Investing in new firms is risky, but the potential for big rewards is hard to ignore. As Microsoft and Apple have evolved into monoliths, they no longer have the capacity to expand by a factor of two or three.

Institutional investors have yet to uncover many of the significant growth potentials of small-cap companies. Investing in only one or two small enterprises since small businesses have a greater failure rate. Small-cap ETFs may help with that.

How does it work?

Value is defined by low prices and high dividend yields: low growth rates for earnings, sales, book value, and cash flow. There are many different types of small-value funds that invest in small-cap stocks that are either less expensive or grow slower than the rest of the market. More than ten percent of the overall market capitalization in the United States is accounted for by small-cap stocks.

Three things about small cap value ETFs to know before starting:

- Buying near the bottom of the fund’s 52-week price range is a great opportunity.

- Inquire about the ETF’s yearly dividend yield. You should think about investing if the yield is increasing.

- If the yield is stable, the good idea is to invest in the ETF. On the other hand, conservative investors may want to take a look.

Best small-cap ETFs to buy in 2022

Let’s take a look at some small-cap ETFs to buy.

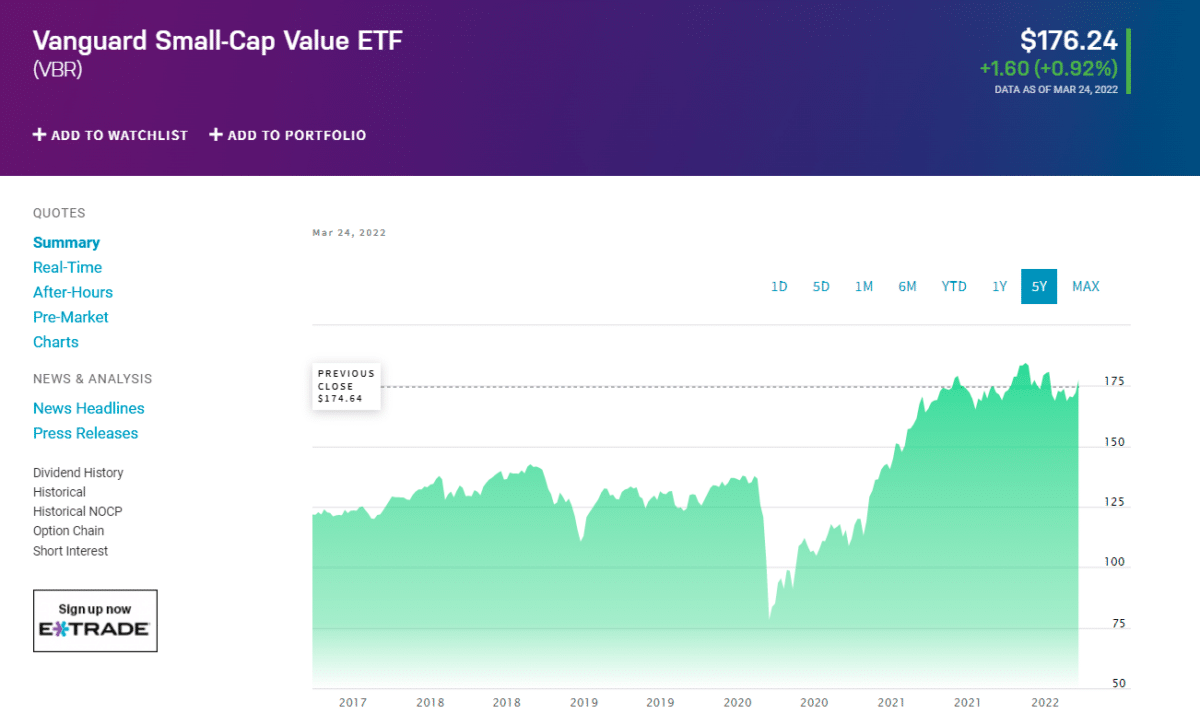

Vanguard Small-Cap Value (VBR)

Among the ETFs covered here, the Vanguard Small-Cap Value is the largest in terms of net assets. As a result, a $10,000 investment in VBR will only cost $7 per year for administrative charges.

Value trends in the CRSP US Small Cap Value Index are based on several financial indicators, including price-to-book (P/B), future P/E, past P/E, and dividend to price (D/P) ratios. CRSP US Small Cap Value Index is a collection of small-cap companies in the United States that display value trends.

The Vanguard Small-Cap Value Index aims to match the CRSP US Small Cap Value Index by investing in all firms included in the index. In addition, all assets are given the exact weighting as the index they are based on.

Currently, VBR has 997 holdings, while S&P has 940. There are 6.1 billion dollars in market capitalization on average. American companies make up all of the fund’s $26 billion in net assets.

