Private equity exchange-traded funds hold companies that can be financially complicated because they use leverage and are strongly transaction-oriented. Such funds’ focus is oriented toward transactions. They expose stakeholders to private equity investments, holding solid returns on investment.

Similar to a mutual fund or hedge fund, a private equity (PE) fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors and uses that money to make investments on behalf of the fund.

These funds might seem like a great idea. The high returns of some large listed companies – some of the funds offered have returned over 25% – that are typically only available to high net-worth investors are very attractive.

How does it work?

PE caters to the capital of high net worth entities. It obtains equity rights in companies with significant potential seeking capital to improve their cash flow positions or expand. These firms provide finances and the financial knowledge to run their businesses.

PE funds give ordinary investors a way to get involved in this market. We reviewed three private equity funds to produce this list of the best options.

Top three things to know before starting:

- PE is an investment category that deploys capital to private companies not publicly traded on stock exchanges.

- PE firms often have interests that conflict with the funds they manage and, by extension, the limited partners invested in the funds.

- The majority of the world’s PE assets are based in North America.

Best private equity ETFs to buy in 2022

For better comparison, you will find a list of funds with details on size, cost, age, income, expense ratio, dividend yield, returns, ESG rating, etc.

Let’s take a look at the best ETFs to invest in.

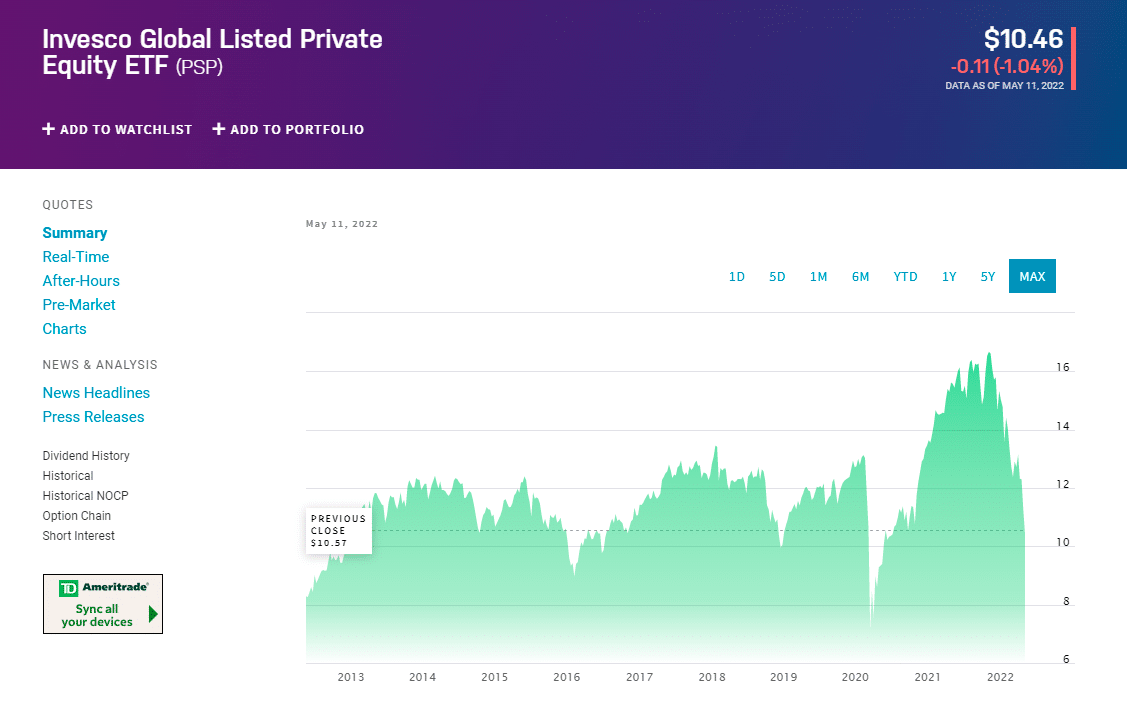

1. Invesco Global Listed Private Equity Portfolio (PSP)

It is the largest private equity ETF, with over $267 million as of May 2022. It was launched in 2006 and managed by Peter Hubbard since June 1, 2007, at Invesco.

