Switching from cars fueled by fossil fuels to those powered by batteries is critical in the fight against global warming. Tesla shares are not the only way to invest in electric cars; an EV battery ETF is another option.

Battery ETFs are a great choice to invest in, but there are specific parameters you should look upon investing in. Continue reading this article to know about the pros and cons of investing in battery ETFs and also know which are the top three battery ETFs to invest in 2022.

How does it work?

About 16% of all global greenhouse gas emissions are attributed to transportation. Therefore, reducing automotive emissions as quickly as feasible and electrification is necessary to prevent climate change. As a bonus, electric vehicles are quieter and need less upkeep than gasoline-powered vehicles.

To meet the growing demand from consumers, the industry’s major players are introducing new models. Establishment manufacturers are catching up to Tesla, which is still at the top of the heap. After just 4% in 2016, UBS Research predicts that electric cars will account for 40% of all vehicles made globally by 2030.

Lithium-ion batteries power the vast majority of electric cars. In 1991, Sony began selling the technology developed in the 1980s. The battery is the most expensive part of an electric car, accounting for 30% to 40% of the overall cost. As the electric car revolution continues, there has never been a better moment to invest in batteries.

Top three things to know before starting:

- A great time to purchase the fund is when its 52-week price range is at its lowest point.

- It’s essential to look at the ETF’s yearly dividend yield. If the yield seems to be increasing, you should think about investing.

- The ETF is a good investment if the yield remains stable. But conservative investors may want to take a look.

Best battery ETFs to buy in 2022

Let’s take a look at the best battery ETFs to invest in.

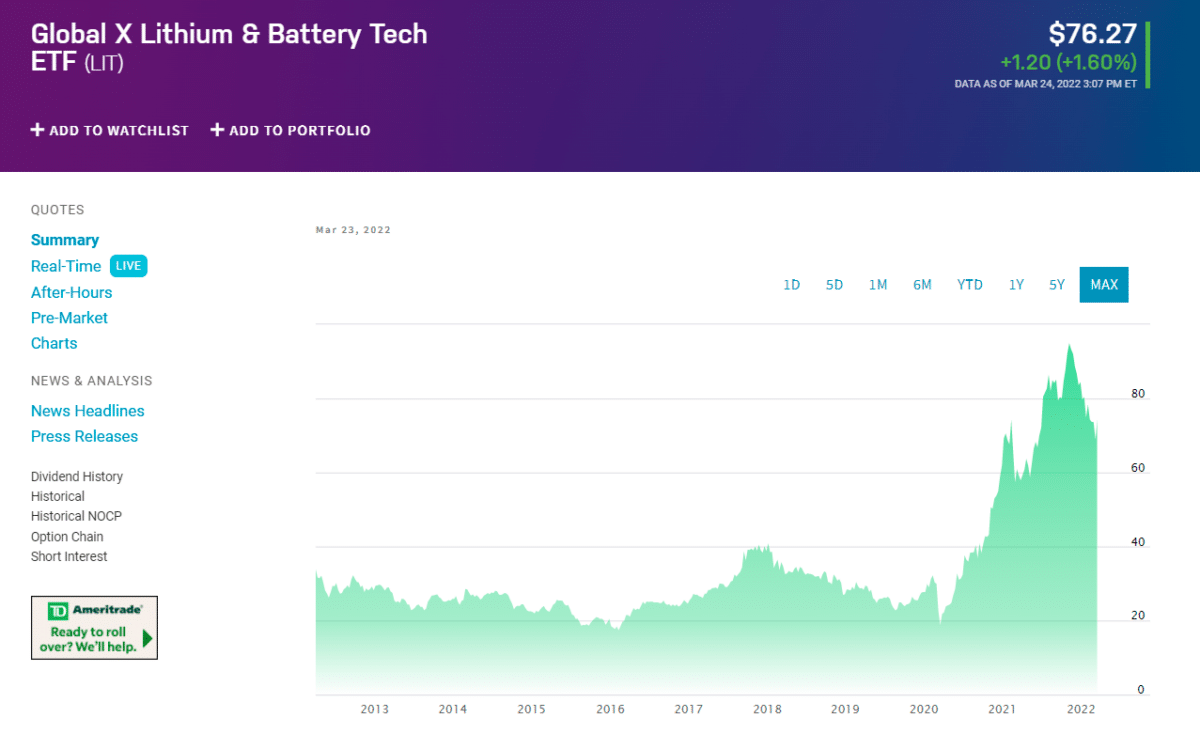

1. Global X Lithium & Battery Tech ETF (LIT)

For investors, Lithium-related activities span a wide range of sectors and provide direct pricing and a wide range of lithium-related mining and production companies. In addition to Li mining and battery production, the ETF invests in the stocks of firms involved in the exploration and mining of Li. Among the fund’s top 43 holdings are Albemarle Corp., LG Chem, and Tesla.

