If we didn’t have water, we’d starve to death. As a result, water ETFs were launched by exchange-traded fund managers. Water conservation, purification, bottling, and transportation are infrastructure restoration and replacement aspects. Identify the many responsibilities corporations play in this underappreciated industry.

An easy way to get exposure to the water industry is by purchasing a water exchange-traded fund. For example, water ETFs often invest in water utilities, purification businesses, sewage and pipeline construction companies, and equipment manufacturers and suppliers.

Let’s look at water ETFs, what to check when buying them and which are the top three water ETFs not to drain your budget in 2022.

Top three things to know before starting:

- Water isn’t given the same level of attention as other utility suppliers, including electric and gas.

- Water ETFs are still beneficial given the rising worldwide demand and flat supply.

- Several of the funds also come under the ESG investing category, which may contribute to the momentum of theme investment.

What is a water ETF?

Everyone should have access to clean water at all times. “The Human Right to Water and Sanitation” was ratified by the United Nations in 2010 as a fundamental human right. As the world’s population and economy continue to grow, so makes the demand for clean water, which is why the issue of water supply will become more important to humanity in the years ahead. In our world, water distribution disparity is a significant problem. Investors have recognized this as a megatrend, and it’s not surprising. ETFs may be used to invest in water at a minimal cost.

What to check before choosing a water ETF?

Water ETFs, without a doubt, provide a good return on investment. However, a few factors to keep in mind while choosing an ETF.

- Consider the fund’s 52-week price range and buy at the lower end.

- Look at the ETF’s annual dividend yield history. If the yield is rising, go for it.

- If the ETF’s product is stable, you may invest in it. However, careful investors have the option of making a decision.

Best water ETFs for 2022

The following are three topwater ETFs to invest in right now: each of these is something you should consider investing in for the long term.

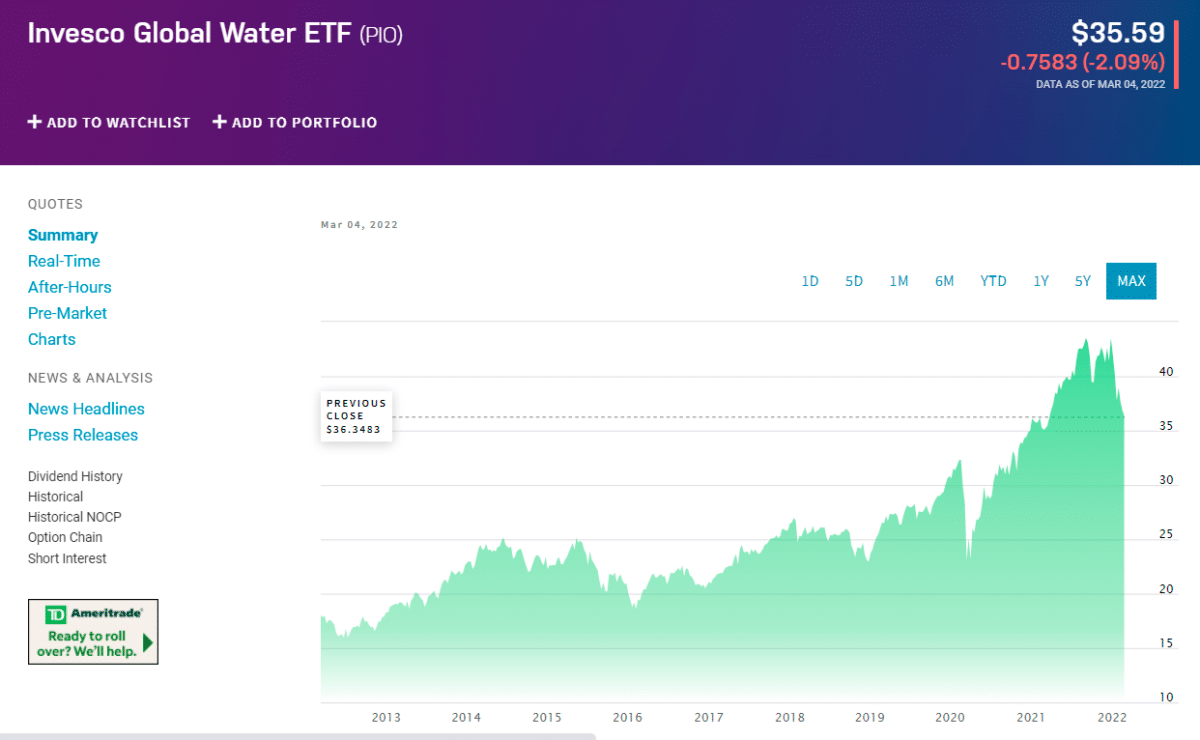

- Invesco Global Water ETF (PIO)

This ETF’s holdings include water utilities, infrastructure businesses, equipment and materials manufacturers, and suppliers. Individuals concerned about water shortages may find this ETF appealing because of its focused type of exposure; it is unlikely to fit into a long-term buy-and-hold portfolio. However, even though this investment thesis is attractive, it is not apparent how strongly future performance will be correlated with water demand and shortage developments.

