Crypto ETFs are financial products that track the performances of digital assets and cryptos. Many investors seek to diversify their portfolios by investing in these assets cause these are potent with the rise of the crypto industry.

However, cryptos are new products in the financial world that are still developing. So choosing financial assets like crypto ETFs as investments requires conducting a particular level of research. This article will introduce you to the top three crypto funds that are potent to gain.

What are crypto ETFs?

They are funds that track the performances of cryptos. In crypto ETFs, an investment executive manages all funds, and profits are distributed to clients’ accounts proportionately. Most ETFs pay quarterly payment but some offers monthly and bi-weekly payments also. Crypto-relevant investments are growing rapidly, and these crypto ETFs have become attractive investments to financial investors. Investors can invest in these assets as these ETFs involve price fluctuations frequently like many other financial assets.

Is it worth investing in crypto ETFs?

Cryptos are volatile assets that often cause significant price swings. So when someone follows “all in” in any digital asset, that might involve risks. On the other hand, these crypto ETFs allow diversifying portfolios by investing in several crypto assets. Additionally, organizations that issue these funds usually have sufficient research about the potential of investment assets that an individual may fail to observe. So these assets can be attractive investments and less volatile and safer investments than cryptocurrencies.

Top three crypto ETFs

These funds don’t directly hold cryptos. Usually hold derivatives like futures contracts or backed by physical cryptos. When choosing the best crypto ETF, it is mandatory checking on several data such as historical performance, objective, structure, portfolio holdings, expenses, etc. We check many crypto funds from several angles and reckon the best three among them or most potent to gain among them are:

