Retirement could be at the same time good and a bad feeling for many people. As for some, there would be no steady source of income, and for some, they might want to be at home and relax. But whatever the case is, we all make arrangements to save money for our retirement age.

A study discovered that an average American’s savings had grown significantly over a few years from 10% to 13% in 2021. The approximate amount would be from $65,900 to $73,100 in just a year. At the same time, the retirement savings have surged 13% from $87,500 to $98,800.

So, whatever age you are currently in, it does not quite matter as you must keep exploring and learning different plans open for you to use for your retirement.

Three things to know before starting:

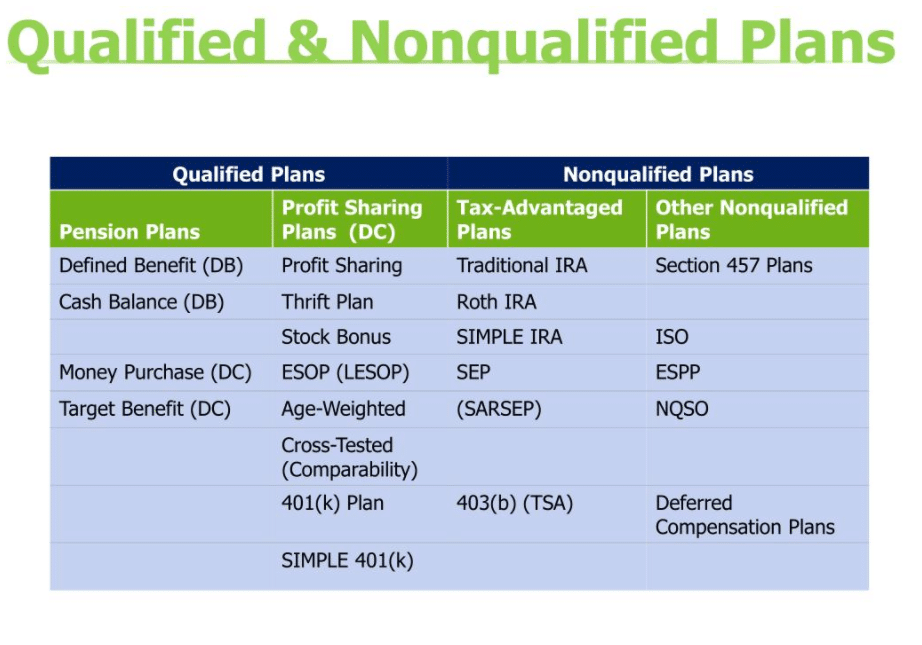

- Such plans witness few tax benefits and meet IRA provisions. Some examples include 401(k), 403 (b), profit-share, and pension plans.

- Investing in REIT, mutual funds, and stocks also sometimes comes under such retirement plans.

- There are two major types of such plans.

Defining qualified retirement plan

It is a plan to accumulate funds for your retirement age. An employer sets up an account to provide retirement income to preferred employees and their beneficiaries. These plans meet IRS Code requirements in both form and operation.

In a qualified retirement plan, both the employer and the employee may need to contribute depending on their chosen plan. The keynote to understand here is that the taxes on the contribution earnings are postponed and not free until the employee withdraws the funds from the plan.

The ERISA of 1974 was established to help protect employees’ retirement money by providing guidance and a sense of transparency.

How does it work?

Working on such a plan mainly falls under two sections:

