Being a trader, it is natural to question the endless possibilities the trading world offers, especially when the options under consideration are so appealing.

Swing trading is popular among traders because of the profitable results it has yielded over the years. On top of that, it is less stressful as compared with other trading methods.

The benefits of futures, however, appeal to various types of traders. They help in hedging risks, have low commissions, are liquid, and are highly leveraged investments.

Now that we know the unique benefits of both trading types, the question arises: are they compatible?

In the article below, we have mentioned everything you need to know about both trading types and the use of futures in swing trading.

What is swing trading?

Traders can take their swing trading to either extreme: day trading or position trading. In this type of trading, market participants hold their positions for several days but no longer than a couple of weeks.

Swing traders often use indicators to evaluate potential trading assets.

Understanding futures in trading

In a future contract, you agree to buy or sell a fundamental asset for a pre-decided price at a certain date in the future. The seller agrees to sell an asset to a buyer in the future at a price that both parties have mutually set.

Can you use futures for swing trading?

It is possible, but you must first be 18 years old to trade them. It is essential that you thoroughly understand how the market works not to undertake too much risk. Doing so will deplete your capital, and you certainly would not want that.

Futures is a different market because the trades are offered for the future with a predetermined expiration date. On the other hand, this type of trading entails purchasing and selling contracts over a few days or weeks.

Therefore, you should not purchase futures with upcoming expiration dates if you are swing trading futures. If you end up buying a contract with an impending expiration date, you will be exposed to the risk of taking the delivery on the expiration date, or you will have to extend the contract to the next month.

If that happens, you will have to pay higher transaction fees, and your gains would decrease. In such circumstances, the buyers may be able to sell contracts to get rid of positions, whereas the sellers may buy contracts. This will dissolve the agreement.

How to swing trade futures

You need to follow these four steps.

Step 1. Understand how the market works

First of all, you need to learn how futures contracts work and derive profits from the markets. While the free material available on the internet can help, it does not explain everything you need to know.

You can enroll in a swing trading course to learn from the best, or you can subscribe to a signal service that will provide you with the right signals so that you know when to buy and sell.

Step 2. Open a futures trading account

Once you have learned all the basics, the next step shall be opening a futures account with a suitable broker. Again, make sure to evaluate the minimum deposit, trading fees, and any hidden charges before you open the account.

Step 3. Choose the contract to trade

There are futures contracts for many assets such as commodities, equities, equity indexes, etc. You can do for non-assets like weather and volatility as well.

Once you have chosen the contract you want to trade, study the factors that move their market and note the expiration dates.

Step 4. Formulate a plan and start trading

Develop your personal strategy and stick to it. The strategy should cover everything from your entry/exit plan to the management procedures. Once you are fully prepared, start trading.

Best strategies for successful trading

To become a successful futures swing trader, you need to have an efficient strategy. Following are some strategies that might help you.

Breakout trading

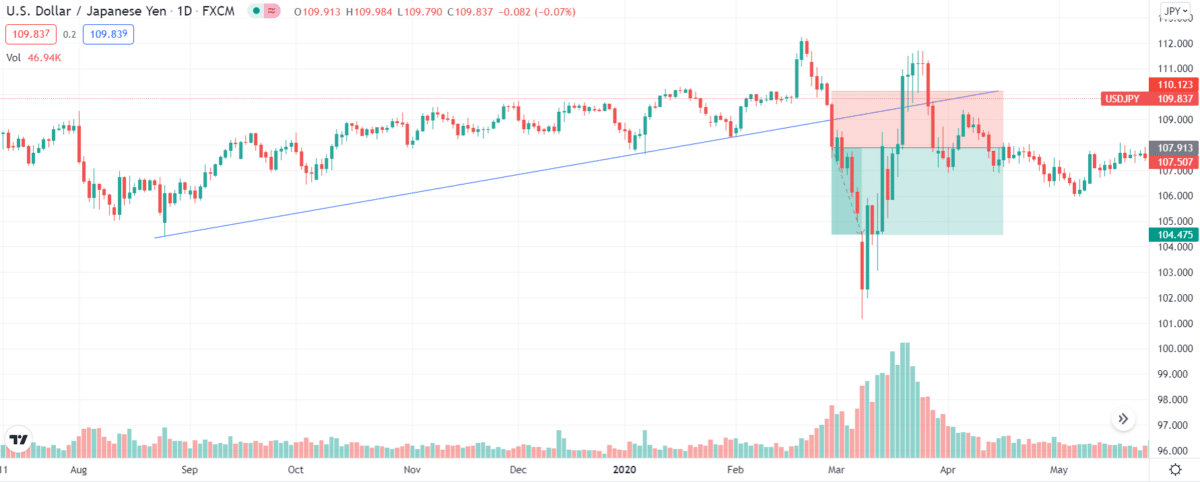

This strategy allows the trader to take advantage of the market trends. A breakout takes place when the price of a fundamental asset surpasses a support and resistance zone.

You can take it as a signal and keep the trades short when the price breaks below the support and take long trades when prices break above the resistance level.

