Long and short positions are two aspects of a trade between two or more parties to form a contract between them. A long position refers to buying security or stock, currency or commodity with the expectation of making a profit. When a stock’s value relies on another one, it is known as a derivative. In contrast, a short position is when a trader sells security or a commodity to repurchase it later at a lower rate.

In the investment industry, purchasing assets in a long position refers to purchasing shares of an asset in hopes that its value increases in value over time. In this technique, the investor buys assets at a reasonable price and then sells them higher.

It is a practice in which a trader expects that the value of an asset will decline for a short period, such as the next few weeks, and then revive. Reading on, you will find what it means to be a long or short derivative and the top three trading rules.

Why is it best for advanced/novice traders?

The most frequent underlying assets are stocks, bonds, commodities, currencies, interest rates, and market indexes. If an asset has a risk, certain derivatives may be utilized to protect against it. For example, speculating on the future value of an asset or finding a way around exchange rate concerns may be done via derivatives. Thus, an understanding of short and long positions in the market will benefit both professionals and beginners.

Top three rules of trading

Let’s check out the key rule of trading derivates.

Check market suitability

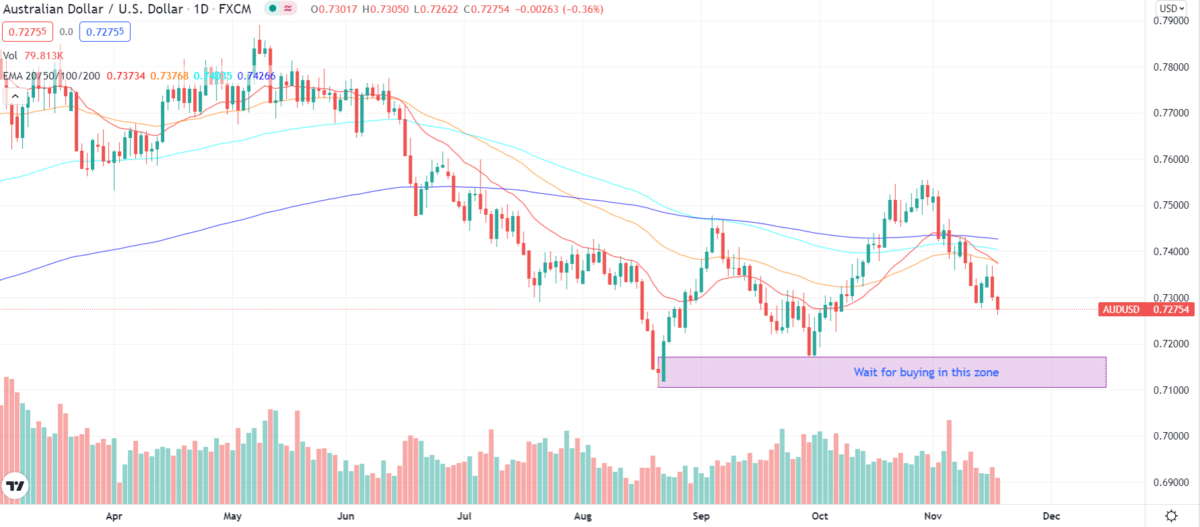

Recognize the importance of appropriate preparation before you begin trading. It’s critical to match your objectives and temperament with tools and markets that are relevant to you. For example, if you are familiar with retail markets, it makes more sense to trade retail equities rather than oil futures, which you may be unfamiliar with. Market knowledge includes long and short position knowledge.

How to buy/trade?

Two kinds of equity options are available: puts and calls. If the buyer or holder of a stock option contract holds it until its expiry date, they will be granted the right to purchase or sell the underlying shares at a set price until that time.

What risks to avoid?

To protect a long stock position, an investor might create a long put option position, entitling him to sell his shares at a certain price at any time. Thus, the approach of shorting call options without borrowing the underlying stock is similar to that of short selling.

As a result of holding this position, an investor might get the option premiums as a form of income along with the opportunity to surrender their long stock position at a guaranteed, often higher price.

Example

They have the option to acquire 100 shares of the underlying stock in every contract if they go long the call. In addition, if the price of ABC stock exceeds the call option’s strike price by more than the premium paid for the call option, the trader’s payout is positive.

Now, assume a trader predicts that the underlying stock will collapse and wants to trade negatively. As a result of this purchase, they are now long put options. They may now sell the shares at the strike price until it expires, giving them a profit.