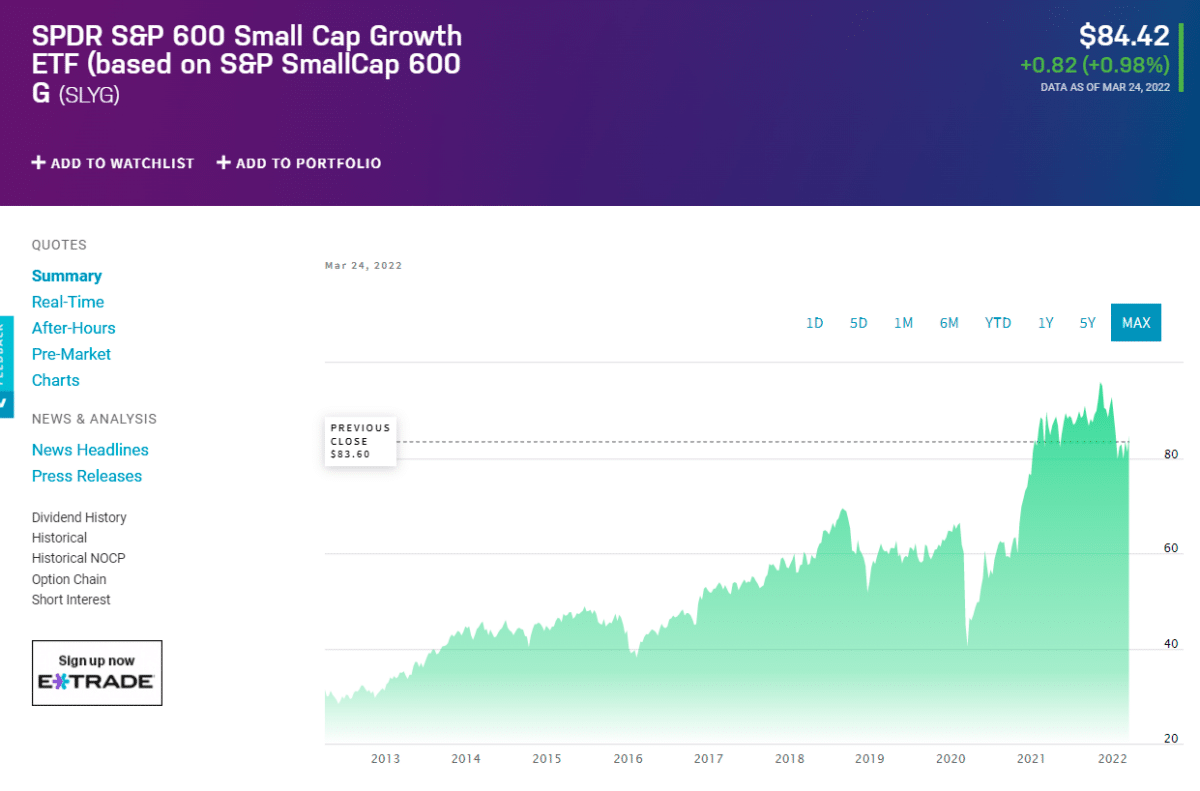

SPDR S&P 600 Small Cap Growth ETF (SLYG)

A set of small-cap firms with above-average growth characteristics, such as growing sales, price-to-earnings improvements, and momentum, are represented by the SPDR S&P 600 Small Cap Growth ETF.

A company must have at least a 10% public float and four consecutive quarters of profitable operations to be included in the index. Annually, the benchmark is rebalanced and reweighted according to market capitalization in December.

SLYG, like many other small-cap ETFs and exchange-traded funds in general, uses a sampling technique to replicate the index’s performance. Consequently, not every firm in the index is owned by the fund.

However, the SPDR S&P 600 Small-Cap Growth ETF has 332 holdings in its $2.1 billion total net assets, precisely the same as its underlying S&P 600. In three to five years, the fund’s assets will be valued at an average of $2.9 billion, and earnings will rise by 16.6 percent.

The ETF’s three most significant sectors by weight are technology 18.7%, financials 16.9%, and industrials 16.9%. A small-cap growth fund, while advertised as such, is, in fact, a hybrid that has 55% of its portfolio allocated to growth and value.

