About the FNCL ETF

The Fidelity MSCI Financials Index ETF inception was on 21 October 2013. The Fidelity Management & Research Company LLC manages the ETF, and Fidelity is the fund’s issuer. FNCL seeks to track a market-cap-weighted index of large-cap US financial companies. Furthermore, the fund tracks to the MSCI USA IMI Financials Index and is benchmarks against the Thomson Reuters US Financials.

FNCL Fact-set analytics insight

FNCL has a weighted market cap of $165.21 billion and $1.93 billion assets under management. The fund has an expense ratio of 0.08%.

FNCL performance analysis

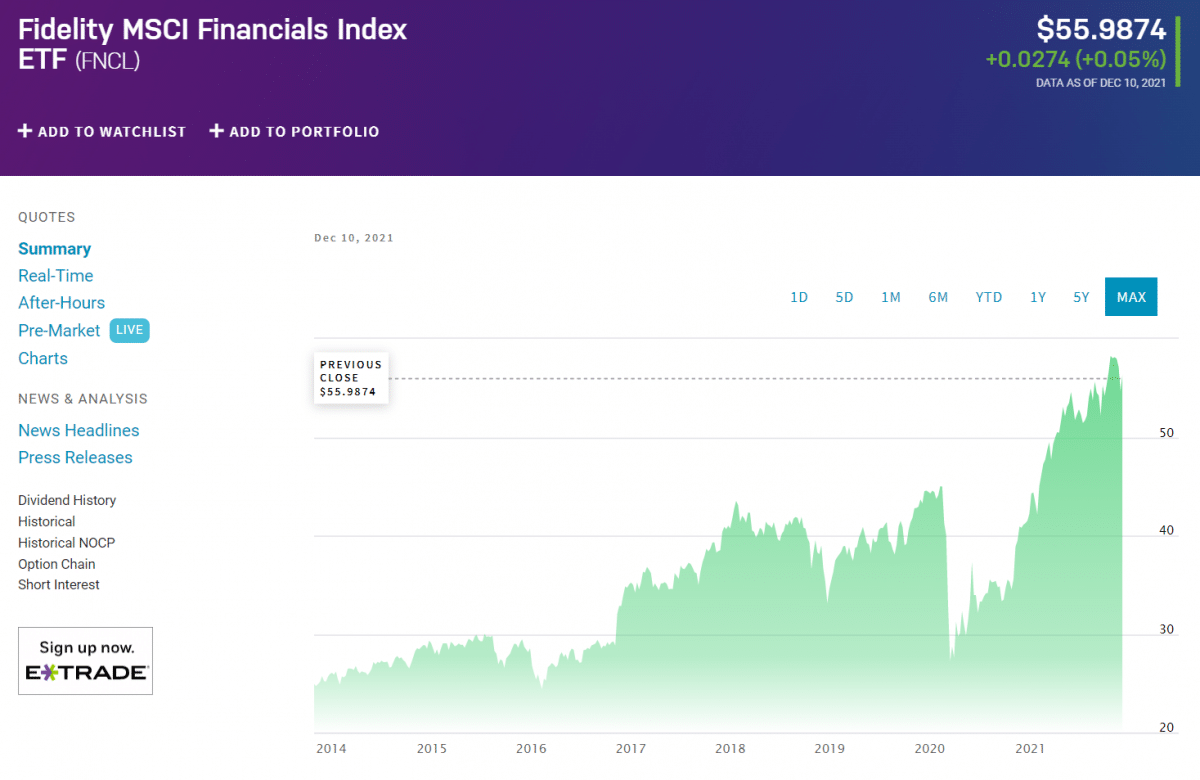

The FNCL ETF had an annual return of 40.42% and a year-to-date return of 34.46%. The fund has a price per earnings ratio of 11.63, and its last dividend payment was on 17 September 2021 at $0.28 per share. The FNCL ETF has an annual dividend of $0.93.

FNCL key holdings

The Fidelity MSCI Financials Index ETF has 395 holdings. The fund invests in the financial sector, contributing to 94.15% of the weighting. The fund invests 94.82% of US companies. Furthermore, 82.91% are large-cap, 12.96% mid-cap, and 3.92% in small-cap equities.

The top ten holds are listed below.

| Ticker | Holding name | % of assets |

| JPM | JPMorgan Chase & Co. | 8.99% |

| BRK.B | Berkshire Hathaway Inc. Class B | 7.04% |

| BAC | Bank of America | 6.26% |

| WFC | Wells Fargo & Company | 3.80% |

| BLK | BlackRock, Inc. | 2.63% |

| MS | Morgan Stanley | 2.59% |

| GS | Goldman Sachs Group, Inc. | 2.51% |

| C | Citigroup Inc. | 2.37% |

| SHOW | Charles Schwab Corporation | 2.20% |

| NEXT | American Express Company | 2.13% |

| SPGI | S&P Global, Inc. | 2.13% |

Industry outlook

ETFs focused in the financial sector rallied recently after the re-election of Jerome Powell as Fed Chair. The FNCL specifically gained 1.9% as a result of the announcement.

Powell is a favorite among Wall Street’s banking sector, and the news was good for banking stocks.

ETFs are a safe option for investors, especially in the financial sector. Since Covid-19 impacted economic growth in the US, the recent months have shown the country is recovering well. The FNCL fund has returned over 40% over the last year, and its low expense ratio of 0.08% makes for an affordable investment with high returns.