According to the US SEC, penny stocks are small companies that trade under $5 per share. Traditional penny stocks have low liquidity and low trading volumes, and these companies usually don’t trade on stock exchanges.

However, blockchain penny stocks are a new variation of this tradition, and these companies are more significant than the typical penny stock company. Their trading volumes are substantial, and their products are involved with blockchain and its related technologies.

The companies we review in this article are not small, and their products are some of the world’s leading blockchain innovations. Furthermore, their share price is very low, allowing you to purchase more shares than the traditional high-value listed stocks.

Therefore, you would want to continue reading if you are interested in investing in blockchain penny stocks.

Three things to know before starting:

- Blockchain penny stocks are companies that design, manufactures, and sell blockchain technology hardware or software.

- The five stocks we review in this article are trading below $10 per share.

- Many technology companies are now using blockchain innovation as part of their operations.

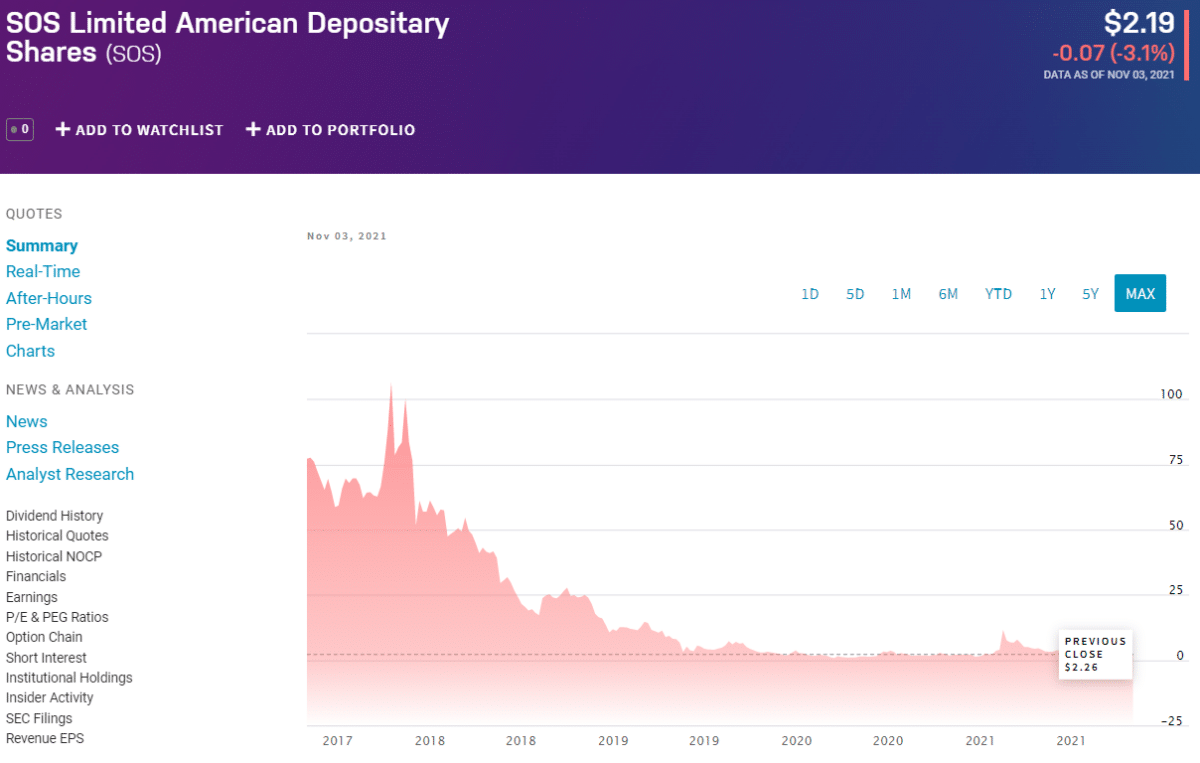

№ 1. SOS Limited American Depositary Shares (SOS)

Price: $2.19

SOS Ltd. is a Chinese-based holding company. The company specializes in marketing data, technology, and solutions to emergency rescue services in China.