- Amplify Transformational Data Sharing ETF

- First Trust Indxx Innovative Transaction & Process ETF

- Siren Nasdaq NexGen Economy ETF

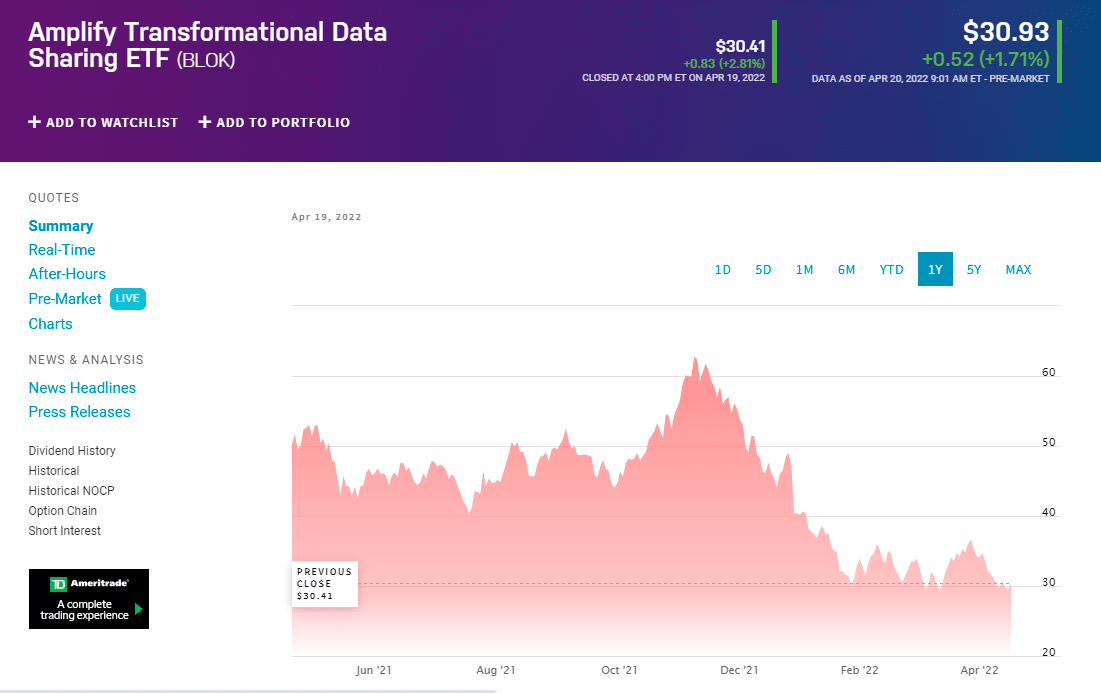

1. Amplify Transformational Data Sharing ETF (BLOK)

BLOK is one of the most attractive ETF funds that invest in businesses involved in blockchain, the core technology behind cryptos. Rather than directly investing in cryptos, BLOK seeks companies or organizations involved in the utilization and development of blockchain technology. The inception date of this fund is 18 Jan 2018, and the issuer of this fund is Amplify Investments. The top ten holdings of this fund BLOK include Silvergate Capital Corp. Class A, Coinbase Global, Inc. Class A, NVIDIA Corporation, CME Group Inc. Class A, MicroStrategy Incorporated Class A, HIVE Blockchain Technologies Ltd, etc. This fund currently has $906million in assets under management.

Where to buy BLOK?

Any individual investor can invest any amount in BLOK at Stash and many other exchange platforms.

What is the perspective of BLOK?

Many financial analysts anticipate the Price of Amplify Transformational Data Sharing ETF (BLOK) might regain the last year’s top near $64 within the next few years.

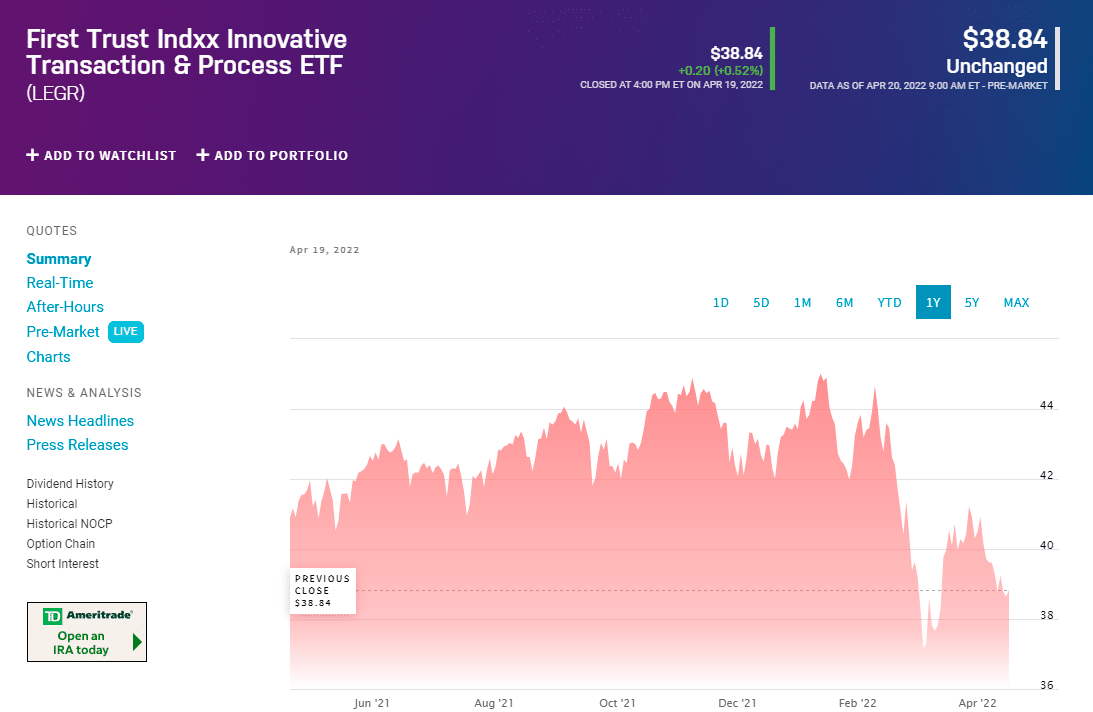

2. First Trust Indxx Innovative Transaction & Process ETF (LEGR)

The next top crypto ETF is First Trust Indxx Innovative Transaction & Process ETF (LEGR) with a design purpose to track the performance of companies that are actively using, developing, or investing in cryptos, blockchain technology, or its products. The issuer of this fund is First Trust, and the inception date of this fund is 24 Jan 2018. The asset class is equity, and this fund belongs to the Large Cap Blend Equities category. The top holdings of this fund include ICICI Bank Limited Sponsored ADR, JD.com, Inc. Sponsored ADR Class A, Mastercard Incorporated Class A, Amazon.com, Inc., PayPal Holdings, Inc., Alibaba Group Holding Ltd. Sponsored ADR, etc. This fund is currently worth $150 million in assets under management.

