Blockchain protocol is an emerging technology that may shape many sectors, including real estate. World REIT is a marketplace worth hundreds of trillion dollars, and the internet makes it easy to connect buyers and sellers of this sector. Blockchain technology involves various attractive features that can solve the issues that investors’ issues in the REIT market.

However, when you are interested in such investments, it is better to precisely understand blockchain as it can and maybe will transform REIT in the future. This article will introduce you to the key affecting or attractive factors that investors might consider while adopting.

What is blockchain in real estate?

Each crypto takes advantage of distributed ledger or blockchain to operate. This technology can increase the capabilities of the real estate industry as this protocol can help record data, exchange currency, legal contracts, and other info in a secure and safe network. So, real estate can utilize nodes or computer networks to deliver faster and advanced services to individual clients.

A seller of any property can offer his asset and can request payment over a blockchain network by using blockchain. Nodes verify every transaction, and when a transaction takes place, it stores the data, so all remains transparent.

How will blockchain or can transform the REIT?

This revolutionary innovation that can shape the REIT industry, facilitate more secure and faster transactions, and make the marketplace available. Let’s take a depth look at all possible ways blockchain can shape the REIT:

- Smart contracts

- Programmable money

- Removing intermediary

- Reducing cost and time

- Fraud prevention

- Tokenization

Smart сontract

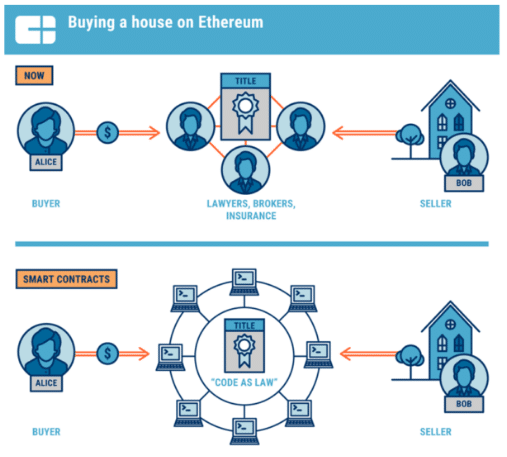

The ultimate goal of a “smart contract” is to eliminate human interruption while verifying an agreement or executing any process. These are pieces of code that enable self-execution by matching certain conditions. For example, traditionally, two parties or entities A and B may seek to occur a transaction. Maybe party A offers a property worth 100K, and party B is willing to buy. When party B sends the money, party A will hand over the documents that will prove the ownership of the property to party B. Once receiving payment, party A may refuse to hand over the document, so party B needs a third-party like a lawyer to ensure his right.

On the other hand, when this transaction occurs through the smart contract, parties A and B come to an agreement, where B may agree to send 100K worth of crypto to A for the property. When A receives the money, it automatically initiates the transfer of the document to B. And after completing transactions, it remains on the blockchain for verification.

Programmable money

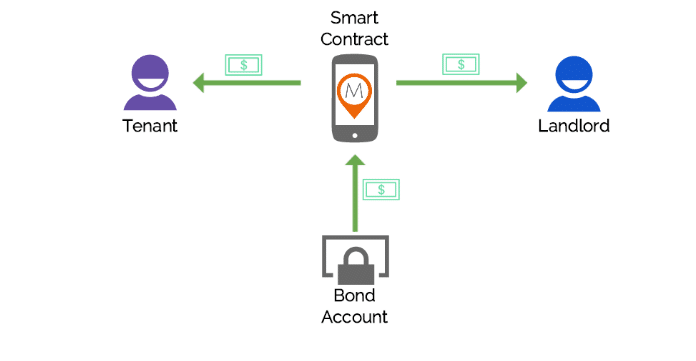

Blockchain technology introduces us to digital payment system cryptos. Programmable or digital money can be useful in the REIT sector. For example, traditionally, you may want to rent an apartment, and the landlord may require a security deposit to cover any tenant damages.

You have to rely on the landlord’s faith to get back the money when the period ends. On the other hand, Bitcoin has a multi-signature feature that enables three parties involved in a fund and requires at least the signatures of two parties to spend the money. The tenant, landlord, and a neutral entity can hold keys in this case, and the fund remains safe.