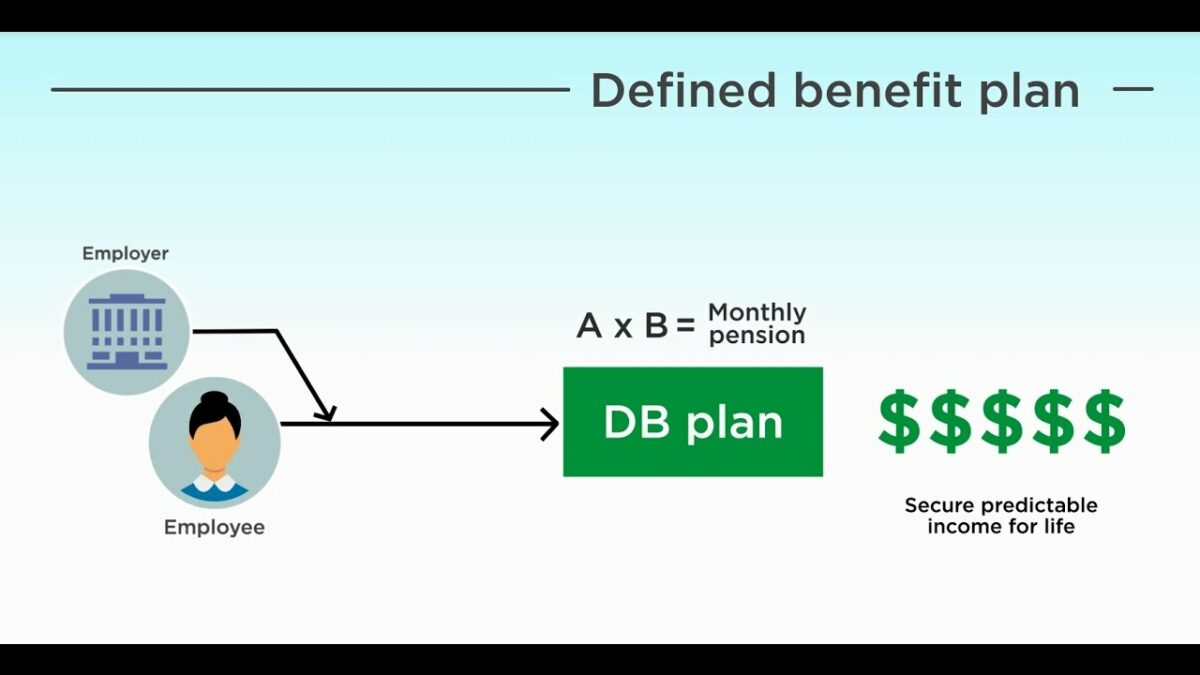

- Defined-benefit

The employer pays a fixed retirement amount for the employee. This means the employee is assured of receiving a specific amount into their retirement fund, having the employer bear the risk to save and invest appropriately to meet plan liabilities.

This amount may be fixed, say $150-$200, or sometimes calculated by the employer keeping in mind the future payouts of the employee based on their salary, age, and experience.

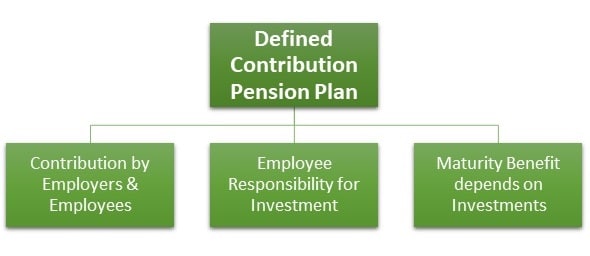

- Defined-contribution

Following this contribution plan, an employee adds to their retirement plans, and the employer may wish to do the same, but it is not compulsory. Still, if they do, they need to add an equal amount like the employee. So, the defined contribution plan more or less depends on the employee and how much he saves during their working days.

Types of qualified retirement plans:

- 401(k)

- 403 (b)

- Money purchase pension

- Cash balance pension

- SEP IRAs

- SIMPLE IRAs

- Keogh

- ESOPs

- Profit-sharing

- Stock bonus

Mainly both the retirement plans are offered by an employer to their employees to benefit both parties. An employer does it to save on taxes, while it is a fund to be enjoyed after retirement for employees.

The major difference between these plans is that a qualified retirement plan follows ERISA guidelines while a non-qualified plan does not.

In a qualified retirement plan, the amount contributed by an employee is tax-deferred, meaning the tax will be paid only when an employee withdraws the amount. In this plan, an employer may choose to deduct the contribution they made.

Non-qualified plans use after-tax dollars to fund them, and in most scenarios, employers cannot claim their contributions as a tax deduction.

