TD Ameritrade is one of the largest online brokers in the US, offering investors access to a wide range of financial products and services. Founded in 1975 and headquartered in Omaha, Nebraska, TD Ameritrade provides trading platforms, investment tools, education resources, and customer support to help traders and investors achieve their financial goals. In this review, we’ll take a closer look at what TD Ameritrade has to offer and whether it’s the right choice for your investment needs.

Features

TD Ameritrade offers a robust set of features to help traders and investors make informed decisions and manage their portfolios effectively. Here are some of the key features:

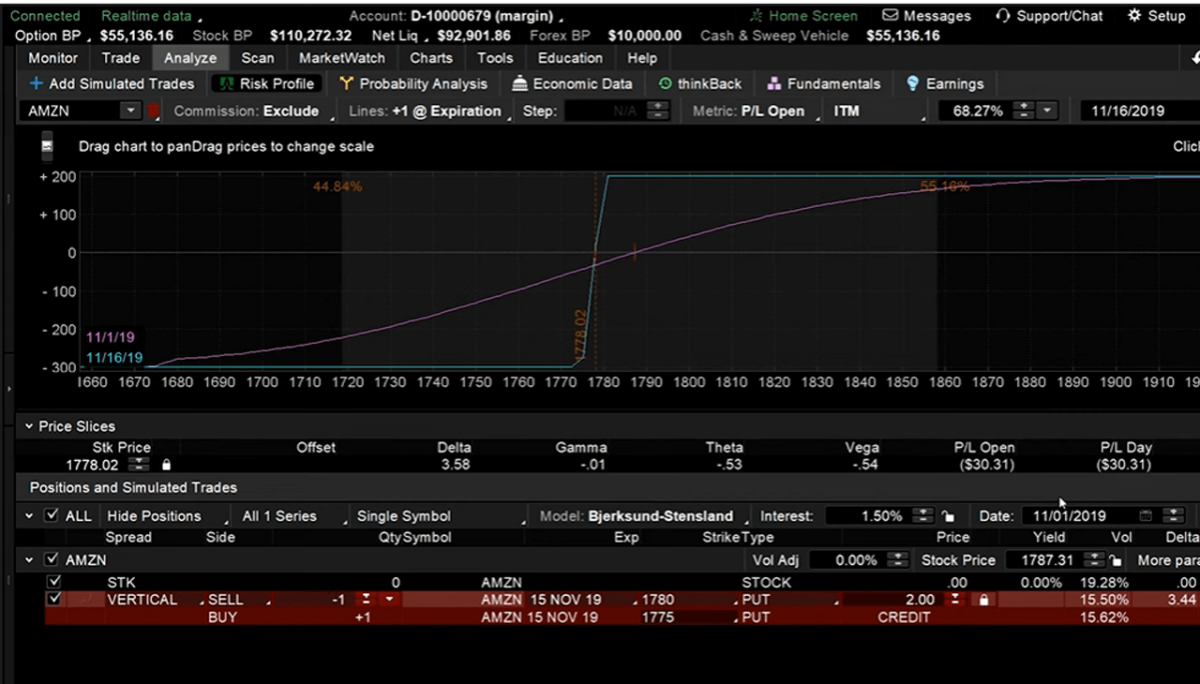

- Trading Platforms – TD Ameritrade offers three trading platforms: the web-based thinkorswim platform, the mobile app, and the web-based TD Ameritrade platform. The platforms offer a range of tools and features to help traders analyze the market, place trades, and manage their portfolios.

- Investment Products – TD Ameritrade offers access to a wide range of investment products, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, futures, and forex.

- Education Resources – TD Ameritrade offers a wealth of educational resources, including webinars, videos, articles, and in-person events. They also have an immersive education platform called TD Ameritrade U, which is designed to help students and young investors learn about investing.

- Research Tools – TD Ameritrade provides a variety of research tools, including real-time quotes, news articles, and analyst reports. They also offer a customizable dashboard and alerts system to help investors stay on top of their investments.

- Customer Support – TD Ameritrade provides customer support via phone, email, and live chat. They also have over 280 branch locations where you can receive in-person support.

Overall, TD Ameritrade offers a comprehensive set of features to help traders and investors manage their portfolios effectively.

Account Types

TD Ameritrade offers a variety of account types to meet the needs of different investors. Here are some of the main account types:

- Individual Brokerage Account – This is a standard investment account that individuals can use to buy and sell stocks, bonds, mutual funds, ETFs, options, and other securities.

- Retirement Accounts – TD Ameritrade offers several types of retirement accounts, including Traditional IRAs, Roth IRAs, Rollover IRAs, Simplified Employee Pension (SEP) IRAs, and Solo 401(k)s. These accounts offer various tax benefits and are designed to help individuals save for retirement.

- Education Savings Accounts – TD Ameritrade offers two types of education savings accounts: 529 plans and Coverdell Education Savings Accounts (ESAs). These accounts are designed to help individuals save for education expenses such as college tuition.

It’s worth noting that TD Ameritrade also offers specialized accounts for businesses, trusts, and other entities. Additionally, they allow joint brokerage accounts for two or more individuals who share ownership of the account.

Fees and Commissions

TD Ameritrade charges fees and commissions for certain transactions and services. Here’s an overview of their fee structure:

- Stocks and ETFs – TD Ameritrade charges $0 commission for online equity trades. However, there is a $6.95 flat fee for trading over the phone or with assistance from a broker.

- Options – TD Ameritrade charges $0.65 per contract for online options trades, plus a $6.95 base commission. The fees are higher if you trade options over the phone with the assistance of a broker.

- Mutual Funds – TD Ameritrade offers more than 13,000 mutual funds, including no-load, no-transaction-fee funds. For transaction-fee funds, TD Ameritrade charges $49.99 per trade.

- Bonds – TD Ameritrade charges a flat fee of $25 for online bond trades. There are additional markups on the bond price, which vary depending on the specific bond.

- Futures and Forex – Fees for futures and forex trading depend on the specific instrument and exchange.

It’s worth noting that TD Ameritrade also charges fees for various services such as wire transfers, paper statements, and account transfer fees. However, they do not charge fees for account opening, closing, or maintenance. Compared to some of its competitors, TD Ameritrade’s fees are on the higher side, especially for certain products like options and mutual funds.

Security and Regulation

TD Ameritrade takes security seriously and employs several measures to protect its clients’ data and assets. Here are some of the key security features:

- Encryption – TD Ameritrade uses 256-bit encryption to protect its clients’ personal and financial information. This is the same level of encryption used by major banks and financial institutions.

- Two-Factor Authentication – Clients can use two-factor authentication to add an extra layer of security to their accounts. This requires them to enter a unique code in addition to their password when logging in.

- Fraud Protection – TD Ameritrade monitors its clients’ accounts for suspicious activity and offers fraud protection guarantees for unauthorized transactions.

- SIPC Insurance – TD Ameritrade is a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for up to $500,000 in securities and cash held in a client’s account.

In terms of regulation, TD Ameritrade is regulated by several entities, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations oversee broker-dealers and ensure that they comply with applicable laws and regulations. Additionally, TD Ameritrade is subject to regular audits and compliance reviews to ensure that it operates ethically and in its clients’ best interests.