Futures contracts investors mainly belong to two categories, i.e., hedgers and speculators.

- Hedgers buy futures contracts to mitigate the risks and cushion unfavorable price movements.

- Speculators are mostly aggressive investors who utilize significant leverage, up to 90%, to gain exploding profits or losses.

Currency futures are one of the most lucrative products that investors use to tackle the foreign exchange or interest rate risk. Moreover, these contracts run on margin, allowing trades from as low as 10% of the original contract value.

So, do you want to know about a currency futures ETF that tracks the prices of G10 currencies? Read this article to learn about the features and details of the Invesco DB G10 Currency Harvest Fund.

Three things to know before starting:

- The fund seeks the investment results of G-10 currencies futures contracts.

- The fund has integrated both long and short selling with a leverage ratio of 2:1.

- Its expense ratio is 0.78%, which is near the category average.

What is the Invesco DB G10 Currency Harvest Fund (DBV)?

DB G10 Currency Harvest Fund tracks the performance and fluctuations of Deutsche Bank G10 Currency Future Harvest Index™ – Excess Return, including the interest yield from US Treasury securities and money market income. This index incorporates currency futures contracts on G-10 currencies, the most liquid and widely traded monetary assets.

DBV is an efficient and cost-effective fund for individuals who want to invest in the futures market using long and short positions. The fund’s primary working principle is that currencies with higher interest rates generally grow in value and excel the low-interest rate currencies.

Moreover, the fund’s underlying index delivers the investment results of up to 2:1 leveraged basis on both the long and short positions.

DBV FactSet analytics insight

The fund is a convenient and straightforward investment fund that exposes diverse currencies. This commodity pool fund establishes long positions with high-interest yield currencies and shorts with the lower interest rate currencies.

As of December 2021, this fund has about $27.4 million assets under management, with more than 1 million shares outstanding. It has a management fee of 0.75% and a futures brokerage fee of 0.03%, totaling to 0.78% expense ratio.

Moreover, the fund deals with the ‘developed-market’ currencies and comes under the category of ‘absolute returns.’

DBV pricing and performance

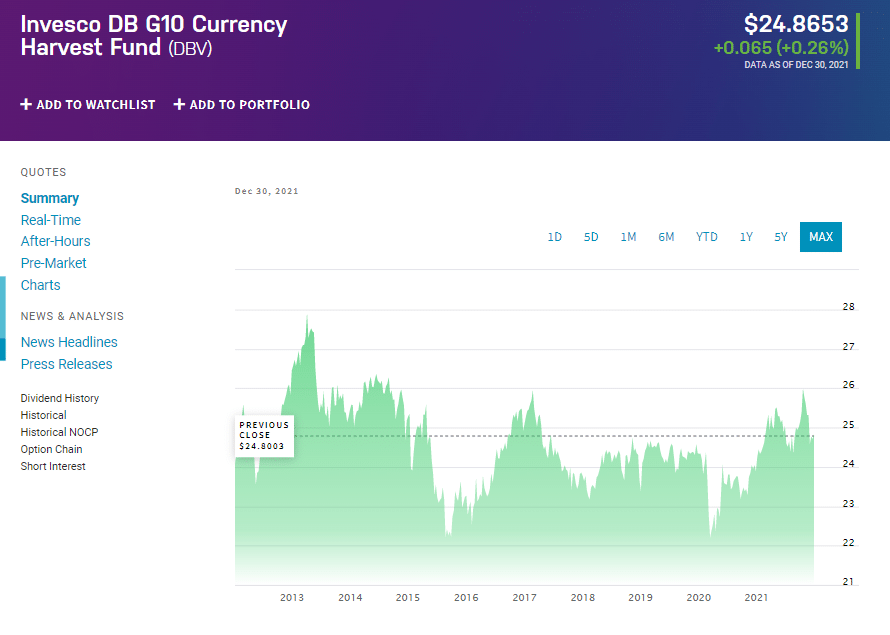

Invesco issued the DBV fund in 2006 that has been trading on the NYSE Arca exchange since then. The fund’s inception price was around $25 that peaked at almost $29 by the end of 2007.

During the economic crisis of 2008, DBV plunged to its all-time lowest point of $18. After 2008, the price has not faced any major fluctuations as it keeps ranging between $23 to $25. Currently, the fund is trading at $24.86.

