CFD stands for contract for difference — a contract entered by two parties who agree to pay the price difference of an asset when the contract term expires. Bitcoin CFD refers to a financial agreement for BTC. A similar Bitcoin product is Bitcoin futures. With these two investment vehicles, you can take part in BTC speculative trading even without owning it.

The two BTC products allow you to bet on the future price of a crypto leader, whether it goes up or down from a specific price, and then make or lose money depending on the side taken and the resulting price relative to the predefined price. If you are familiar with binary options trading, the concept is very much alike.

Although BTC CFDs and BTC futures look very similar, the two options differ in some respects. This is what you are going to learn in detail in this article.

What are Bitcoin futures?

Futures contracts came into existence to alleviate the risk in trading. The original purpose of futures contracts is to protect trades from price fluctuations, whatever assets are invested in. If you want to ensure a potential income, you will find it hard to achieve that goal when prices fluctuate continuously. This is where the futures market comes into the picture.

Purchasing a futures contract is akin to entering a contract with someone that you will buy an asset at a specified price at a specific future time. Suppose you are a BTC miner, and you make money through mining and then selling them into the market.

While you can come up with a ballpark figure as to the number of Bitcoins you might be able to mine each month, estimating the equivalent amount in dollars will prove difficult because a crypto leader constantly fluctuates relative to USD.

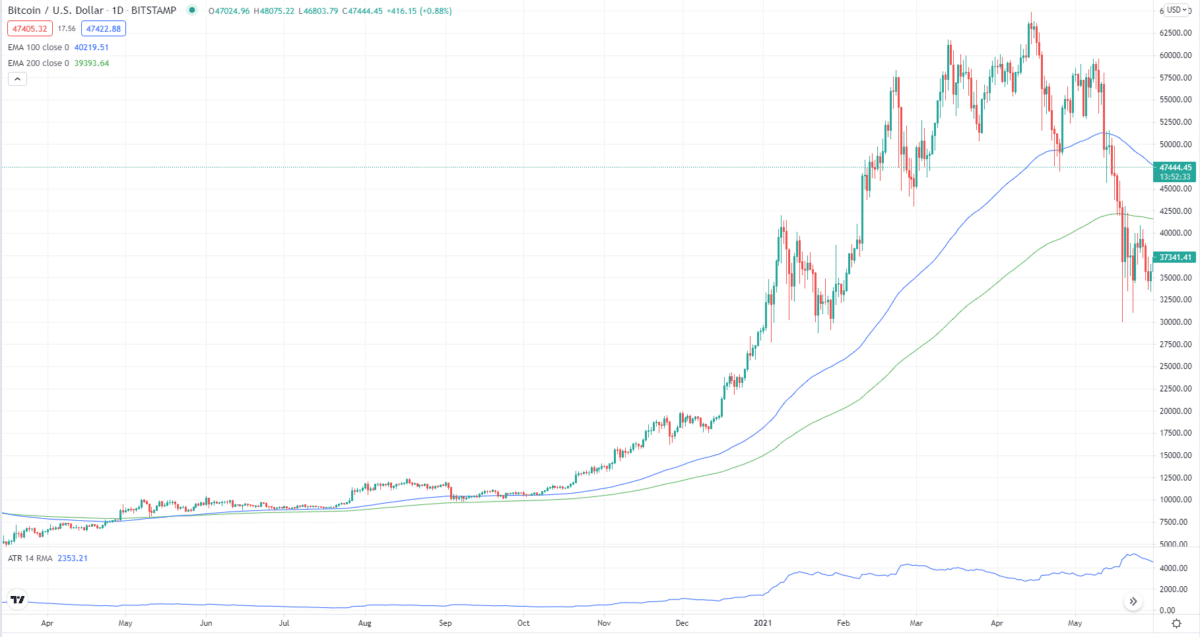

The daily Bitcoin chart above shows the price fluctuations of the Bitcoin and USD pair daily. When the crypto king starts to move either up or down, it can move unidirectionally with great zeal.

To manage a BTC price change risk, you can sell a BTC futures contract indicating you would sell a specific number of Bitcoins at a special price, say, on the first day of the month. When the first day of the month comes, you will settle the contract with the other party and get your dollars in exchange for Bitcoin at the agreed price.

You can settle a futures contract in one of two ways. First, you can have the product delivered to the counterparty. Second, you can settle the obligation through cash. Physical delivery refers to the process of sending Bitcoin to the other party and then getting the amount indicated in the contract in dollars. Cash settlement refers to computing the amount of Bitcoin in dollars at contract expiry.

