The diamond pattern is an outstanding pattern with occasional nature, and its V-shaped neckline makes it similar to a head and shoulder technical figure. It is a reversal pattern that happens at swing tops and lows. It hardly takes place at market bottoms.

In the buying market, the diamond pattern is widespread, while on the contrary, the overall execution of those takes second place in the bear market. It rises rapidly but replaces it with a rapid fall. It is the indemnifying feature of diamond bottoms.

To technical traders, defining the reversal is the most beneficial trading opportunity. Professional market participants use these methods combined with other technical indicators to accelerate the winning chance.

The following section will see a guide containing exact buying and selling trading methods with this technical figure.

Three things to know before starting:

- This pattern is an effective tool to spot reversals.

- It is a high-yielding technical figure if it is identified correctly.

- It occurs at the top of the chart closer to the market tops and can indicate an uptrend reversal.

What is the diamond pattern?

It is a technical figure that is not in demand yet among traders. Hence, many of them do not know how to apply the diamond pattern in their trading strategies. However, market participants can utilize it for defining the uptrend reversal; Besides, traders can spot diamond top patterns as a bearish reversal strategy. When a robustly up-trending price outlines a demolishing sideways movement, it forms a diamond pattern as a part of the price reversal.

However, there are very few opportunities available in this pattern, while others like H&S or triangles are widespread in the chart. With early recognition, the pattern allows technical traders to have a robust trading opportunity, and they must gather knowledge of the diamond pattern.

What is an analysis of diamond pattern strategy?

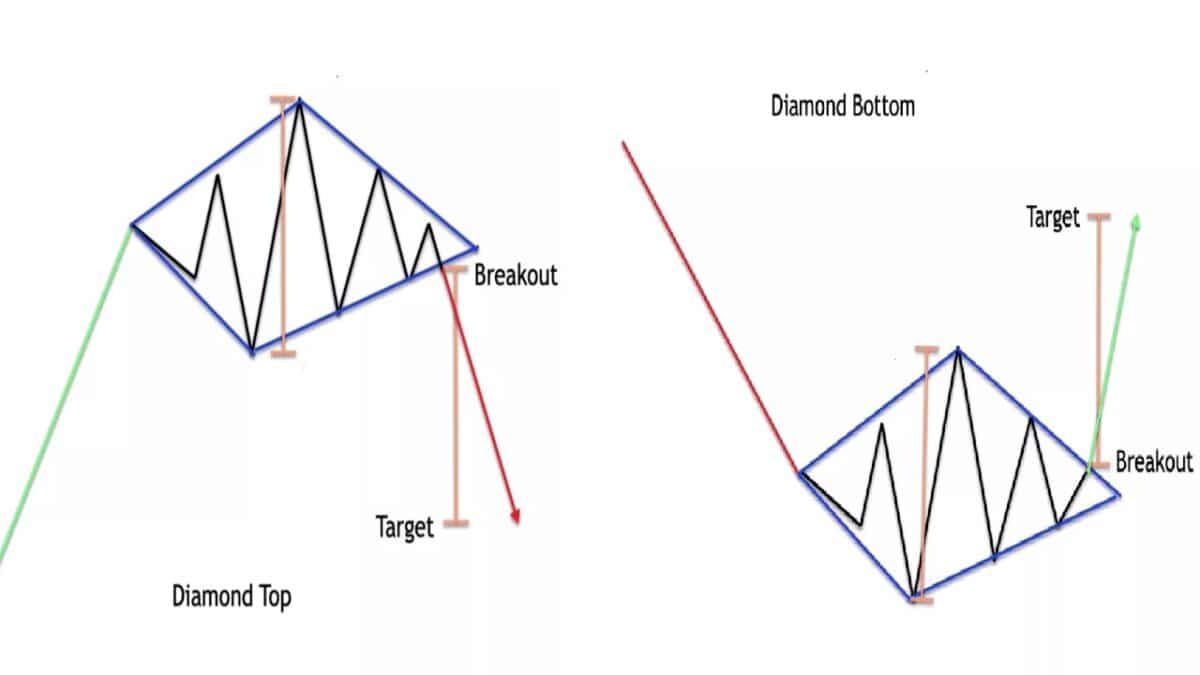

The basic of the technical figure initiates when the price starts to make new highs and lows, but after making some movement, it squeezes the momentum to a point. At last, when the pattern completes, it looks like a diamond.

The diamond pattern forms a new low and high by upcoming higher low and lower high instead of prices going along with the similar pattern. In any chart, diamond top and bottoms only depict the trading sentiment and a stoppage before the emergence of a new trend. Nonetheless, the pattern is rare in the price chart due to its infrequent nature.

The above image shows what the diamond pattern looks like in both bullish and bearish market conditions. The trading entry is valid in both cases once the price breaks out from the squeeze.

How to trade using the figure?