This fund tracks the Red Rocks Global Listed Private Equity Index. It will normally invest at least 90% of its total assets in securities, which may include American depository receipts (ADRs) and global depository receipts (GDRs), that comprise the Index. It provides access to approximately 70 publicly-listed private equity companies worldwide, including business development companies and financial institutions.

It is the perfect option for investors looking for global exposure. One risk to keep in mind is that the fund invests in American Depository Receipts of foreign companies, which can expose investors to things like currency fluctuations and other risks.

Dividend yield

PSP has a dividend yield of 15.44% and paid $1.61 per share in the past year. The dividend is paid every three months, and the last ex-dividend date was March 21, 2022.

Holdings

Holdings are concentrated at 37% among American companies, 21.5% in UK firms, and 36% in Europe.

Expense ratio

Its expense ratio is high compared to funds in the Global Small/Mid Stock category. PSP has an expense ratio of 1.44%, which is 79% higher than its category.

Returns (annualized)

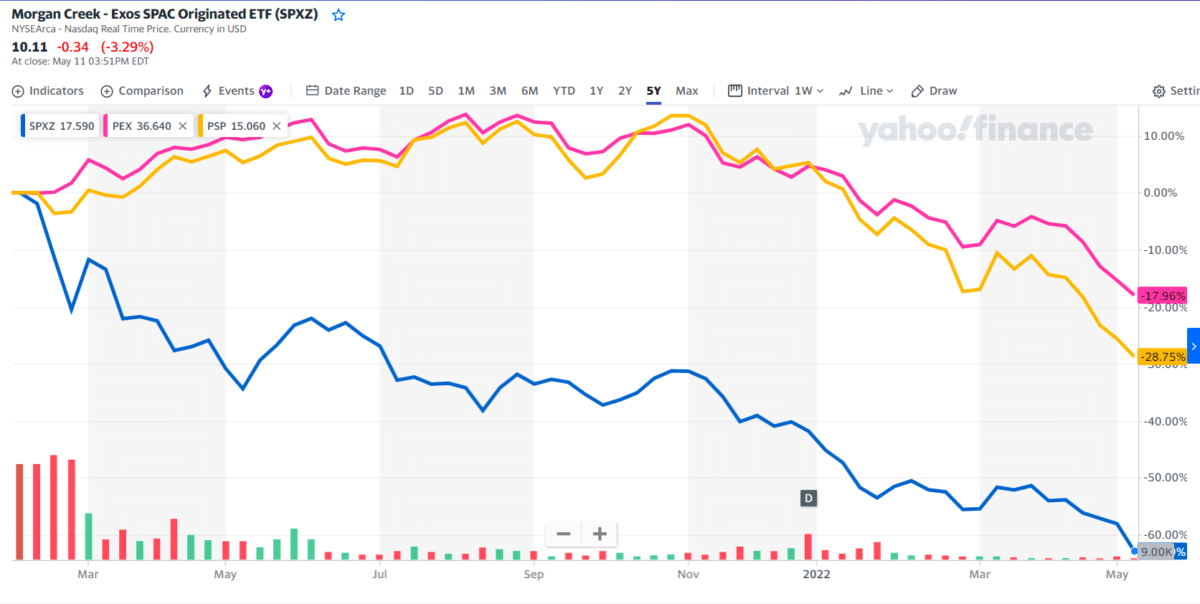

The fund has returned -19.8% over the past year and 5.7% annually over the past three years, 6.2% per year over the past five years, and 9.5% per year over the past decade. In April 2022, PSP returned -12.9%. It has an R-squared of 90%, a beta of 1.43, and a standard deviation of 27.0%. It has an above-average total risk rating.

The fund does not have an ESG score.