We have concerns about this ETF’s ability to meet investors’ expectations given the complexity of the issues at hand and the many other business operations of the component companies. Due to the large allocations given to a few select firms. It is also the most costly of the funds in this category. Investors wanting exposure to the water sector would be better served by looking elsewhere than in this fund, the most concentrated and expensive water ETFs, along with FIW, PHO, and CGW.

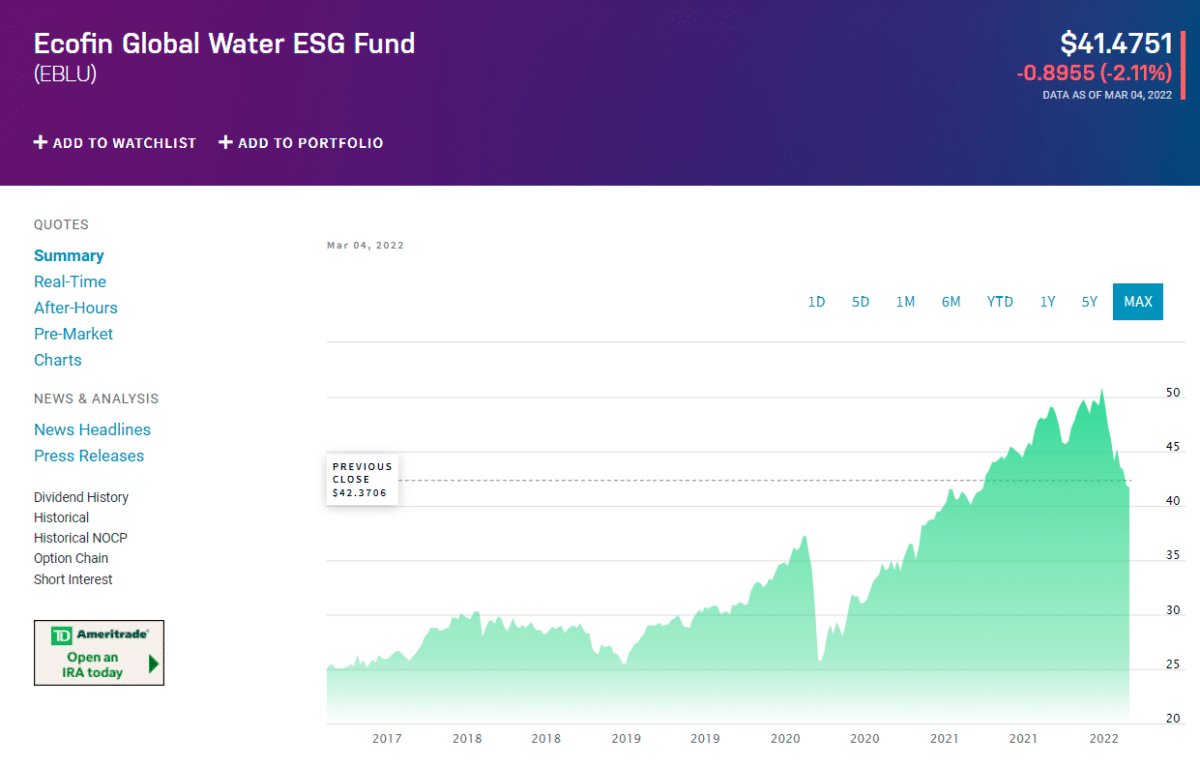

- Ecofin Global Water ESG Fund (EBLU)

An investment in EBLU gives exposure to all capitalizations of developed-market water firms. Water infrastructure, equipment, and water services provide at least 40% of the fund’s overall revenue. Water infrastructure firms offer water distribution, engineering, construction, or consulting to the general public.

Water equipment firms provide water pipes, valves, pumps, and water efficiency products, including filtration, treatment, and testing. Service firms are better equipped to handle water supply, use, purification, and irrigation. A component must also meet minimum ESG requirements to be included in the index.

The portfolio comprises a few dozen names, most of which are from the United States. On or before June 5, 2018, the fund invested in North American water companies through the Tortoise Water Index. Until August 21, 2020, when it merged with Ecofin, the fund was known as Tortoise Global Water ESG Fund and traded under the ticker TBLU.