Their focus is on researching and developing cloud computing, the Internet of Things, blockchain, and artificial intelligence.

The stock trades on the New York Stock Exchange under the ticker symbol SOS.

SOS Limited American Depositary Shares has a trading volume of 7.64 million shares, and the company has outstanding shares of 182.37 million. The SOS Limited American Depositary Shares has a market cap of 384,81 million.

In terms of performance, SOS Limited American Depositary has a P/E ratio of 1.60. The year-to-date stock performance for SOS is 23.25%.

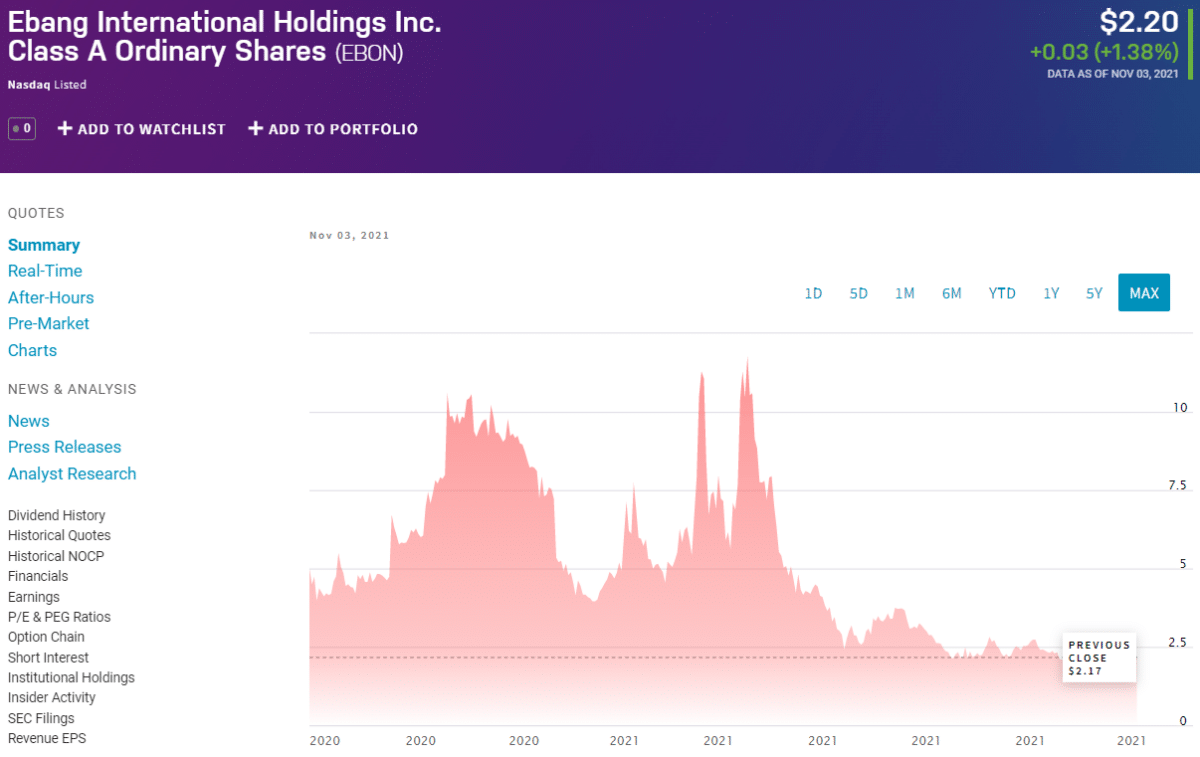

№ 2. Ebang International Holdings Inc. (EBON)

Price: $2.20

Ebang International Holdings Inc. is a stock that trades on the Nasdaq stock exchange under the ticker symbol EBON. The company operates in the technology and hardware sector.

Ebang International Holdings Inc. manufactures and sells Bitcoin mining equipment. Furthermore, they provide telecommunication products, management, and maintenance services. EBON’s customer base is Chinese.