Removing intermediary

Blockchain doesn’t require any intermediary to verify or process any transaction. Many experts believe that this intermediary issue is a major factor in the traditional real estate market. On the other hand, blockchain enables a most secure way of transactions through smart contracts, so there is no middle man or intermediary insolvency to complete transactions.

Reducing cost and time

Other significant factors of real estate are the cost and time. Traditionally, it usually takes a certain period to hand over the asset and complete payment as there are always third parties like lawyers, banks, or financial institutions. Meanwhile, when these transactions occur in blockchain, it takes less time to execute without involving any third party.

In the meantime, when transactions occur using blockchain, there are no more extra fees you need to pay. So these cost and time effectiveness features are an advantage for blockchain technology to shape the real estate sector.

Fraud prevention

In the traditional REIT sector, there are many fraud reports. When this sector implements or relies on blockchain technology, it can eliminate fraud. For example, when someone deals in the traditional real estate system, they only depend on a single company, organization, or entity.

Meanwhile, the blockchain involves storing data on a verifiable network. So the chance of fraud automatically reduces. So any property that you don’t own, you can’t advertise or sell, it is almost impossible in blockchain to replicate.

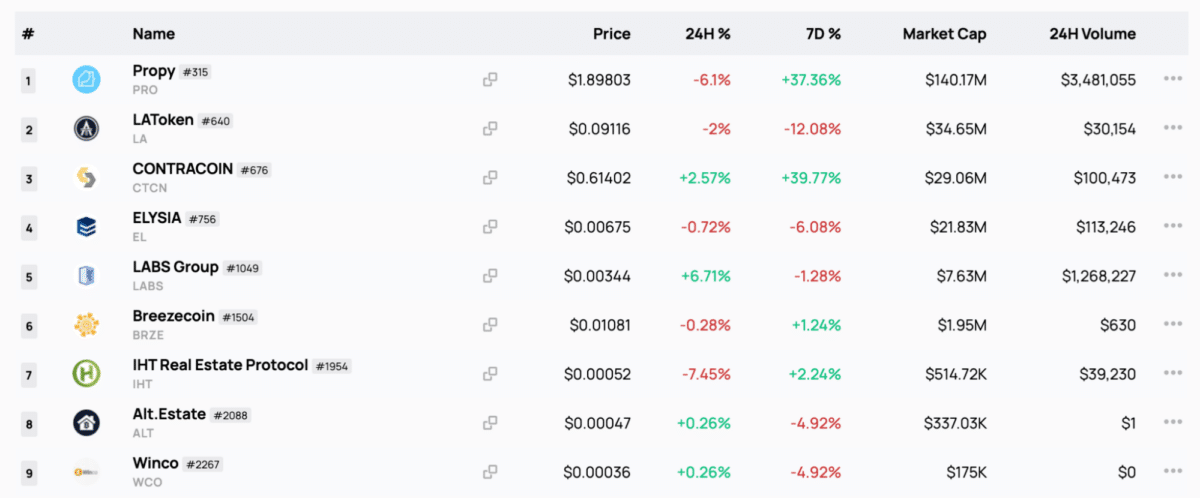

Tokenization

Digital securities are verifiable, and as blockchain technology underpins them, proofing ownership is straightforward. Blockchain involves transparency, so purchasing digital assets or tokens removes barriers from the traditional real estate system. Individual users have to visit their apps to complete any transaction.

By tokenizing their properties, owners can easily manage their properties, and investors can purchase properties without involving hassles as the traditional way.

The tokenized version will dramatically increase the potential of the real estate sector, and the global liquidity will surge upside. It will allow investors and owners to access the assets or capital quickly.

Final thought

Blockchain is emerging with its various attractive features. Many other sectors, including healthcare, government, banking, payment solutions, etc., are also working alongside real estate. However, we are only in the developing period and have a long way to go with this technology as it can disrupt the whole real estate industry. The complete adoption of this digital technology is still a challenge, but the rapid growth suggests blockchain will overcome all barriers in the future.