The most significant industries produce electrical components and equipment, commodity chemicals, and automobiles and trucks. More than a tenth of the economy’s output comes from only a handful of other industries.

More than two-thirds of LIT’s investments are concentrated in the Asia Pacific and North America. Each country in Latin America and Europe receives somewhat more than 3%.

The Solactive Global Lithium Index is the one being closely monitored. It was formally formed on July 22, 2010. 736.72 million dollars in assets under management with a 0.75 percent cost ratio. Annualized, that’s a return of 41,02 percent.

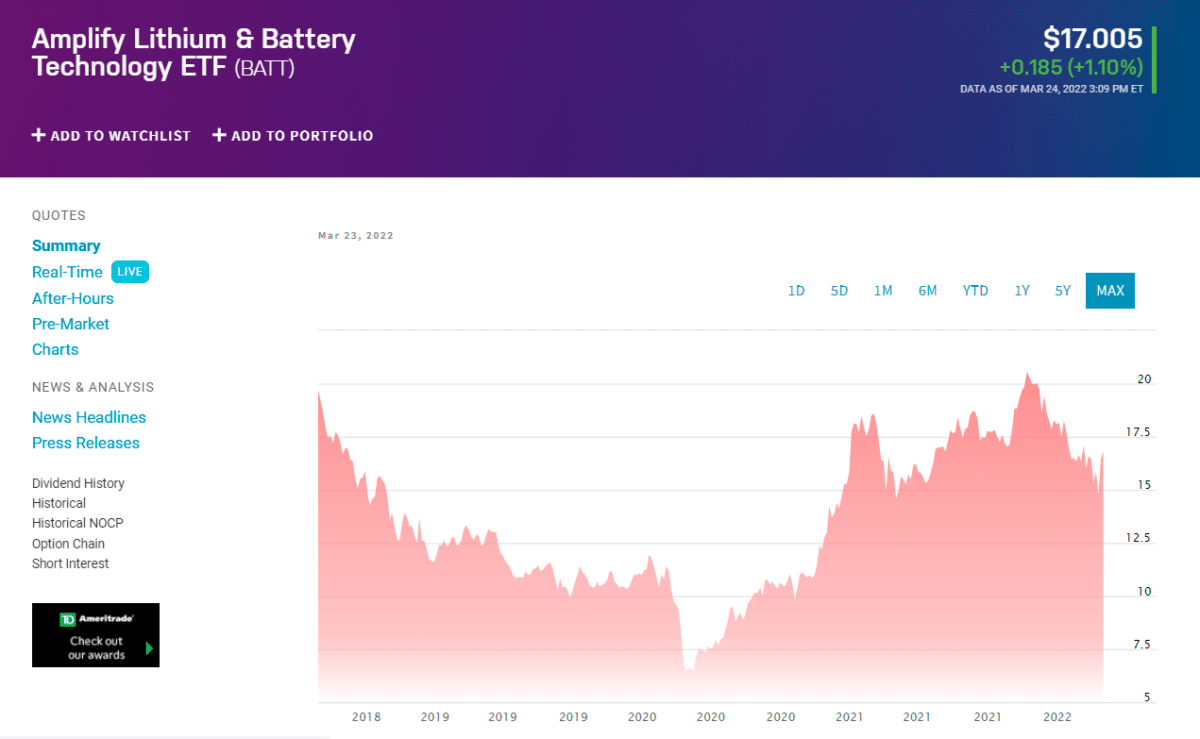

2. Amplify L&G Battery Technology ETF (BATT)

The fund was formally established on January 18, 2018. The Solactive Battery Value-Chain Index is being tracked. There are 2,284 shares in the ADTV. This fund is traded on the London Stock Exchange. $158.27 million is invested in the fund and share class.

Firms that offer electrochemical energy storage technologies and metals for battery manufacture are among the companies BATT invests in. Lithium, lead, nickel, and sodium batteries are all included in the index, and lithium mining companies now making lithium-ion batteries.

This is the breakdown of the assets: net assets are made up of 99.81% long-term stock allocations and 0.19% cash: 1.15% long-term, 0.97% short-term.

The fund primarily invests in Japan 25.31%, the United States 22.47%, Europe 13.15%, Australasia 12.87%, and Emerging Markets Asia 9.12%. SolarEdge Technologies and Tianneng Power International Limited are among the company’s primary holdings.