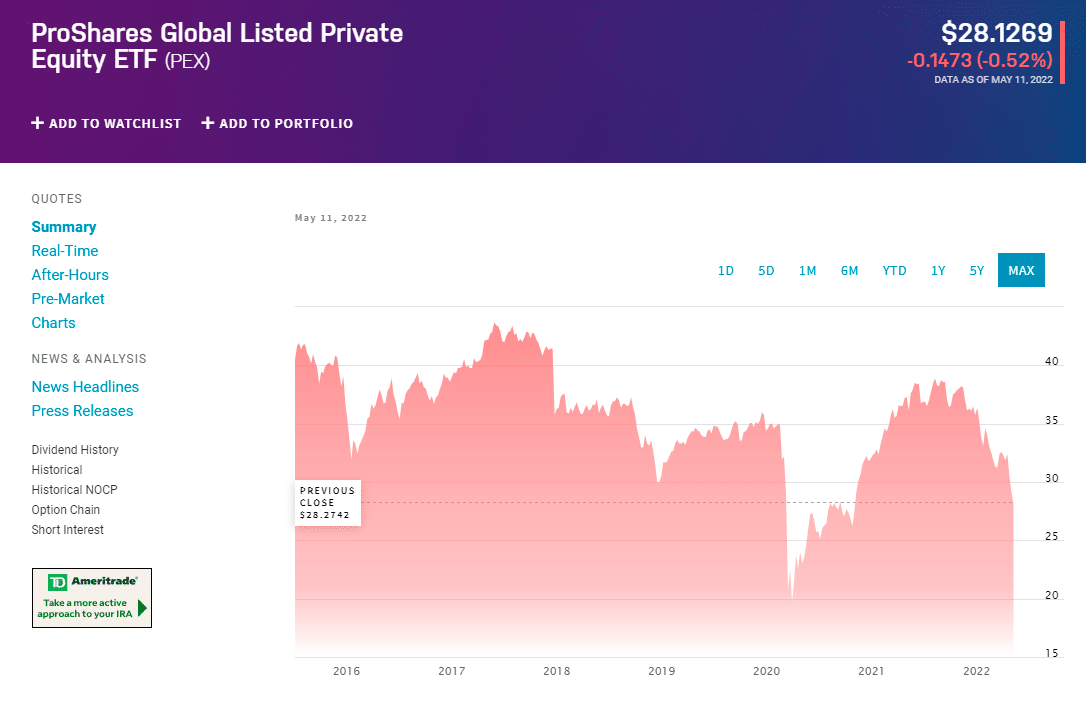

2. ProShares Global Listed Private Equity ETF (PEX)

It is a fund that aims to provide investors with results, excluding fees, similar to the performance of the LPX Direct Listed Private Equity Index. It was launched in 2013 and managed by Ryan Dofflemeyer on April 5, 2019, at ProShares. This index, identical to the underlying index of PSP, includes up to approximately 30 publicly-listed private equity companies, which share a primary purpose and function to invest in privately held companies and lend capital.

Dividend yield

PEX has a dividend yield of 15.27% and paid $4.32 per share in the past year. The dividend is paid every three months, and the last ex-dividend date was March 23, 2022.

Holdings

Holdings for this fund are allocated 44.5% to the USA, 23.5% to the UK, and the balance to Europe.

Expense ratio

PEX has an expense ratio of 2.67%, which is 293% higher than its category.

Returns (annualized)

The fund has returned -9.3% over the past year and 4.5% annually over the past three years. Recently, in April 2022, PEX returned -8.1%. It has an R-squared of 84%, a beta of 1.36, and a standard deviation of 26.8%. It has an above-average total risk rating.

The fund does not have an ESG score.