The company has a daily trade volume of about 1.99 million shares and a market cap of 290.95 million. Ebang International Holdings Inc. has shares outstanding of 139.21 million.

In terms of valuation, Ebang International Holdings Inc. has a price per earnings ratio of -10.30. The company’s annual performance is -74.42%.

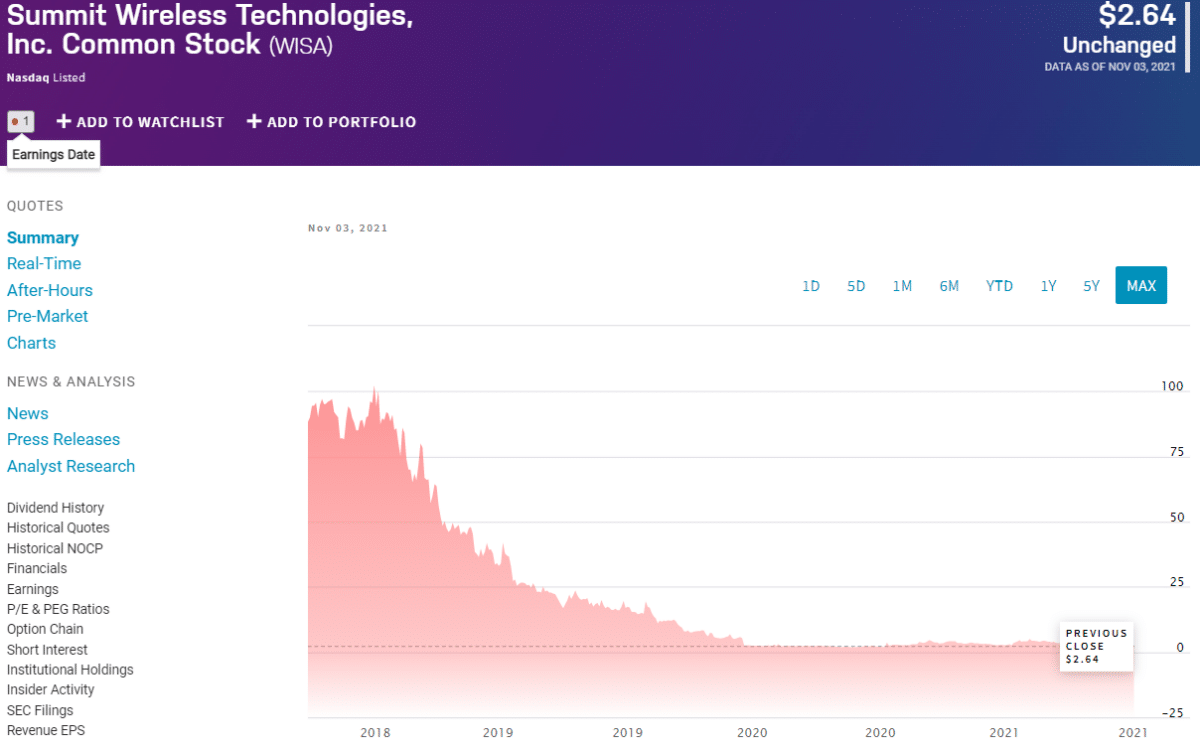

№ 3. Summit Wireless Technologies Inc. (WISA)

Price: $2.64

Summit Wireless Technologies Inc. is a technology company. The main focus of Summit Wireless Technologies is to offer ordinary consumers and audio devotees high-quality wireless audio.

Their main product is wireless audio products. Furthermore, they sell semiconductor chips and wireless modules to consumer electronics companies.

They integrate their designs into their products, such as TVs, media hubs, and speakers, to name a few.

Summit Wireless Technologies Inc. is a component of the Nasdaq stock exchange and trades under the ticker symbol WISA.

Summit Wireless Technologies Inc. has a trading volume of 234,150 shares and a market capitalization of 38.97M.

The company has a price-per-earnings ratio of -4.90% and a year-to-date performance of -27.97%.