Momentum strategy

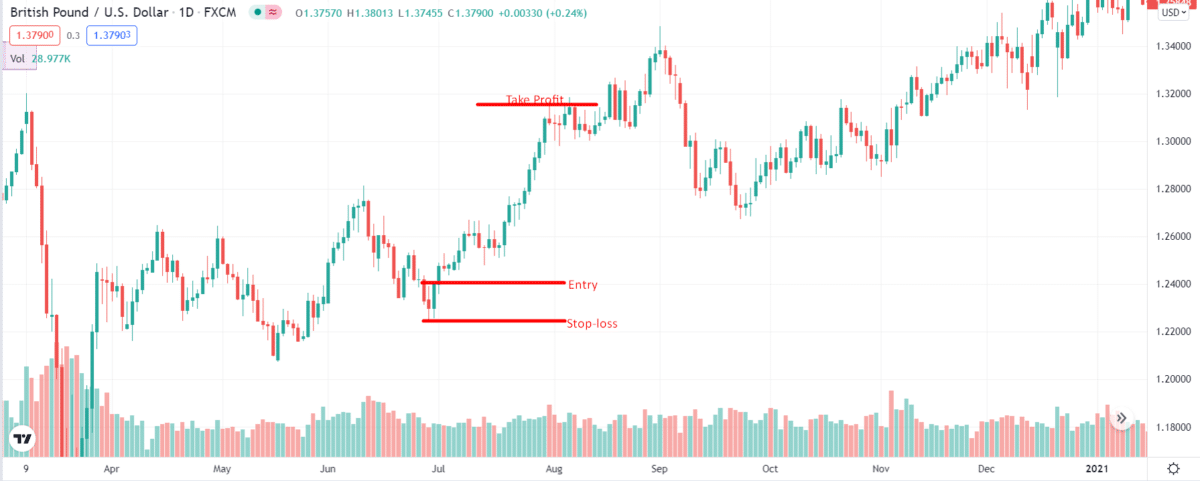

This strategy promotes trading in the direction of the trend once a pullback has completed and a new impulse wave is about to originate.

Support and resistance levels, reverse candlestick patterns, and oscillators are some of the indicators for this strategy. The traders are advised to wait for the prices to reach the support or resistance levels if they want to enter at a better price.

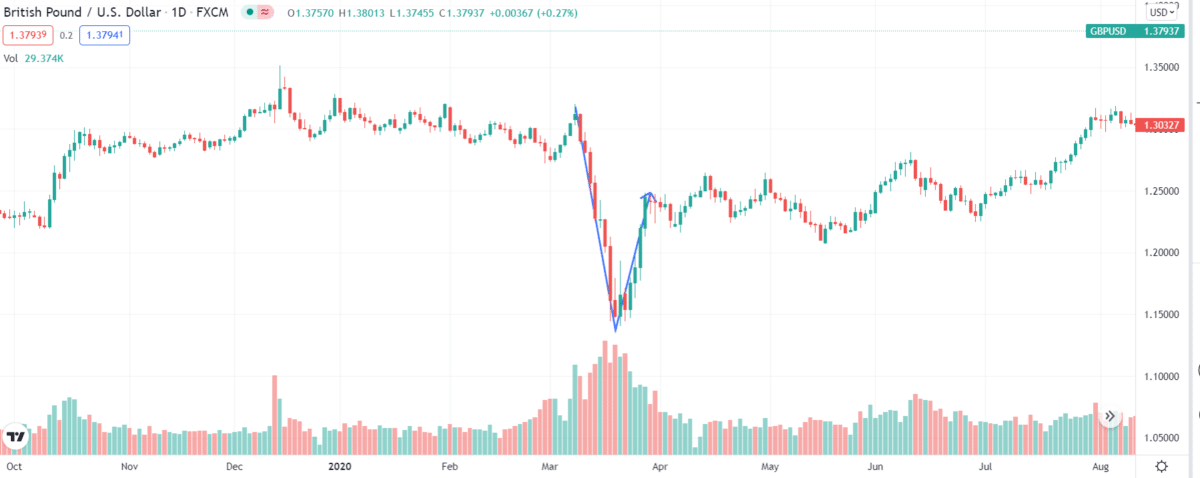

Mean-reversion strategy

A mean reversion strategy aims to benefit from a return to a more normal price level as the price of an asset abruptly moves in a direction.

Capital required for swing trading futures

You don’t need a fixed amount for that. The size of your trade affects your capital as well as the price. You have to identify when a price has swayed from its mean and is expected to revert. Indicators like RSI, moving averages, and price action setup make the identification easier.

However, make sure you have enough balance in your account to meet the margin requirements for trading. In addition to that, the capital should be able to bear the market price movements. Rather than requiring a minimum deposit of $5000-10,000, reputable brokerage firms allow you to open a trading account with a small deposit of $500.

Final thoughts

Swing trading is one of the best trading styles for beginner traders. It offers significant profit potential for experienced traders. Swing traders get sufficient dynamism in their trades while minimizing risks to reasonable limits.

Of course, the swing may seem too small for prominent market players, but such trade has vast potential for those who do not have much-starting capital. If, of course, the trader can catch the market trend and hold the position exactly as long as required, without succumbing to the mood of other market participants.

Like all other trading types, swing trading futures have their fair share of risks, but it is nothing you can’t overcome. Make sure you know what you are doing. It would be better if you blend your trading style with the chosen strategy for optimized results.