When we decide to invest in the trading market, it is hard to choose which way to go. There are many possibilities, and all of them require time and money. It’s not like we can try any market and see how it goes, mainly because nobody wants a high probability of losing money.

While the principles for trading in different markets are very similar, many details make a big difference between markets. So, the possibilities are diverse. One of the possibilities is options trading, which is trading the right to buy or sell an asset instead of dealing with the asset itself. Option trading is more common in the stock and futures market, but it is also possible to trade it in the FX.

If you are a newbie in the trading world, options trading is certainly a possibility for you, but, like any other market, it has its advantages and disadvantages. So let’s learn about options trading so you can decide if it’s right for you.

FX options

Options trading is an effective way of managing risk. When trading options, the market participants receive or transfer the risk of the operation. Whoever receives the risk is paid a premium to do it, and the trader transferring the risk is the one who pays.

So, in principle, it can be thought of as a secondary market of markets like stocks and FX because the purpose is to bet on the direction of the asset’s price movement to take advantage of your prediction while ensuring a minimum risk by paying a premium.

In reality, options are a market itself. Traders don’t need to execute the option to make a profit. By trading the option itself to a third party interested in buying the asset, an options trader makes money not by buying or selling an asset but by trading the right to buy or sell the underlying asset. This allows the trader to operate with less money because he only has to cover possible losses derived from the trade, which are more likely to be limited according to the option that the trader bought or sold.

Good for newbies?

If the new trader enters the options trading market as recommended, he should be a disciplined and prepared investor. He should have sufficiently studied all the market principles and understands that his trading will take a while to generate profit.

In this scenario, options trading is an excellent choice because the possibility of reducing risks would favor a trader whose first trades won’t be as good as he may hope. In this way, he’d have time and money to continue on his learning curve until he can become an experienced trader.

In reality, there are very few new traders with those characteristics. Instead, the new trader will probably enter the market attracted by all the publicity that makes him think he can be rich and quit his job soon. This type of trader is less likely to study the options market, and here is the main obstacle to begin trading options as a newbie.

Option trading is more complicated than FX because first, you need to understand how forex trading works and then move on to options trading. Otherwise, you are just gambling.

For example, if you think that a currency will enter a bullish trend, in options trading, you would buy a call option to buy the pair for a lower price, but first making sure that the appreciation occurs.

This all makes sense, but the first step in this trade is assuming that the price will rise. But, of course, you need a good reason to believe that first, so you need to study fundamental and technical analysis to understand the market and make good predictions. This way, the logical thing to do is to first completely understand the FX market to then move on to options trading.

Advantages

Options trading has several advantages that make it very attractive for newbies and experienced traders. Let’s check a few.

