cryptocurrency market is immature. As a new type of investment, cryptocurrency has no defined metrics or criteria for investors to assess reward versus risk. Speculation primarily drives altcoins. Many cryptocurrencies entered the scene and vanished forever along with the investors’ money.

Pros of altcoin investing

- Altcoins are improved versions of Bitcoin and attempt to sort out BTC issues.

- Stablecoins, a form of altcoins, can fulfill the original purpose of BTC as a medium for conducting payment transactions.

- Several institutions have adopted some altcoins, such as ETH and XRP, for business transactions.

- Investors have a wide selection of altcoins to choose from, and these altcoins are used for different purposes.

Cons of altcoin investing

- Altcoins take up a small portion of the crypto market. Bitcoin accounts for 60 percent of the cryptocurrency market by April 2021.

- Altcoins have thinner liquidity and fewer investors than BTC. The result is more volatile prices compared to BTC.

- Classifying altcoins can be difficult, as well as determining their specific functions. As an investor, you might find it confusing or difficult to distinguish the use cases of altcoins.

- Several altcoins have been dead and long forgotten, divesting investors of their investment dollars.

Final thoughts

Altcoin investing is suitable for investors with the audacity to take on risks in an uncharted market, highly volatile and unregulated. If you can handle stress related to wild price fluctuations inherent in the altcoin market, then this type of investment might be for you. There is a significant potential to make great profits investing in altcoin for the short term.