With the increasing urgency to save a good amount of cash for the future, investing has gained immense popularity. However, each investor’s investment strategies differ relative to their risk appetite and financial goals.

Standard deviation is one of the several metrics known to indicate the risk and volatility of investment products. This measuring scale allows the investors to compare the risk level of entirely different securities trading in different markets.

Do you want to learn about the intricacies of standard deviation and how it can affect investment choices? Read this article to know about the details of this metric and a promising fund with a moderate standard deviation.

Three things to know about the standart deviation before starting:

- It is a statistical metric that estimates the volatility of stocks, funds, or other investment products.

- High deviation stipulates an asset’s wilder price swings and higher risk.

- iShares MSCI USA Min Vol Factor ETF is a moderate-standard deviation ETF with low cost and a consistent growth record.

What is the standard deviation?

It measures the deviation of values in a data set from the arithmetic mean over a fixed period. In the investing domain, standard deviation points to the volatility of assets or portfolios. In simple words, this measurement helps specify the level of variation or spread of securities’ prices from their average price.

A fund’s greater price movement results in a higher standard deviation, indicating significant volatility. In contrast, a slight price fluctuation implies a lower standard deviation, pointing to less volatility.

Moreover, as standard deviation determines the spacing and dispersion of data, it can never be negative. The minimum standard deviation can be zero when there is absolutely no fluctuation within the sample group.

An example of standard deviation

Suppose there is an ABC fund with an average return of 10% in the trailing twelve months. We can calculate its standard deviation by subtracting the mean from each month’s value, then squaring, adding, and averaging the figures.

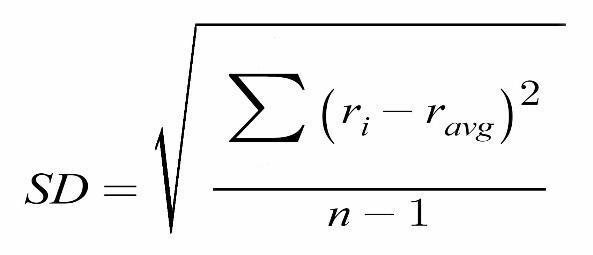

The simple formula is as follows:

We would suppose that the above standard deviation comes out to be “2%” after all the calculations. Generally, this deviation follows a specific pattern to determine the price variance. ABC fund’s future returns can fall within one standard deviation 68% of the time and within two standard deviations 98% of the time.

In other words, we can presume the fund’s future return to remain between 8% and 12% (plus or minus 2% standard deviation from the 10% return), 68% of the time. And to range between 6% and 14% around 98% of the time.

Why is the standard deviation important for investors?

Investors utilize standard deviation measurements for assessing a fund’s risk and how much its returns diverge from the average returns. As an investor, you can consider the standard deviation data to predict the range of future returns. Resultantly, you can plan or balance your investments according to your risk tolerance.

Moreover, the standard deviation is a pretty all-rounder concept that could have different contexts. A fund with either a 2% or 50% standard deviation does not guarantee a profit or loss. It is because this measuring factor does not take into account the price “direction.” The 2% deviation may be on the losing side, whereas a 50% deviation may be on the winning side or a mix.

Therefore, an investor must carefully consider all the relevant data and historical returns to take advantage and make sense of standard deviation.

Here, we have discussed a moderate risk fund with a standard deviation value that does not fall to either extreme.

iShares MSCI USA Min Vol Factor ETF (USMV)

Price: $80.40

Expense ratio: 0.15%

iShares MSCI USA Min Vol Factor ETF (USMV) tracks the performance of the MSCI USA Minimum Volatility (USD) Index, which incorporates the lower volatility US stocks. The USMV fund measures the investment results of mid and large-cap US stocks that are potentially less risky than the broader US equity market.

This fund applies a unique optimization technique to build a minimum variance and low volatile portfolio. In other words, the fund works by applying a sector and cap weightage formula to the current stocks and not just by adding low-volatile stocks.

Currently, the fund has around 28 billion net assets and 377 million shares outstanding. As of November 2021, the fund reported three years standard deviation of 15.22%, which comes under the moderate-risk category, close to low risk.

