Exchange-traded funds are a basket of securities that give significant exposure to any specific industry or numerous industries, such as currencies, bonds, commodities, stocks, futures, etc. Many investors choose these securities as these assets are potent to give handsome returns after a specific period. Aerospace and defense funds are popular sectors in the ETF industry.

However, it is mandatory to check several factors before choosing the fund, such as security profile, historical performance, return ratio, duration, etc.

Let’s introduce you to the top three aerospace and defense ETFs and provide all essential info about each asset.

What are aerospace and defense ETFs?

These funds track the performances or an alternative way to invest in stocks of companies that distribute and manufacture aircraft parts and aircraft. These companies also produce equipment and components, including military radars, military aircraft, weapons, and other elements related to these sectors.

How to select an aerospace and defense ETF?

Like all other funds, you need to check several factors while choosing. Checking on the company profile, historic performances, return ratio, expense ratio, etc. will help you select the best potent A&D ETF.

The best three aerospace and defense ETFs

The top three most potent A&D ETFs worth watching and buying in the current year:

- iShares U.S. Aerospace & Defense ETF (ITA)

- SPDR S&P Aerospace & Defense ETF (XAR)

- Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN)

1. iShares U.S. Aerospace & Defense ETF (ITA)

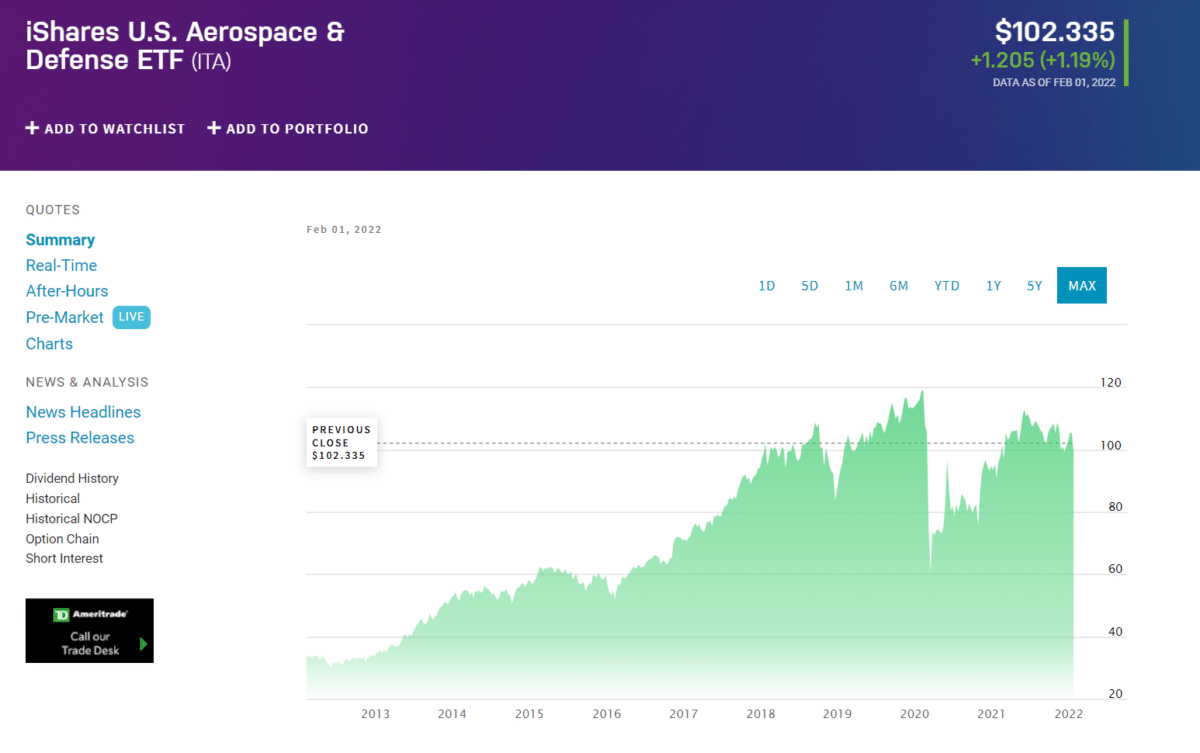

This ETF tracks a market-cap-weighted index of US-listed distributors, assemblers, aircraft parts, and manufacturers. The fund caps limit a single company to 22.5% of the fund’s assets, prevent completely unbiased exposure to the top few that dominate the industry, and its holdings meet diversification requirements. Companies in this sector tend to be rather large, slow-growing, but notably stable due to the widespread use of more extended government contracts for most of their services.

The issuer of this fund is Blackrock Financial Management, and the inception date is May 01, 2006. This fund has an expense ratio of 0.42% and assets under management $2.48B. The price of this fund is floating near $99.69 today.