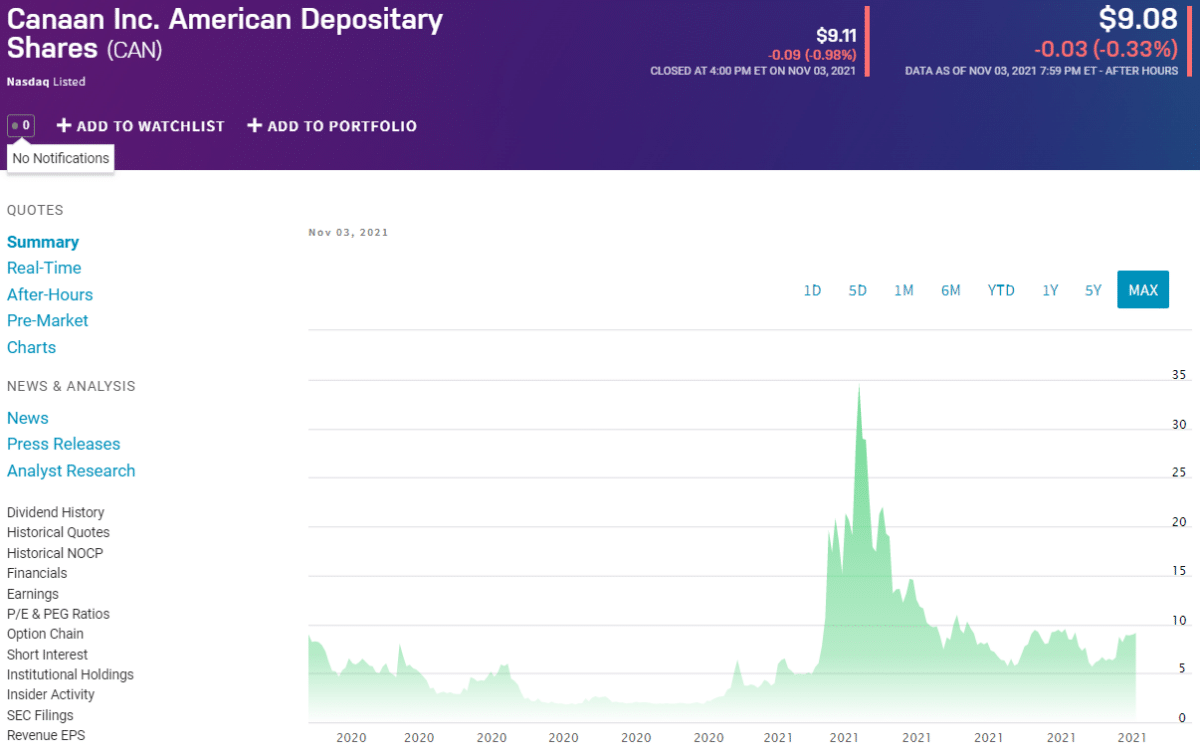

№ 4. Canaan Inc. (CAN)

Price: $9.08

Canaan Inc. manufactures Bitcoin mining hardware, and they are in Hangzhou, China.

According to a research study by the firm Frost & Sullivan, Canaan Inc. was the second largest designer and manufacturer of Bitcoin mining machines globally in terms of computing power in the six months ending June 30, 2019.

The company’s mining machines sold in the six months ending June 2019 accounted for 21.9% of all Bitcoin mining machines’ global combined computing power.

Canaan Inc. stock had a one-year performance of 269.54%, and the company’s annual returns to date are 47.22%.

The company’s valuation shows a price-to-earnings ratio of 1134.2. Canaan Inc. has a market cap of 1.38 billion and 158.1 million shares outstanding.