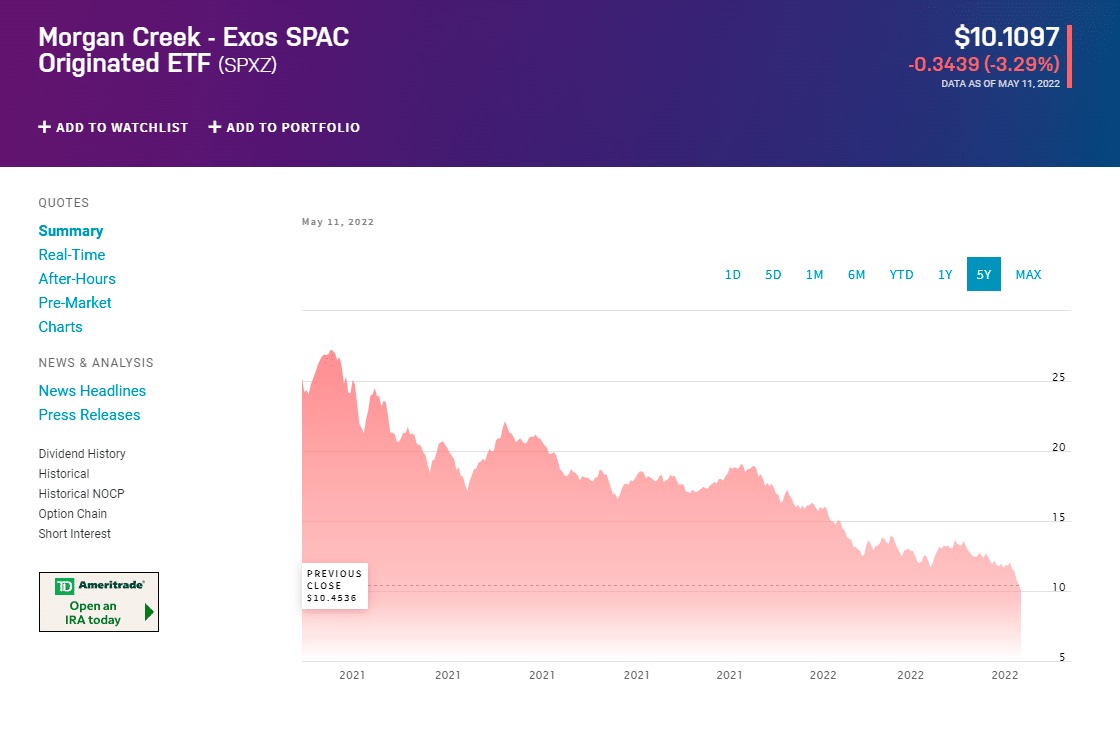

3. Morgan Creek – Exos SPAC Originated ETF (SPXZ)

It offers liquid, transparent access to an actively-managed portfolio of companies going public via SPACs. It was launched in 2021 and has been managed by Dewey Tucker since January 25, 2021, at Morgan Creek. By market capitalization, the fund provides broad exposure to a selected cross-section of the largest pre-and post-combination SPACs.

This actively managed to limit exposure to poor-performing companies. It targets equal dollar weights so no one company, or group of companies, will have an outsized effect.

Dividend yield

SPXZ has a dividend yield of 0.68% and paid $0.08 per share in the past year. The last ex-dividend date was Dec 28, 2021.

Holdings

Holdings for this fund are allocated 99.92% to the USA and 0.08% to Canada.

Expense ratio

Its expense ratio is average compared to funds in the Consumer Cyclical category. It has an expense ratio of 0.50%, which is 6% lower than its category.

Returns (annualized)

It has been popular in its total returns, resulting in a 127% growth across the past year and 52% since inception. The fund has returned -42.0% over the past year. Recently, in April 2022, the fund returned -13.1%.

The fund does not have an ESG score.

Pros and cons

| Worth to invest | Worth to getaway |

| Private businesses often have huge growth potential. | High management fees. |

| Exposure to a unique asset class. | Few ETFs on the market. |

| Investors will have to decide whether they think the historical trend of higher private equity returns will continue. | Many small companies fail. |

Final thoughts

If you’re interested in investing in private equity, using a PE ETF is easier. Thus, the cost of entry is low compared to the significant investment private equity firms typically require. PE can be risky and have long time horizons, so make sure it fits your goals and only invest money you can afford to lose.