The recent performance of this asset is not so impressive as the whole sector suffers from the recent pandemic Covid-19 and post-pandemic issues.

When you look at the performance of return data of recent one year or three years it shows a 10.75 and 8.58% respectively. Meanwhile, the five years return is 46.08%, which is an impressive amount. The beta value of this fund is 1.26, and the standard deviation is 4.18%.

The top three holdings of this fund include:

- Raytheon Technologies Corporation — 19.71%

- Boeing Co. — 18.63%

- Lockheed Martin Corporation — 5.55%

2. SPDR S&P Aerospace & Defense ETF (XAR)

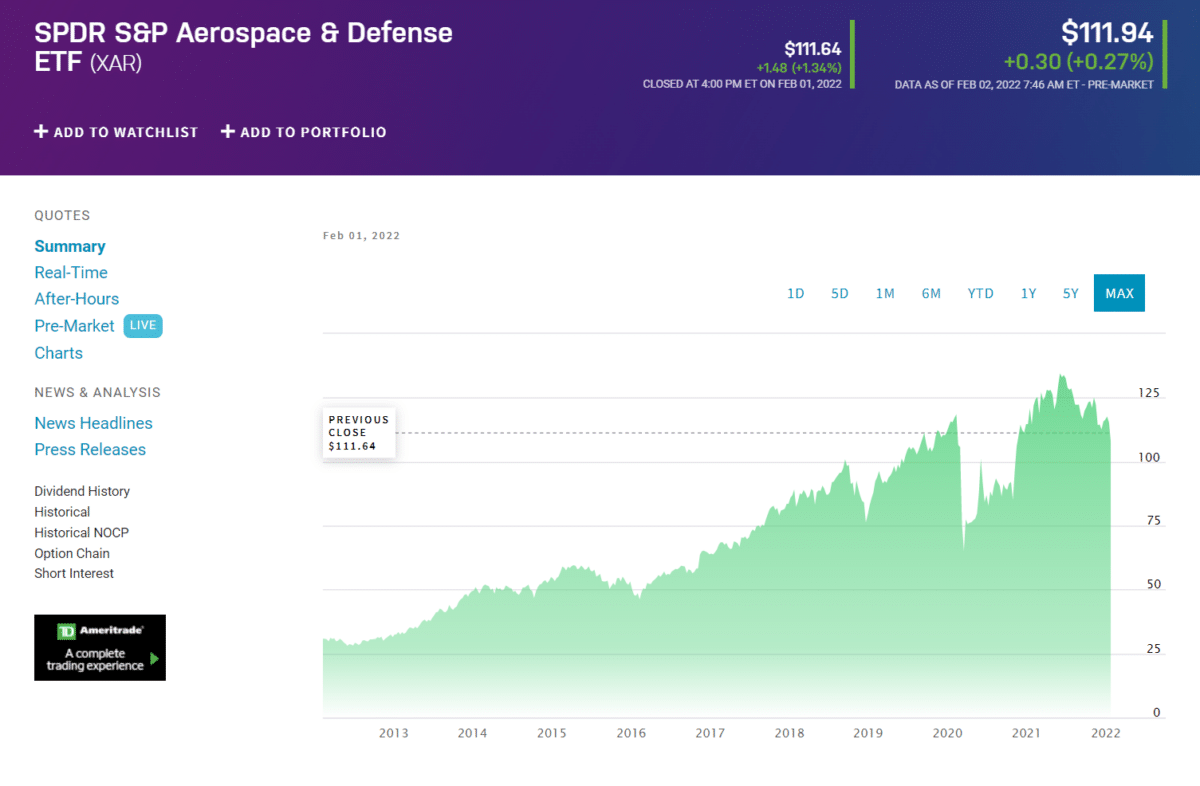

The SPDR S&P Aerospace & Defense ETF takes a different approach to achieve its goal than other funds of a similar category. It seeks to track the performance of Aerospace & Defense on S&P Select Industry Index (the “index”), employing a sampling strategy. The legal structure of this fund is an Open-Ended Fund that focuses on large-cap stocks. XAR invests at least 80% of its assets in compromising underlying asset securities. Additionally, it delivers a diversified exposure.

The issuer of this fund is State Street, and the inception date is Sep 28, 2011. So it’s been operating for over two decades with an expense ratio of 0.35%. The asset under management is 1.11B. The price of this fund is floating near $107.93.

The performance info is an essential factor and checking before choosing any asset. Look at the chart below that shows performance info of XAR for different periods.

It appears that this fund is recently suffering from the recent Covid-19 pandemic and post-pandemic situation as many other financial assets. So the recent return amount is negative of this fund with a 3-years return of 27.08% and 73.61% for five years, which are such an impressive and handsome amount.

