Investing in high-frequency forex trading (HFT) for market participants is not less than enjoying good profits, high liquidity, and fewer transaction costs. It also permits the market participants to trade on margin and make a great revenue within 24 hours.

HFT trading is a smoothie way for those holding a significant investment instead of retail traders as the chances of losing capital may increase. But despite all the risks and money-losing ratios, HFT has covered the 50% of volume in the US equity market. Moreover, it helps you in the price fragmentation process and increases the trading volume considerably because HFT raises the market competition.

From this investigation, we can get an idea that HFT is risky, but it’s highly profitable at the same time. According to the transaction report, 31 HFTs enjoyed over $29 million with 500 future bargains within a month. As a result, it’s able to boost your money level to billionaire status.

Let’s get straight into the basic principles of such trading. Everything you should know before investing in HFT is described below.

What is foreign currency investing?

Whether short-term or long-term, investing in foreign currencies is always profitable. To secure their future wealth in any economic stagnation, traders invest vast amounts in foreign currencies. This is done through a forex market.

To complete the transaction, one country’s currency should be exchanged from another. Currency always trades in pairs. For example, you buy the pounds and sell euros or vice versa. The Swiss franc, the Canadian, Australian, New Zealand dollars, and African rand are the most tradable currencies.

In the FX, diversification of portfolios is mandatory to prevent high risks. Foreign currency trading also charges lower administrative rates, which help you invest more in buying and selling. Compared to the stock market, forex can quickly turn your amount to 10x. While in stock, you can earn more profit only when the price increases.

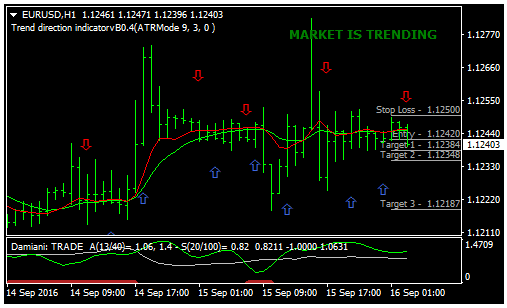

Trend trading is the most effective strategy in foreign currency investment. You can earn a handsome profit by identifying the right trend direction, strength, and duration. Although, investing in foreign currencies is also accessible for new retailers who want to trade a small capital anytime in a day.

What should I know before investing in high-frequency forex?

It is algorithm-based trading where the chance of high turnovers, big revenues, and order-to-trade ratios is more than stock markets. But without knowing the solid tactics of investing, you can lose a significant amount in a day. So HFT has enough benefits, but there’s a lot of money threat.

About 80% to 90% of traders failed in HFT because they couldn’t implement the right strategies. Before investing, you should keep these elements in mind.

Investment risk

It is a lot in HFT as it’s the most crucial point. Foreign bonds indirectly participating in the FX market is the name of investment risk.

A diversified portfolio of investments can prevent you from this high risk. If you’re already rich, you’ll need to spend nearly $125,000 for competitive hardware and software setup in HFT.

Trading fees

High-frequency forex trading’s brokers may ask for commission in every buying and selling of currencies. Their income is derived from the net profit. They are not paid daily wages or salaries by the HFT investors.

Leverage

For the long term, an investor should acquire leverage at fewer costs. A leverage ratio of more than one is a risky investment. The higher the leverage ratio, the more cashwise risk can be expected.

Margin requirements

Margin involves a lot of risks. A margin account can expectedly raise 50% of profit, but it all depends on the suitable investment at the right time. It’s as simple as that if you pick the correct one, you’ll get a considerable amount, and if you choose wrong, you’ll lose a significant amount.

Profit or losses per pip

Pips are very important when it comes to HFT. Admittedly, it’s a very small unit of measurement, but the only $1 pip in any trading can be the reason for notable profit or loss.

Uses of investment strategy in HFT

Investment strategies in HFT are designed to focus on the investment goals. For the current era of trading, there are many investment strategies built to test out the profitability before investing in trading. Planning, placing trades, and executing trades are part of a trading strategy.

Backtesting is a standard method to test the algorithm trading strategy. It would help you to see how well your system is working. If backtesting works well, traders and investors may believe in implementing this strategy in live investment.

Pros and cons of HFT

| Worth to use | Worth to getaway |

| HFT increases the liquidity in the market. It’s algorithm trading, so numerous orders win within seconds or minutes. It also helps in terminating the small bid-ask spreads. | Professional traders condemn that HFT harms the traders who have a long-term investing strategy. |

| Such trading saves your time. The Fraction of a second is the speed where trade is measured. It’s 100 times faster than a human and can generate high profit. | If a trading algorithm continuously sends too many orders, the exchange will not process all trades. This downside is critiqued by traders a lot. |

| Due to many contracts, HFT assists in the price formation process. | Such trading only creates ghost liquidity in the market. HFT professionals argue that the liquidity created is not real as the security is kept for a few seconds only. |

Final thoughts

High-frequency forex trading has its advantages and downsides. For example, if 70% of people have failed in earning significant revenues, 30% of people also became millionaires overnight.