- What is the wheel strategy?

- How to trade with it?

- What are the pros and cons of this strategy?

The wheel strategy is an effective method of trading that maximizes profits and minimizes risks. This trading method allows having semi-passive type income with lower risks in comparison to many other trading strategies.

However, this strategy applies to traders with a sufficient understanding and mindset to have income from premiums or holding assets for a particular period. Let’s check a complete guideline to make money from any potential stock options trading.

What is the wheel trading strategy?

It is an authentic way of making money that allows you to profit from declining or increasing stock options prices. Either you get a premium; otherwise, make money from the increasing price of the target asset. If it keeps declining, you can also make money from premium to a certain level.

The significant factors of this strategy are scalability and consistency. These factors allow making money for both large and small investors. Moreover, this strategy suggests out of the trade if it keeps falling for a long time.

Although this strategy is very potential, we suggest not to invest your whole capital through this strategy. For example, you can invest 60% of your total capital at any potential index fund and 40% through wheel strategy.

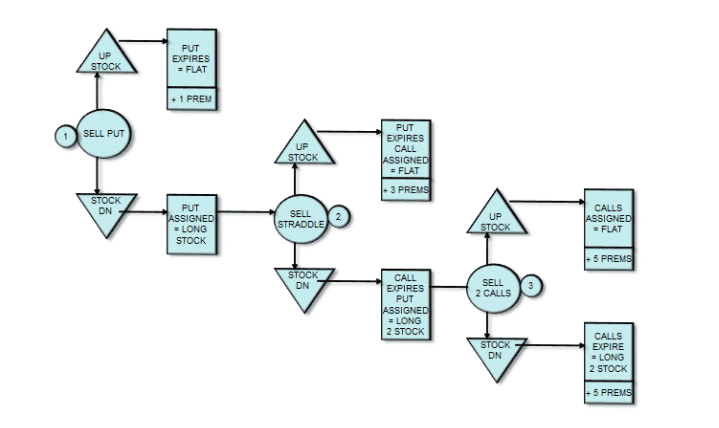

You need to have a certain amount of cash in your trading account to trade through this strategy. The account needs to have at least a purchase ability of 100 shares or more. For better understanding, we are attaching a flowchart of the wheel trading strategy below.

There is no guarantee that the price movement will always occur as the same as the flowchart above. You need to have a minimum of $2500 investment for trading any stock option or ETF shares that have a price of $20. These investments involve lower risks than other financial assets such as penny stocks.

How to trade with the wheel trading strategy?

In this part, we will explain the method. Trading occurs through these steps below:

Step 1. Choose the target asset

When you choose any stock for applying the wheel trading strategy, you have to keep two things in mind.

- The stock has the potential to rise in the long term.

- Your trading account has a sufficient balance to buy at least 100 shares of the asset.

Some popular assets that suit this strategy are AMD, INTC, SPY (ETF), TNA (ETF), etc. INTC’s price is floating near $49.46 today. If you choose this stock, you need to have at least $4946 capital in your trading account.

Step 2. Selling cash covered put

In this step, you have the cash to purchase 100 shares of the asset. Now you can write a contract that you will buy 100 shares of the stock if that asset price declines to a level that will be the target price. If the price stays above the target price, you will get buyers’ premium.

For example, suppose your target stock ‘X’ price is $110, you sell the first put $105 put 2p and 30 DTE (date of expiration). The price remains above $105 at the end of the expiration date and may decline from $110 to $106. You will get a $200 (2X100) premium as a 100 shares contract. Higher strike price involves higher risk and much premium; meanwhile, lower strike price involves lower risk and lower premium. Premium should be at least 1% value of the share price.

Step 3. Repeat the process

Repeat step two till the price comes below the put price. The scenario will change if the price hits below the strike price.

Step 4. Sell the covered call

It is another possible scenario that the price comes below the strike price. Suppose stock ‘X’ price hits $104 before the expiration of the contract. In this case, you can also keep the premium and sell the stocks at a $1 loss per share. Reducing the loss amount from the premium of $200, you still have $1 profit from the asset. Don’t get stuck at the 100 shares.