The figure is profitable, and many market participants use this technique in their strategy. As it is a trend reversal pattern, a trader can achieve good risk/reward ratio-based trade when it breaks in the current direction. Because when a new trend arrives in the market, it moves very impulsively on the initial stage. So, a trader makes a good profit if they can enter the market after the diamond pattern breakout.

We will endeavor to keep this strategy as basic as conceivable by using price action tools. However, we know that the figure does not occur on the price chart. As such, we would instead not put an excessive number of factors into the trading strategy, which would sift through a generally decent setup.

Bullish trade setup

Entry

Look for a buy trade when the price forms a diamond bottom pattern and has a bullish close above the upper resistance level.

Stop loss

Put the SL order below the lower support level with at a 10-15 pips buffer.

Take profit

Take the profit when the trade achieves at a 1:3 risk/reward ratio. Otherwise, you can take the profit when the price reaches the next resistance level.

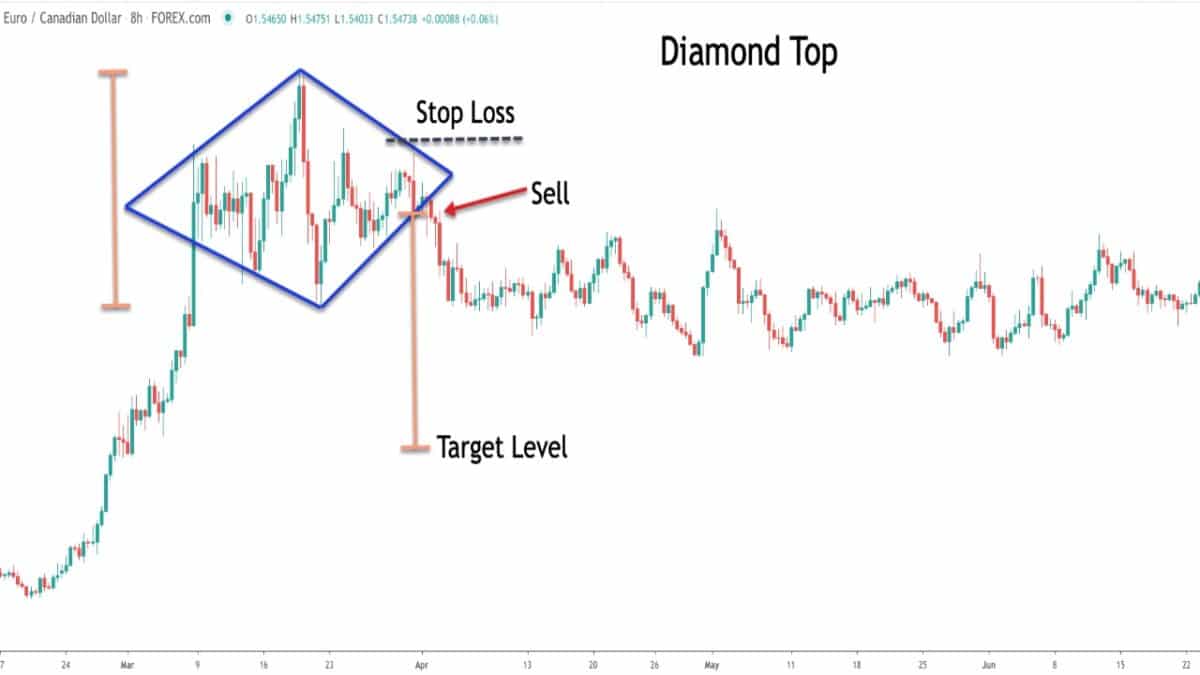

Bearish trade setup

Entry

Look for a sell trade when the price forms a diamond top pattern and has a bearish close under the lower support level.

Stop loss

Put the SL order above the upper resistance level with at a 10-15 pips buffer.

Take profit

Take the profit when the trade achieves a 1:3 risk/reward ratio. Otherwise, you can take the profit when the price reaches the next support level.

Pros and cons

| Worth to use | Worth to getaway |

| • This pattern can form in any time frame, yet it is more suitable for long-term. | • Although this figure needs a very sharp eye to spot thus, for novice traders, trading can be stressful. |

| • It can be in uneven shape to some extent, which helps to be easily identified. | • Unavailability of the technical way to measure how high or low the pattern may go hence creates trouble putting SL. |

| • It helps traders to have a detailed look at trades behavior. | • The figure is rare in the market. |

Final thoughts

To conclude, the diamond pattern hardly takes place in the market; still, it can bring about winning trades reliably. While defining an ideal entry point for your trade, the pattern can make it effortless. If traders apply this strategy correctly, the diamond pattern can yield a handsome outcome but lower risk.

Also, the pattern is available after a robust price movement occurs; the pattern’s emergence is infrequent. It is wise to cross-check the availability of the diamond structure on the trading chart.