The financial needs of people are substantially expanding either to buy a house, land, car, or other properties. These monetary requirements of individuals have increased the demand for loans and mortgages.

As a result, financial institutions have drafted numerous policies and plans for lending various types of loans.

So, are you nearing your retirement age and worrying about the ways to secure a mortgage? Gone are the days when banks granted secured loans solely on your present taxable income. Now, you can qualify for a loan grant based on your liquid assets also.

Let’s check the limitations, conditions, and prospects for nominating your retirement account as collateral for obtaining mortgage funding.

What is a retirement account?

It is an investment account that offers tax benefits, whether at the depositing period or at the time of withdrawals. These tax-advantaged accounts provide you with economic and financial security after your retirement. Investing or directing a part of your income in a retirement account during early age compounds your wealth, leading to a comfortable life later.

Employees contribute to employer-sponsored accounts like 401(k) with pre-tax income that becomes taxable only at the time of distribution. Traditional IRA accounts work similarly to 401(k), but they are individual accounts with no interference from employers. Alternatively. Roth IRA is an appealing retirement plan in which you pay taxes at the time of deposit and receive tax exempted withdrawals at the time of retirement.

Three things to know before starting:

- Withdrawing from retirement accounts before a specific age leads to penalties and converts all your contributions to taxable income.

- Lenders consider only half or 3/4th of your retirement account for calculating your mortgage wages.

- You can retain the ownership of your assets as long as you pay loan installments on time.

How to get a mortgage during retirement?

You might be thinking of relocating or buying a new house after your retirement. But for the realization of these plans, you need substantial financing. Mortgage programs are an excellent way to gain funding with reasonable conditions. Even without an active income paycheck, you can obtain a mortgage if you own considerable financial assets or a retirement account. Banks or lenders utilize two strategies to devise a virtual income from the current assets.

Your pension and social security earnings may not be enough as proof of income. As a result, lenders can consider the recent or past two months withdrawals from your retirement account to determine monthly income.

On the other hand, you can be entitled to a mortgage if you own sufficient assets in your savings/retirement account. Lenders consider 70% of the value of the total account assets and divide it into 360 days. This formula determines whether a person has enough investment to cover loan payments. The borrower doesn’t need to cash out these assets as long as they regularly pay their monthly quota. Such asset depletion loan method provides security to the lending institution in case you cannot make regular payments.

What is an asset depletion loan?

Asset depletion loans are loans that are granted based on valuable assets possessed by the borrower. You need not have any employment or traditional income source as your assets can serve as sole collateral for obtaining the loan. In addition, you can also present both your assets and any secondary income to qualify for a mortgage.

Asset depletion loan requires your liquid assets to have a good market value and be worthy to the lenders if you default on the loan. These assets count as your income source for the stretch of the mortgage payments. In addition, you must have a good credit score above 500 or 620 for securing this loan type. Lenders consider other vital aspects before giving out a loan: your debt-to-income ratio and house expense ratio.

How do asset depletion mortgages work?

Lenders utilize a specific calculation method to determine your “asset income” before considering you as a potential borrower. Your assets must be sufficient to cover the down payments, closing costs, and monthly loan remuneration. In simple words, the basic idea behind these types of mortgages is that the buyer can liquidate his assets each month for loan reimbursement.

The standard assets that qualify for this loan scheme are investment accounts (bonds and stocks), saving funds, real estate, certificate of deposit, or retirement accounts. For using a retirement account in an asset depletion loan, you must be of the specified age.

In most cases, people below 59 ½ years of age cannot avail this loan opportunity. They can face penalties and bear loss of tax benefits in case of not following the guidelines.

How much of your assets are counted?

Typically, the lending institutions do not count the entire asset value for deriving your virtual monthly wages. After subtraction of initial payments, lenders usually consider 70% of your total assets in the case of a retirement account.

Similarly, they may regard 50 to 70% of your whole belongings in case of other investments accounts. And in some liquid asset accounts, they can even count 100% of your holdings. The resultant asset value is divided by 360 to determine your monthly earnings and the rate of monthly installments.

It is important to note that lenders do not consider any percentage of retirement account assets if you are not of age. It is because the lenders cannot access the IRA or 401(k) accounts directly.

In most asset depletion loan programs, lenders demand 30% of your total financial assets as a down payment. But some institutions require down payments as low as 10%. Thus, you need to search for a suitable and reasonable mortgage program according to your capacity.