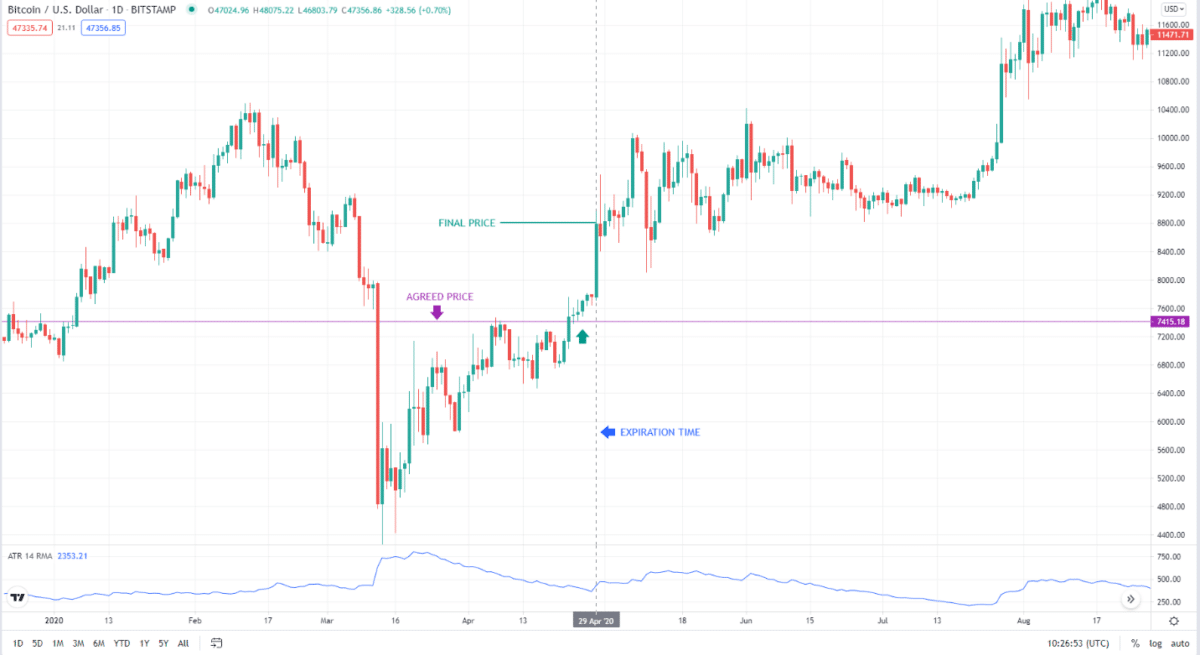

For the second option, you can make or lose money depending on the final value of Bitcoin. If the computed amount is higher than the contract amount, you have lost potential profit. Thus, you will pay the other party the dollar amount equivalent to the difference. This is the event that unfolded in the above chart.

If Bitcoin price goes down instead, you do not lose money, but the other party does. Then he will send you the dollar amount equivalent to the difference. At any rate, BTC did not change ownership; only cash has moved from one party to another. The advantage of the whole transaction is that you will know exactly how much money or cash you will have to earn during contract settlement time.

What is Bitcoin CFD?

Bitcoin CFD is a lot like Bitcoin futures. With BTC CFD, you and another party will agree to pay any difference arising from the price fluctuation of Bitcoin, and this payment is made in cash rather than physical delivery of the product. As with Bitcoin futures, BTC CFD lets you engage in trading Bitcoin without necessarily owning the asset.

Let us continue the discussion from the previous example. Suppose you believe that the value of Bitcoin will appreciate in the near term, and you would like to invest in this asset. Without a verified account in a crypto exchange, you would find it hard to buy the crypto king. If you could not own BTC through mining, then your best option is to buy a BTC CFD.

With this investment option, you can agree with a seller to reconcile the difference in Bitcoin price through cash at the time of contract termination. Your seller will pay you the difference between the contract price and the current market price. If your analysis ends up being correct, Bitcoin will grow in value. In contrast, if your hunch turned out to be false and Bitcoin plunged instead, then you will pay the seller the price difference.

Consider the above scenario. Since the price was on support at a previous swing low, you thought a price reversal to the upside would happen. But as you can see, the price fell. When the contract expires, you will lose money because the price ended up below the settlement price.

In essence, trading BTC CFD is making a call whether Bitcoin price will rise or fall at a specific time in the future. That is how simple Bitcoin CFD is. That is why many traders engage in it, and many brokers provide such service.

Differences between Bitcoin CFD and Bitcoin futures

Some traders think that BTC CFD and BTC futures are the same product. While the two look the same, there are differences you must be aware of. One difference is that Bitcoin futures have defined expiration dates while Bitcoin CFDs do not. You can keep a CFD indefinitely so long as the contract allows.

Another difference is the minimum entry requirement. Futures contracts are pricier than CFDs, so futures are the playground of institutional investors. Bitcoin CFDs are suitable for small traders. One benefit of Bitcoin futures is the transparency of orders among market participants. In CFDs, you trade against your broker, which also provides the quotes.

One more difference is in terms of spread. Bitcoin CFDs have wider spreads than do BTC futures. As a trader, you always want to trade with brokers who provide the least spreads as possible. However, it is often easier to open an account for BTC CFD than for BTC futures. CFDs have less strict regulations than futures, and you can begin trading even with small capital.

Final thoughts

If you think owning and securing BTC is a drag, consider trading Bitcoin without possessing coins. You can do so when you trade Bitcoin futures or Bitcoin CFDs. If you are a beginning trader with less capital, you can go for BTC CFDs but know that the spreads are higher. If you have more capital and want to trade the open market for more opportunities, you can choose BTC futures.