Pricing and performance

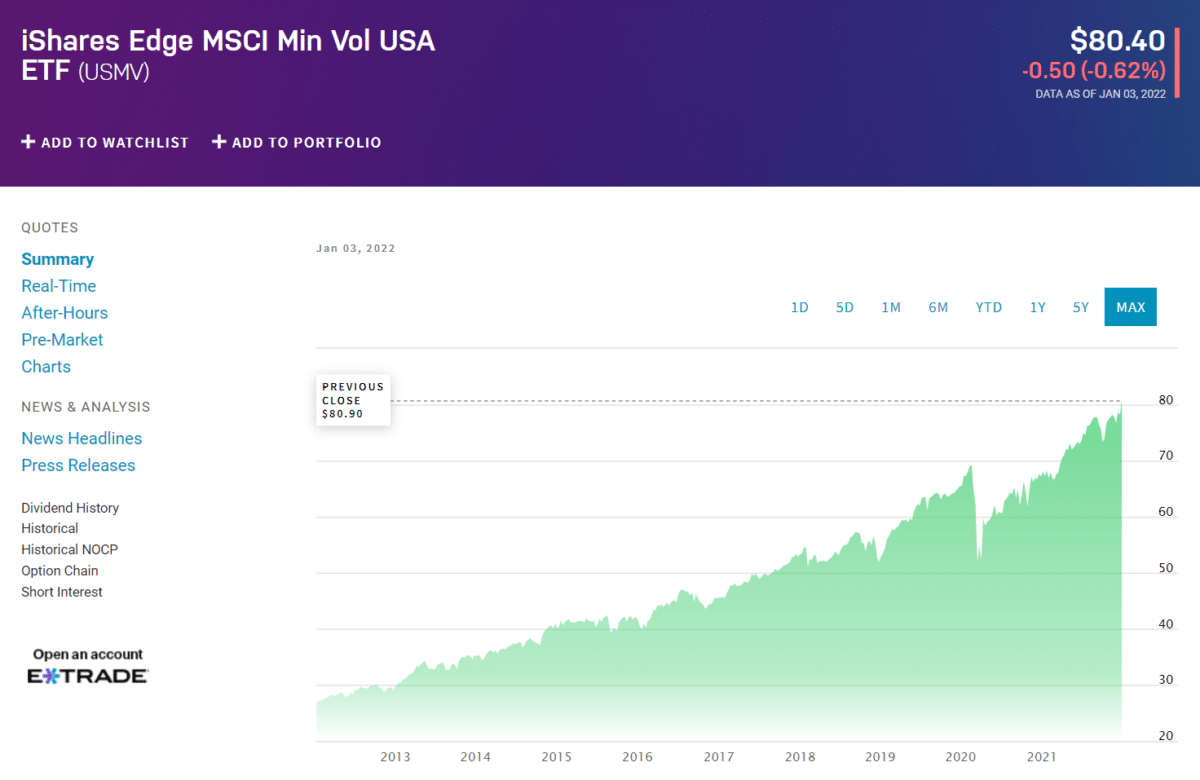

Blackrock Financial Management issued the USMV fund in October 2011. The fund’s inception price was around 26$. Since then, it has maintained a smooth upward momentum, reaching the current $80.

During the 2020 pandemic devastation, the price plunged from the $68 peak to approximately $52; however, a swift recovery broke the previous all-time high.

As of December 2021, the fund has reported a 1-year and 5-year annualized total return of 17% and 12.26%, respectively. Moreover, the fund’s P/E ratio is about 32.54% and demonstrates a reasonable since-inception total return of 13.54%.

The fund gives exposure to various sectors, providing the maximum weightage to Information Technology, Healthcare, and Consumer Staples. USMV has around 172 holdings, out of which the top three are:

- Accenture PLC Class A

- Johnson & Johnson

- Cisco Systems Inc.

Strategy and benefits

iShares MSCI USA Min Vol Factor ETF (USMV) is one of the most popular ETFs as it provides a simplified diversification to numerous sectors along with mitigating the volatility risk. Moreover, this fund gives access to stable, large-cap companies that can withstand adverse economic conditions.

In addition, USMV has a significantly low expense ratio than the category average. This fund’s stable growth over the last ten years and a robust rebound from the corona turmoil indicate its effectiveness.

Final thoughts

Standard deviation can be an excellent indicator to determine the relevant risk and price movement of assets if utilized correctly. Though higher standard deviation is usually associated with riskiness, it can also indicate exceptional returns. Generally, a fund with a moderate standard deviation is the safest bet to achieve substantial gains without too much risk.

USMV is a medium-risk ETF that can be a suitable investment option for long-term and risk-averse investors. The fund has a low standard deviation and incorporates stable blue-chip stocks; however, investors should make any investment decision after evaluating their personal capacity.