Mutual funds allow investors to access diverse assets by pooling all the capital into one fund. The investment can be in stocks, bonds, or any other asset.

Investors find mutual funds alluring because of the diversification. However, some funds solely follow one asset class. In this case, we are referring to the real estate sector of the market. Real estate has been a historically stable investment, except for the 2008-2009 housing bubble, which caused a global recession.

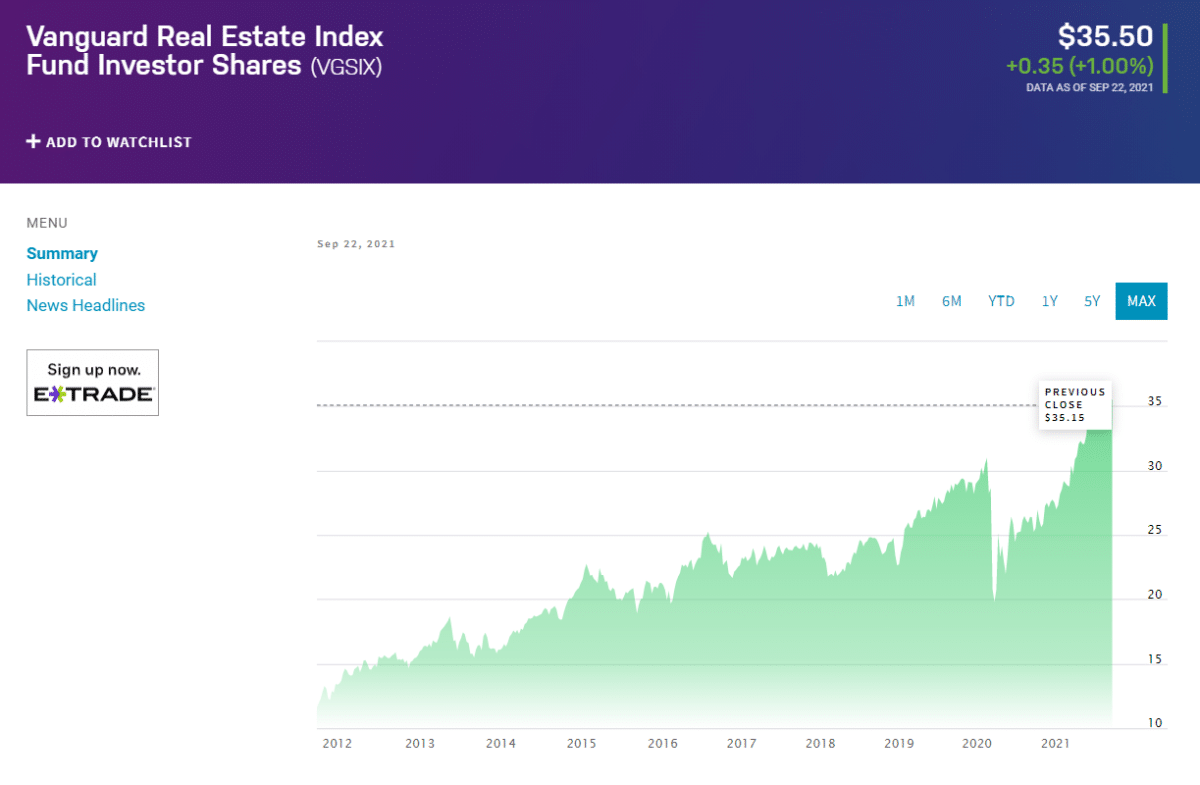

However, the VGSIX fund has been in existence since 1996. Therefore the fund has surpassed the decades of market highs and lows.

Furthermore, if you read on, you will see that the fund has good returns and meager fees, which makes for a lucrative investment.

Three things to know before starting:

- VGSIX fund allows investors access to real estate investments without owning property.

- The mutual fund is not diversified, and all assets are focused on real estate.

- The VGSIX fund has a low expense ratio compared to funds in the same category.

About VGSIX

The fund invests in Real Estate Investment Trusts, which buys offices, hotels, and other property types.

Vanguard issued the VGSIX fund in May 1996. Vanguard provides the most mutual funds in the USA, including an array of mutual funds and ETFs.

The fund has attracted many assets due to its low fees structure. The Vanguard REIT mutual fund benchmarks against the MSCI US REIT Index, which tracks local real estate equity investment trusts. These trusts are firms that collect rent and manage properties.

The VGSIX has an asset holding of $43.90 billion and a total of 176 holdings. The top holdings are in the Vanguard REIT II Index Fund, Simon Property Group, Equinix, Prologis, and Public Storage.