Where to buy LEGR?

You can purchase this ETF through many online brokerages or even through banks. Available on Nasdaq.

What is the perspective of LEGR?

The Price of LEGR is currently floating nearby, facing resistance near $45.38. Many financial analysts expect the Price might regain toward the previous top soon and above that level with increasing buy pressure.

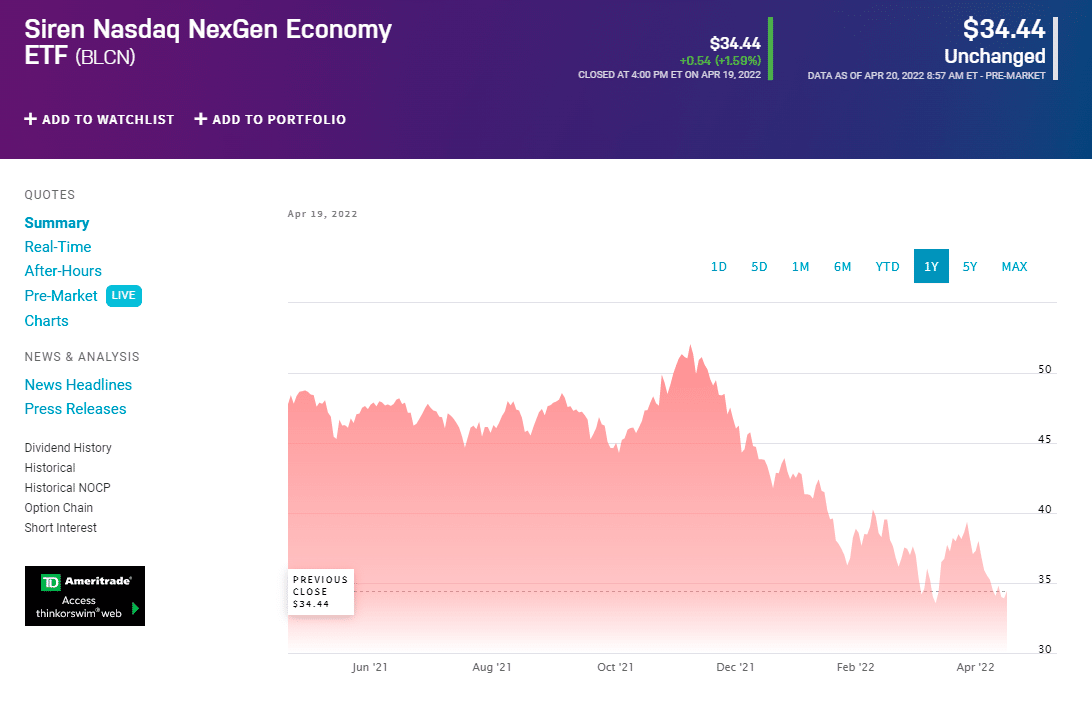

3. Siren Nasdaq NexGen Economy ETF (BLCN)

Siren Nasdaq NexGen Economic ETF (BLCN) is another EXchange-traded fund that seeks to invest in companies committed to researching, developing, and utilizing blockchain technology. The issuer of this find is SRN Advisors, and the inception date is 17 Jan 2018. Top holdings of this fund include Coinbase, Mastercard, AMD, ACN, etc.

Where to buy BLCN?

You can invest in BLCN through many exchange platforms.

What is the perspective of BLCN?

Many financial analysts anticipate the Price of BLCN might regain the previous year’s high near $52.28 within the next few years.

Pros and cons

| Worth to use | Worth to getaway |

| These assets are accessible to individual investors and often allow investing any amount. | These assets involve risks as any other financial asset. |

| These assets are less volatile than cryptos. | It requires sufficient research to spot the best crypto ETF. |

| These assets allow diversifying portfolios rather than investing in any one crypto. | The concept is still developing as cryptos or blockchain technology remains in a developing period. |

Final thought

Finally, we make this list of the top three cryptos ETFs by doing sufficient research. Anyone can generate handsome returns by investing in these assets over a certain period as blockchain technology keeps booming. However, many more are coming into the marketplace, offering many more features. However, these assets are less volatile than the actual cryptos. We recommend checking the primary factors before investing in any crypto fund.