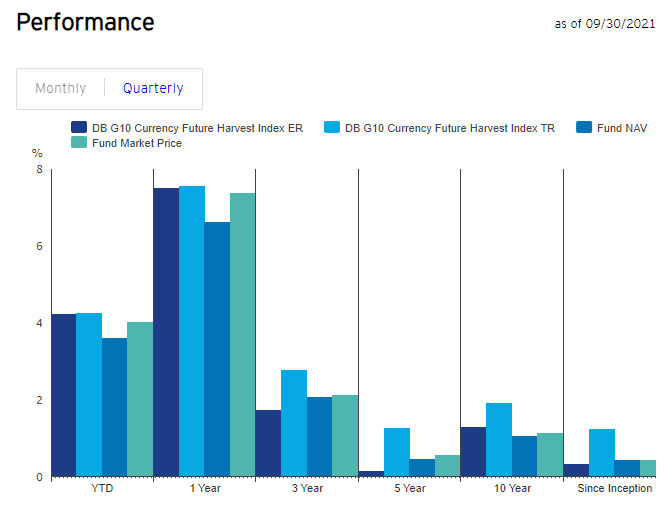

According to the fund’s quarterly report of September 2021, DBV has shown a YTD and 3-years market price growth rate of 4.04% and 2.19%, respectively. This commodity pool fund has demonstrated exemplary performance in the last year, manifesting a growth rate of 7.39%; however, its since-inception performance is inadequate and nearly nil, i.e., 0.45%.

Assets classification and key holdings

DBV incorporates two major asset classes in its holdings, i.e., currency futures and collateral. Following are the current futures holdings and their relative net assets.

| FUTURES | % OF NET ASSETS |

| Norwegian Krone | 34.06 |

| New Zealand Dollar | 33.37 |

| Swedish Krona | -33.20 |

| Euro | -33.22 |

| Swiss Franc | -33.53 |

| COLLATERAL | % OF NET ASSETS |

| Invesco Government & Agency Portfolio | 70.94 |

| United States Treasury Bill | 29.23 |

Strategy and benefits

Generally, futures markets are significantly liquid than the cash or spot markets; hence relatively easy to trade. DBV is an enhanced currency fund that focuses on high-interest-yielding currencies to maximize gains.

Moreover, this fund provides significant diversification from the stocks market. Therefore, it can be a great hedge against equity and fixed-income investments. In addition, the collateralization of futures assets with Treasury Bills can generate substantial interest income.

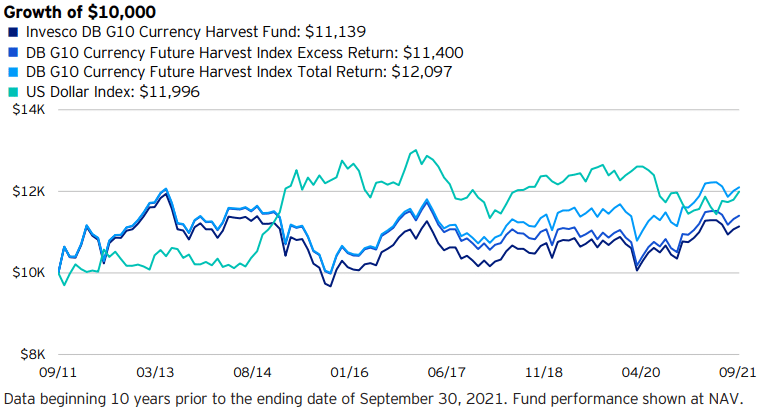

The following graph shows the hypothetical growth of $10k invested in this fund over the last ten years.

Risks associated with DBV

According to the fund’s official report, DBV is not right for all investors due to its speculative nature and incorporation of volatile futures markets.

Any meager market movement can result in compounded losses due to its leverage component. In addition, foreign exchange products are prone to many risk factors such as trade deficits, changes in domestic or foreign exchange rates, and political or economic events.

Final thoughts

It is a reasonable fund for gaining diversified exposure to the G-10 futures contracts. It is a leveraged investment product that tracks the highly developed currency markets; hence can deliver amplified annual returns.

However, the fund may not be suitable for long-term investors as it has not shown any considerable growth since its inception. Investors should decide on investing in this security after calculating their financial goals and whether they are investing as a hedger or speculator.