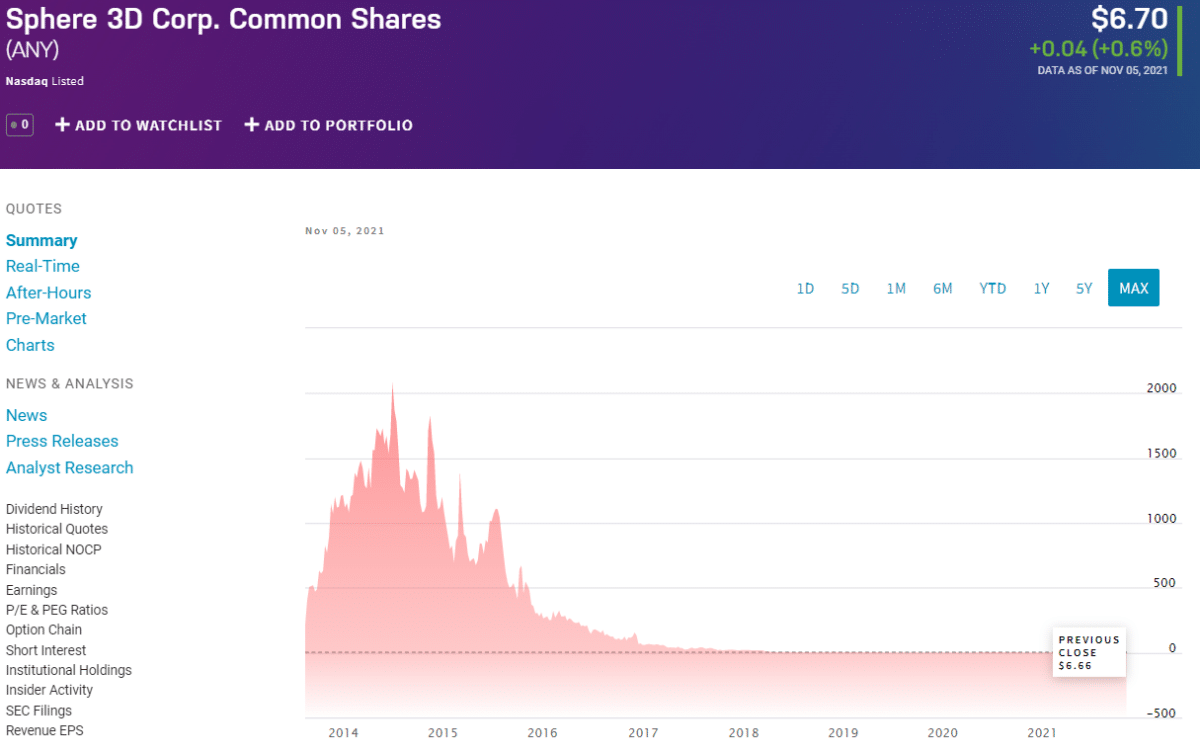

№ 5. Sphere 3D Corp. (ANY)

Price: $6.70

Sphere 3D Corp., located in Canada, focuses on the software development sector. They provide desktop and application virtualization solutions through hybrid cloud, cloud, and premise implementations via their global reseller network.

Sphere 3D Corp. trades on the Nasdaq stock exchange under the ticker symbol ANY.

The company is migrating into the Bitcoin mining industry, and they recently merged with Gryphon Digital Mining.

Sphere 3D Corp. has a market cap of 394.02 million, and it has 58.8 million shares outstanding. The company has made 58% returns over the last five years.

Pros and cons

Below are the main pros and cons to consider before investing in blockchain penny stocks.

| Worth to use | Worth to getaway |

| Affordable Penny stocks are affordable since their trading value is low, usually below $5 per share. | Blockchain penny stocks are new ventures Most of such companies are relatively new, and therefore they do not have a long history or track record. |

| Blockchain technology is expanding Investing in blockchain technology is a good option as many technology companies are integrating it into their businesses. | Bitcoin mining regulations The Chinese government recently cracked down on BTC mining activities. Therefore, companies that supply this equipment are also at risk of losing sales. |

| High returns Most of the blockchain penny stock companies have high returns, which makes them lucrative investments. | Low trading volume Penny stocks provide low trade volume and thus inferior liquidity, which makes profit taking a challenge. |

Final thoughts

Those interested in the crypto industry might find blockchain penny stocks a viable option vs. buying crypto directly. The companies on our list have substantial growth potential and are a superb way to make returns quickly.

However, investors should weigh the risks and benefits carefully since the markets are unpredictable, and any investment related to crypto is bound to be highly volatile.