The investment seeks to invest in a portfolio that tracks the Bitwise 10 Crypto Index Fund (BITW) while minimizing investment-related and administrative costs for each market participant. The fund seeks to invest in a portfolio of cryptos by the index. The purpose of the index is to track a basket of cryptos that represents the majority of cryptos by market cap.

Do you wish to know more about this fund and increase your invested capital? If yes, read this article as we have done a detailed review of the fund and its performance.

Three things to know about the fund before starting:

- It seeks to track an index composed of the ten most highly valued cryptos.

- It provides the security and simplicity of a traditional investment vehicle.

- It is screened and rebalanced monthly.

About the BITW

The fund is a Delaware Statutory Trust that issues common units of fractional undivided beneficial interest, representing ownership in the trust. The trust was initially formed as a Delaware limited liability company on September 18, 2017, and commenced operations on November 22, 2017.

The fund seeks to track an index comprised of the ten most highly valued cryptos, screened & monitored for certain risks, weighted by market cap, and rebalanced monthly. The fund provides the security and simplicity of a traditional investment vehicle, with shares tradable in brokerage accounts using the ticker “BITW.”

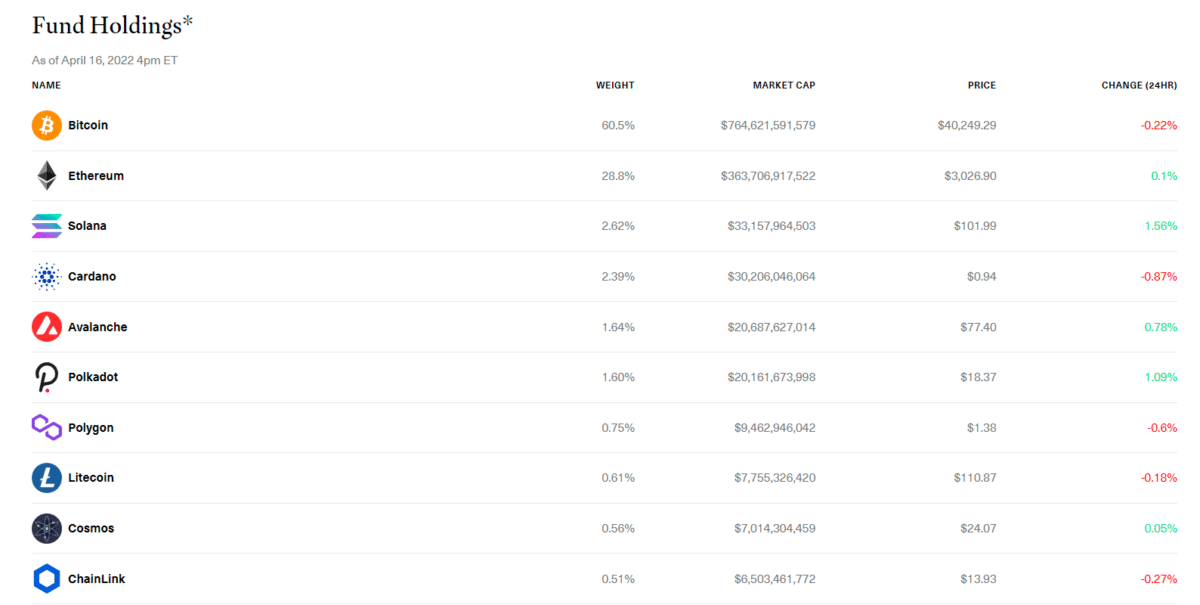

As of March 2022, the following were the ten most significant constituents of the fund:

- 12.21% Silvergate Capital (SI)

- 10.84% MicroStrategy (MSTR)

- 9.14% Coinbase Global Inc. (COIN)

- 5.42% Canaan (CAN)

- 4.72% Galaxy Digital Holdings (GLXY CN)

- 4.62% Hut 8 Mining (HUT CN)

- 4.29% Marathon Digital Holdings (MARA)

- 4.29% Voyager Digital (VOYG CN)

- 4.24% Riot Blockchain Inc. (RIOT)

- 4.23% HIVE Blockchain Technologies (HIVE CN)

The below list makes up the top ten holdings for the fund.

Role in portfolio

The fund holds a market capitalization-weighted portfolio of cryptos, providing coverage of approximately 70% of the larger cap portion of that market. Notably, the fund’s dominance by Bitcoin and Ethereum has slowly been diminishing; back in June 2021, these two holdings made up more than 92% of the fund, but now they make up less than 90%.

Management

The company is headquartered in San Francisco, CA. Bitwise’s team combines expertise in technology with decades of experience in traditional asset management and indexing — coming from firms including Facebook, Google, Wealthfront, BlackRock, Fidelity, Deutsche Bank, IndexIQ, and ETF.com.

Bitwise is backed by leading institutional investors and asset management executives and is a frequent commentator on crypto in the press. The firm is a trusted partner to financial advisors, RIAs, multifamily offices, hedge funds, and other professional investors as they navigate the crypto space.