The top three holdings of this fund include:

Virgin Galactic Holdings Inc Shs A — 4.94%

Axon Enterprise Inc. — 4.23%

Maxar Technologies Inc. — 4.17%

3. Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN)

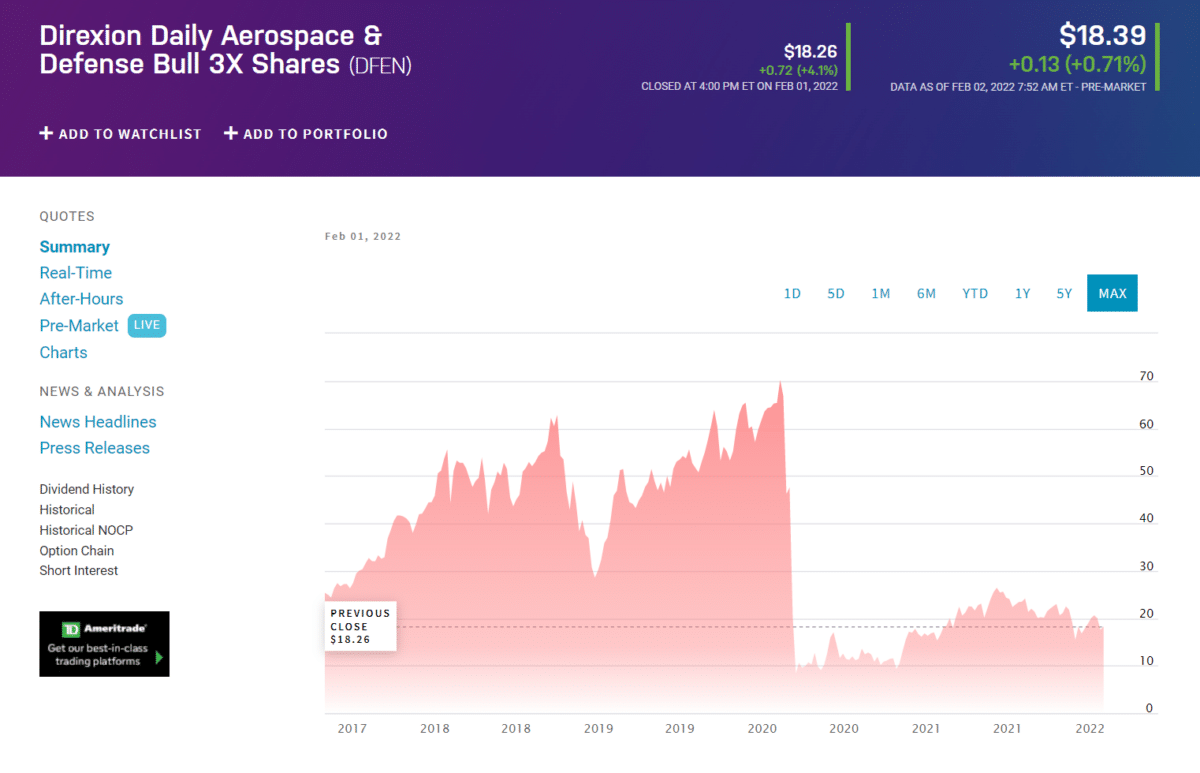

The Direxion Daily Aerospace & Defense Bull 3X Shares fund is a daily 3x leveraged bet track performance of the aerospace and defense stocks of the Dow Jones U.S.The designing purpose of this fund is to magnify the index’s daily performance, not a 300% return of the index performance over a long period.

The issuer of this fund is Rafferty Asset Management, and the inception date is May 03, 2017. This fund has assets under management is $243.21M with an expense ratio of 0.99%. The price of DFEN is floating near $16.91 today.

When checking on performance, it shows the price plunged due to the Covid-19 pandemic as other funds of the same category. The price fell from near a peak of $70.51 to $6.99 during that period.

The top ten holdings of this fund include Dreyfus Government Secs Cash Mgmt Admin, Dow Jones U.S Select Aero Def Index Swap, Boeing Co, etc.

The top three holdings of this fund include:

Dreyfus Government Secs Cash Mgmt Admin — 18.88%

Dow Jones US Select Aero Def Index Swap — 14.75%

Boeing Co — 14.44%

Pros and cons

| Worth to use | Worth to getaway |

| These funds are potential as long-term investments. | No guarantee that these funds will keep booming. |

| These funds involve a tiny expense ratio. | Geopolitical and weather issues affect this sector. |

| These funds are not volatile as other financial assets such as currencies, stocks, commodities, etc. | Stock prices can fluctuate by business variables. |

Final thought

The perfect storm of the aircraft demand, a boost from the White House’s infrastructure proposal good tax reform may make these funds more attractive as soon as the post-Covid situation ends. Our article lists all essential info about these top three Aerospace and Defense funds. We hope it will be helpful to you to have an adequate understanding and knowledge to decide on investing in any of these funds.