- Managing risks

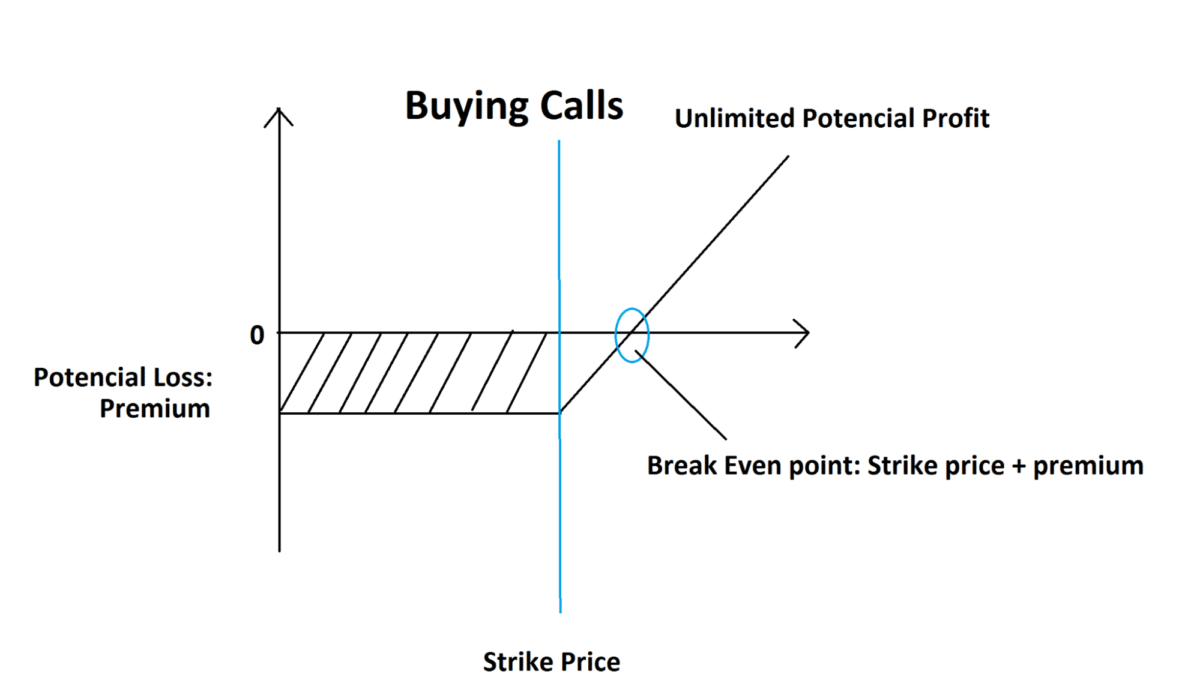

The most common reason for big investors to trade with options is to protect their assets from unexpected market moves. As a result, most option trading strategies are designed to improve the reward/risk ratio by limiting the risk.

Above, we can see the chart of the potential risks and reward when buying a call option.

- Low capital

When trading options, the amount of money required is lesser than in other markets. Because what you trade are options and not the underlying currency, your investment depends more on the premium, which is lower than buying the underlying currency.

Disadvantages

- Complex

A new trader may find the options market confusing. The fact that you trade an abstract thing such as the right to buy or sell an asset is difficult to understand even for some experienced traders. In FX, it could be even more complex because the trade consists in trading a currency with another currency which could lead to even more confusion.

The other aspect of complexity is that most strategies are made to compensate for the possible loss of trade. So, in most option trading strategies, the trades are sometimes counterintuitive for the inexperienced trader.

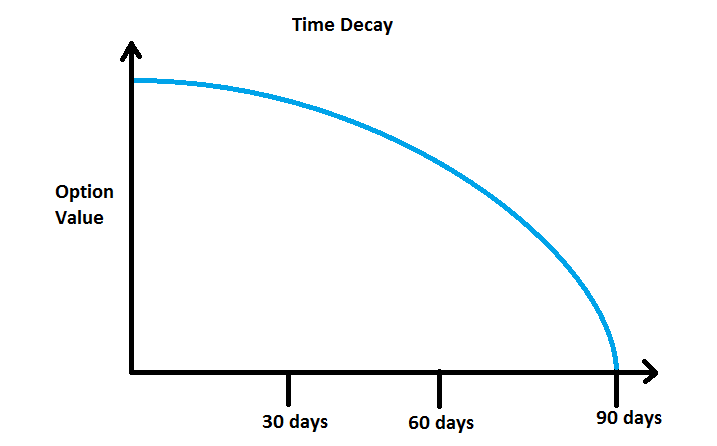

- Time decay

An important element of an option is the expiration date. The fact that the option has an expiration generates time decay for the option. So trading options is in some sense a race against time.

Final thoughts

Trading options seem like a good choice for new traders because of the possibility of limiting risk, which is very important for new traders since their first trades will have poor results. By limiting their losses, they will have more time to learn and find the right strategy and not become one of the many traders that give up on the first days. Unfortunately, every new trader is in a hurry to start trading.

Options trading requires a lot of study and preparation. Most new traders won’t be willing to respect their learning process and probably will rush into trading, making nothing but losing money and abandoning the market. However, some simple ways of options trading like simple call and put options alone can be good for newbies to enter the options trading market.