The fund allocated 99.97% of its assets in stocks and 0.03% in cash. Furthermore, it is 100% invested in the real estate sector. Regarding geographical breakdown, 99.93% of the firms are US-based, and 0.04% are non-US firms.

Role in portfolio

The fund’s objective is to track the equities of realty companies and is therefore not a diversified mutual fund since its holdings are 100% invested in the real estate sector.

Management

Vanguard Group has managed the fund since 1996. The fund managers of the VGSIX mutual fund are Gerald C. O’Reilly and Walter Nejman.

Gerard C. O’Reilly is the Principal of Vanguard Group and has been with the firm since 1992. O’Reilly has managed investments with the firm since 1994. And during his tenure, he has been in charge of stock index portfolios. He holds a BS degree from Villanova University.

Walter Nejman is a Portfolio Manager at Vanguard, and he joined the firm in 2005. He started managing investments in 2008; he also co-managed the Communication Services Index, Health Care Index, Industrials Index, and Information Technology Index funds since 2015. Nejman holds a BA degree from Arcadia University and an MBA from Villanova University.

Risk

Morningstar has rated the fund’s risk above average compared to its peers for the three-, five-, and ten-year terms.

The fund’s volatility could be more than other diversified asset funds since it is focussed fundamentally on the properties sector.

Performance

VGSIX has an annualized return of 35.30%, 13.15% the last three years, 6.98% the past five years, and 9.88% over the previous decade.

Fund performance over the last year. The fund has outperformed the MSCI US REIT Index since its inception. The fund is currently trading at $35.15 per share.

Fees

Investors who hold mutual funds have to pay specific management fees. The running of the fund comprises certain management costs, transactions costs, advisory fees, and marketing and distribution charges.

Investors pay for these fees in different ways. Furthermore, the management fee represents a percentage of the assets under management, and the VGSIX fund has a management fee of only 0.25%.

Regarding cost projections for a $10,000 investment that grows by 5%, the fees will amount to roughly $146 in five years and $331 in ten years.

Net expense ratio

The fund has an expense ratio of 0.26%, a reasonably low fee. The fund requires a minimum investment of $3000, and the admiral shares version requires a $10,000 minimum investment. However, the expense ratio for this version is only 0.12%.

Category average

The category average compares the fund’s expense ratio, performance, and management fees to similar funds in the same category. It is a good benchmark for investors to gauge the fund against its peers.

The average expense ratio for the category is 1.18%. Therefore, the fund is considerably low costed. In terms of management fees, the category average is 0.72%.

Volatility measurements

The level of uncertainty or the risk of change of an asset’s value is the volatility measurements. The following statistical data represent the volatility measurements.

VGSIX standard deviation – 18.608

The standard deviation measures the variation of the fund’s returns with relation to its average performance over a specific period. It indicates the fund’s historical volatility; it also helps compare similar fund price swings. The further the returns vary from the mean, the higher is the standard deviation.

VGSIX mean – 1.182

The mean represents the average of the fund’s historical annualized returns. It is calculated by adding all the numbers and dividing them by the total in the data set. The mean of a fund is an indication of its performance over a specific period since its inception.

VGSIX Sharpe ratio – 0.699

The Sharpe ratio is an indication of the level of risk applied to generate a return on investment.

Pros & cons of Vanguard REIT Mutual Fund

| Worth to use | Worth to getaway |

| Affordable The fund is very affordable and only requires a minimum of $3000 to initiate your investment. | Risk The fund is risky, considering all its assets are in the real estate sector. |

| Low fees The fund has a low expense ratio and management fees of 0.26% and 0.25%, respectively. This is considerably lower than similar funds in its category. | Lack of diversification Due to its singular holdings in real estate, the fund does not offer diversification opportunities to shareholders. |

Consistently good returns The fund has returned 35% over the last year and made positive returns for the previous ten years. | High-interest rates High-interest rates are not suitable for REIT investment types since the value declines if interest rates increase. |

Final thoughts

Investors must conduct thorough research into the different funds available. Since they all have good and bad points, it all comes down to your affordability and investment goals. Investing in properties has been considered a wise choice; however, it comes with unavoidable risks like any other financial asset.

Investors should study the metrics like management fees, expense ratios, risks, and annualized returns to make an informed decision.

Furthermore, REIT investments perform well during low-interest rates, and since the pandemic’s start in 2020, the US government has kept its interest rate unchanged at 0.10%, which is ideal for the real estate sector. However, investors should be aware that this sector does not perform well when interest rates increase, and you should consider diversifying into other asset classes.