If you are new to investing, you must have heard about the derivatives market or came across one of those articles that tell mind-boggling stories about how big the market for derivatives is.

Some estimate that the worldwide derivatives market surpasses $1.2 quadrillion regarding its notional value, more than ten times larger than the global gross domestic product. While that may be a bit misleading and only partially true, there is no denying that derivatives have their place in the world of investment.

Today, we will learn what the derivatives are and their advantages and flaws and try to help you figure out whether they are the right choice for your portfolio.

What are derivatives?

The word “derivative” marks something that draws its value from something else. Financial derivatives are simply contracts that derive their value from the so-called underlying asset that people invest in.

Let’s explain this with an example. Say your coworker wants to sell his car once his contract with the company expires, which will happen in exactly one year. You like the car but are expecting a raise that would allow you to afford it at about the same time.

Since he doesn’t need to sell his vehicle right away, and you will be able to buy it only once the year has passed, you two decide to sign a contract that he will sell you his car in exactly 12 months from now and for say $10,000. You two have just, you guessed it, created a derivative.

This is where it gets interesting. You can, if you will, “sell” your part of the contract to somebody else. Once the deal is signed, your coworker can’t back out of it, even if the price of that model goes up. This way, you would get to keep the difference without actually investing anything to begin with.

And the beautiful thing is, the underlying asset, which was the car, in our example, can be anything ranging from a house, oil, stocks, funds, student debt, and pretty much anything else.

There are many types of derivatives, including futures contracts, forward contracts, options, swaps, and warrants, but they are a topic for a different article. For now, we will try to decipher what are the upsides and downsides of trading derivatives.

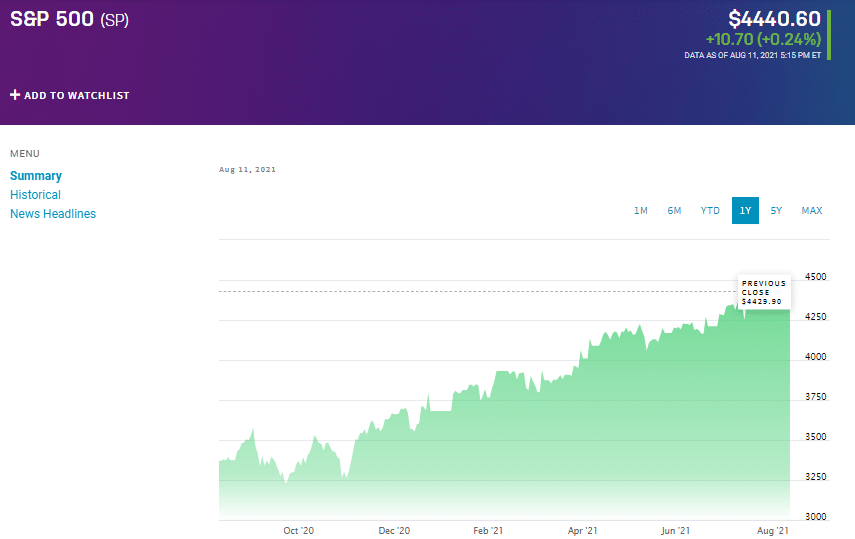

The above chart shows the trend of the futures contract for the S&P 500 index. Notice the upward trend that occurred as the benchmark started gaining value.

Pros of derivatives

Hedging against volatility

If you have security but are not sure how it will fare in the future, turning to derivatives, in this case, the forward contract, could be the right choice for you. That way, you are sure to get the price you settled on regardless of market trends that the future brings. From our previous example, even if the price of the car fell to, say, $8,000, your friend would still end up with $10,000 in his pocket.

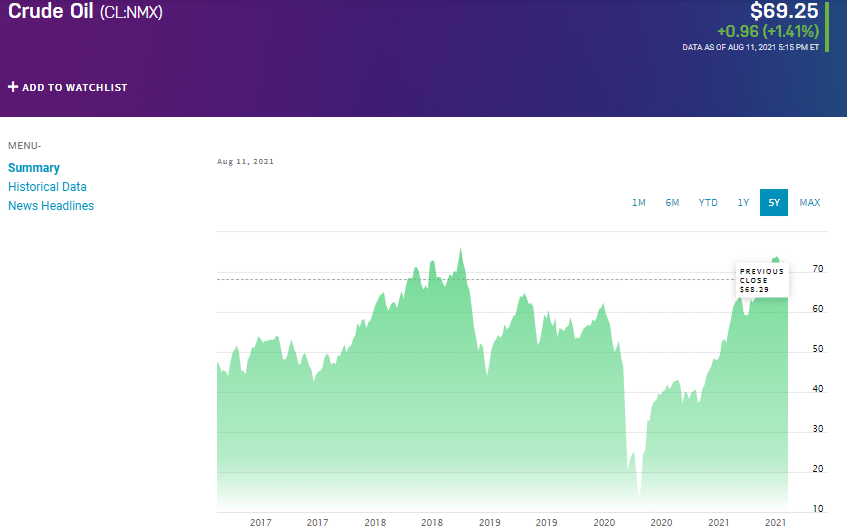

Take a gander at the volatility observed in the oil market in the past five years. We know how much oil airlines generally use. It would make sense to buy crude futures to make plans for the coming period, expenses-wise.

Market efficiency

If you trade derivatives, you don’t have to wait for the market to be open. Simply signing contracts will move the cash around without actually having to wait for a brokerage or an exchange to sanction the transaction. This goes to boost market efficiency.

Making unavailable assets available

Derivatives can aid you if there is an asset unavailable to you that you need — for example, an interest rate. Imagine you have a loan to your name, and it has a floatable rate. It can be a bit difficult for you to get other loans if your initial conditions are sub-par.

However, via an interest-rate swap, a type of derivative, you can exchange your floatable interest rate with someone who has the same debt with a fixed rate. That investor will usually believe that the interest rates will generally go down in the future.

Cons of derivatives

Speculative traits

Most investors see derivatives as a tool of speculation. Keeping everything honest, they tend to be speculative and risky, leading to losses if you don’t fully understand using them.

Volatility

This one ties into the previous downside of the derivatives. We have already said that we use derivatives to protect the investors against volatility, so you might ask why they are marked as volatile in this section?

Simply put, there are many types of derivatives, and the movements of some of them can be extremely difficult to predict.

Leverage

It means betting with money that’s not your own. The leverage can amplify your gains, which is excellent, but at the same time, it can handle multiple losses if it turns out you were wrong. Since many derivatives are leveraged, they require a steady hand and an experienced trader to be used the way they were meant to.

Final thoughts

Berkshire Hathaway’s Warren Buffet once called the derivatives “financial weapons of mass destruction” and has repeatedly advocated against using them.

On the other hand, that same investor, at the same time, holds derivatives as a way to make a profit. While you might feel confused, remember that there are no really and truly good or lousy investment vehicles. As long as you make sure they are the right choice for you at a given point in time and that you get a grip on how to use them properly.