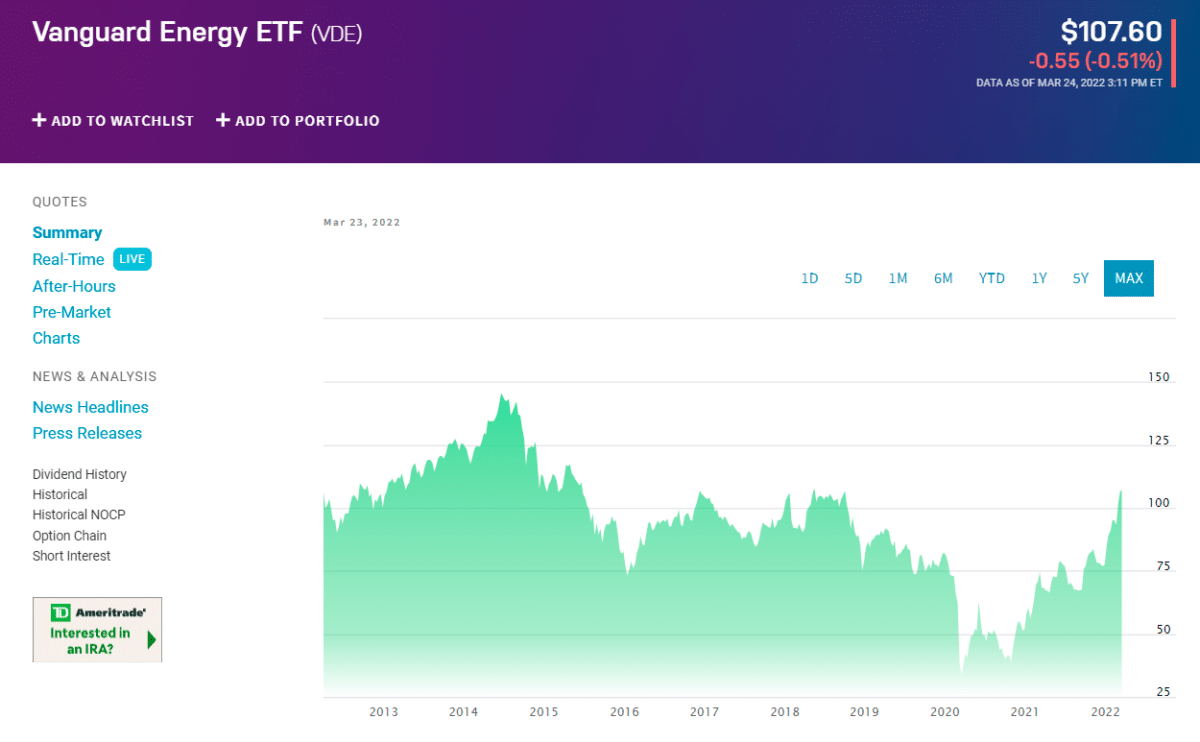

3. Vanguard Energy ETF (VDE)

It is anticipated that the fund will be live on the market on September 23, 2004, with the first trade. Investing in energy stocks yields a positive return on investment for the fund. Complete replication and sampling are the two investing methods used. Managers are nefarious when the former is impossible. Voluntary Environmental Determination invests in firms specializing in fossil fuel exploration and production.

The fund’s holdings are made up of energy shares from particular companies. They must be traded on the secondary market and held in brokerage accounts to buy and sell shares. There may be a brokerage fee, so investors may pay more than the NAV when they purchase and get less when they sell the stock. Shares of the ETF may only be redeemed for millions of dollars at the issuer in huge volumes.

Oil and gas drilling 0.7%, coal and consumable fuel 0.1%, integrated oil and gas 44.9%, equipment/services 9.1 percent%, exploration and production 22%, refining/marketing 11.7%, and storing/transporting 11.7% comprise the portfolio 11.5%. To categorize the firms, GICS is employed.

The top three holdings are Exxon Mobil, Chevron, and ConocoPhillips Inc.

Pros and cons

| Worth to invest | Worth to getaway |

| The regulatory bodies are responsible for a wide range of issues. | CFD transactions. |

| Bar with a low-cost entry fee. | Only expose you to a small portion of the market. |

| There are a wide variety of payment options available. | Prone to the risk of downfall. |

Final thoughts

Firms in the minerals and mining industries that produce high-end electric cars or battery storage solutions and companies in the electric vehicle and energy storage sectors are included in these ETFs for investors. Every fund has a different weighting for the various sectors, which significantly impacts the overall performance. In recent years, technology has disrupted many sectors, which has led to a lot of discussion in the larger market. In addition, hedge funds feel the effects of the current financial climate.