The financial markets have been a volatile hub, especially during the Covid-19 pandemic. Stakeholders were concerned their capital could be at risk due to the unpredictable market behavior.

However, growth stocks have been performing exceptionally well, especially technology stocks. Apple, Alphabet, and Microsoft are raking in over $57 billion in quarterly earnings, and therefore any fund that diversifies in these stocks is bound to perform well.

It will help if you read further about the Vanguard Growth Index Fund, which invests in large-cap stocks, has low fees, and has solid returns.

Three things to know before starting:

- The Vanguard Growth index Fund tracks large-cap US growth stocks.

- It has a net expense ratio of 0.17%.

- The Fund has over 290 holdings, with 70% invested in growth stocks.

What is the Vanguard Growth Index Fund?

The VIGRX traces the weighted average return of the indices for the underlying funds.

The Fund tracks the CRSP U.S. Large Growth Index; CRSP stands for Center for Research in Security Prices, developed by the financial and investment research at the University of Chicago’s Booth School of Business. The Fund initially tracked the Standard & Poor’s 500 index/Barra Growth Index.

The Fund has been tracking the Russell 1000 index closely since 31 August 2017. Furthermore, the Fund uses a passive management approach suited for investors looking for a passive return from US large-cap growth stocks.

VIGRX aims to offer low-cost access to a diverse range of sector funds. It allows you to diversify across numerous assets. The Fund invests in growth assets, and it allocates 30% to income asset classes and 70% to growth asset classes.

Its holdings are predominantly in growth assets; therefore, it has invested in technology stocks:

- Apple Inc. — 10.13%

- Microsoft Corp. — 9.52%

- Amazon.com Inc. — 6.8%

- Facebook Inc. — 3.89%

- Alphabet Class A and C 3.43% and 3.22%, respectively

Furthermore, the Fund has over 290 holdings and $7.73 billion assets under management.

History of the Vanguard Growth Index Fund

The Vanguard Growth Index Fund’s inception was November 1992. Gerard O’Reilly has managed it since 1994, with Walter Nejman joining the team in 2016.

Pricing & performance

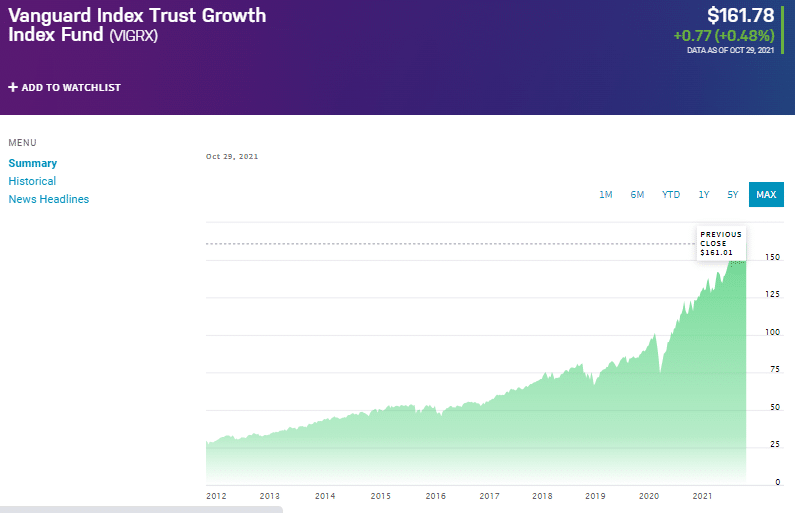

The VIGRX is currently trading at $161.01 per share. The Fund has annualized returns of 36.8%, 25.47 % over the last three years, and 22.54% in the previous five years.

Strategy & benefits

As we mentioned, the Fund’s strategy is to invest in growth stocks. Therefore, it has 70% of its assets allocated to growth stocks.

Benefits

- Vanguard’s investment methodology offers investors an effective way to secure long-term market performance.

- The Fund invests in a diversified collection of stocks, which means it exposes less to the performance fluctuations of single securities.

- It has low ongoing fees since they strive to minimize managing and to operate the Fund.

Fees

The Vanguard Growth Index Fund has an expense ratio of 0.17% and management fees of 0.16%. The category average expense ratio is 1.03%, and the management fee for the category averages around 0.61%.

Risks

Investors should note that investments’ value might go up or down; furthermore, there are no guarantees of returns. Therefore, the risk of losing money is a consideration investors should take note of.

The Fund’s volatility measurements are as follows:

- Standard deviation — 19.978

- Mean — 2.07

- Sharpe ratio — 1.181

Vanguard Growth Index Fund 2021/2022 forecast

The Vanguard Growth Index Fund has displayed excellent gains over the last decade. The Fund’s leading securities have been performing above the average of the sector.

Expert market analysts predict that it will be increasing long-term. Forecasts are that it can reach $344 per share by 2026; in addition, expectations for a return exceeding 113% over a five-year investment.

Pros & cons

| Worth to invest | Worth to getaway |

| High returns The Fund has had excellent annual returns. | Long term returns Investors should note that returns on growth stocks take long and should be willing to hold their investments for more than five years to see good returns. |

| Low fees Its expense ratio management fee is affordable and is less than its category averages. The Fund management always aims to minimize the costs for its investors. | Large investment To benefit from index funds, investors require significant capital to invest, and an investment of $10,000 is advisable to start. |

| Diversification The Fund allows investors to invest across numerous assets, thereby removing the risk of investing in singular assets. | Performance dependent on holdings The Fund’s performance is solely dependent on its holdings. Therefore, if the stocks perform poorly, it will impact the value of the Fund and the possible returns for investors. |

Final thoughts

The VIGRX seems to be a safe option for investors. The Fund’s overall performance makes it an investment worth looking at.

Furthermore, the VIGRX’s management team has kept the costs low to ensure the highest possible returns for investors. Therefore, if you have extra funds you would like to grow long-term, you can opt for the Vanguard Growth Index Fund.