Specify a timeline

The timeframe determines the sort of trading that is best suited to your temperament. For example, you are more confident taking a position without overnight risk if you trade off the five-minute chart. However, if you’re comfortable with overnight risk and prepared to see some days go against your position, then weekly charts are a better choice.

How to trade?

If investors believe that the stock price will climb, they will purchase call options with a lower strike price, a bullish position.

There are times when an investor’s account value falls below the broker’s minimum requirement. Therefore, a margin account’s minimum maintenance margin should be increased by depositing extra funds or securities.

What risks to avoid?

Keep in mind that short positions carry greater risks and that certain positions may be restricted in IRAs and other cash accounts owing to their nature. You may be able to trade in more risky positions with your brokerage firm if you have margin accounts for most short positions.

Example

Minimal earnings or losses are the characteristics of short-term scalping. For example, long-term success in the foreign exchange markets necessitates patience. You’ll have to trade more regularly if you’re in this situation.

It’s important to know if you can devote the necessary time and energy to your trade or if you want to conduct your study over the weekend and then make a trading decision for the following week. So, time management while trading is crucial.

Careful management trade investment

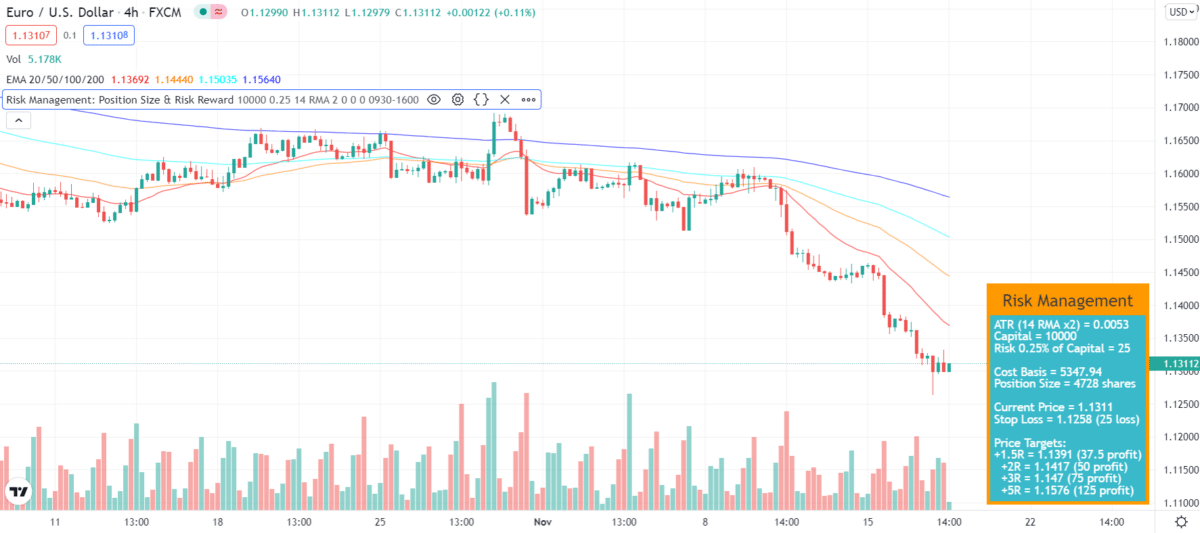

In forex trading, this is one of the essential components. You should never invest more than 2% of your real cash in any single deal. If you do so, you are putting yourself at a high chance of losing. On the other hand, you are less likely to lose all of your money because you are not placing all of your eggs in one basket.

How to trade?

Ensure that the system or approach you select is reliable and gives an advantage before you commit to using it regularly. Then, after you’ve found a strategy that regularly produces favorable results, stick with it and keep testing it with other tools and timelines.

What risks to avoid?

Transaction risks are exchange rate risks linked with time gaps between the start and end of a contract. Because forex trading operates 24 hours a day, currency rates might fluctuate before deals are finalized. As a result, currency values may fluctuate throughout trading hours. This makes trade management essential.

Example

As an example, the maximum loss on your account should not be more than 2 percent. $100 is the maximum loss per transaction if you follow these criteria. If you lose 2% on every trade, it will not take long before your account is completely drained.

| Worth to use | Worth to getaway |

| It ensures that pricing is fixed. | Suffers from sudden price adjustments and short-term movements. |

| Losses are kept to a minimum. | Loss of profit before it is recognized. |

| It corresponds to the historical performance of the market. |

Final thoughts

Read up on market circumstances that may affect your trading, and utilize a demo trading account to learn market dynamics. Your main focus should be on trading currency pairings that you understand effectively.