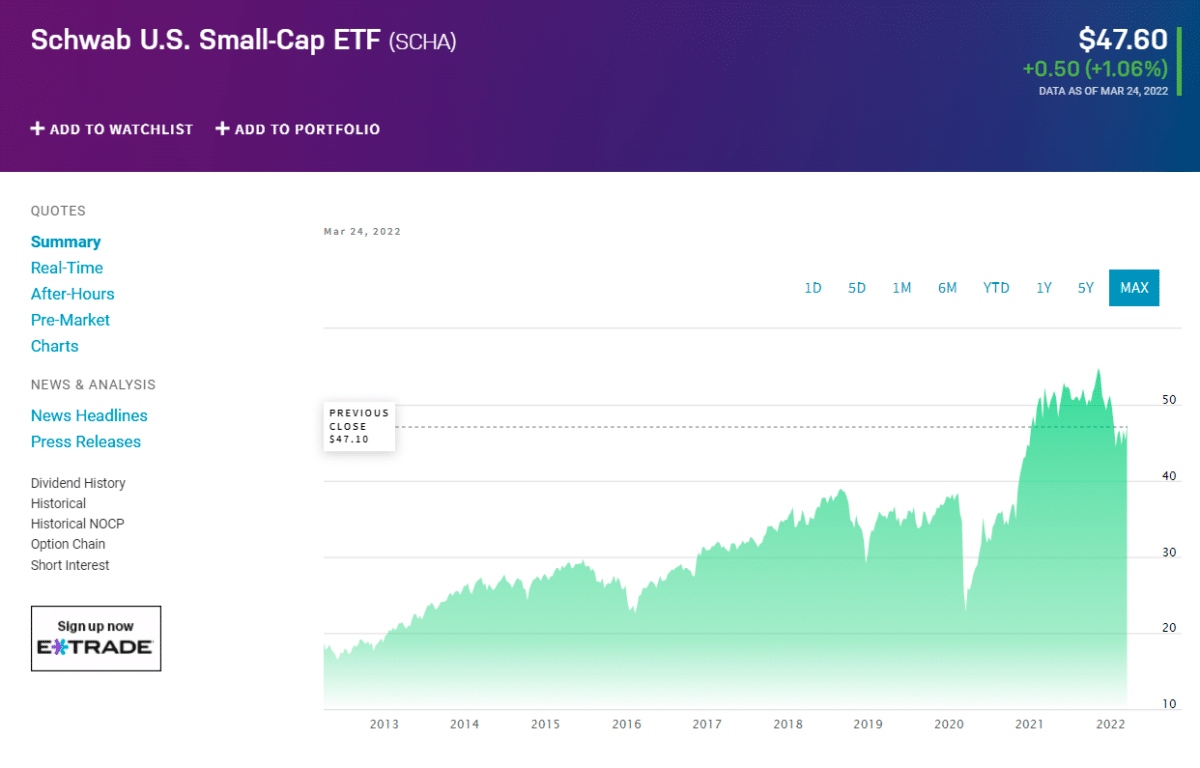

Schwab U.S. Small-Cap ETF (SCHA)

The Schwab US Small-Cap ETF tracks the Dow Jones US Small-Cap Total Stock Market Index. Market capitalization ranges from $751 to $2,500 for the Dow Jones U.S. Total Stock Market Index. For the most part, it’s a market-cap-weighted index that invests in firms valued at $37 million to $22 billion.

Rebalancing occurs four times a year: in March, June, September, and December. Unlike SCHA, which started operations in November 2009, it didn’t begin operations until February 2005. As a result, 1,794 shares with a market value of $4.9 billion and a P/CF ratio of 12.2x are in the portfolio.

Three of the largest industries in weight are industrials, financials, and technology 15.2%. Only 3% of the fund’s $15.2 billion net assets are invested in aluminum giant Alcoa (AA) and construction services supplier Builders FirstSource (BFS) (BLDR). In the Schwab U.S. Small-Cap ETF, there is a turnover rate of 17 percent every year.

Mid-cap and small-cap companies are just as crucial to SCHA as to other investors. As a result, 67% of the ETF’s assets are allocated to companies with a market capitalization between $3 billion and $15 billion. Other equities are valued between $1 billion and $3 billion in the portfolio.

Comparable small-cap funds have underperformed the Schwab U.S. Small-Cap ETF by 11.6% annually over the previous decade.

Pros and cons

| Worth to invest | Worth to getaway |

| It’s common for small-cap companies to be start-ups with innovative ideas and room for growth. As a result, it’s more probable that small-cap stocks will expand exponentially than large-cap companies. | A shortage of financial media coverage might be a double-edged sword, as unscrupulous corporate practices flourish in the shadows. Small-cap stocks with low floats are especially prone to pump-and-dump methods. |

| Only 30 companies make up the Dow Jones Industrial Average, whereas the S&P 500 includes 505. By having smaller companies, you may increase the variety of the major indexes, which tend to move in lockstep. | The returns on small-cap stocks have shown that they are prone to significant changes year to year. As a result, small-cap stocks might be too volatile for confident investors, especially those looking for a steady return despite their superior long-term performance. |

| There is a shortage of analyst coverage for small-cap companies, resulting in many profitable businesses unnoticed. This is bad news for institutional investors, but it’s excellent news for the rest of us. So before the sharks get their teeth into the stock, you may earn a lot of money. | Small-cap companies, which by definition lack strong moats and safety margins, were anathema to Benjamin Graham, who favored investing in them. Small-cap enterprises may be particularly vulnerable to economic downturns since they lack the financial resources to weather the storm. |

Final thoughts

An inexpensive way to get exposure to some of the market’s fastest-growing companies without taking on the dangers of owning individual stocks is to invest in small-cap ETFs. However, there are risks and drawbacks like any stock market investment.