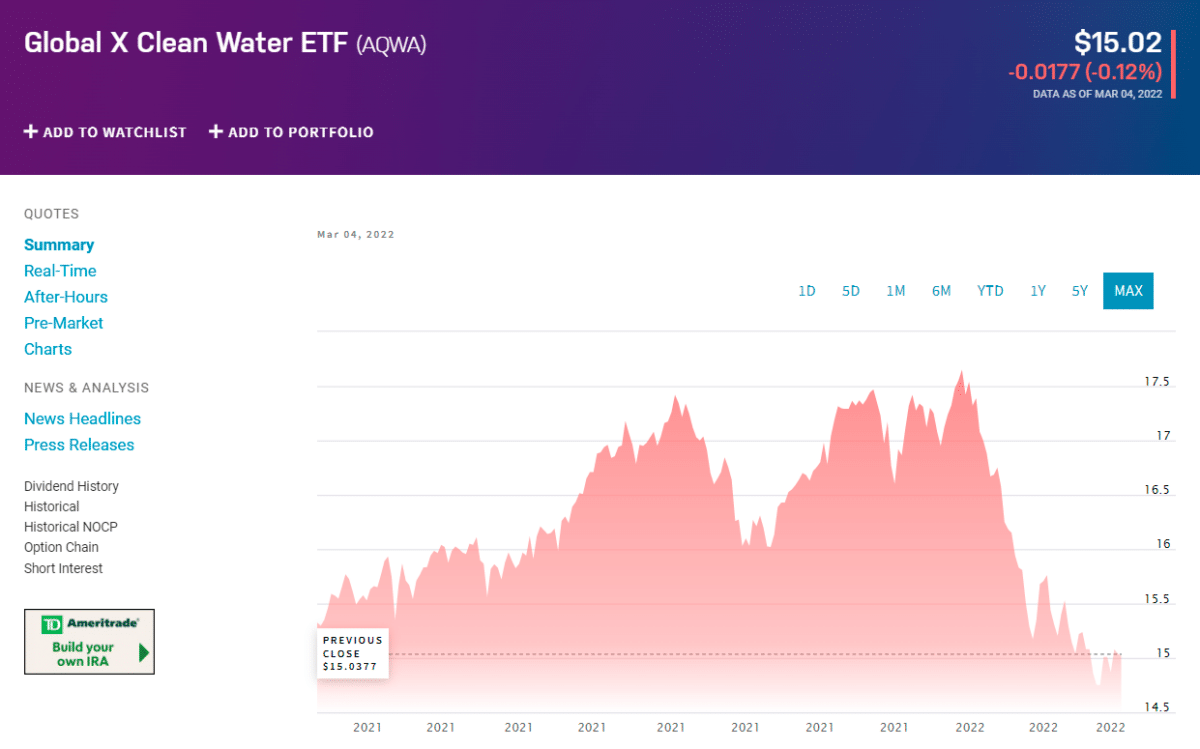

- Global X Clean Water ETF (AQWA)

AQWA invests in companies of all sizes that produce at least 50% of their income from water infrastructure or water equipment and services to expose them to the global water industry. Clean water enterprises involved in water treatment, purification, conservation, and management are discovered by screening public data using a proprietary natural language processing method.

To be eligible for inclusion in the index, qualifying equities must first meet the UN Global Compact’s minimum ESG guidelines. In addition, each stock’s weight is limited to 8% of the total market capitalization, while the aggregate weight of businesses with 4.5 percent or more weight is capped at 40%. The index is reconstructed and rebalanced every two years.

Pros and cons

| Worth to invest | Worth to getaway |

| Investing in index ETFs is similar to investing in index mutual funds. However, it suggests that the cost-to-income ratios are modest compared to actively managed funds. | Investing in water companies is notoriously difficult because of the low valuations. In addition, it might cause havoc on the market. |

| You’ll get a water stock portfolio managed by a professional. It is beneficial if you don’t want to perform your investigation and analysis. | Prices may be more volatile if fewer people buy and sell stocks. |

| A water ETF allows investing in a large selection of water-related firms rather than just a handful. | The bid-ask spread, which operates as a markup on ETF purchases and sales, rises because of a lack of liquidity. |

Final thoughts

Investing in water ETFs may be a low-cost and straightforward approach to exposure to water utilities’ stock prices and financial performance, water purification firms, and other relevant companies. In addition, investing in a sector fund is an excellent approach to diversify your portfolio since it only invests in one area. When building an ETF portfolio, starting with a broad index like the S&P 500 is a good idea. Currently, sector ETFs and other auxiliary assets may be available.