The Bitwise Crypto Indexes follow transparent, rules-based processes to make them both investable and replicable. The methodologies consider crypto-native factors surrounding liquidity, security, regulatory status, market representation, network distributions, and more to ensure they fully capture the investable crypto-asset market opportunity.

Bitwise Investment Advisers, LLC is the sponsor of the fund. The sponsor maintains a website, bitwiseinvestments.com, containing general information about the fund and the sponsor.

Risk

Custody is a critical component of crypto asset management and the fund’s assets are held securely with Coinbase Custody Trust Company, LLC. Moreover, the fund’s sponsor strives to keep up with industry best practices, including best practices for storing and securing crypto assets.

The fund’s investment in digital assets involves a high degree of risk and comes with a lot of volatility. Uncertainties in government regulation is an ever-present risk in the crypto space and may result in significant price fluctuations. The high expense ratio of 2.50% also adds to the downside risks.

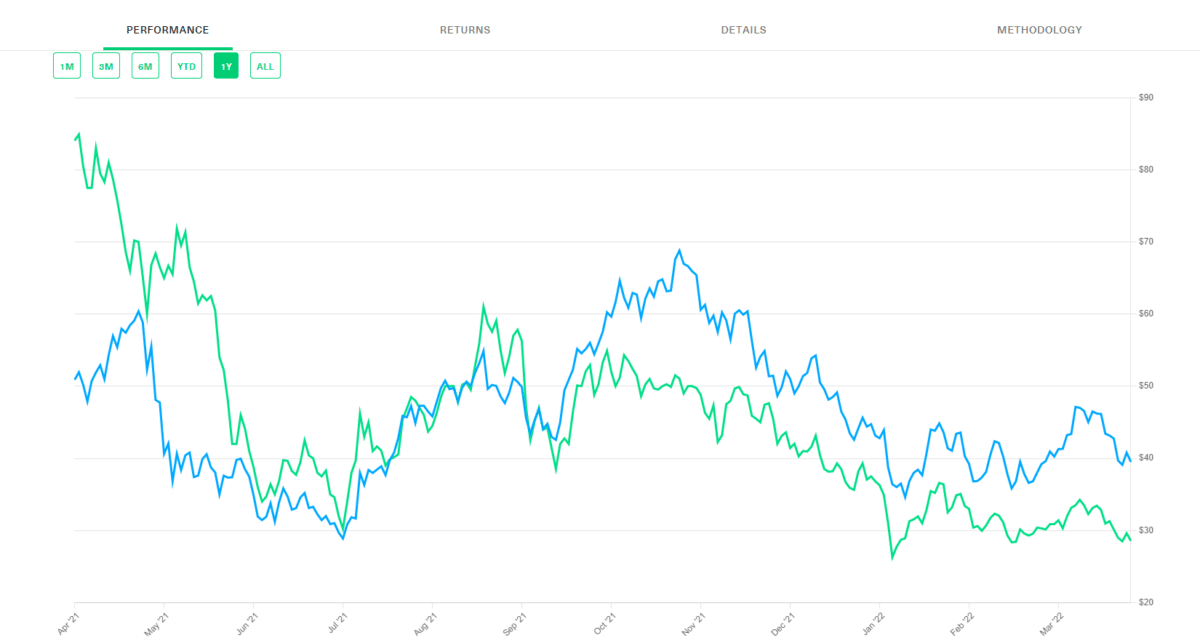

Performance

- Inception date: November 22, 2017

- Expense ratio: 2.50%

- Performance fee: 0%

- Other fees: none

- YTD return: -17.93%

- 1-year return: -29.11%

- Shares outstanding: approximately 20,242,000

- Sponsor: Bitwise Investment Advisers

- Its 52-week high/low is $26.10-$95.22

- As of writing, it was trading at $28.56

Fees

No other fees are available for the fund.

Net expense ratio

It has an expense ratio of 2.50%.

Category average

The fund’s primary competitor is the Grayscale Digital Large Cap Fund (GDLC) within the traditional investment vehicle space. Both have largely overlap in their holdings, although GDLC does hold two fewer holdings, and the fund (compared to GDLC) has a couple of percentage points.

Pros and cons

Overall, the fund has a good marking, but you must consider the upsides and downsides before investing in it.

| Worth to use | Worth to getaway |

| It provides investors with a secure way to get diversified exposure to BTC and other leading cryptos. | One of its drawbacks for investors is that the fund is classified as a partnership for US federal income tax purposes. As such, investors receive a K-1 at the end of the year. K-1s can complicate tax reporting and certainly add to the cost of an investor’s annual income tax accounting. |

| It tracks an index of the ten most highly valued cryptos. | Investors should be sure to understand the tax implications of an investment in the fund. |

| The index components are screened and monitored by the fund’s sponsor for certain risks, weighted by market capitalization, and rebalanced monthly. | Under its large-cap focus, the fund necessarily misses some of the massive returns in the smaller cap token space. |

Final thoughts

The fund’s assets are held in 100% cold storage with a regulated, insured custodian and are audited annually. The underlying index has a formal, public methodology that includes eligibility rules to screen out critical risks around custody, liquidity, regulatory, and other concerns.