Asset depletion mortgage example

For an easy understanding of the workings of asset depletion mortgage, let’s look at an example. Suppose a 60-years old borrower has $800,000 in his retirement account and another $3,000,000 in the form of different liquid assets.

The lender will calculate their monthly income as follows:

- Retirement account worth: $800,000

- After down payment: $800,000 – $60,000 = $740,000 ($60k is down payment)

- Considered retirement assets: 70% of $740,000 = $518,000

- Total assets counted: $3,000,000 + $518,000 = $3,518,000 (Liquid assets count 100%)

- Monthly income: $3,518,000/360 = $9,772

It is the borrower’s monthly income, so the lender will derive monthly payments value by optimizing the monthly earnings value with the debt-to-income ratio and borrower’s existing debts.

In this case, if the debt-to-income ratio is 45%, the maximum monthly installment could be $4,397. In addition, if the borrower has other monthly debt payments of $500, his full monthly repayment would amount to $3,897.

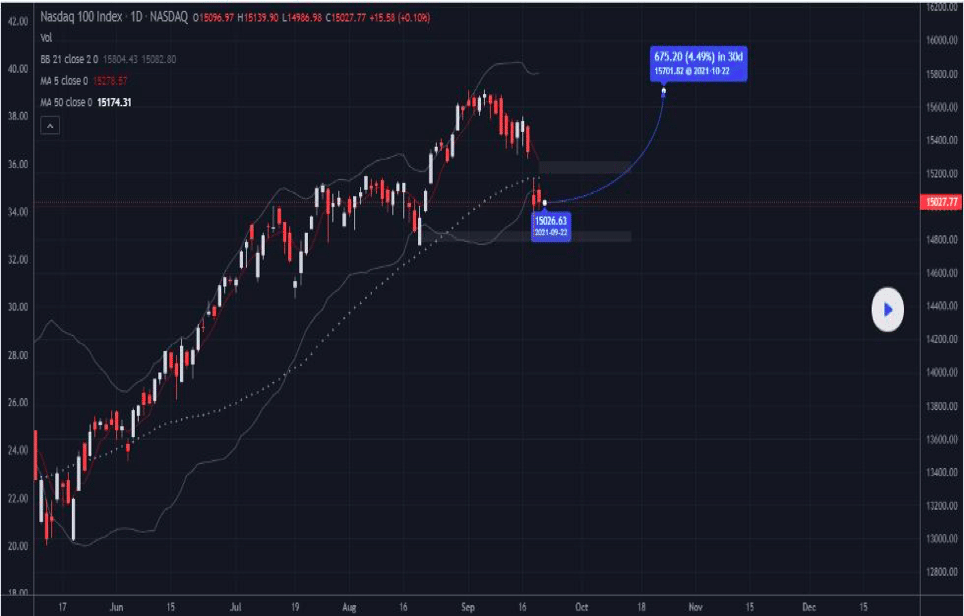

Nasdaq is a stock exchange index comprising a large number of stocks reaching up to 3,000 stocks. Whoever owns this stock is eligible for asset depletion mortgage as stocks and bonds come under the category of liquid assets.

In this type of loan, the lenders consider your stocks as collateral. In most cases, you will maintain the ownership of the stock and can reap its benefits as long as you do not default on the loan.

Pros & cons

| Worth to use | Worth to getaway |

| •Lower interest rates Asset-based mortgages impose lower interest rates of 3% to 2.5% as compared to conventional loans. | •Risk of asset confiscation If the borrower cannot pay the loan installments, the lender can seize his collateral assets and sell them. |

| •Quick processing You can receive the funding in a short span of time as long as you meet all criteria. | •Increased scrutinization Lenders inspect most of the transactions and financial dealings of the borrower for their assurance. |

| •Flexibility of using Unlike traditional bank loans, the borrower has complete authority to spend the capital however they like. | •Limit to loans You cannot receive a loan amount more than the worth of your assets. |

Final thoughts

Retirement accounts are a secure financial investment for your future. By this program, you avail the necessary funding as well as maintain ownership of your assets. These accounts can also assist you in gaining loans even when you have no regular paycheck.

However, before going for an asset-based mortgage, you must consider your repaying ability and capacity to avoid unfortunate asset seizure. With proper planning and management, you can enjoy immense benefits by using your retirement assets to obtain a mortgage.