Step 5. Keep the wheel running

You will choose assets with the potential to go on an uptrend in the long run, so there should be no problem if you buy and hold that asset for a certain period. You can sell the asset when the price goes up after you purchase the share. If the price keeps declining, don’t hold the asset for a longer period. This strategy is not suitable for holding an asset that may decline by more than 10%.

For example, stock ‘X’ may fall at $102; you have to buy at $105, then $3 loss per share. After eliminating losing $3 from the premium of $200, you will get a $1 loss per share. Repeat step one till the price doesn’t decline and make money from premiums as the expiry of the contract.

Wheel trading example

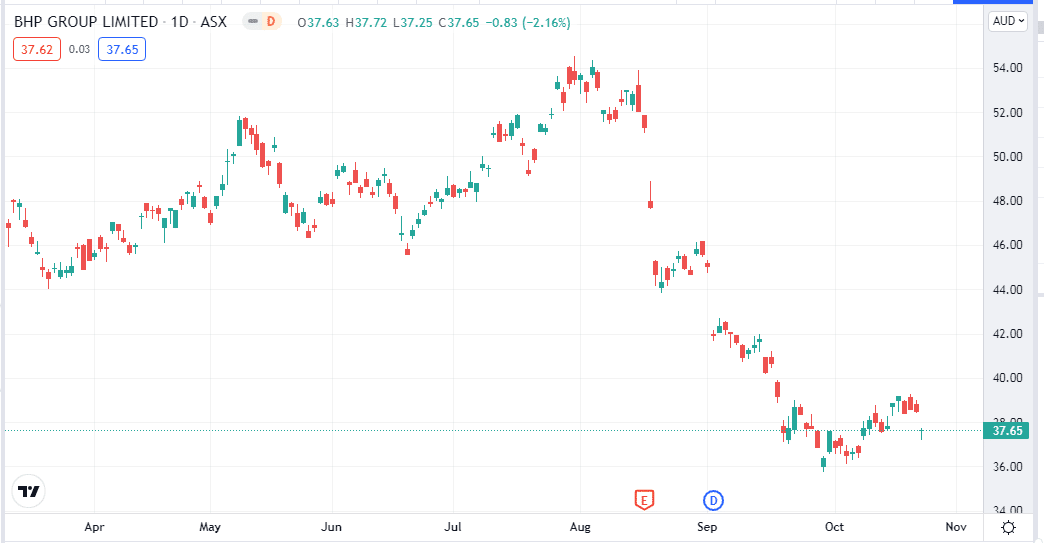

It’s prevalent to make money from winning trades. This example will give you a clear concept of using the wheel strategy. Suppose BHP group Stock [BHP] is trading near $50.56; you may make a contract at a strike price of $45 for $4.70. The contract starting period is July 2021, and the selling time of the put is Feb 2022. If the put is worthless, you will have an 11.85% annualized return.

Or the stock drops, and you have to purchase. You can collect dividends by holding the assets for a more extended period.

Since the opening, the price has been low, near $35.83 for the China trouble and Evergrande news. You may have to assign this asset in a few months, and at the time of writing, you don’t need to bother with the $845 loss from the trading account. You will have ownership of the stocks and will continue to get the dividend. You can sell covered calls when the price is at or above $45.

Pros and cons of the wheel strategy

| Pros | Cons |

| The win rate is high for this strategy. | You can’t trade every financial asset using this strategy. |

| You don’t need to monitor your asset price all day. | Capital amount varies with the investment asset. |

| Easy to understand and manage. | It is not a good or bad strategy; you can define it as a way of collecting premiums from potential stocks, not like traditional trading. |

Final thought

Finally, the wheel strategy is a powerful method to make money by investing in potential stocks with a long-term bullish outlook. We suggest not to get stuck at any stock that continues to decline. Better seek another option with more potentiality.