Qualified employer plan

In general, when it comes to skilled plans, awareness is the most important thing employers need. Employers are responsible for obtaining qualified plan status, establishing appropriate procedures, ensuring that operating procedures are consistently followed and that plans are audited annually for compliance. One of the essential requirements for a qualified plan is non-discrimination.

This means that a qualified plan must be offered to all employees equally, regardless of their status in the company. Employers have several benefits to a company if they offer a qualified plan. Any contributions to a qualified plan are tax-deductible. Companies with 100 or fewer employees can get a tax credit. Finally, skilled plans are an essential benefit that helps companies attract talent to their organization.

Withdrawals from a qualified retirement plan before you turn 59.5 typically incur a 10% early termination penalty and are subject to income tax at the current annual rate.

Employee skill plan guidelines

When it comes to skilled plans, employees don’t necessarily have any special obligations. Some employees may not even know the difference between a qualified and an unqualified plan. However, there are several differences that the employee needs to be aware of for their own sake.

Skilled plans are considered a tax haven, which means that employees contribute to the plan with pre-tax dollars that are not immediately taxed but rather held until revoked in the future. Pre-tax payroll contributions reduce the amount of earned wages the employee receives with each paycheck, resulting in a reduction in withholding tax.

Some employers may allow short-term loans from 401 (k) with regular payments and low-interest rates back to the account, which can be an effective way to get a loan.

Pros & cons

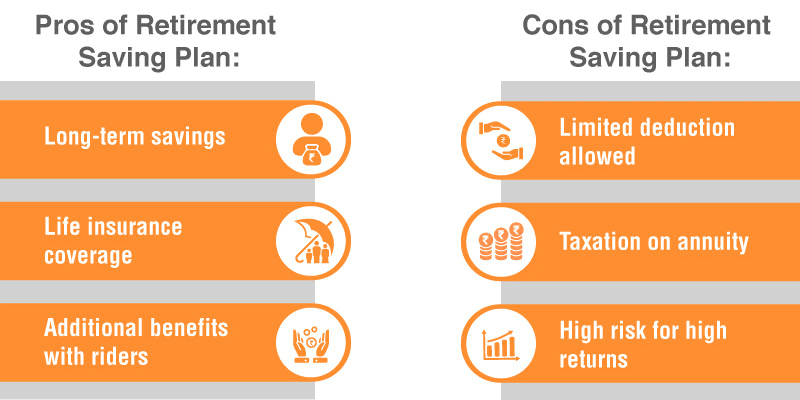

Qualified retirement plans are suitable for an employer and an employee, but it does not mean it is full proof. We have listed a few pros and cons for you to understand everything better.

| Worth to use | Worth to getaway |

| One of the benefits to the employer is that they can attract more good employees and at the same time maintain those who are of worth. A good retirement plan will make an employee stay in the organization for longer. | There is mandatory funding that the employer does and the fulfillment of many compliance requirements; this is an extra burden to them. |

| Plan contributions under qualified retirement plans are not taxable immediately. Usually, the texts are charged only on the distribution and withdrawals. | Few employees on a lower salary terminate their employment to get their funds and then re-apply to the job again. |

| Advantages for an employee are the ease and sense of security that savings are happening and will benefit them in their retirement age. | An employer must dedicate to and be permanent if they have to maintain the qualified status of a retirement plan. If an employer does not want to continue the funding, the IRS may disqualify the proposal, which in return means rejection in deductions for earlier employer contributions to the plan. |

Final thoughts

The law associated with the qualified retirement laws is the ERISA, and its work is to protect the retirement funds of US employees.

Such plans are very beneficial for the employees to put aside some dedicated money for retirement. It also gives a hand to the employers by allowing tax breaks on the contributions they will be making for the employee.

An employer has to serve a process to guarantee employees and beneficiaries are receiving their benefits. Also, they must be updated with any changes in the retirement plan laws and regulations.

If you are into a job, you most probably are in your plan set by your employer. However, if your job does not provide you with one or are self-employed, you can still save money for your retirement age by opening and funding an IRA. If you are an entrepreneur and have no employee associated with you, you may choose 401 (k).